Multiple market disruptions—including the shale gas renaissance in the United States, plummeting oil prices worldwide, and a capacity expansion drive in China and Iran—are reshaping the Middle East’s petrochemical industry. These disruptions are shifting the balance of power among major regional players and putting many Middle Eastern producers at risk of losing the competitive edge they long enjoyed from cheap feedstock. Slowing growth rates in the global chemicals industry will only worsen the problem. To achieve a sustainable competitive advantage in the future, companies in the region must develop capabilities aimed at strengthening their commercial, operational, and innovation prowess. Capability building takes time, however, so petrochemical companies in the region should embark on their transformation journey now.

US Shale Gas: A Domino Effect

In the United States, the much-talked-about shale gas renaissance has flooded the market with abundant supplies of cheap ethane, a feedstock for the petrochemical industry. This development has given US producers a hefty cost advantage over their European and Asian rivals—most of which rely heavily on high-priced naphtha as feedstock. The cheap-feedstock environment has spurred a massive capacity expansion drive in the US petrochemical industry. Indeed, ethylene capacity is expected to soar by 7.8 million tons per year over the next two years. What’s more, many US petrochemical companies are stepping up methanol production. By some estimates, North America may become a net exporter of methanol as soon as 2018, competing head-to-head with Gulf Cooperation Council (GCC) exporters.

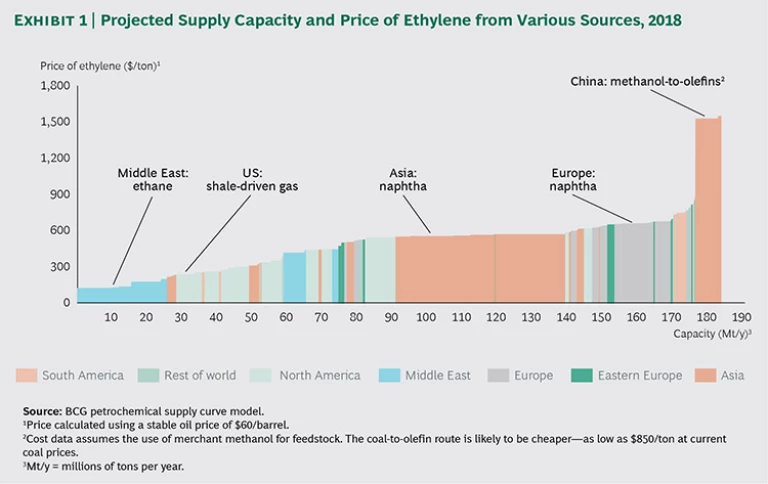

Although the sharp drop in oil prices has eroded the ethane advantage, in the long run the United States will continue to benefit from its abundant low-cost ethane. Meanwhile, naphtha-based ethylene producers in Europe and Asia and coal-based ethylene producers in China will remain on the high end of the supply cost curve. In short, while ethane-based producers in the GCC continue to be the most competitive in the world, North American producers are catching up. (See Exhibit 1.)

