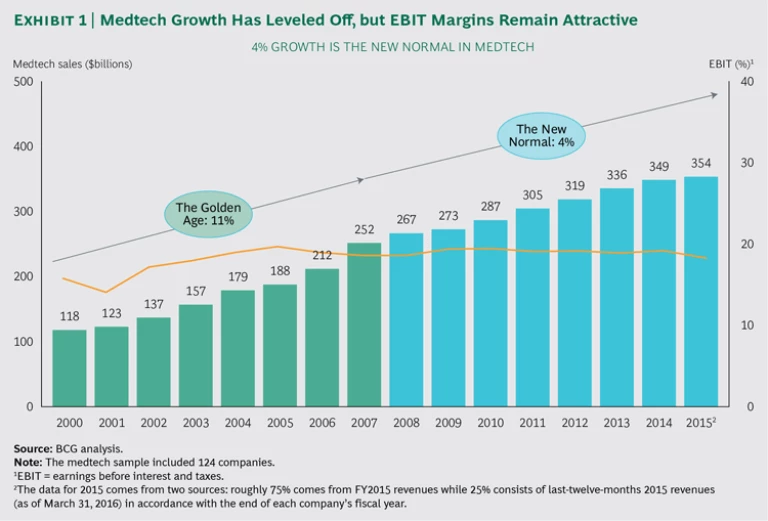

The medical technology (medtech) sector of the health care industry has been highly attractive to investors for more than a decade, delivering total shareholder returns of nearly 350% between 2001 and 2015. In the first few years of the 2000s—the golden age for medtech—sales grew by double digits. But sales growth has leveled off considerably in recent years and now hovers at around 4%. (See Exhibit 1.) There are many reasons for this, including the pressure to reduce health care costs, the increasing power of economic stakeholders in purchasing decisions, more consolidated and sophisticated health systems, new low-cost competitors, and the ubiquity of information with which to assess value.

Despite slowed growth across the health care industry, market forecasts for the medtech sector—as measured by investors’ expectations and growth predictions—are still high: between 2009 and 2015, valuation multiples rose 42%. These high expectations are justified in part by the sector’s healthy earnings before interest and taxes (EBIT) margins, which have remained steady at approximately 20% over the past decade.

Times are still good for medtech—but the health care industry as a whole is undergoing a period of significant change. These changes could create a downward spiral for companies that cling tightly to business as usual. But those that build their capabilities and adapt their business models will find enormous opportunities to grow and thrive. In this report, we identify the major forces that are reshaping the industry and outline the transformative actions that medtech companies should take in response to them. We also describe how to manage such a transformational effort. By leveraging BCG’s proven transformation framework, medtech companies can improve their financial positions, close performance gaps, and establish a winning position.

The Forces at Work

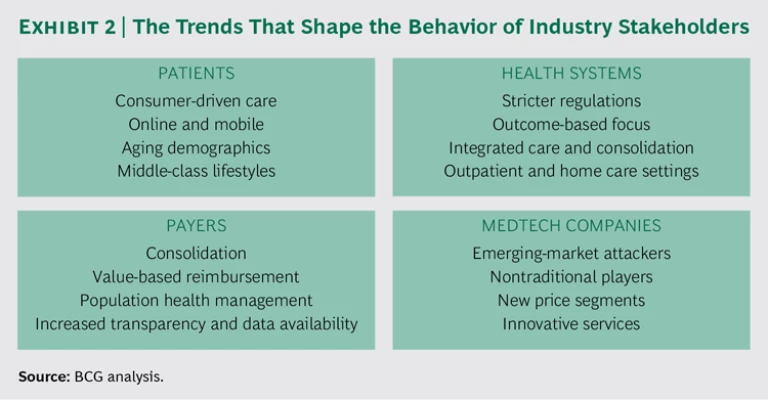

Many forces have played a role in reshaping the behavior of key stakeholders in health care, and medtech companies need to respond accordingly. (See Exhibit 2.) The following reflect just some of those trends.

- Patients. Medtech companies need to shift their portfolios to reach patients in aging populations who are living increasingly sedentary lifestyles and grappling with chronic diseases. They also have to address the needs of a rapidly growing middle class in emerging markets. In addition, many consumers are eager to adopt online and mobile platforms that help them stay informed, actively participate in their health care decisions, and handle their health needs quickly and easily.

