The United Kingdom’s decision to leave the European Union will undoubtedly have a considerable impact on M&A in the coming years. According to BCG analysis, deal value will be 30% lower than it was in 2014 through 2015. The impact, however, will vary by industry. M&A activity will likely grind to a halt in some industries and accelerate in others.

In the years leading up to the referendum, optimism about the UK economy created a favorable environment for M&A. From 2014 through 2015, the UK saw high levels of M&A activity, primarily on the back of strong annual GDP growth of 2% to 3%, improving consumer sentiment, and a few large deals, such as the one between Anheuser-Busch InBev and SABMiller. This led to higher M&A valuations, with the median EBITDA multiple increasing to 10 to 11, the highest it has been since before the global financial crisis.

In early 2016, however, M&A activity began slowing in response to concerns over Brexit and, more important, macroeconomic worries. In March 2016, the Office for Budget Responsibility reduced the UK’s GDP forecast to reflect weaker-than-expected productivity growth. Brexit has now compounded these concerns.

Given the uncertainty about the timing and terms of the UK’s exit, executives need to understand not only how Brexit will affect their company’s financial performance but also the opportunities and risks it may present for their merger, acquisition, divestment, and defense strategies.

Exploring the likely M&A impact of Brexit by deal type and by industry, and asking the right questions, can help companies ensure that their M&A strategy is Brexit-ready.

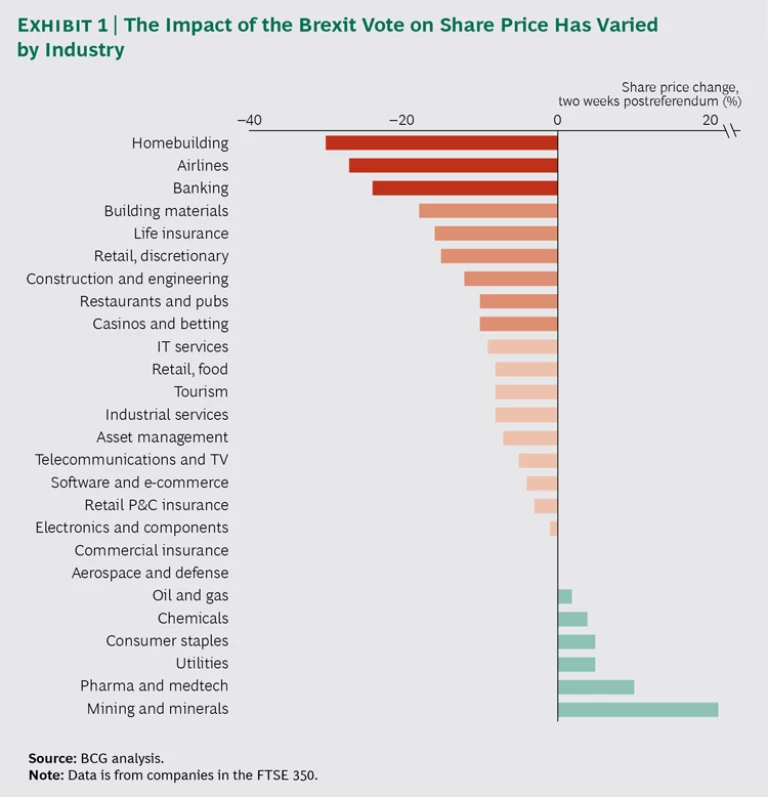

Brexit’s Impact on Share Prices

Regarding Brexit, the only certainty is uncertainty. Each exit scenario will have a different impact on the UK economy. The consensus among economists, though, is that any exit will have a negative effect; most forecast that GDP will be 3 to 8 percentage points lower in the long run.

The impact on UK businesses, however, has varied significantly so far. For example, airlines and homebuilders saw share prices fall 30% on average in the two weeks following the referendum, while mining companies saw share prices rise approximately 20%. (See Exhibit 1.)

This variation in share price movements in the aftermath of the referendum can be broadly explained by five factors.

Internationalization. UK businesses with a high share of international revenues are benefiting from foreign-exchange translation effects. Businesses that focus on the UK but are exposed to foreign cost of goods sold are negatively affected.

Consumer Demand. Industries that produce nondiscretionary goods and services, or that have longer-term subscription-based revenues, are not seeing large changes in sales. More-discretionary industries are harder hit.

Interest Rate and Asset Volatility. Businesses in which profitability is linked to interest rate policy, asset valuation volatility, or financial investments are negatively affected.

EU Regulation Exposure. Industries that depend heavily on EU permissions to operate, such as airlines and banking, are experiencing significant uncertainty and an increase in their cost to serve.

EU Labor Dependency. Industries that rely on low-skilled EU migrants for labor face rising labor costs in the longer term, which will depress financial performance.

Brexit’s Impact by Deal Type

The types of deals we will see in the coming years will probably change. Consider the following categories.

Strategic Inbound. International players that were looking to build market share in the UK or to establish a European position but had not yet acted because of comparatively high asset prices and a strong British pound might move to take advantage of the situation.