Oil Prices: A Steep Dive

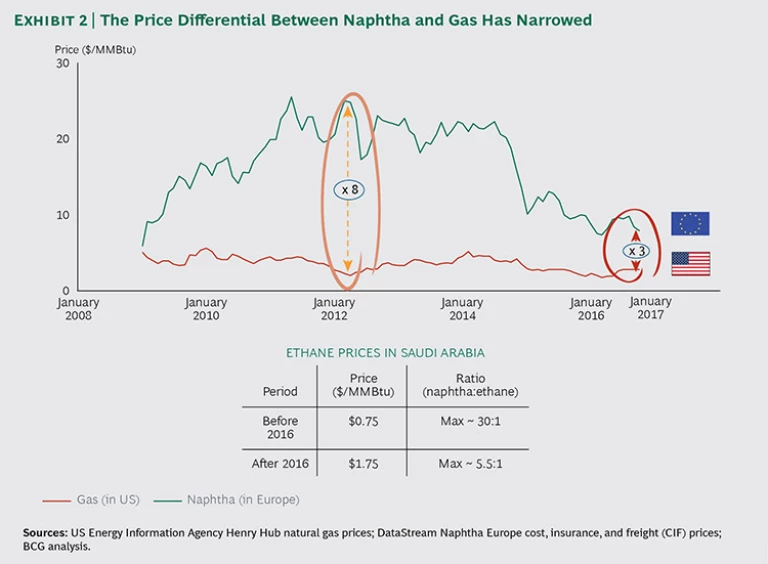

Brent oil prices collapsed from a high of more than $110 per barrel in June 2014 to less than $30 in January 2016. Naphtha prices subsequently plummeted, too. Meanwhile, the price differential between naphtha and gas has narrowed significantly over the past two years. (See Exhibit 2.)

This change in price differential has a huge impact on the margins of ethane-based steam crackers in the Middle East. Since naphtha-based producers tend to be marginal producers of ethylene, a drop in the price of oil, and hence of naphtha, directly affects the price of ethylene-based derivatives. Thus a wide oil-gas price spread favors ethane-based Middle Eastern crackers.

For these reasons, due to sustained weakness in oil price over the past few years, companies in the region experienced a dropoff in performance as the feedstock advantage cushion shrank. As a result, excellence across the whole value chain will become as important in the Middle East as in other nonadvantaged feedstock regions.

China and Iran: Driving Capacity Expansion

China, which has long been the world’s largest importer of polyethylene (PE) and polypropylene (PP), has launched a colossal capacity expansion initiative in its petrochemical industry. From 2015 through 2019, China will have increased its

high-density polyethylene (HDPE) capacity by almost 50%. Producers in countries throughout the rest of world will boost their collective capacity by only 17%. Development of coal-based olefins and dedicated propane dehydrogenation (PDH) units in China may slash China’s PP imports by roughly 80% by 2019 (from 5 million to 1 million tons annually). However, low oil prices will slow China’s adoption of coal-to-olefins technology.

As China’s economy cools down from its years of double-digit growth, and as the country’s economy transitions from export driven to consumption driven, these forces will act as further restraints on the flow of chemical imports into China. For GCC producers, that means shrinking sales to this key export market.

In Iran, the lifting of international oil sanctions and the country’s mission to double its petrochemical capacity in the next ten years pose a similarly alarming threat to GCC producers. Iran has already announced projects aimed at boosting its methanol capacity from about 5 million tons in 2015 to more than 9 million tons in 2020. These producers will directly compete with methanol producers exporting from Saudi Arabia, Qatar, and Oman.

