Growth is imperative. It is the principal pillar of total shareholder return (TSR). Growth is also difficult, especially for companies in mature markets and sectors. Absent a megatrend or big wave to ride, most companies have relatively few options—none of which is easy to execute. One is innovation that leads to new products or services. Another is new products and services that expand into adjacent lines of business or new markets. A third is M&A. One more is simply outthinking and outexecuting the competition.

Suppose that there was a type of sophisticated compass that could direct a company toward the most promising routes to growth. Suppose the same compass could guide all of a company’s growth efforts, from innovation to expansion, from screening acquisition candidates to executing in the marketplace. Suppose the compass could be applied in any segment or industry where consumers make choices. Identifying—and acting on—the highest-growth-potential options could become a lot less difficult and a lot more precise.

The Boston Consulting Group has developed such a compass and proven its effectiveness, providing newfound focus, accelerated growth, and increased share. We call it demand-centric growth (DCG), and we have put it to work on more than 100 projects across multiple sectors since 2009. (See “ Demand-Centric Growth: How to Grow by Finding Out What Really Drives Consumer Choice ,” a September 2015 BCG article based on the book Rocket: Eight Lessons to Secure Infinite Growth.)

Understanding Demand: The Basis for Growth

Understanding demand—what consumers want to buy and when, where, and why they want to buy it—is the foundation for any strategy geared toward growth. Although conventional market analysis is rooted in demographics, industry, usage, and attitude, it often fails to get to the heart of demand—understanding why consumers want what they want. Choice is rarely a one-dimensional decision; multiple factors come into play. DCG identifies the actual drivers of consumer decision making by simultaneously testing all demographic, contextual, occasion-based, and psychographic factors—on an objective and level playing field—to determine which factors are truly driving decision making in different circumstances in any given category.

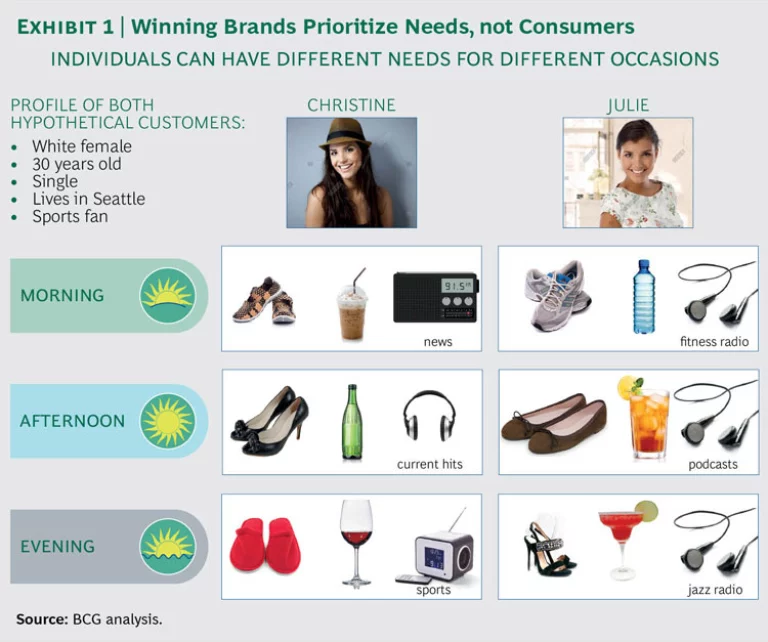

DCG takes into account who the customer is, how he thinks, and where he is and what he is doing in different places at various times of the day. For example, a person could be hungry after exercising in the morning, craving a pick-me-up at work in the midafternoon, and wanting to unwind after dinner. The trick is connecting a product with the consumer’s emotional and functional needs. Emotional needs are rooted in what a person wants to feel—rejuvenated and ready for the day after working out, indulging a craving in the afternoon, or relaxed in the evening. Functional needs are what the person is looking for: energy, satisfaction, and comfort, in our example.

