For the first time in forever,

You don’t have to be afraid,

We can work this out together.

—Anna in Disney’s Frozen

An Academy award. $1.3 billion in box office revenues. Millions of wide-eyed boys and girls. Disney’s Frozen is not only the world’s most successful animation feature film ever but also the fruit of an ingenious “postmerger rejuvenation.” How so? In 2005, Walt Disney was lagging in creative output and commercial traction. It then acquired a small but fast-growing animation studio, Pixar. Rather than absorbing Pixar into the Disney machine, Disney instead used Pixar as a stimulus for self-disruption, learning, and ultimately growth. This required both the confidence to allow some units to remain separate and the ingenuity to recognize where and how to use Pixar’s practices to stimulate Disney’s growth. Notably, Disney put Pixar’s leaders in charge of bringing new glory to its own fledgling animation studio, wholly rejuvenating itself in the process. The result: an annual total shareholder return of 22% and a series of blockbusters culminating in Frozen.

The Overlooked Opportunity: Rejuvenation

Large, established companies like Disney don’t have it easy. Many are struggling, delivering 3% lower TSR, on average, than their smaller, younger peers. The need to continually grow and create value is hardly news to leaders of established companies. Seeking to expand their business but faced with a deficit of organic growth opportunities, many resort to a classic recipe: acquiring and integrating peers to build scale and realize cost synergies. Results vary. As is well known, close to 60% of all deals fail to create value. (See The Brave New World of M&A: How to Create Value from Mergers and Acquisitions, BCG report, July 2007.) These lackluster results are often attributed to poor execution of the post-merger. This may be so, but we see a bigger underlying problem. Large companies need a better, more nuanced approach to PMI.

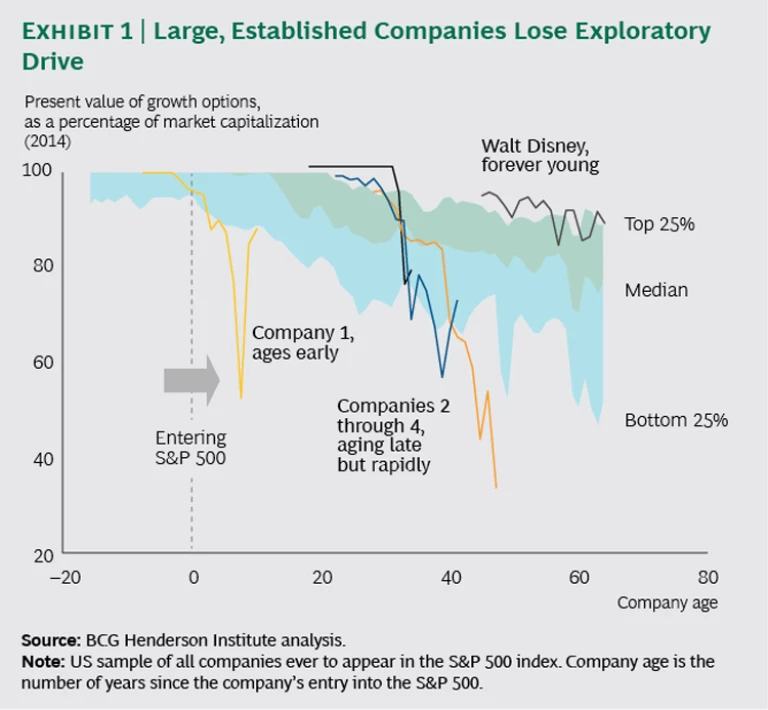

Let’s take a step back to understand why. In past research, we’ve shown that business environments are changing faster and are more unpredictable than ever. To keep pace with such change, companies must simultaneously exploit existing profitable business models and create future growth by exploring new products, markets, and business models. As companies age and grow, however, we observe that they tend to lose exploratory drive (as measured by the

Aging companies often optimize for a historically successful model of growth and profit. This model typically stresses the standardization of business processes and the alignment of culture, people, and ideas. As a result, aging organizations are often highly efficient at what they do but struggle to do anything new. For such companies, the typical PMI, focused on efficiency, standardization, and simplification, may provide temporary financial relief but fails to improve exploratory drive.