Saudi Arabia: An Example

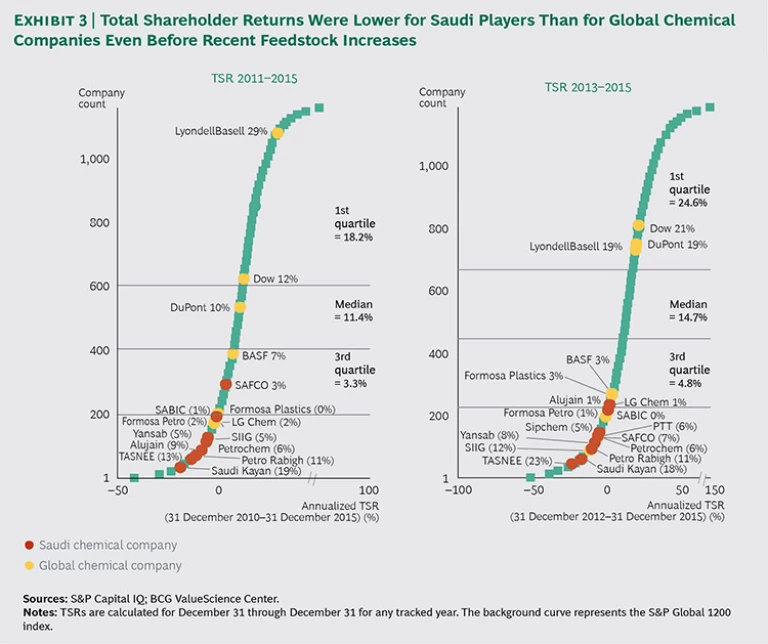

Saudi Arabia is the largest petrochemical producer in the Middle East, so examining how the structural changes described above have affected the country’s petrochemical industry can provide valuable insights. Over the past five years, total shareholder returns (TSRs) of players in Saudi Arabia have underperformed those of global chemical companies. In fact, most of the country’s petrochemical businesses fall into the lowest quartile of TSR when compared with other chemical companies and with an S&P index comprising the top 1,200 global companies. (See Exhibit 3.)

In addition, the Middle East (barring Qatar and Iran) is running out of cheap gas feedstock. Recent petrochemical capacity expansions in Saudi Arabia have focused on mixed crackers using naphtha rather than ethane as feedstock. This trend indicates that feedstock is growing heavier—and thus more expensive—in the Middle East. On the other hand, liquid feedstock opens the door to greater product differentiation and can help create higher value through related products such as aromatics.

Saudi Arabia’s recent increases in ethane prices have raised feedstock costs significantly for existing producers. In December 2015, Saudi Arabia more than doubled its ethane price (per million metric British thermal units), from $0.75 MMBtu to $1.75 MMBtu, and it raised its methane price from $0.75 MMBtu to $1.25 MMBtu. In a related move, the country also increased tariffs on water and electricity, which elevated overall operating costs for petrochemical plants. These price increases are essential to promote the most efficient use of the country’s natural resources, and they represent a key step forward toward the sustainable development of the economy. Nevertheless, in the short term these measures have eroded the competitive power of producers in the region, putting additional pressure on their margins.

The Road Ahead

The message is clear: Middle Eastern petrochemical producers can no longer rely on cheap feedstock and must find other ways to maintain their competitiveness. Moreover, they need to act soon. By enhancing their commercial, operational, and innovation excellence, they can take vital steps toward safeguarding their bottom line. But to execute these excellence initiatives, they must ramp up their internal capabilities.

Commercial Excellence. Historically, GCC producers have invested little in commercial capabilities such as sales, marketing, and supply chain management. Instead, they have relied on off-takers and traders to carry and sell their products in core markets. Through this arrangement, they have lost anywhere from 3% to 5% of their product value to middlemen.

Some companies in the region already have reduced their reliance on long-established off-takers by delivering greater volume to their markets through their own commercial organization. But to capture the full value of their products, Middle Eastern producers must strengthen their sales and marketing capabilities in addition to their supply chain management capabilities. For one thing, they need to do a better job of analyzing their markets (such as understanding the end consumers and end applications of their products). For another, they must get better at segmenting their customers and tailoring service levels to each segment.

In addition, companies will have to deepen their understanding of their customers’ value chain and identify critical applications for their products. Domestic producers can start by more thoroughly analyzing industries that are already big in the Middle East—such as construction and packaging. Deep understanding of consumers will help companies make smarter choices about pricing, too, a key lever of commercial excellence that can help them capture more value from their products.

Commercial excellence has become essential for petrochemical producers seeking to differentiate themselves from their rivals. In many markets outside the Middle East, top players are already making major commercial improvements in response to product maturation and commoditization in their industry. Examples include BASF’s customer interaction models, Lanxess’s commercial and supply chain excellence program, and Solvay’s change initiatives focused on product innovation.

Operational Excellence. Several Middle Eastern producers have experienced unplanned shutdowns or inferior feedstock-conversion rates, resulting in lower operating rates and yields. Launching operational excellence activities to enhance energy efficiency, effective raw materials usage, and asset maintenance could improve their operating rates and boost their bottom line by more than 10%.

Producers in other regions have made such practices standard. In Europe, petrochemical producers that survived the 2008-to-2009 financial crisis had to adjust quickly to operate profitably in an environment beset by low margins, high energy costs, and no revenue growth. Several have reduced their operating costs through tight integration between refineries and petrochemical plants—such as through close proximity of the plants, direct feeding of output across the plants, and optimization of shared infrastructure and utilities. The prime example is BASF’s Ludwigshafen site, where close integration and operational synergies among plants located there are pivotal to the company’s competitive position.