Opportunistic Inbound. Private equity players (particularly those with funds in US dollars) and opportunistic Asian investors will likely take advantage of low valuations in US dollars to gain a stake in the UK market.

Outbound. Brexit could slow outbound M&A. Asset prices outside the UK are now comparatively high, and UK-based businesses will likely focus on managing domestic uncertainty. The exception could be UK-based businesses with a high proportion of international revenues and a high share of costs within the UK. Such companies will see a margin boost owing to depreciation of the pound sterling and may use their improved cash flows to make acquisitions.

Domestic. We expect to see an increase in consolidation activities in industries that have been negatively affected by Brexit (such as discretionary categories). Consolidation plays will likely be made in businesses in which assets are distressed, there are scale benefits, and businesses can be fairly valued—for example, in restaurants and pubs and in casinos and betting, but not in banking.

Divestment. Companies may divest businesses to repatriate cash to the UK. For example, UK businesses may look to divest US assets to take advantage of a weak pound or to reshape their UK portfolio to minimize complexity and risk.

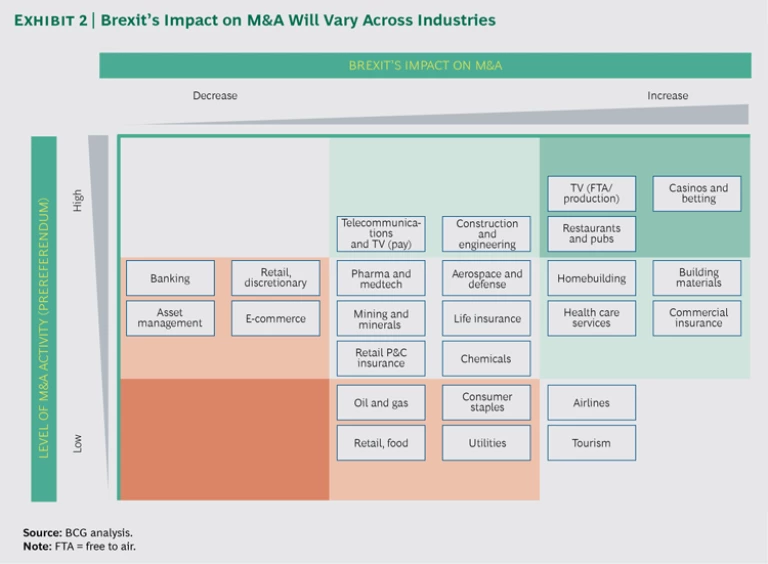

Brexit’s Impact by Industry

Even before the referendum, many industries were experiencing pressure to initiate M&A deals. In the wake of Brexit, we expect to see the mix of M&A activity by industries change. (See Exhibit 2.)

Energy and Industrial Goods. The share price of most companies in aerospace and defense has been resilient, owing to their high share of foreign revenues. UK companies with a high proportion of domestic revenues, such as Babcock International and QinetiQ, have been harder hit. They may now be attractive to private equity or to foreign buyers looking to expand into the UK.

Brexit may also trigger some divestment activities. For instance, Cobham could look to offload noncore US assets that are struggling to gain US defense contracts owing to foreign ownership.

The homebuilding industry was hit hard by an expected reduction in demand following the referendum; share prices were down more than 30%. Undoubtedly, the industry will experience uncertainty and suppressed volumes over the next few years. However, we see an opportunity for consolidation, given several factors. First, the long-term outlook is positive, owing to the persistent shortage of housing in the UK. Second, the industry is fragmented, with the top three companies—Barratt, Persimmon, and Taylor Wimpey—accounting for only 25% to 30% of private-housing output. Finally, consolidation offers potential synergies in design, procurement, sales, and corporate overhead. Any consolidation play will most likely come from a trade buyer. However, low asset values and the housing shortage could pique PE interest.

In construction and engineering, Brexit will not trigger a large wave of M&A in the civil and structural segments but may accelerate the global trend toward consolidation. Global companies have been consolidating in recent years as they look to create larger entities with a diversified footprint, expand into adjacent industries, integrate design and construction activities, and consolidate design centers in order to be more competitive. Historically, businesses focused on the UK and Europe have been less attractive because of their relatively low growth. However, their low valuations may be sufficient to attract inbound M&A, particularly from Asian trade buyers seeking to purchase strong brands such as Atkins and Balfour Beatty.

We don’t expect to see a large increase in M&A activity in building materials. Nevertheless, foreign players such as Saint-Gobain may move to diversify or to strengthen their UK position during this period of uncertainty and low asset prices. Pressure on distressed companies in the industry may also trigger domestic consolidation aimed at reducing overhead costs and taking advantage of common customer bases; for example, large UK companies may merge with Grafton, Marshalls, or Ibstock. Global UK-listed players (such as CRH, Wolseley, and Ashtead) will probably continue making smaller acquisitions.