To be sure, some conventional research and segmentation analyses assess needs, but they rarely take into account the context in which needs arise. Instead, they tend to assign each consumer to a single segment—value-conscious millennials, for example. DCG, though, recognizes that the value-conscious millennial can be in multiple “demand spaces” at different times in varying circumstances and therefore can have a variety of needs. (See Exhibit 1.)

DCG is often easiest to picture in a consumer products framework but has applicability across many sectors and industries. The same analytical approach can be applied to any category that involves choice: financial services, lodging and leisure, durables, technology, and more. For example, DCG showed one telecommunications service provider that its plan for launching a subbrand to target younger consumers in the prepaid mobile phone market was unlikely to succeed because of misassumptions in the targeting; DCG even pointed to a completely different approach. And DCG helped a not-for-profit agency overhaul its marketing and fundraising efforts to better match its successful programs with the types of donors most inclined to support them and to understand when to motivate donors to give.

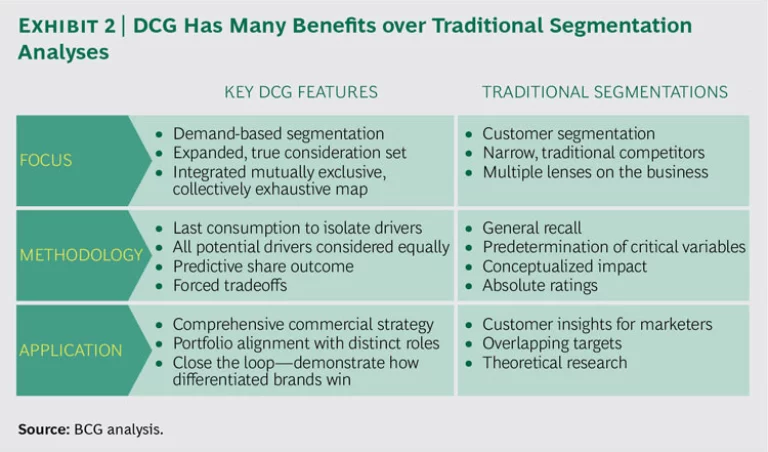

Because DCG maps not consumers or customers but choices, and because it acknowledges that individuals typically have different needs (and thus make different decisions) depending on category, circumstances, and context, the resulting “demand map” presents an objective and all-inclusive assessment of the growth opportunities for a product, service, or company. (See Exhibit 2.) This assessment cuts through information and data clutter and shows the organization how to identify and reach its target customers, establish priorities, and set (or reset) strategy. (See “The DCG Methodology.”)

THE DCG METHODOLOGY

The DCG methodology combines qualitative and quantitative research along with big data and advanced analytics to produce a comprehensive map of demand for almost any company, product, or service. The goal is a map that highlights the handful of demand spaces that represent opportunities for growth and, equally important, reveals those demand spaces that have little or no relevance for the company, product, or service in question.

The qualitative-research phase employs BCG’s MindDiscovery, a proprietary approach that makes extensive use of psychologically derived projective techniques and is particularly powerful for research on emotional aspirations. This phase builds on existing research and hypotheses to define the full spectrum of dimensions—including consumer information, occasions, demographics, emotional and functional needs, and consumer perceptions—that will be assessed in the quantitative phase.

The quantitative phase involves a large-scale survey of 1,500 to 20,000 consumers, depending on the situation and industry. The surveys focus on several factors, using a proprietary approach that BCG developed expressly for DCG. These factors include:

- The Moment of Choice. The research targets a recent and relevant occasion of choice as opposed to a more generic assessment of needs and preferences. We ask people what they did rather than what they are thinking of doing.

- Consumer Tradeoffs. Understanding emotional and functional needs and how they interact is a central focus of the research. We employ a maximum differential scaling (MaxDiff) methodology to uncover critical tradeoffs. MaxDiff enables an infinite series of paired comparisons between attributes—for example, whether a consumer considering a snack is willing to sacrifice health benefits for taste and how taste stands up against value for money. This type of tradeoff analysis has big advantages for advanced analytics.

