A quiet revolution has been happening in sales over the past several years. While many companies have continued to adhere to sales models developed a decade ago, “digital attackers” have been busy reinventing selling. Fueled by the ubiquity of data, the growth of “as-a-service” business models, and the decentralization of account relationships, cloud-based companies such as Amazon Web Services, Salesforce.com, HubSpot, Workday, and ServiceNow are disrupting the sales cycle.

Those companies are creating substantial growth in sales revenue from existing customers while reaching new categories of customers at much higher volume and lower cost than companies using more-traditional sales methods have achieved. They are compressing the sales cycle to hours and weeks from months and years, closing multiple deals per day. Some longer-established companies have adopted these techniques, too, both offensively to gain a competitive advantage in key markets and defensively to fend off threats from disruptive competitors.

To understand what makes digital B2B sales leaders tick, The Boston Consulting Group undertook a study of the end-to-end selling models used by a dozen next-generation sales leaders. We have uncovered five lessons that companies in any B2B industry can learn from and adapt to their industry’s particular conditions.

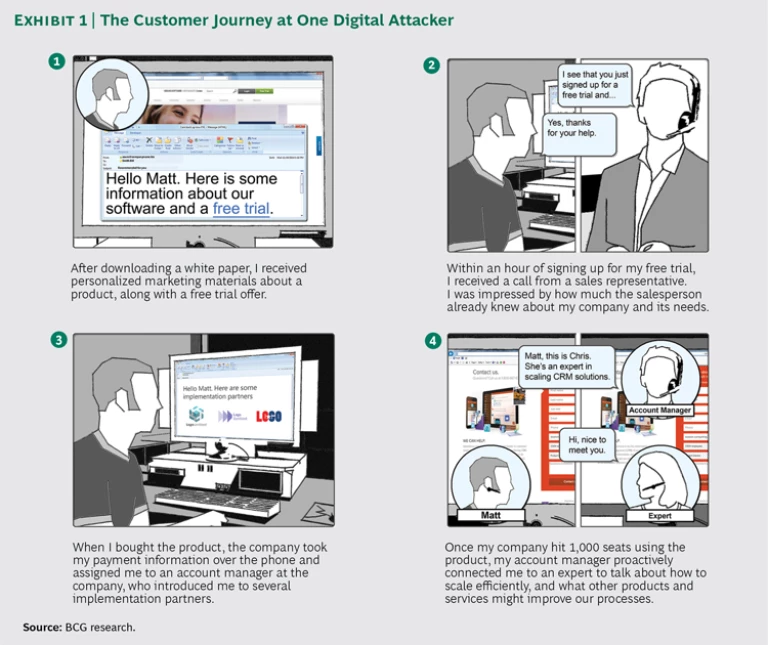

Start with the customer journey. Many companies fail to look at their products and services as an end-to-end customer journey—across stages of the customer experience ranging from consideration and sale to usage and additional purchase. Customers feel the pain of disconnected organizational silos such as marketing, sales, and after-sales. We estimate that 95% of all companies have not written down their target customer journeys. The customer experience in such cases is almost never delightful.

The best companies deliberately design low-friction customer journeys and fine-tune how each marketing and sales activity contributes to the overall experience. They know precisely what step-by-step experiences they want to deliver, which functions will seamlessly deliver them, and what messages will make them effective. For instance, they may identify more than a dozen “personas,” or distinct types of customers with characteristic needs and motivations for buying, and then provide customers of each type with a landing page that is tailored to their industry and needs when they search on Google for information about a product or problem.

On the basis of their previous online activity, targeted customers may receive a trial opportunity to evaluate a company’s offering. A salesperson may try to convert such a trial into a purchase by using knowledge of a customer’s activities and needs. Then a “customer success manager” may follow up to ensure that the customer is getting maximum value from the product, and ultimately becoming a power user for the brand. (See Exhibit 1.)

Track the journey from cookie to customer. Far too many companies fail to capture even basic data about customers that they receive from digital channels. Frequently data is stored in individual silos, or gets lost when it is transferred from one marketing or sales function to another. In the process, companies lose an opportunity to develop a data-driven understanding of where they are winning and losing with customers.

Next-generation sellers create a 360-degree view of customers, starting with customers’ first interactions with a website. The sellers use techniques like Internet protocol (IP) lookups to identify details such as company name and location before customers have officially made themselves known by entering their contact information. They use every subsequent interaction to build a continually evolving, data-informed view of individual customers and to guide them through their buying journey.