- Health Systems. Health systems are becoming more consolidated, and experiments with integrated care models are ongoing. These systems are moving away from procurement, which is based on clinical preference and price, and toward a more holistic perspective that factors in quality and total costs across the product life cycle. This shift is opening doors for new partnerships with medtech companies.

- Payers. Payers are focused on consolidation, the containment of medical costs, and—increasingly—value-based health care (VBHC). They are using ever more sophisticated health economic assessments to appraise the value of new medtech interventions more systematically. They are also experimenting with innovative reimbursement models, such as risk sharing, capitation, and bundled payments. This places a much greater burden of proof on medtech companies as they seek approval, coverage, and payment for innovative therapies—but it also creates new opportunities for them to partner with payers to improve outcomes for patients.

- Medtech Companies. The medtech industry has recently attracted the attention of a number of nontraditional players. Technology giants such as Apple, IBM, Samsung, and Sony are entering the medtech game independently or partnering with medtech companies—and they aren’t looking to make incremental changes to existing innovations. These companies are making big bets on game-changing devices, wearable technology, diagnostics, and big data and analytics, and they are moving at a pace—with enormous investment budgets—that far exceeds the norm in medtech R&D.

Six Winning Moves

With so many dynamic and volatile market forces at work, medtech companies need a solid strategy that paves the way for long-term success. We have identified six actions that companies should pursue now to protect their business models from future changes in the sector. These actions are designed to improve performance, stimulate growth, enable experimentation, and generate lasting results. (See Exhibit 3.)

Make VBHC part of your DNA. VBHC is gaining momentum in health systems around the world. Its goal is to maximize value, which is defined as patient outcomes divided by costs. Governments are embracing value-based programs to lower costs while improving the quality of care. The shift is happening in different ways and at different rates in different markets, but the global trend is clear. In the US, for example, the Centers for Medicare & Medicaid Services (CMS) launched a value-based purchasing program that is expected to reach approximately $1.6 billion in 2017. CMS recently launched its first-ever shared-risk payment model for joint replacement and is currently planning to roll out more than 70 additional bundled-payment initiatives. In February 2014, the European Parliament passed Directive 2014/24/EU, which encourages medtech companies to define the best ratio of price to quality, allowing public authorities to consider full life-cycle costs rather than just the upfront purchase price. (See Procurement: The Unexpected Driver of Value-Based Health Care , BCG Focus, December 2015.)

As VBHC gains momentum worldwide, it’s also gaining the attention of industry leaders. At a conference in 2014, the CEO of one major medtech company argued that “moving to a value-based health care system is the only thing that can keep medtech from being commoditized.” Medtech companies need to integrate VBHC into their culture at each step along the value chain, starting with R&D. Their business should be segmented by medical condition, rather than product type, and should analyze the entire care cycle for every condition. This allows companies to develop and measure the success of end-to-end solutions, rather than standalone products, and to address the outcomes that truly matter to patients. (See “ How to Define Health Care Outcomes ,” BCG article, September 2015.)

For example, one global medtech company is evolving from a medical-device maker into a comprehensive solution provider with a focus on VBHC. The company recently acquired a chain of innovative diabetes clinics, as well as obesity treatment centers, to build up new businesses that focus on integrated care. These clinics not only measure outcomes to prove that their treatment exceeds the health care industry’s standards of care, but they also share data with payers to demonstrate that they are providing better value to patients.

Become an agile innovator. As R&D productivity has declined and commoditization has increased in certain segments of medtech, companies are under pressure to make tangible progress on their innovation agenda. While medtech companies overall increased their R&D spending by roughly 85% over the past ten years, the number of premarket and 510(k) product approvals issued by the US Food and Drug Administration have remained largely flat. Incremental improvements, however, are no longer good enough in today’s fiercely competitive environment.

One BCG study found that the strongest innovators in medtech clearly outperform competitors. These so-called high-science companies had greater levels of R&D productivity and grew 2.3 times faster than their peers. While high-science companies invested approximately the same amount in R&D (in percentage of sales) as their peers, they put more of their money on big bets, allocating 15% more per project and investing 25% more of their R&D budgets on larger, riskier projects. They were also more externally focused, deriving 10% more revenue from licensing and acquisitions and 80% more revenue from emerging markets than their peers. Finally, these companies went to great lengths to ensure that their projects were closely aligned with the priorities of key stakeholders—including payers, providers, and regulators—as well as patients. (See “ High Science 2010: Driving Medtech Innovation in Turbulent Times ,” BCG article, February 2011.)

