For decades, mining majors put innovation low on their priority lists. Why? Perhaps they were getting sufficiently satisfactory returns from their assets. Or they had grown complacent because of the industry’s historically slow adoption of new technologies.

Both reasons are long gone. Miners’ operating costs have soared following massive capacity additions across commodities. In copper, for instance, costs have ballooned at double-digit rates in many producing countries.

In the past ten years in Chile, unit costs increased by roughly 15% annually. At the same time, prices of key commodities have plummeted 50% to 70%, owing to the general economic downturn and commodity oversupply. Most observers don’t see a major rebound coming anytime soon.

Rising costs and falling prices have squeezed profit margins. The EBITDA of 20 leading global mining companies shrank from 45% in 2011 to less than 20% in 2014. Declines in ore grade aren’t helping; in fact, they have compelled players to go underground in search of more attractive deposits. And the additional costs from transitioning to underground operations will further erode margins if miners don’t invest more in innovation.

The good news is that some forward-thinking miners have begun making innovation a priority, investing substantially in programs focused on extracting cost-saving value from technologies such as autonomous

haulage systems and unstaffed air vehicles. And because most such technologies are developed by mining-machinery OEMs, many miners are partnering with these companies to develop technological innovations.

Such efforts can pay big dividends. Indeed, our analyses show that, on average, global innovation leaders across industries generated annualized total shareholder return (TSR) premiums 7.5% and 4% greater than their peers’ over three- and ten-year periods, respectively. However, merely funneling money into R&D isn’t enough to capture such returns, especially if funding is overly concentrated on academic research or ideas with little connection to a mining company’s operations. To get the most from their innovation investments, miners also have to establish a disciplined innovation management system.

Innovation Management

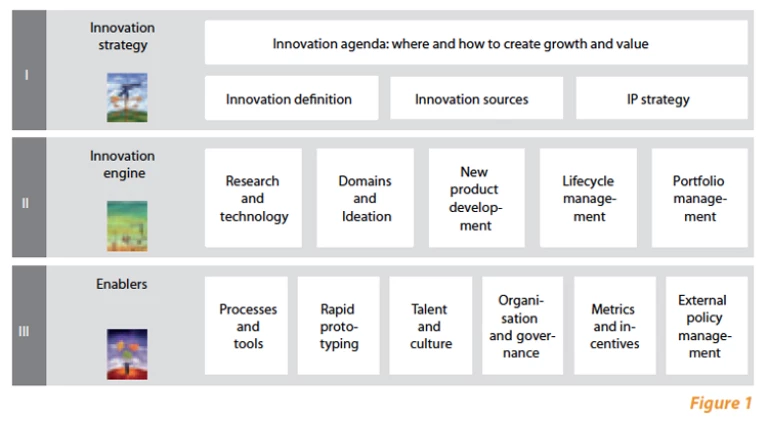

An effective innovation management system comprises three core components: innovation strategy, innovation engine, and enablers. (See Exhibit 1.)

Innovation Strategy. A company’s innovation agenda should reflect where and how it plans to create growth and value. Companies should treat defining their agenda as a systematic, annual process closely linked to strategy definition. And they should start the process by clarifying their strategic priorities and key technological challenges at the group, business unit, or functional level and at each link in their value chain. Regarding innovation sources, miners can’t overlook the advantages of open innovation. In contrast to developing many technologies internally, miners can save considerable time and money by acquiring such innovations from the market through partnerships focused on joint development of needed technologies. In a BCG survey of 1,500-plus senior executives from top global companies, 65% of respondents from strong innovators agreed that strategic partnerships with other companies are “often” or “very often” a source for innovation ideas. For weak innovators, that number was 30%.

Innovation Engine. How a company manages its innovation portfolio can spell the difference between a powerful innovation engine and a sputtering one. Incremental innovations that lower costs in a key process,

for example, can deliver as much bottom-line impact as breakthrough innovations—and often more quickly. With this in mind, one global mining company we worked with defined a portfolio reflecting projects of different magnitudes in each business unit. This approach enabled unit leaders to share wisdom gleaned from their innovation experiences, which in turn supported the effective implementation of ideas, especially for the incremental innovations so critical to units.

To efficiently manage their innovation portfolio, miners must make frequent decisions about the portfolio’s shape (the balance of incremental and breakthrough innovations and proportion of initiatives at particular stages of the innovation process) and individual projects (for example, when to keep funding or to close a project).