But not all companies age alike. Some age early, some stay young but then age rapidly, and others, such as Walt Disney, seem to stay forever young. (See Exhibit 1.) We call companies that defy or reverse the aging process “corporate rejuvenators.” Successful rejuvenators grow faster than their peers, create more value, and are less likely to end up in the corporate graveyard. (See “ Tomorrow Never Dies: The Art of Staying on Top ,” BCG Perspective, November 2015.)

Postmerger Rejuvenation

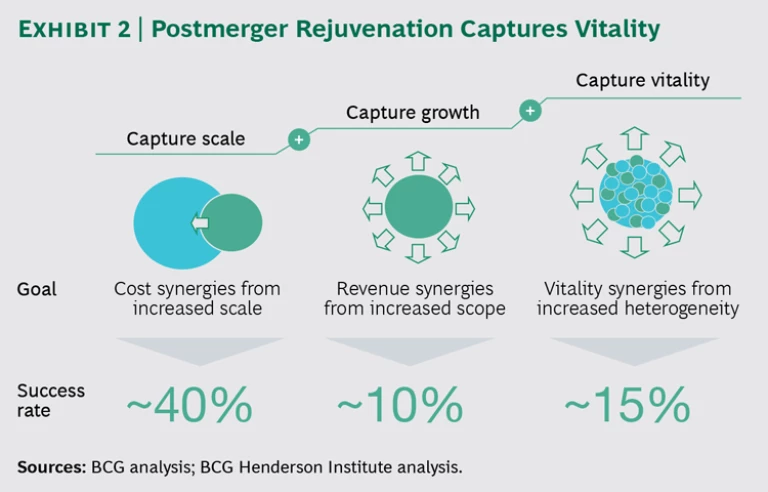

Many roads can lead to successful corporate rejuvenation. Here we focus on the role of M&A, specifically the strategy of acquiring a smaller, faster-growing company to build new capabilities and ultimately stimulate growth. Realizing this requires recasting how we think about the value of M&A. Rather than aiming only to capture scale or growth through cost or revenue synergies, rejuvenators go further. They view the M&A transaction as an opportunity for transformation and also seek to capture vitality through self-disruption. (See Exhibit 2.)

It is useful to think of merger benefits in terms of three cascading levels:

- Capture scale. These benefits arise from greater economies of scale in the combined entity and are commonly called “cost synergies.” Realizing these synergies requires tight organizational integration as well as swift postmerger execution.

- Capture and extend growth. Do no harm. Large, slow-growing acquirers often impede the growth of a more nimble partner, resulting in the destruction of the combined entity. Realizing growth synergies requires identifying growth opportunities that arise during combination. These can include cross-selling across markets or better price realization. Unlocking these opportunities often requires some initial investment and is frequently overlooked in a purely cost-oriented approach.

- Capture vitality. These synergies are qualitatively different because they follow a strategic rather than an operational or a financial logic. They arise from transferring exploratory practices and culture from the target company to the acquiring company in order to create future growth potential. This can happen via cross-pollination, where key exploratory units from each company are deliberately kept separate but primed to learn from one another, or by reverse integration, where exploratory capabilities from the acquired company are infused into the acquirer. Reverse integration often starts by identifying, retaining, and deploying entrepreneurial talent from the acquired company.

Are these types of synergies mutually exclusive? No. In fact, they almost always appear in combination. Leaders therefore need to approach their postmerger activities with a de-averaging mindset—targeting the right type of synergies in each part of the business. Balancing the realization of these diverse benefits is the key role of corporate leaders during a postmerger process. In practice, such a balanced approach is rare. Leaders usually focus on getting cost benefits right, with less systematic focus on other synergies. Such thinking reflects the primacy of financial logic over strategy. Faced with capital market pressure to quickly recoup hefty acquisition premiums, corporate leaders focus on the more predictable and faster results flowing from cost benefits. As a result, very few deals even mention revenue synergies as a postmerger target. (See How Successful M&A Deals Split the Synergies: Divide and Conquer , BCG report, March 2013.)