To make tangible progress on an innovation agenda, medtech companies need to iterate more quickly, take calculated risks, and get comfortable with the notion of failing fast. (See “ Five Secrets to Scaling Up Agile, ” BCG article, February 2016.) In addition, successful medtech companies need to build new digital and analytics capabilities to adapt to changing market conditions, facilitate faster decision making, and foster innovation. Medtech companies should also consider new investment models beyond straightforward M&A, including early-stage investments, phase III clinical trial investments, incubators, and partnerships that open avenues to faster innovation.

We are seeing more and more signs of medtech companies embracing this approach to innovation. Some companies have established “innovation centers” in various regions of the world to foster creativity and tap into early-stage science and technology. In 2015, one medtech company launched an open innovation challenge, inviting clinicians, engineers, designers, and entrepreneurs to submit ideas for remote patient monitoring. The innovation model in medtech is more high-risk, high-reward than ever before, but companies that get it right will reap the benefits of strong pricing and growth in market share.

Shape a new commercial model. Medtech companies looking to transform their commercial models are motivated by continued pressure on pricing and reimbursement and by an ongoing shift in decision making from clinical to economic buyers, who are demanding stronger proof of value and lower costs. In the US, the trend toward hospital consolidation has resulted in 50% of all patient admissions now being driven by the top 100 integrated delivery networks. Purchasing decisions are now often being made by centralized committees, and they are more likely to be focused on overall value for the hospital—improved outcomes at the lowest cost—than on individual clinician preference. Where the commercial model has historically been a relatively straightforward process—medtech sales teams visiting individual clinicians to sell their products—the procurement process is now much more complex. (See “ Medtech Key Account Management in the Age of Consolidation ,” BCG article, May 2016.)

Medtech players need to reshape their go-to-market strategies and transition to a leaner commercial model, focusing on the opportunities with the highest priority. We highlighted this point in our first global medtech commercial benchmarking study, in 2013. (See Fixing the Medtech Commercial Model , BCG Focus, July 2013.)

The 2016 edition of the Milkman benchmarking study, which surveyed more than 100 businesses, including nine of the ten largest medtech players, concluded that the medtech commercial model still needs work. A substantial step up in capabilities is required to reinvent clinical selling; address economic decision makers more effectively; partner with key accounts on joint value creation opportunities; build marketing muscle; invest in pricing, market access, and medical capabilities; and make service a true differentiator and source of revenue. Companies that have embraced these moves are breaking away from the pack and winning in the market.

Double down on operational excellence. While companies experience price pressures differently throughout the medtech sector (depending on a company’s ability to differentiate its products), the pressure to keep prices down has become more acute in recent years. Medtech companies’ costs are still high compared with those in other industries. Their sales, general, and administrative (SG&A) expenses (as a percentage of sales) are twice as high as those of high-tech companies, for instance, and three times as high as those of industrial goods companies.

In an environment where medtech customers are actively putting downward pressure on prices, managing the bottom line becomes a key factor for success. High costs limit the resources available to invest, which slows growth; slowed growth, in turn, further limits the capacity to invest. Operational excellence will therefore become one of the key contributors to sustained margins. A major chronic care company, for example, increased its EBIT margin from 13% to 33%, while growing twice as fast as the market, by drilling down on cost of goods sold (COGS) and SG&A. Improving operational excellence and moving to a leaner commercial model can also act as a conduit for addressing new low-cost market segments with cost-effective offerings that allow direct competition with global challengers in both mature and emerging markets.

To achieve operational excellence, companies need to optimize their organizational structure, supply chain, and support functions.

It is imperative to create a lean organization. Companies should maintain as few layers as possible, allow a broad span of control for all managers, and keep bureaucracy to an absolute minimum. With fewer management layers, companies typically speed up decision making, improve customer insight, create more meaningful and rewarding management roles, and—crucially—generate immediate savings that can be reinvested into growth areas.

