For medical technology companies, innovation is a matter of priorities. At least it should be.

Today, however, when its importance is greater than ever, medtech innovation productivity is in decline.

This is not a regulatory issue. The rate of regulatory approval—in terms of 510(k) and other premarket clearances—has been relatively constant since 2011. R&D budgets have been growing by 5% per year. The problem is the declining productivity of medtech companies, which is compounded by the higher burden of proof of efficacy today’s health care systems require. Large multihospital health systems have unprecedented purchasing power; they are putting more price pressure on medtech suppliers and demanding more clinical, operational, and financial benefits of medtech products.

The Innovation Challenge

In our work with medtech CEOs, division heads, and R&D leaders, we hear about a common set of challenges that companies face in making the right innovation investment decisions. Their most frequent complaints include the following:

- We are still coming at this from a product and technology perspective, not from a customer or market point of view.

- We have such a large portfolio that we have to spend more and more on maintaining the existing product lines instead of investing in new growth fields.

- We focus too much on incremental innovation and too little on breakthrough innovation.

- Too often, we base R&D investment allocations on the previous year’s expenses or ratios. A real strategic discussion on where to invest on the basis of market opportunity is not happening.

- Too often, we kid ourselves and continue investing in R&D in areas where we honestly have no chance to win.

- It is difficult for the CEO to assess the tradeoffs and make portfolio decisions. Every division has different definitions, metrics, and portfolio elements.

Medtech companies have three options for boosting innovation. They can commit more money; redirect spending to innovation projects by cutting R&D overhead (for example, by reducing the site footprint) or unit costs (for example, through outsourcing); or assign priority to high-return R&D projects while keeping overall spending levels constant. In our judgment, prioritizing R&D spending has the biggest potential for increasing returns in the medium to long term. The challenge is that this approach requires changing the way most medtech companies make innovation decisions. Here’s how they can go about it.

Volume and Diversity: High Hurdles in Prioritizing the Innovation Pipeline

Medtech is not generally a business of blockbuster products, so most innovation portfolios are large and diverse, comprising many individual projects. Although companies have many analytical tools, they often have difficulty applying rigorous and consistent strategic and financial metrics. Furthermore, product life cycles vary—for some products, improvements are rapidly iterated, while others stand the test of time—and this makes it difficult to assess financial impact. Companies frequently need to evaluate the tradeoffs between financial and strategic returns. It’s not always easy to justify, on the basis of ROI alone, a major investment in early-stage development in areas of long-term strategic importance.

Four Steps to Portfolio Prioritization

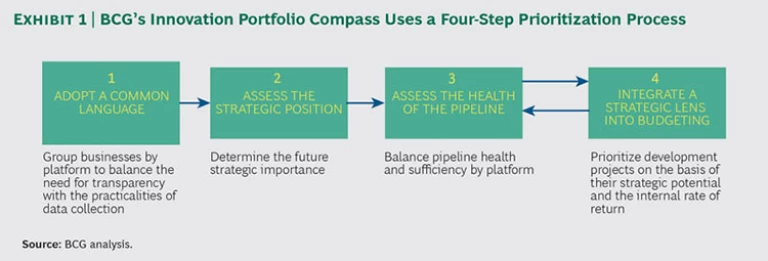

In our work with clients, we see four ways for medtech companies to overcome the hurdles of volume and diversity in order to bring discipline to their portfolio prioritization efforts. (See Exhibit 1.) Individually, each step can help, and the full package can provide a powerful boost to innovation productivity.

Step 1: Adopt a common language. In terms of units of measure and metrics, many medtech companies are inconsistent in their assessment of their R&D portfolios. For example, companies can take a business unit perspective in one area, a technology platform or project view in another, and a customer or channel view in a third. They also can apply a variety of metrics, such as customer satisfaction, financial projections, and even business intuition, making comparison difficult. This problem is particularly prevalent in companies with multiple lines of business and numerous business units—especially those companies with a history of acquisition. Aligning decision-making criteria and allocating innovation spending across historically separate units can pose significant challenges. Medtech companies need a common language and approach (including consistent definitions for what constitutes a unit of innovation) for assessing innovation across the entire company.

In our experience, the most effective way to define the unit of innovation is to first adopt a consistent definition of the innovation platform. Three factors are critical:

- Market Focus. Innovation platforms should be based on customer needs rather than technologies, channels, or locations.

- Decision-Making Scope. The platform needs to be narrow enough in scope that its potential can be assessed realistically and sufficiently large in financial or strategic promise that it is worth a significant commitment of senior management’s time.

- Intent to Invest. Companies need to compare platforms within set investment parameters. That is, they should compare two platforms that are in an area in which the company either has an existing pipeline or sees a strategic priority in building a pipeline. But they should not conflate the two categories.