Financial Services. M&A activity will probably halt in banking and consumer finance as uncertainty brought on by Brexit makes asset valuations difficult. Key drivers of uncertainty for banks include an increase in funding costs, low loan growth, an increase in nonperforming loans, and delays in base rate increases, which depress net interest margins. Additionally, capital markets face uncertainty from the potential end of financial passporting.

If valuations fall further, large banks may start acquiring monoline or specialist lending businesses such as MBNA. However, with most players trading at a price-to-book ratio of 0.5 to 1.5, current valuations are not low enough to trigger such activity.

The life insurance industry is unlikely to attract inbound M&A, even at current depressed valuations. The UK life insurance market’s products, systems, sales practices, and regulators differ considerably from those of other markets. As a result, integration offers few opportunities for synergies. On the contrary, uncertainty and increased volatility could push more foreign companies to divest their UK businesses. Closed-book operators like Phoenix may look to take advantage of such divestments. Brexit may put additional pressure on UK insurers to diversify and increase scale by, for instance, moving into asset management.

The commercial insurance industry is consolidating, owing to the lack of growth in developed markets and the potential for economies of scale. Many UK-based insurers have been acquired by large global companies, such as Brit, acquired by the Canadian firm Fairfax, and Amlin, purchased by the Japanese firm Mitsui Sumitomo. The fall in the pound may accelerate this trend.

Consumer and Retail. Most players in consumer staples operate international businesses; hence, Brexit would trigger increased activity in this industry only for businesses that have a high degree of exposure to the UK.

For example, we may see a merger between Britvic and A.G. Barr to increase scale in the UK soft-drinks market (a previous attempt to merge was called off in 2013). Or PZ Cussons could be purchased, given current valuations, by a consumer packaged goods company seeking to reshape its portfolio, such as Reckitt Benckiser, P&G, or Unilever.

In retail, we don’t expect a high level of M&A activity in discretionary segments, in which companies tend to be differentiated, thus limiting the potential for scale benefits. The most likely source of activity is from private equity or Chinese buyers looking to capitalize on low asset valuations. Many UK retail companies are relatively weak financially and might be interesting acquisition targets, such as Sports Direct.

We expect limited activity in food retail. One opportunity is the merger of Morrisons with Co-op’s grocery business unit—a move that would increase buying power and create a complementary convenience and supermarket footprint.

Travel, Media, and Entertainment. The case for consolidation in commercial airlines in Europe was already quite compelling before the Brexit vote, but companies faced significant hurdles owing to national interests, antitrust challenges, and limits on foreign ownership. We foresee no immediate reduction of these hurdles. If Brexit triggers a broader macroeconomic slowdown, however, governments may allow further consolidation among the flagship carriers, such as IAG.

In telecommunications and TV, UK production costs have fallen by 10% owing to a decline in the pound. Brexit may increase inbound activity, as US players who were already mulling over acquisitions of UK production companies speed up their acquisition schedule. Strict antitrust regulations in this industry would likely prevent any major domestic deals, but given industry pressure, we may see the consolidation of smaller production houses or the acquisition of UK production companies by international players seeking synergies and access to low-cost capabilities.

Brexit might trigger consolidation in casinos and betting. However, such activity will likely prove difficult, given antitrust challenges, as was evident in the merger attempt between Gala Coral and Ladbrokes. Brexit will probably accelerate the trend toward diversification across subsectors. The takeover attempt by 888 and Rank Group of William Hill is a case in point. We will also likely see vertical integration and investment to mitigate technology risks (for example, William Hill’s investment in NYX).

Brexit’s anticipated impact on demand in restaurants and pubs, combined with a cyclical decline and new government regulation ending “tied pubs”—pubs that are required to purchase a portion of their beer from a particular brewer—may stimulate a new wave of consolidation in this area. Larger and more financially stable players, such as Mitchells & Butler, may buy struggling peers in order to manage their footprints and achieve scale in procurement and food service.

Implications for Business Leaders

The uncertainties surrounding Brexit’s impact present both opportunities and risks. Executives in UK businesses should take time to reassess their strategies by exploring questions in the following areas:

- M&A. Is now the time to make acquisitions in the UK or internationally in order to increase scale or diversify my business? Which companies are the most attractive or receptive targets? What level of synergies could be realized?

- Divestment. Is now the time to reshape my portfolio? How do I maximize value from my divestments? Which companies might be the right buyers?

- Defense. Am I exposed to a takeover? What would I consider acceptable and unacceptable terms for a takeover? What value-enhancing actions can I take to preempt an unwanted takeover? Do I have a solid defense strategy?

Executives in non-UK companies should consider the following:

- What are the UK deal opportunities in my sector? Is there a clear strategic rationale for the deals I’m considering, or am I just being opportunistic? How does the rationale change depending on the Brexit scenario (for example, free trade versus no free trade)?

- How much risk am I willing to take on?

The prospect of Brexit has upset the status quo. Deals previously under consideration might now look more attractive or affordable, whereas others may seem too risky or unattractive. Executives must take time to understand Brexit’s implications for their business and their industry, and consider how they can best use M&A to create shareholder value in a post-Brexit world.