Companies also need to improve procurement practices, balance inventory with product availability, and optimize manufacturing and logistics. Strong execution in these areas can consistently reduce costs (especially COGS) and help strengthen a company’s competitive position, offsetting losses from declining prices. Indirect procurement, for example, is often undervalued, though it can be relatively easy to generate significant cost savings when compared with direct material spending. A strong supply chain offers a competitive advantage in an industry that performs far worse than industrial goods across a wide range of key metrics (including cash conversion cycles) and that is vulnerable to lasting market share loss following stockouts.

Finally, it is important to optimize support functions. Eliminating duplication and integrating company-wide functions (such as HR, IT, and finance) across divisions and business units reduces overhead costs. Companies also need to clarify the responsibilities of local and central operations to further avoid duplication and eliminate reporting procedures that use up time and resources but add little to overall effectiveness. All of these actions are essential to free up resources that can be invested in the new capabilities, innovation, and experimentation needed to achieve a successful transformation.

Go digital. The digital revolution is dramatically transforming health systems. Funding for digital health has experienced a steep growth trajectory, quadrupling (from $1.1 billion to $4.5 billion) between 2011 and 2015. Physicians are already using custom-made 3D-printed devices and prosthetics, implementing augmented reality in operating rooms, and monitoring patients remotely via ever-smaller mobile devices. Consumers are using their smartphones and adopting wearables to monitor their health, interact with physicians online, and participate in online patient networks. Advances in digital technologies are also creating exciting opportunities in personalized medicine, as clinical decision support tools help physicians predict, prevent, and treat disease. From 2014 to 2015, funding for personal health and tracking tools in the US experienced an increase of 223%, totaling $407 million, according to a recent report by Rock Health.

Medtech companies need to identify the risks and opportunities presented by digital technologies. “Forward-thinking companies need to rewire themselves around digital innovation by building new offerings around customer behaviors and needs,” says Jeff Schumacher, the CEO of BCG Digital Ventures. Using data analytics, executives can create a heat map to pinpoint the areas in which digital technologies have the greatest potential to transform their business. By envisioning the customer journey and analyzing pain points, medtech companies can develop new products and services that boost patient engagement and provide support to clinicians.

There is also an opportunity for medtech companies to expand their role by marketing end-to-end digital offerings and using software-as-a-service business models to improve clinical work flows and patient experiences. The notion of a standalone device is evolving—and digital technologies allow companies to transition toward more comprehensive services quickly and effectively.

From an operational perspective, companies can digitally transform their entire business from top to bottom, including R&D, internal operations, logistics, supply chain, sales, and marketing. A solid digital strategy helps companies better understand and engage with their customers, address the needs of the new connected world, and fend off both emerging startups and tech giants.

Leverage inorganic growth opportunities. Global M&A activity continues to gain momentum at a high level as medtech companies look to increase scale and build complementary product offerings. From 2014 to 2015, medtech companies spent more than $180 billion on M&A. BCG research indicates that companies that commit to M&A as an integral part of their expansion strategy significantly outperform the market. From 2013 to 2015, the companies most active in M&A generated significantly higher total shareholder returns than their less acquisitive peers. Given the sector’s slowed sales growth, margin pressures, and high shareholder expectations, M&A activity offers an important new avenue for companies to sustain their growth profile over the long term.

Savvy deal-making enables companies to adapt to a changing competitive environment more quickly than making organic moves. With the right deals, medtech companies can strengthen their competitive positioning through consolidation, access new customers and markets, strategically expand product portfolios, bolster R&D pipelines, and secure strategic footholds in emerging markets. Given the high valuations of most medtech companies, strong strategic positioning, operational effectiveness, and postmerger integration are critical to realizing the value of a deal.

There’s a time window for mergers and acquisitions, however, and it is narrowing in many parts of the medtech market. New, innovative companies are entering the field and being acquired by companies eager to transform their competitive position. But funding for medtech startups has decreased in recent years, which means that fewer innovative startups will be available. This is especially true for markets that have recently experienced high M&A activity, such as orthopedics, cardiovascular, and dental. In these markets, fewer attractive targets will be available, and competition for them will be fierce.