Middle Eastern players can benefit from such integration, and they can strengthen integration across more plants to achieve cost synergies. Jubail and Yanbu, petrochemical industry hubs in Saudi Arabia, are cases in point. Producers in these locations could capture infrastructure-related synergies across plants through feedstock and product exchanges. This approach could prove especially valuable as the use of liquid feeds sourced from refineries increases in the Middle East.

Innovation Excellence. GCC petrochemical producers must strengthen their product specialization skills, too—for the benefit not only of their existing value chain but also of future value chains that will arise from increased use of liquid feedstock. Traditionally, producers have sold basic chemical products (immediate derivatives from crackers) that are commodities. As we have seen, however, the profits derived from these products depend on external market conditions—including feedstock prices and local supply-demand dynamics. By going farther downstream and increasing the specialization of their products, GCC producers can reap higher and more-stable earnings. That’s not to say that the road to specialization is easy. To excel, companies will need considerable experience and fine-tuned capabilities.

In that respect, companies in this region are often at a disadvantage compared with their peers in the West, because they have fewer opportunities to partner with universities and academic institutions in order to spur innovation. Moreover, the region lacks the kind of innovation ecosystem that other industries have, to help create a fertile environment for R&D. Often, GCC players spearhead product specialization through joint ventures (JVs) with strategic partners that already excel at innovation. Sadara, a JV forged by Dow Chemical Company and Saudi Aramco, is an example. The great plans in the region to develop world-class academic institutions and investments in R&D have the potential to fill this gap and create the right ecosystem—but it will take some time to fully realize the benefits.

Producers must innovate not only in the area of technology but also in their business processes and operating models. For example, the ability to respond swiftly to customers’ product needs (such as by adapting formulations) is vital to maximizing customer satisfaction and the value of products. This form of innovation becomes increasingly important when a producer expands downstream in the value chain and gets closer to customers.

In addition to the above three excellence domains, companies should aim to achieve overall corporate excellence and excellence in specific functions. Areas that contribute to overall corporate excellence include portfolio management, capital allocation and discipline, financial controlling, and JV management. Areas of functional excellence include such human resources responsibilities as talent management, succession planning, learning and development, and performance management.

Tailoring Capabilities to Business Strategy

Some Middle Eastern producers have in the past launched initiatives focused on achieving commercial, operational, and innovation excellence. But because they tended not to align these programs with efforts to build up required internal capabilities, their initiatives delivered limited results.

To address this shortfall, companies must focus on strengthening capabilities that best support execution of their overarching corporate strategy as well as on formulating strategies for individual businesses in their portfolio. Producers need to clearly define key success factors for each business. They must also differentiate between capabilities that are essential to keep the day-to-day business running (for example, in manufacturing and commercial functions) and those that are necessary to successfully implement major corporate change (such as postmerger integration).

Finally, companies must tailor their plans for building corporate and functional leadership capabilities to the requirements of different product segments—such as commodities versus specialized offerings, each of which has its own business model. These plans should be integrated into a coherent capability development roadmap. For instance, in a commodity business, capabilities such as operational excellence and market intelligence are most vital, while in specialized offerings, capabilities including innovation and customer intimacy matter more. By linking their capability development efforts to the different requirements of the businesses in their portfolio, companies can avoid the all-too-common error of “capability overstretch”—whereby an enterprise tries to develop a common set of capabilities across all its businesses, to the disadvantage of individual businesses’ special needs and potential contributions.

Fundamental changes are already shaking the foundation of the GCC’s petrochemical industry. Producers in the region will have to build new capabilities to survive and thrive under these conditions. Stagnation is no longer an option. By investing in commercial, operational, and innovation excellence, producers can protect their leadership position in the global arena—and weather the increasingly powerful forces reshaping the industry.