As they witness the proliferation of sensors, software, computing power, and connectivity embedded in everything from motor vehicles to home appliances, equipment manufacturers of all kinds are asking an existential question: is it time to stop thinking of themselves primarily as hardware and systems companies and instead to view themselves as providers of software solutions and services?

Consider automobiles. The electronic systems inside connected cars, which have Internet access and onboard computers, can process some 25 gigabytes of data each hour on the vehicle’s location, performance, and passengers. This data might create far more commercial value for vehicle manufacturers than those companies can gain by using the data merely as a source of information for better designing and servicing their products. Automakers could launch service businesses that provide detailed digital maps, help urban designers improve their management of traffic flows, and enable insurers to offer personalized policies based on the risk profiles of individual customers.

The steady expansion of the Internet of Things and the growth of connectivity open similar possibilities for a wide range of original equipment manufacturers (OEMs). Suppliers of medical devices, building and factory controls, and farm equipment are among the many traditional hardware companies that are investing in new software and analytics-driven solutions.

Thus far, however, the results of these endeavors have been mixed. While some hardware manufacturers are creating value with their software and data solutions, others are not meeting their revenue goals.

We have found that hardware companies that successfully make the transition to offering software solutions and services share several key characteristics: They recognize how their software, data, and connectivity can create value for specific customer segments, including end users. They understand these particular customers’ experiences, pain points, and needs. They create new business and revenue models appropriate for the software world and redesign existing software offerings—such as embedded software in hardware—to fit those models. They devise new go-to-market strategies for software solutions and develop new sales and support capabilities to execute them. And they use metrics appropriate for software businesses to measure success and enable growth.

All too often, though, hardware manufacturers find it difficult to make the transition. In some cases, the software products and services that a company designs miss the mark. In others, the engineering and product concepts are sound, but the offerings fail to meet sales expectations as a result of go-to-market challenges.

In our experience, companies that struggle to unlock the commercial value of their software and data share several basic shortcomings. They develop and market products that don’t offer the right value proposition for their target customers, which differ from the traditional hardware client base. Such companies also lack appropriate business and revenue models. For example, they may still bundle software with equipment as a one-time sale, rather than marketing it as a stand-alone offering designed to generate continuing revenue on a subscription basis. The strugglers also tend to have flawed go-to-market strategies. They have trained their sales representatives to sell tangible, physical hardware through a channel or directly to enterprise customers; but they now expect those representatives to sell software to end users, chief information officers, or senior business executives who lead operations such as supply chain management, maintenance operations, and customer service. In the case of business-to-business-to-consumer software and data applications, companies need to establish a fundamentally different sales process if they are to succed in the new area.

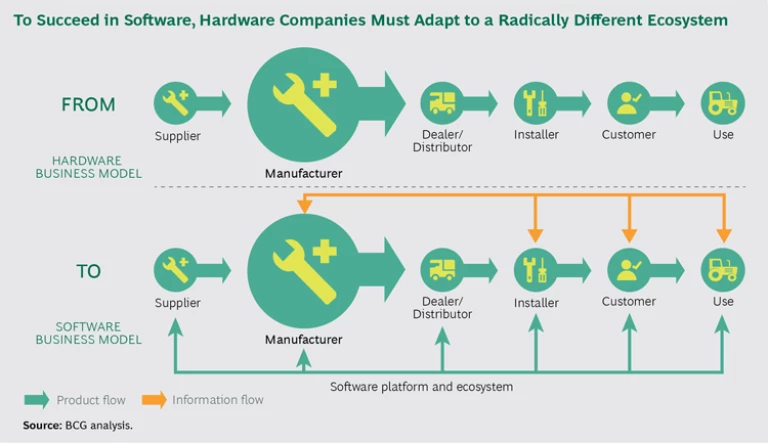

In short, many hardware companies do not yet approach software solutions as an end-to-end business. Nor have they fully internalized the fact that the software and services business operates within a radically different ecosystem and uses a different supply chain. For example, in the hardware business, OEMs may sell their products through dealers and installers, which also typically provide after-sales service. In the software ecosystem, these same suppliers may find themselves in the position of selling a set of services to end customers and collaborating with their traditional channels to sell products. (See the exhibit.)