- A Wide Array of Dimensions. We investigate all the potential drivers of demand, including demographics, contextual elements, and attitudes, without presupposing which ones matter; the goal, in part, is to find out not just which ones are driving demand but also which are not relevant and have no impact on demand. BCG’s proprietary algorithm runs a sequence of “statistical tournaments” to identify which variables have the biggest impact on needs and thus choice. By identifying the different needs and the elements that define the demand spaces (such as time of day, whether alone or with others, and whether adult or child), the algorithm easily identifies the right consumers and occasions.

- In-Market Performance. Surveys include questions that size demand spaces (by both volume and value) so that these results can later be calibrated to actual in-market results—for example, results gleaned from the purchase patterns of a company’s loyalty club members. This validation enables companies to evaluate the financial value of each demand space for a product or service brand and set priorities.

- The Brand’s Starting Point in the Consumer’s Mind. The quantitative assessment tests consumers’ perceptions of how well or how poorly a brand (or product or service) delivers on consumers’ emotional and functional needs. This allows the company to “close the loop”—that is, to analytically demonstrate that brands that deliver on the needs of a demand space outperform in that space. This has direct implications for strategy. Companies can use these results to spotlight pathways for growth, for example, and to facilitate portfolio decisions.

How Arby’s Got Its Growth Back

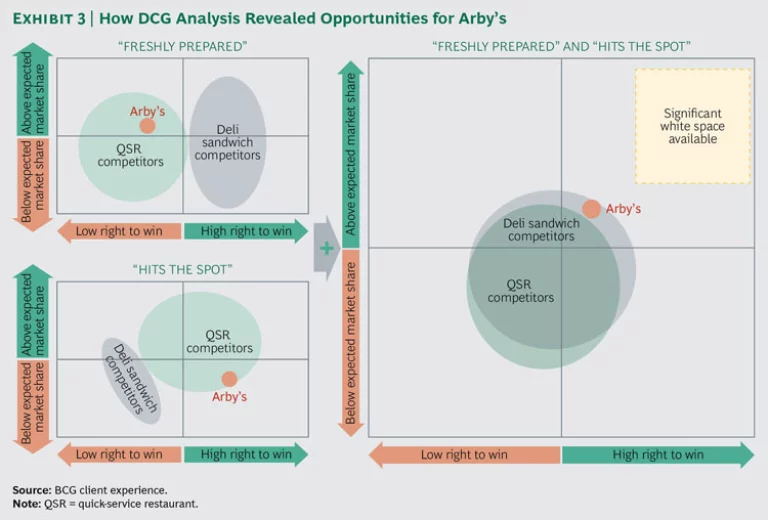

Take the case of Arby’s. In 2010, the classic fast-food brand acknowledged that it was struggling—it was losing relevance with consumers and same-store sales were declining. Arby’s straddled several segments of the dining industry, including quick-service restaurant (QSR) and deli sandwich, but it was unsure where it wanted to play, and consumers were unclear about where Arby’s fit.

Arby’s decided to rethink its strategy. The company had historically seen itself as a QSR brand competing primarily with other QSRs. DCG research revealed that the competitive set was actually broader and that consumers perceived Arby’s as a player in the deli sandwich segment as well. In fact, this overlap enabled Arby’s to differentiate itself from other QSRs. The DCG approach further showed that the combination of two big spaces on the demand map (“freshly prepared” and “hits the spot”) represented wide-open territory—an enormous source of demand untapped by any dominant, or even strong, player. And the Arby’s brand had more equity with consumers (what we call the “right to win”) with respect to this combination than any QSR or sandwich shop brand. (See Exhibit 3.) A new growth strategy was born.

Guided by the revelations of the demand map, Arby’s management embarked on a full-scale repositioning, overhauling its menu, marketing and advertising, new-product development, and restaurant design. Pillars of the new positioning included the company’s long heritage, its commitment to fresh preparation, its tradition of slicing its meats in stores, and a program to educate consumers about its fresh preparation of roast beef in stores.

The impressive results show the impact that DCG can have on a company. After two straight years of declining same-store sales, management delivered five consecutive years of same-store sales growth ranging up to 8% a year—significantly outperforming the QSR category.