Metrics must be relevant and consistently applied. For example, it is not uncommon today for a company to have one division tracking total revenues from innovation projects while another tracks revenues from new products net of cannibalization, rendering head-to-head comparisons impossible. We recommend assessing each platform on the basis of three composite metrics: market attractiveness, the company’s current innovation position (or its ability to execute), and the health of the pipeline.

Market attractiveness comprises several factors: a platform’s market size, growth, and profitability; the “headroom” for innovation, or the unmet need and readiness of science to address the unmet need; and market conditions, including competitive, clinical, regulatory, and pricing risks.

The company’s innovation position is made up of its current market position (for example, its commercial scale), its innovation capabilities in the particular platform area, and the uniqueness of those capabilities.

Pipeline health is a composite metric that accounts for the distribution of products in the pipeline by stage of development, the pipeline’s competitive strength, and the level of the pipeline’s innovativeness (the balance between incremental and transformative innovation, for example).

The critical factors are consistent comparison across the various platforms and the creation of a common language in the organization with respect to assessment of the portfolio.

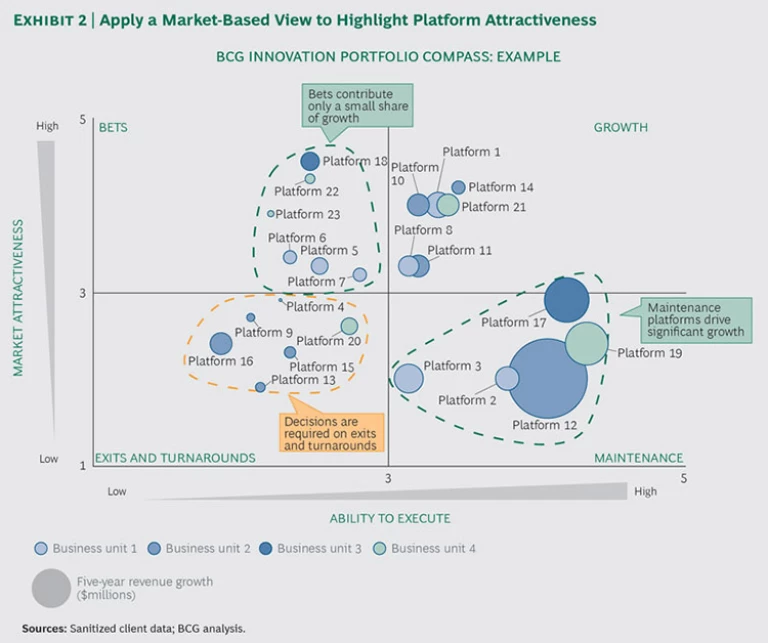

Step 2: Assess the strategic position. By comparing market attractiveness with its innovation position, a company can accurately evaluate the strategic position of each platform—on its own merits and relative to other platforms. (See Exhibit 2.)

On basis of their scores, platforms will fall into one of four quadrants:

- Growth. These platforms are in highly attractive markets in which the company has a strong position. In many cases, they are the growth drivers of the future.

- Maintenance. These are in less attractive markets in which the company has a strong position. They generally form the historical business base of a company.

- Bets. These platforms are in highly attractive markets where the company has a weak (or no) position. They are new areas in which the company is trying to build scale.

- Exits and Turnarounds. These platforms are in less attractive markets where the company has a weak position. Many are mature and require tough decisions.

In addition to conducting a qualitative assessment of the portfolio’s overall shape—asking, for example, whether there are enough growth platforms—executives should focus their time on two quadrants: bet platforms and exit and turnaround platforms.

To get a big bang for its innovation buck, a company needs to identify its bet platforms—the areas in which it should double down and disproportionately fund high-potential investments while shuttering those with lower prospective financial or strategic payoffs and higher risks. It should establish clear go-no-go criteria, as well as milestones for assessing progress that will guide decision making down the road.

Such milestones can serve as red-light signals when progress falls short of expectations, helping avoid “zombie” platforms that impede the company’s performance for multiple years.

The big question for exit and turnaround platforms: What is the strategic rationale for these investments? A strong strategic rationale may lead a company to turn a struggling platform around, and the lack of strategic importance should indicate the need to develop an exit plan. In our experience, companies are often tempted to try to assess the implications of where the platform is positioned in this quadrant, while the more telling question is, What does the fact that the platform falls in this quadrant mean for its future?