In addition, most hardware manufacturers do not have the right skill sets and organization structures to succeed in software solutions and services. A hardware maker must transform itself from being a company focused primarily on tollgate-driven design and large-scale production of long-life-cycle hardware products to being an agile, customer-focused company capable of delivering short-life-cycle products. To accomplish this, it must acquire capabilities in software product management, engineering, sales, and customer support.

Successfully making this transition is very important. Hardware companies that sell sophisticated products used in complex systems are in a unique position to capture value from new software offerings. Besides missing important growth opportunities, hardware manufacturers that don’t adapt run the risk of becoming suppliers of commodity equipment. Another company will own the software solutions that become the primary customer interface, including the intelligent analytics. Hardware companies therefore face increased pressure to develop software and services offerings.

Keys to Success

The following are the keys to success.

Identify the value proposition. To succeed in the software and services business, a company must intimately understand customer needs and pain points so that it can formulate appropriate new software offerings. Often, the customers are different businesses than the ones that hardware manufacturers traditionally sell to. Even if they are current corporate customers, the decision makers for software offerings may be in different departments.

Developing new markets for the telematic data collected from motor vehicles illustrates this challenge. The main purpose of GPS systems in cars is to help drivers navigate, and such systems are typically sold to vehicle owners. But the immense quantities of data on driving behavior that GPS systems capture and transmit can be hugely valuable to insurance companies, for example, which can use the data to better manage risk or to provide discounts to drivers. Insurers can offer individual customers personalized policies based on how well they drive or on how many miles they log.

Instances in which hardware manufacturers are fundamentally shifting their value propositions—and therefore must reach new end customers—are becoming more common. One example: A supplier of building controls equipment now offers energy management software and services, which it has to sell to property managers rather than to general contractors.

Another example: A lighting manufacturer is integrating Bluetooth beacon technology into LED lighting equipped with location sensors that follow the movements of individual store customers by tracking their cell phones. The system can enable retailers to send highly targeted sales offers to customers as they move through a store, such as by sending text messages with discount coupons for items that are on their shopping list when they are in the proper aisle. Selling such a solution to a retailer requires different capabilities (such as strong retail knowledge) than are needed to market and sell light fixtures.

Develop the right business and revenue models. In a conventional hardware-based business model, software is usually bundled with the equipment. The customer pays for the hardware and sometimes purchases a maintenance contract for upgrades over a fixed period. Software solutions, by contrast, can be sold in multiple ways. They can be offered as a one-time license combined with a software maintenance contract and periodic upgrades, for example, or as a continuing subscription-based revenue stream. Providers can also charge on the basis of usage or even on the basis of outcomes.

Customers who use software to aggregate and analyze data—as in the case of automotive traffic patterns, discussed earlier—may want to subscribe to a data-feed service that they can periodically renew. Or they may prefer a pay-as-they-go usage fee that reflects factors such as the level of data usage or the number of devices or people accessing data.

Delivery models vary. In the software as a service (SaaS) model , customers pay to use cloud-based software and applications that a vendor hosts and sells directly to end customers. Another approach is to sell software in a more traditional license-and-maintenance-contract model with required implementation and integration. Companies may also need to develop new channels, such as IT system integrators, to sell and support software. Before rushing to market with software solutions, hardware manufacturers must study these business model and go-to-market options carefully.

A stronger focus on software solutions and service will dramatically change a hardware company’s revenue and profit structures. Consider the real (but disguised) example of a company that plans to make the transition over five years from having hardware account for 75% of revenue to having it account for 60%, with the remaining 40% to come from software licensing and maintenance, product-related services, and value-added services. Going forward, software will likely become the chief driver of the company’s profit growth, given the much higher gross margins that software can provide. New profit pools will come from a new line of business: professional services, such as remote maintenance and operations optimization. The value drivers in the company, therefore, will fundamentally change.