Shaping Strategy with Superior Insights

DCG works because it delivers powerful insights that provide the basis for both strategy and execution. We have deployed DCG-based plans successfully for companies in industries as diverse as consumer products, insurance, telecommunications, auto, apparel, and pharmaceuticals. This work has helped clients boost revenues and profits and, when necessary, reverse declining sales and margins, generating big gains in value. DCG ignites growth by defining strategy and directing specific actions.

An Integrated Foundation of Insights. One DCG study has multiple uses. The DCG demand map provides a complete view of the drivers of choice in a category, which can anchor and integrate portfolio strategy, innovation, and marketplace execution. DCG delivers an integrated map of demand that is often broader—with more opportunities—than the company was expecting. It uses a rigorous approach that puts all the variables—demographic, contextual, psychographic, occasion based—in competition with one another, and it allows the research to reveal what is actually driving choice in the category or segment. All potential drivers are considered equally.

Companies can create a map of demand that is grounded in consumer needs and that predicts share outcomes. They get a consumer-centric basis for understanding the key dynamics at work in their business—something we find many companies were wrestling with before applying the DCG approach.

A Comprehensive Commercial and Portfolio Strategy. The DCG demand map is the basis for developing a strategic approach for the entire organization that applies to all lines of business as well as the overall brands and subbrands in a multibrand portfolio. It highlights the most attractive demand spaces for each brand from the perspective of both the individual brands and the overall portfolio so that the company can make logical choices about where to compete.

DCG puts a foundational understanding of the customer at the center of strategy development and, in so doing, helps companies avoid some common pitfalls. One such pitfall is gravitating toward what’s “cool” or trendy—targeting the burgeoning Hispanic or millennial demographics, for example, when ethnicity or age may not be the factor that drives different needs and choices. Such criteria can be flimsy pillars for strategy, and given that cool is almost by definition a fleeting concept, they also result in frequent shifts in direction.

Another misstep is viewing categories, and the segments within them, through either an industrial or a demographic lens. Conventional market research and competitive-intelligence reporting tend to compare products with like products and demographic segments with other demographic segments. A traditional analysis may tell a particular product to target millennials because millennials are a big demographic segment that spends freely and because the product in question has attributes that younger consumers typically like. But that analysis does not reveal what millennials seek from the product in question in different types of circumstances, or why. It also doesn’t tell the brand that many baby boomers may have the same desires as the millennials—for the same reasons that have nothing to do with age.

Identification of “White Space” Opportunities. DCG shows companies where to direct their efforts at innovation and expansion (including expansion through M&A) by revealing the most attractive opportunities for growth. These white spaces are anchored in underlying consumer needs that are not being met by the current options in the marketplace, which means that consumers have to compromise. Brands that move into a new demand space and that already possess the attributes consumers seek have big upside potential because they don’t force consumers to make concessions.

A New Level of Clarity and Confidence. DCG provides a clarity of purpose and a common language across the entire organization, and these attributes enable a company to reframe the market, based on what the consumer sees as the company’s competitive set, and sharpen the target or targets for a brand or portfolio of brands, including defining each brand’s role and purpose within a portfolio.

Stage One: Mapping Demand

DCG is a two-stage process. The first stage involves uncovering the principal drivers of demand and how to act on them; the second sets strategy and a plan of execution for the entire organization to follow.

Get the Competitive Frame of Reference Right. Companies think about categories—beer, snacks, or airlines, for example. Consumers think about what they feel like consuming or what they want (or need) to do. So a particular light beer, from the point of view of the company that makes it, is a brand in the beer category; from a consumer’s point of view, it is one choice among many alcoholic-beverage possibilities in a variety of situations—at a party, relaxing at home, or at a bar or restaurant with friends. To a company, potato chips are a salty snack; to a consumer, they are also an indulgence, like ice cream or chocolate. Airlines are one way to get from point A to point B, but so are trains, buses, cars, and, increasingly, disruptive sharing-economy services such as Uber. This type of thinking is likely to become more important as consumer behavior and purchasing patterns evolve. In the auto industry, for example, the frame of reference is shifting from “buying cars” to “accessing mobility” as more (especially younger) consumers think less in terms of owning a car and more in terms of using (under various models) the type of transportation they need in a given situation—an SUV for a visit to a do-it-yourself center, a sporty sedan for a date, or a minivan to pick up the kids at school.