With every interaction, companies can see when and where customers signal their interest, and can calibrate the next customer engagement—either online or offline. Real-time data about customers’ actions and intent informs every conversation salespeople have and every action they take. For example, when customers engage in an online trial or demo, digital leaders take advantage of data specifying how the customers used the trial, which functionality they accessed, and how actively they used the product, in order to prioritize which customers to contact and which conversations seem most likely to help generate a sale.

Sources of this data aren’t just tech products like cloud software or mobile apps; data can also come from connected sensors in a physical product such as a jet engine or a car that relays how it’s working. Early warning signs that a product is failing can trigger a maintenance call. Given mobile connectivity and Internet of Things capabilities, physical goods can relay valuable information about systems used and levels of customer adoption or efficiency.

Successful companies ask questions such as these:

- Are we measuring the right things?

- Are we creating a low-friction experience to catch demand, or are our organizational silos hindering customers?

- Are we creating barriers to quick transactions, such as delays in getting a price quote?

- Are we losing customers at a particular step in the process?

- Are customers who have purchased a product using it regularly and deriving value from it?

In one case, for example, a global enterprise technology company identified gaps between its target and its actual digital customer journey. By introducing end-to-end visibility into its customer journey, the company tied upstream gaps in the journey to the downstream revenue losses that those gaps caused. With that lens on value, the company recognized that the effort and investment needed to close gaps were clearly justified. In just three months, the company doubled its sales yield for targeted offerings.

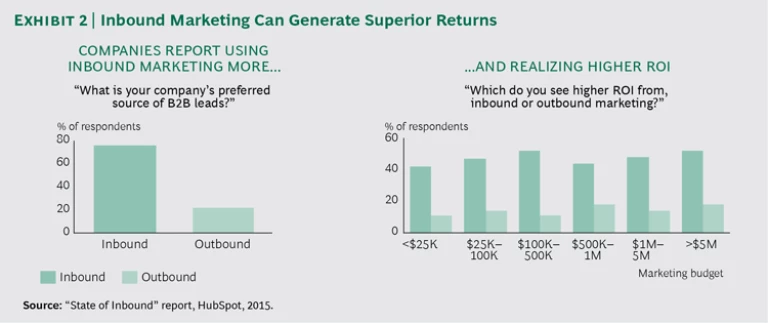

Stop cold calling. Inside many B2B organizations, salespeople spend much of their time on unsolicited “outbound” sales calls to lists of customers, often from third parties and partners, with little customization of offers and sometimes with minimal knowledge about the prospect. Often that approach entails making dozens or hundreds of calls to yield a single sale, and the sales process feels more like high-pressure telemarketing than like a sophisticated sales discussion.

Digital attackers’ sales efforts are much more targeted, based on “inbound,” digitally qualified leads. Search-engine optimization, social media, e-mail marketing, and blogs provide leads for more than three-quarters of B2B customers surveyed by HubSpot, an inbound marketing and sales platform. These leads cost half as much as those drawn from traditional outbound sources, and they can yield important data about a customer’s existing needs and interests. (See Exhibit 2.)

When digitally enabled salespeople follow up on an inbound lead, they know which products and content the customer has tried or downloaded. They know the customer’s search and social-media history, and the level of usage of current customers. They can engage in informed conversations about services and features, based on a comprehensive understanding of the customer and the customer’s areas of interest.

Consider the selling process of a global enterprise cloud-software company. By using predictive lead-scoring systems that assess marketing engagement activity and other first- and third-party data, the company can chart the size of a potential deal and the customer’s likelihood of purchasing. The highest-value leads can be funneled to in-person salespeople; medium-value leads can go to in-house sales teams; and low-value sales can be nurtured online before the most promising of those prospects graduate to the next level. The conversion rate of properly scored leads can be two to three times as high as the corresponding rate for traditional cold leads. Some teams have seen as much as a tenfold increase in productivity once they started working warm, well-scored leads.

Rethink inside sales. The traditional B2B sales process is face-to-face, highly orchestrated, time consuming, and difficult to scale. Typically, a team of well-compensated salespeople travels to the client for a major pitch meeting. It’s the model of the heroic sale.

That model is being replaced by a high-volume, high-quality inside-sales engine that quickly capitalizes on demand before it evaporates. Traditional salespeople can see perhaps one or two clients per day in person. Sellers who work inside for digital attackers may have ten times more high-quality sales conversations in the same period.

These conversations result from a different model of inside sales. Armed with data about the customer’s progression through the buying journey, an inside sales rep can have a phone conversation or close a sale at a speed and with an improved economic model that traditional call centers or face-to-face reps cannot match. For digital attackers, inside sales is often the primary sales channel. Inside sellers are highly skilled and motivated, with career paths, competitive compensation, and a good working environment.