Industrial equipment manufacturers are now experiencing something similar to what the information technology equipment industry underwent during the past two decades. As hardware such as PCs, servers, and storage became commodities driven largely by industry standards, software—and then online services—emerged as the main drivers of profits and value. In response, computer makers such as IBM created new software divisions, and so did telecommunications equipment companies such as Cisco. Among transportation equipment companies, General Motors established OnStar nearly two decades ago.

Industrial companies such as General Electric, John Deere, and Schneider Electric are moving through a similar transition. General Electric, for example, has established a unit consolidating all of its software activities. Companies must decide whether software solutions and services should and can be operated within core hardware business units, or whether they would be more successful as separate business units. Given the differences in the business models, we have found that it usually is better to establish a separate business unit to incubate and grow software and services businesses.

Design the right products. Software that is embedded in products to operate hardware is, of course, sold with the hardware. Companies must radically modify such software if it is to add value as an ongoing software solution. Suppliers must provide enough differentiation for customers to recognize the software as a separate offer that they are willing to pay for.

The control software that an engine manufacturer develops for long-haul trucks is illustrative. The manufacturer decides that it wants to use the engine sensors and software to develop a driver coaching solution that will lead to improved fuel efficiency—a tremendous benefit to a customer with a large fleet of trucks. But developing embedded engine-control software is a far cry from creating enterprise software with an end-user interface for the fleet manager to use in coaching drivers about efficient driving behavior. The new software and data offering needs to be launched, marketed, priced, and supported—which in turn requires new pricing, legal, marketing, sales, and customer support capabilities.

The different revenue model requires a different approach to product development. In a hardware-based business, conventional practice is to try to bundle as much hardware and software as possible in the one-time license deal. The goal is to bring in as much cash as possible up front. In a subscription model, customers pay only for software and data they actually use. They expect continual improvement and continuous support, with low switching costs.

To hook customers, suppliers rely on the “freemium” approach. They offer core digital products or services for free, but charge for enhancements or upgrades to premium versions. Providers then constantly monitor their customers’ patterns of usage to help ensure that they realize value, thereby improving the odds that they will remain customers and buy higher tiers of service. In fact, subscription-based software businesses introduce a critical new sales role, the “customer success manager,” whose mandate is to help customers realize value from the offering (through sophisticated usage analytics), retain customers, and up-sell them to increase revenue per customer over time. Unlike makers of hardware products that go through discrete development cycles, subscription software suppliers have to monitor usage patterns nonstop and continually evolve their software and services to meet changing customer needs as they arise.

For example, a telecom equipment supplier could market a basic package with software that routes calls to sales representatives who are least busy. A more advanced solution might include voice recognition and artificial intelligence to automate some of the call responses and thereby boost the call center’s labor productivity. The offering could also include advanced analytics capabilities for sending more-targeted, higher-value offers to customers. Thinking through the business model, figuring out how to acquire and retain customers, and up-selling them to higher tiers of service are foreign concepts to traditional hardware companies and sales representatives hunting large deals.

Adopt new capabilities and go-to-market strategies. Hardware companies need to understand that the up-front costs of building a successful software business are substantial. Small, fast-growing software companies with annual revenue of less than $500 million may spend 25% to 35% of revenue on R&D and, in some cases, up to 85% on sales, general, and administrative expenses as they grow the business to gain scale. Even a large, established software leader like Microsoft or Oracle spends about 13% to 14% of its annual revenue on R&D. It took approximately 25 years for Oracle’s SG&A to drop from 70% of revenue to about 35% after it went public. Because industrial equipment companies generally have lower gross margins, they typically spend roughly 5% of revenue on R&D and substantially less on SG&A than software companies do.