Who’s doing such rejuvenating deals, and how do they fare? Companies that acquire with the objective to rejuvenate tend to acquire a specific type of target: companies of sufficient size and clout (at least 2.5% of their own market capitalization) with a steeper growth trajectory than their own. Overall, one-third of all deals fall into this category and thus have the potential for rejuvenation. Notable examples for such transformative deals are

How do these (potentially) rejuvenating deals fare? We find that most fail, reaching their implicit objective (increasing the percentage of PVGO over three years) less than half of the time (around 45%). Unsurprisingly, companies that need rejuvenation the most—companies that are prematurely aging with low levels of exploration (below the median percentage of PVGO in the years leading up to the deal)—do such deals more often (approximately 35% more likely), but their more exploratory counterparts are significantly more likely to succeed when doing them (about 40% more likely). This suggests that companies benefit from a minimum level of in-house exploratory orientation before embarking on postmerger rejuvenation (PMR).

Let’s return to a prime example of postmerger rejuvenation: Walt Disney and Pixar.

Disney and Pixar: Winning an Oscar for Postmerger Rejuvenation

Walt Disney is the epitome of a creative organization, with a legacy of world-renowned movies such as The Little Mermaid and The Lion King. But by 2005, the company faced doubts about its creative future following years of poor performance: annual TSR of –3% over the previous five years and sluggish progress in 2D and 3D computer-animated feature films, resulting in a write-down of $98 million for 2002’s Treasure Planet. Meanwhile, competitors Pixar and Dreamworks released computer-animated, genre-shaping icons such as Monsters, Inc. and Shrek. Industry legend Harvey Weinstein lamented the decline in Disney’s creative prowess:

Fast-forward to 2006. Disney, under new CEO Bob Iger, embarked on a turnaround through the acquisition of Pixar. Led by Steve Jobs and creative mind John Lasseter, Pixar had had a string of computer-animated successes, including Monster’s, Inc., Finding Nemo, and The Incredibles. When Disney purchased Pixar for $7.4 billion, many on Wall Street were skeptical, publishing such reports as

But Wall Street shouldn’t have worried about integration. Iger had no intention of uniformly incorporating Pixar, beginning instead with a novel philosophy:

To secure cost synergies, Iger integrated marketing, distribution, and the lower-value-added parts of production. Iger also convinced Lasseter to outsource some animation to India—a cost-saving initiative that was well established at Disney but initially vehemently opposed by Pixar teams. To reap substantial revenue synergies, Pixar selectively adopted Disney’s practices of creating profitable sequels and direct-to-DVD films. Disney also prominently featured Pixar characters in theme parks and merchandising.

Most remarkable, however, was Disney’s approach to vitality synergies. Iger began with reverse integration, putting Pixar’s creative leaders in charge to revive the struggling Disney animation team, noting,

Fast-forward again—to 2016. The Disney-Pixar acquisition has endured and performed well above Wall Street’s expectations, with an annualized TSR of 22% since 2006. The company’s level of exploration remains unusually high for companies of its age. In effect, the Disney-Pixar deal set the stage for Anna’s promise in Frozen: “We can work this out together.” And so they did.

Going from Postmerger Integration to Rejuvenation

Disney and Pixar have shown that executing a postmerger rejuvenation requires rethinking much conventional wisdom around classical PMI. PMR differs from PMI strategy in both strategic objectives and execution on a number of key dimensions.

PMR has a different spirit and objective than does PMI. The objective of a typical PMI is to simplify the operations of the combined entity and extract cost synergies. This requires speed and discipline in integration. A PMR—in contrast—is intended to build the organization’s capacity for exploration. This requires a process focused on building the machine rather than streamlining it. Instead of What can we integrate and streamline? the question becomes What levers can we use to rejuvenate? As a result, a typical PMI would seek to reduce variance and heterogeneity, whereas a PMR would selectively build and amplify them. Different cultures across companies are seen as a rejuvenation opportunity, and cultural variation within a company is a necessity for realizing that opportunity. Disney’s capacity to see Pixar’s apparent cultural incompatibility as an opportunity—rather than a risk—exemplifies this reasoning.