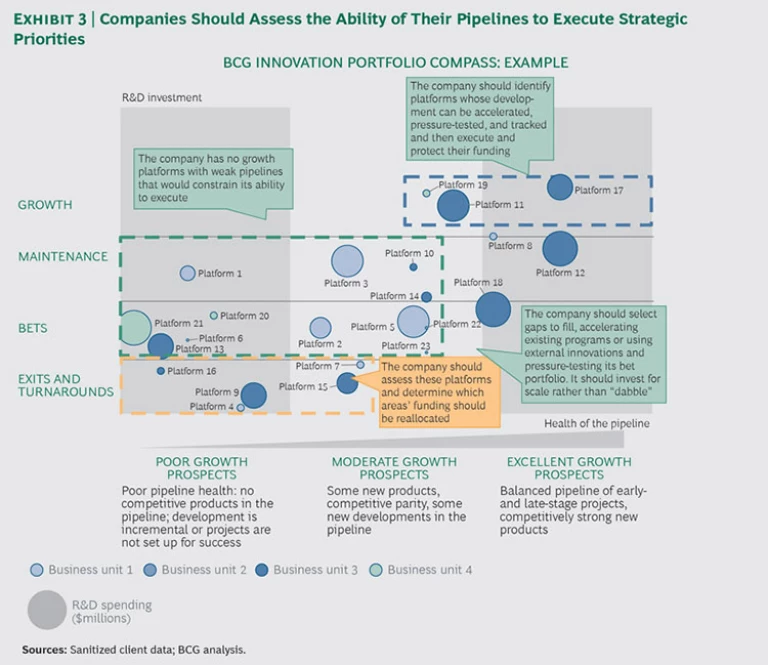

Step 3: Assess the health of the pipeline. After assessing the strategic positioning, a company should consider how well its pipeline can execute strategic priorities. In this analysis, the critical platforms are growth and maintenance. (See Exhibit 3.)

- Growth Platforms with a Healthy Pipeline. The key questions are, How does the company accelerate development of these assets? Does it simply protect current funding and resourcing, or should it disproportionately fund these platforms? Are the platforms given priority for internal shared-service resources? Should they be actively managed at a senior level to ensure that any development or regulatory risks receive appropriate attention?

- Growth Platforms with a Weak Pipeline. The company should decide how to augment these platforms (with internal and external resources) to improve their long-term sustainability and positioning. Again, should the company protect current funding or disproportionately fund these platforms? Should it raise the priority on business development and external innovation efforts to fill in the pipeline gaps?

- Maintenance Platforms. It’s important to avoid the overinvestment trap. The company should ruthlessly evaluate prospective returns on these investments. At the same time, it should investigate opportunities to reduce spending and to invest through different innovation models (such as outsourced development) to lower the cost base.

Step 4: Integrate a strategic lens into budgeting. When project priorities are set using financial-return metrics without applying a strategic lens, those at the bottom of the list can be orphaned—regardless of their strategic importance—because the company runs through its R&D budget before it gets to them. The company should integrate a strategic lens into its project-level prioritization process. We suggest that a company start by assessing projects on the basis of their strategic role within the platforms—growth, bets, maintenance, or exits and turnarounds, as described above. Subsequently, it can perform a financial assessment on the projects in each strategic category. The combination of the two will result in a more robust analysis of the overall innovation portfolio and a comprehensive discussion of the company’s innovation priorities.

Smart Portfolio Decisions

It takes time, of course, for the impact of today’s R&D decisions to show up in a company’s income statement. But our work with medtech clients has shown that a rigorous R&D portfolio analysis delivers multiple near-term benefits. First and foremost, it identifies and elevates major platforms and projects so that the organization can consider the need for further investment, external sourcing, resources, and capabilities or talent. It establishes a structured approach that allows management teams to more effectively assess and challenge the portfolio. It identifies the platforms that should be challenged and weighs the alternatives of reinvention and divestiture. And it creates a common language for management that facilitates analysis and assessment.

The actual decision making can be tough, but it is not overly time-consuming. The approach we describe can be applied quickly—within two to three months, in our experience, even for large and multi-divisional medtech players. Setting out a few basic rules in advance—and adhering to them—helps ensure a smooth process:

- Upfront, management should map out the key decisions that need to be supported with the analysis so that both reasoning and expectations can be explained to the organization, helping it focus on the resulting priority platforms.

- To ensure objectivity, management should establish a mix of qualitative and quantitative metrics with clear definitions.

- Portfolio mapping is an inherently iterative approach; the company should plan for significant calibration and validation with the organization over time.

- Portfolio management is an emotional topic—everyone has his or her favorite project or platform. The company should work to build wide-ranging support and buy-in for decisions.

BCG’s 2016 Value Creators survey found that in the current environment of modest GDP growth and high valuation multiples, investors appear to be seeking companies with credible strategies for value-creating growth. Among the traits investors seek are compelling equity stories based on strong fundamentals and intelligent capital allocation. Two of today’s top five investment criteria are management strategy and vision and three- to five-year revenue growth. (See “

In a Tough Market, Investors Seek New Ways to Create Value

” BCG article, May 2016.) Given the medtech industry’s recent pattern of underperformance in innovation, executives could not pick a more propitious time to undertake a rigorous analysis of their portfolios and construct a compelling fact-based case for the future.