As hardware companies start to create and sell software, they will need to develop appropriate go-to-market capabilities. In a hardware business, the price of equipment is often anchored in the costs of components. In the software and services business, there is no such anchor: value drives pricing. Companies must also learn to deliver their products through digital channels, which require a completely different supply chain, including billing, license management, and usage monitoring. And companies may have to build the capability to manage an entire ecosystem of outside developers and users who interact with and often contribute to the value of the software solution.

Businesses need a different type of sales force to engage with software customers. In a hardware-based business, agents typically find and win over a customer—and then begin searching for another. In software and services, the more common strategy is to “land and expand”: after the initial sale, the goal is to deepen the relationship over time. To accomplish this, agents must be far more engaged in helping the customer succeed and gain value from the company’s offerings. Some hardware companies are discovering that they need to hire a new sales force that specializes in software.

Software businesses need different kinds of partners, too. If a telephone equipment supplier enters the videoconferencing business, for example, it will likely need to distribute its products through a value-added retailer rather than through contractors that install its equipment. Companies must assess the suitability of traditional channel partners to support the new software businesses and must invest in training and support for the channel. In many instances, they may have to consider working with completely new channel partners, such as software value-added resellers and system integrators. Investing in new channel capabilities alongside a software-focused sales force may be necessary.

Use the right metrics. To capture the value of a hardware-to-software transition, a company must choose the right metrics for funding and monitoring growth. In place of unit sales and average selling price, common metrics used to measure success in software products include weekly growth in the user base, number of active users, average time spent by users on each session, and amount of data exchanged each minute. Software companies must also track how customers perceive them—for example, by using scores that advocates of the service post, and by learning from critics. If the software depends on a vibrant developer community, the number of app developers within the software solution’s ecosystem may be another key measure of growth. Assessing key performance indicators that gauge success in a software business is essential to ensuring that new ventures are on track.

Making the Transition

Many hardware companies have begun making the transition in their product and engineering organizations. They have been establishing agile teams, developing proofs of concept, and producing nascent software applications. Nevertheless, the overall business model remains underdeveloped. Companies need to understand how to price, sell, and support their new software and analytics solutions. To reap the high margins and revenue growth that software solutions make possible, hardware companies need to change their mindset and rethink the end-to-end business model they use. They must also acquire the end-to-end capabilities needed to succeed in the software solutions business.

We recommend that hardware manufacturers take the following steps in preparing to move into the software market:

- Understand the market. Identify the target customer of a software offering. Equipment suppliers should dedicate themselves to gaining a deep understanding of how the needs and business models of these end users differ from those of their traditional customer base, and of how software and services add value to their current user base.

- Build an agile software business capability. Invest in new platforms, tools, and capabilities to deliver software products. But don’t focus on product development alone. Think through the end-to-end business model. Instead of being an organization dedicated to developing products and pushing them onto buyers, hardware companies need to develop solutions that they can sell as part of a platform to which customers subscribe and may contribute data or solutions. Determine how the new offers will be marketed, priced, sold, and supported. Define the overall operating model needed to support the new software business.

- Set up a new business unit if appropriate. Consider establishing a different organization to house your software and services business. Understand the different cost structure and metrics necessary to run a software business. Establish a sales force that understands the needs of business leaders and developers who are the customers of software solutions. Nurture and protect the software business from the pressures of the core business. In situations where the integrated solutions deliver value, consider creating a software-and-services-led organization in which the sale of hardware is incidental to the task of satisfying customers’ needs optimally.

- Inject software talent into your organization. Fill some key roles in the business’s transition effort with people from outside the organization who have experience in the software and services industry. Product owners, sales leaders, customer success managers, and members of the software pricing team are all roles that could be filled with external candidates.

Making the transition from being a company that has long excelled at hardware to being one that also succeeds as a provider of software solutions is complex and challenging. It requires a radically different mindset, business model, and organization. Companies that successfully navigate this transition, however, are likely to be in a powerful position as the Internet of Things creates tremendous new growth opportunities in the decades ahead.