A Medtech Transformation Agenda

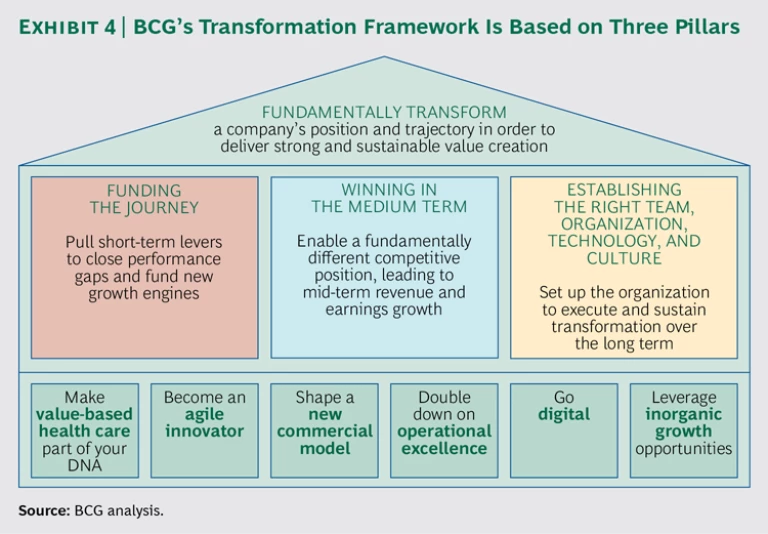

While it may appear prudent to move cautiously and experiment with just two or three of the winning moves detailed above, companies need to develop a comprehensive transformation agenda and a rollout plan that moves forward on all fronts now. The changes sweeping across medtech—slowed growth, increased emphasis on VBHC, static R&D productivity, price and cost pressure, digital growth, and heightened M&A activity—are here to stay. A transformation agenda requires change in multiple areas of the business, from cutting costs internally to investing in high-growth opportunities. These parallel actions are essential for success. Companies that move too cautiously will fail to free up sufficient resources to reinvest and will therefore lose ground in high-impact areas where they need to develop critical new capabilities.

BCG’s transformation framework is based upon three pillars: funding the journey, winning in the medium term, and establishing the right team, organization, technology, and culture (see Exhibit 4):

- Funding the Journey. Launch short-term, no-regret moves; simplify the organization; reduce costs; boost revenue; and free up capital to fund new growth engines.

- Winning in the Medium Term. Develop a strategic direction to increase competitive advantage and drive growth.

- Establishing the Right Team, Organization, Technology, and Culture. Deploy change management, identify and develop talent to fill critical gaps, and set up the organization to sustain high performance over the long term.

- Each company’s transformation agenda will look different. BCG has published a detailed report for companies that want to customize a transformation agenda, giving leaders the tools and approaches they need to lead a successful and sustainable transformation effort. (See Transformation: The Imperative to Change , BCG report, November 2014.)

For medtech companies, it is crucial to follow through on all three pillars of the transformation framework. Funding the journey will become an overriding concern for many companies over the next year as margins get squeezed from multiple directions, including downward price pressure and an increasing cost base. But the medtech companies that can proactively lower their costs and boost revenues (by optimizing pricing and sales force effectiveness, for example) will free up funds to develop new capabilities—in market access, digital innovation, data analytics, and operational excellence—and invest in new growth areas.

The health care industry is in the midst of sweeping changes that are having profound effects on the medtech sector. With investor expectations at an all-time high and growing pressure to produce high-value products at low cost, the current business model needs to evolve. Times are still good—with strong gross margins, healthy growth in sales, and high valuation multiples—and medtech companies would be well advised to begin their transformation journey now. When addressed as part of a comprehensive, coordinated transformation, the six actions outlined in this report will position medtech companies for long-term success.

Acknowledgments

This report was sponsored by the Health Care and Transformation practices. The authors would like to thank their colleagues for sharing their medtech expertise during the development of this report. Chris Bergstrom, Michele Brocca, Jens Deerberg-Wittram, Christophe Durand, Lars Fæste, André Kronimus, Andrea Miotto, Daniel Schroer, and Gunnar Trommer were all important contributors to it. The authors would especially like to thank Margarida Correia for her extensive contributions in developing content and analysis for the report.

In addition, the authors would like to thank Neveen Awad, Dominik Bundschuh, Bettina Buschhorn, Maya Gavrilova, Erik Gilbertson, Janina Jauch, Doris Michl, Ines Santos, Katie Sasser, Rebekka Schlatter, Nina Teichert, Johannes Thoms, and Sarah Wulfert for their content contributions to this report.