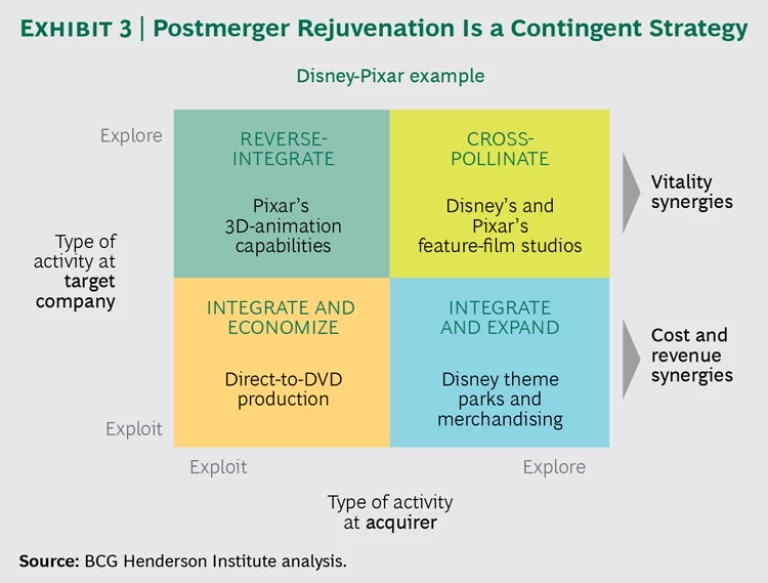

PMR also takes a different approach to execution. A typical PMI is implemented uniformly, whereas a PMR is executed according to the needs and character of each part of the business. Leaders first define an aspiration level for cost, revenue, and vitality synergies. Next, they build a detailed understanding of the companies and their mix of exploratory and exploitative activities. Finally, they make nuanced decisions on the integration approach—which activities to integrate and in which direction, and which not to integrate and use instead for reverse integration or cross-pollination. Exhibit 3 lays out the logic for PMR.

- Jointly exploiting activities, often in supporting, non-market-facing functions, should be swiftly integrated to yield cost synergies. (See the lower-left quadrant in Exhibit 3.) This is the dominant approach taken in typical PMIs and remains valid in these circumstances.

- An activity that is highly exploratory at the target company but not so at the acquiring company would fall into the upper-left quadrant of the PMR matrix. Here, reverse integration, meaning the transplantation of target company practices or business units, would be advisable. In the inverse case, the team would typically integrate the less exploratory part of the target to retain the exploratory practices of the acquirer (lower-right quadrant).

- The last case is one in which both companies pursue exploratory practices, most typically but not confined to product development, R&D, or parts of the commercial organization. (See the upper-right quadrant.) In this situation, deliberate nonintegration and cross-pollination are likely to be the vitality-maximizing choice.

A nuanced postmerger approach protects exploration activities by making the company more heterogeneous, setting in motion a virtuous cycle. Put simply, a

Reprogramming Your Postmerger Mindset

The secret to successful PMR is balancing integration with deliberate nonintegration, reverse integration, and cross-pollination in different parts of the business. To do so, leaders need to question and rethink five common and apparently reasonable PMI assumptions.

- Winning the Merger. Companies often equate acquiring with winning and feel uncomfortable promoting a target company’s leaders or methods over their own. PMR requires full identification and leverage of the entrepreneurial activities in the target.

- Keeping It Simple. To stay in control of an impending integration, companies often reach for simplicity. But “streamline, integrate, standardize” is the wrong approach for exploratory activities. And different parts of the organization will require different approaches. Avoid the temptation to oversimplify.

- Keeping It Real. The temptation to focus on the more tangible and easily obtained benefits of cost synergies at the expense of growth and vitality can destroy value and even exacerbate the long-term prospects of corporations. Avoid such tradeoffs.

- One Company. Stressing one culture and one entity to accelerate integration and collaboration is understandable—but dangerous in a PMR, since it effectively strengthens exploitative at the expense of exploratory potential.

- Tried and True. “Measure what you manage” still holds in PMR. Hence define and, if possible, quantify your exploration targets and track progress in parallel to cost and revenue synergies.

Large established companies often struggle to keep exploring. Those that fail to do so see lower long-term growth and value creation. To counter this tendency, companies need to rejuvenate themselves. Leaders faced with this situation can repurpose a classical approach—M&A and PMI—and use it as a catalyst to get back on a higher-growth trajectory, aiming for vitalization benefits in addition to the classical cost and revenue synergies.

Companies like Walt Disney show the way. Yet in practice, such successes are rare. We think this signals opportunity. Overall, the payoff is huge. Besides higher value creation, there is something more fundamental: longevity and survival. In 2004, Disney barely survived a hostile takeover bid. These fears have since subsided, as Disney has rebuilt its creative foundation. Leaders striving to shape the future of their companies should follow Disney’s example.