One company we worked with implemented quarterly portfolio-monitoring meetings, closely linked to bimonthly meetings focused on stage gate decisions for individual innovation projects. During meetings, key managers discussed the entire portfolio’s status and important financial parameters as well as individual projects that were encountering problems. Those exchanges helped the company reconfigure its portfolio as needed and thus proactively address strategic challenges.

Enablers. Enabling processes, tools, and capabilities help fuel a company’s innovation engine. Examples include a stage gate decision process for innovation projects. Most mining companies define four or five gates, usually mapped to innovation maturity milestones—such as initial idea, detailed concept, feasibility study, pilot, and implementation. Miners should avoid overly strict and complex criteria (such as provision of a detailed business case) for approving projects for the first gate.

Such criteria can kill ideas if employees avoid submitting them because they fear extensive bureaucracy.

With this in mind, another mining company we worked with revamped its first-gate decision process, developing a simple, one-page document through which employees could submit innovation ideas. The document required only a description of the idea, its key benefits, and an estimate of the needed investment. The second gate was where teams had to submit a formal business case for an idea that had won approval at the first gate.

Another company required initiative teams to submit a commercialization plan at the implementation gate to encourage them to think broadly about the innovation’s potential value.

Another enabler is clear definition of the roles and responsibilities of headquarters, the business units, and individual mines in the innovation process. Most miners select a hybrid option that lies between the two extremes of innovation driven by headquarters or the business units. In this middle way, headquarters serves as a center of excellence dedicated to coordinating innovation activities.

Companies should also set up governance structures such as an innovation committee comprising key managers from different functions, who review the portfolio and decide on priorities and budget allocations. A dedicated innovation portfolio management team, armed with up-to-date data on the portfolio and on individual projects, can lead all innovation-related meetings.

IT tools can facilitate this process. For instance, one mining company uses an iPad app enabling managers to review information on the portfolio as well as on individual innovation projects. But even simple tools like a Microsoft Excel spreadsheet can serve this purpose.

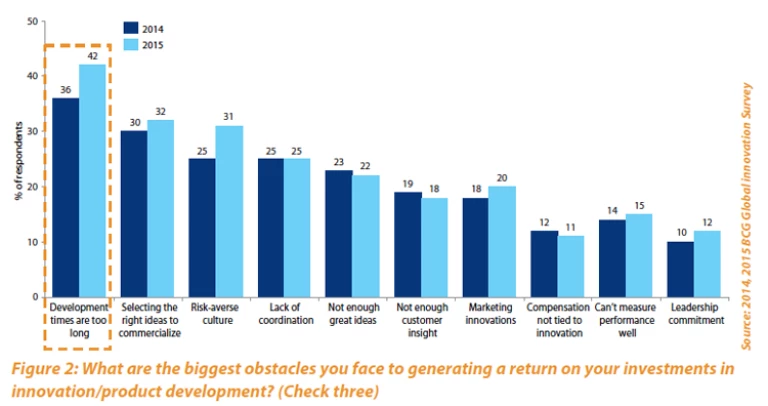

The right innovation management system can help shorten innovation development times for miners, mitigate risks, and ultimately improve returns on innovation investments. Indeed, BCG research shows that overly long development times are a key obstacle to generating desired ROI. (See Exhibit 2.)

Measuring Innovation Prowess

An old saying goes “What gets measured, gets done.” But many mining companies don’t assess the outcomes of their innovation efforts to compare them with their plans. Without such measurement, companies have difficulty making changes needed to close gaps between expected and actual outcomes.

To successfully measure innovation effectiveness, miners can use three types of KPIs—inputs, processes, and outputs—for their overall portfolio and for individual innovation projects. Input KPIs for a portfolio might include “allocated investment budget” and “number of innovation projects advancing past the first gate.” Process KPIs might include “conversion at gates” (a project is approved to advance to the next gate), “size of the portfolio at each gate” (such as number of projects and amount of funding released), or “actual portfolio spend at each stage versus the plan.” Output KPIs could include “financial impact of implemented innovation projects” (such as incremental EBITDA or net present value) or “number of successfully implemented innovation projects.”

To survive in the next 30 to 50 years, mining companies—large or small, global or local—must embrace the innovation imperative. But they don’t have to limit their innovation resources to big, investment-heavy breakthroughs. Instead, to reap the benefits offered by the technologies shaping their industry today, they can master a disciplined approach to designing and managing an innovation portfolio that has the right mix of projects.

This article was originally published in the March 4, 2016, issue of Mining Journal.