Consider HubSpot. Throughout its rapid growth from zero in revenue when it was founded in 2006 to more than $180 million in revenue in 2015, the company has relied on inside sales as its primary selling channel. Use of inside sales reps and inbound selling techniques has enabled sellers to reach dozens of customers per day. Taking advantage of the rapid sales cycle that inside sales teams make possible, the company can fine-tune marketing levels daily to ensure that the volume of high-quality leads matches the capacity of the sales force. From its start in the US, HubSpot has now scaled its model internationally, building inside sales centers in Dublin, Sydney, and Singapore to reach new markets and customers.

Grow through customer success. Traditionally, companies have achieved most of their revenues up front when they deliver a product. Digital attackers, on the other hand, achieve most of their revenues when customers succeed with the product and keep buying more.

In fact, almost all the digital attackers we studied have created a customer success function. Customer success managers (CSMs) engage customers to improve their adoption and deployment of the product, and to increase their value creation from it. The experience of these companies is that customers who use products more extensively are “stickier”—they stay with a company longer—and tend to buy more.

The key to making the customer success function work is using real-time data about customer usage to proactively engage customers in the places that create the most value. For instance, customers who have purchased but have not used a product may receive “getting started” training and user guides. Customers who are already using the product, but aren’t using all of its modules and features, may receive introductory “how to” coaching on using and getting value from new modules. Customers who are heavy users of the product may be connected to sales teams encouraging them to increase their volume, move up to higher-level product tiers, and expand their buying in adjacent offerings. (See the sidebar, “Three-Dimensional Sales Expansion.”)

THREE-DIMENSIONAL SALES EXPANSION

Many digital attackers achieve most of their growth by “expanding” sales to their current customers. This expansion model is based on a deliberately designed approach to product offerings and customer success.

At the core of the product-focused approach is a “Three-Dimensional Sales Expansion” process. (See the exhibit, “Customer Success Management Creates Value Along Three Dimensions.”) The company designs a product to be expandable along three dimensions that, in combination, help salespeople achieve geometric growth in the account:

1. Volume Expansion. Digital attackers can increase the volume of the initial “landing” offer, such as by adding more seats, units, or transactions. Amazon Web Services is a well-known example of this. It has built flexibility into its infrastructure-as-a-service offerings, thanks to software that enables users to automatically scale service up and down to better match demand.

2. Up-Sell Expansion. At digital attackers and elsewhere, up-selling is a powerful growth dimension. Constructing a “price lineup” of good-better-best or bronze-silver-gold offerings encourages customers to migrate to higher-value (and higher-price) product tiers as they become familiar with offerings. The entry-level offering of Salesforce.com’s Sales Cloud product provides a basic customer relationship management database and collaboration tool on the cloud for up to five users, while its premium products offer sophisticated automation tools to manage complex sales processes and collaboration across larger teams.

3. Cross-Sell Expansion. A classic strategy is to design products around adjacent categories to facilitate cross-selling. Digital attackers have made this strategy relatively simple to pursue through integrated products and value propositions. For instance, Workday offers products to manage complementary processes such as HR and finance. The customer barrier to adoption of each successive cross-sell is lower because of shared data and online interfaces across offerings.

Building three-dimensional expansion into a company’s product strategy is a powerful source of growth. When complemented with customer success processes that proactively advance customers through the three dimensions of sales expansion, three-dimensional expansion can generate dramatic sales growth from an existing customer base.

Spending the time necessary to understand the crucial data to track, and to identify the triggers for sales interventions from CSMs (or the digital tools that can automate CSM roles for smaller customers) is a critical design point in creating value. Structuring the function is typically an evolutionary process that involves using the product roadmap and an analysis of customer attrition to continually fine-tune the model to improve customer success.

For digital attackers, customer success is mission critical. In nearly all the companies we studied, customer success is the focus of a CXO leader, with a title such as “chief success officer” or “chief adoption officer.” Although these companies often devote up to 25% of total sales spending on customer success teams, the long-term returns of the model more than justify the investment. Customer success efforts such as these can help companies achieve breakout growth, boosting sales by as much as 30% from existing customers alone, and giving companies a powerful engine for growth.

Huge shifts in business and technology have upended the world of B2B selling. Digital attackers have responded with bold plays that are rearranging the competitive landscape.

Established B2B companies have a major opportunity to recapture growth and build a substantial go-to-market advantage. Companies cannot simply tinker at the margins of their current approach. They must build a fundamentally new sales organization—before digital upstarts disrupt their business.