Create a Map of Demand. The next step is to create a map of market demand that is grounded in consumer needs and provides a superior ability to predict consumer choice. This demand-centric view recognizes that consumers experience many needs over time—both emotional and functional—and that consumers engage with brands on the basis of those needs. Emotional needs vary by category and segment but include such elementary desires as “to feel cool or up to date,” “to take care of my family,” and “to be worry-free.” Functional needs also differ by category and are met by specific elements of a brand’s promise, such as affordability, quality, efficiency, convenience, security, simplicity, and friendliness.

The demand map identifies segment boundaries and specific bundles of needs, including the following:

- What drives different needs, and what does not (often breaking conventional wisdom in the process)

- The combined set of emotional and functional needs in each demand space

- A depth of statistically derived data for each demand space, including size, consumer and usage profile, and attributes required to win (such as product categories and customer service capabilities)

- Insights about the company’s starting position and performance relative to competitors (such as the fit between consumers’ perceptions of the brand, the demand space targeted, and the brand’s share in each demand space)

Stage Two: From Analysis to Action

The demand map should lead clearly to the demand spaces in which the brand meets, or can meet, the emotional and functional needs and has, or can develop, the attributes necessary to win. Some of these can be spaces where the brand already competes; others can be adjacent spaces that represent white-space opportunity. DCG can also reveal issues that are undermining the brand or restraining growth; addressing these issues presents growth opportunities as well.

The demand map will point clearly to the three elements of setting (or resetting) strategy: where to play, how to win, and the brand’s ability to win. The first is determined by the attractiveness of the space (based on such factors as size, inherent growth, and competiveness) and the brand’s right to win (including its attributes, fit, and existing share). How to win is about setting priorities for spending and other resources: the demand map shows which elements customers care about in any given demand space—and which they don’t—so that the organization can direct its efforts accordingly. For multiple-brand portfolios, the demand-centric approach will seek to maximize coverage and minimize overlap. The ability to win involves assessing the ease of execution—the level of investment needed to make an impact—in each demand space.

DCG makes a direct connection from strategy to action with an overall plan for resource allocation across channels and outlets as well as specific, cohesive, cross-functional plans by brand for each targeted demand space. The demand map will direct relative investment in each demand space on the basis of top-down strategic attractiveness (drawing on the relative differences from the where-to-play analysis) and bottom-up responsiveness to commercial investment. In addition, it will establish a framework for the commercial execution plan’s three main components, which direct activities throughout the organization:

- Communication, including the basis for core messaging that is anchored in the brand personality and crafted to address the consumer needs that make up the demand space

- Innovation, including the product development pipeline (what to keep and what to cut), immediate opportunities, and longer-term possibilities for expansion

- Activation, including customer and channel strategy with explicit implications for channel priorities and tools, sales tactics, promotion shape and level, and pricing

The execution plan can be used to engage the entire organization, directing such activities as innovation and product development, marketing, and merchandising—as well as real estate, finance, and human resources.

Consider the case of Frito-Lay. The company discovered that, despite its size, its products were not well represented in the fastest-growing channels. In fact, its scale worked against it. It could marshal huge amounts of data on how people with different demographic backgrounds viewed Frito-Lay products versus those of rivals, and it could parse differences in how consumers purchased particular categories of food. But in the end, it found itself playing a zero-sum game: successful line extensions for one product would at least partially cannibalize sales of other products in the portfolio.

DCG revealed a much more useful map of demand. It showed, for example, that the snack cravings of a single millennial Latina college graduate were not defined by her demographics. Instead, she wanted something different from a snack depending on the time of day, her mood, and whether she was alone or with friends. This thinking uncovered nine unique “demand spaces.” On the basis of this insight, Frito-Lay rethought its growth investments across its brand portfolio. By focusing different brands on different “demand spaces,” it was able to develop a set of core growth bets that did not cut into the sales of its other products. After years of decline, growth exceeded the market and share increased materially. The DCG-based insights laid the foundation for a highly successful marketing campaign that included the most widely used brand app in Facebook history. As Indra Nooyi, CEO of Frito-Lay’s parent, PepsiCo, said: “Demand spaces opened our eyes. It gave us a lens for growth. It gave us a way to spread our brands, to target new users.”

Putting It All Together: A Global Food and Beverage Company in an Emerging Market

Here’s another example that shows what DCG can do. A few years ago, a global food and beverage marketer was a close number two player in an emerging market, but it faced a variety of challenges that threatened its long-term position and growth. Its portfolio was heavily skewed toward value and standard brands, rather than premium products—at a time when rising incomes meant consumers were moving upmarket. The portfolio was also weighted toward one type of product, when consumer tastes were trending toward other types. And its principal competitor—the market leader—had several “fortress” brands and the ability to invest significantly to protect share.

The DCG approach revealed the primary drivers of consumer choice in the country’s market for the company’s products. It also showed that demographic variables such as income, region, and gender were not very predictive of needs and that they largely correlated with the other factors that did not act as drivers of choice.

Together, we were able to construct a demand map that included ten demand spaces, each of which was defined by a distinct set of needs and attributes. For ex-

ample, the emotional needs for the “single gender bonding” demand space were to relax and have fun, to feel rewarded, and to be confident. The emotional needs for “house party” were totally different: to let loose and to belong. The key attributes for execution in the various demand spaces showed a similar disparity, ultimately allowing the company to prioritize (and deprioritize) investment. The company was able to analyze how consumers’ perceptions of each of its brands (and those of its competitor) worked in each demand space on the map. It could then link needs, brand perceptions, and size of demand space to determine which brands fit best in each space on the map—and whether the space was worth pursuing.

The analysis also uncovered several issues. The company had both high brand overlap— multiple brands covering the same demand space—and largely unserved demand spaces. None of its brands was delivering on the full bundle of needs in a given space. Its investment was fragmented, and the level of brand support was not linked to the ability to win.

The company was able to reset its brand and portfolio strategies based on newfound clarity with respect to how the category (really) worked and where the company’s products (actually) stood. It developed a unified strategy that included new cohesion across the portfolio, new sharpness for each brand (including repositioning some upmarket), and a reallocation of resources with investments going to brands where the company was best placed to win. The company was able to identify a compelling set of expansive white-space growth opportunities that were grounded in consumer needs and each brand’s right to win.

The reset strategy led to a clear execution roadmap for the entire commercial organization, with communication, innovation, and activation activities all guided by a “true north” direction for each brand. For the three years after the strategy went to market, the company turned around declining sales for multiple brands and grew at a double-digit rate and faster than the market leader.

When to Deploy DCG

DCG can have an impact in any industry that involves consumer or customer choice. The following five tests can reveal whether DCG will benefit a particular company or brand:

- Consumer Test. Can the company explain simply how consumers make choices about its brand or a competitor’s? If the company is losing share (even while it is growing), can it explain why?

- Market Test. Is the shape of the market fundamentally shifting? Are disruptive new players emerging?

- Portfolio Test. Are multiple brands going after the same targets, resulting in high rates of cannibalization? Does the company lack an integrated view of the role in the portfolio for individual brands?

- Commercial Cohesion Test. Are the marketing, sales, and innovation teams operating under diverse and disjointed sets of priorities?

- Growth Test. This is the ultimate test: Is the company’s growth rate below ambition or historical norms? Does management finds itself constantly making tradeoffs involving price and volume growth?

If any of these tests comes up positive, DCG can help. Given the importance of growth to TSR, a company or brand that has stagnated or is losing share is also likely losing value. DCG has proven itself in multiple sectors and industries, helping companies focus strategy and resources, turn around stagnant products or brands, and ignite (or reignite) growth. The sooner management gets a clear picture of where the company’s true opportunities lie, the quicker it can reset on a path for improved growth, profitability, and value creation.