The more you engage with customers, the clearer things become and the easier it is to determine what you should be doing.

— John Russell, former managing director, Harley-Davidson Europe

This article is the first in a series exploring the effective development of customer insights in large corporations.

Eyes wide shut? Most business leaders stress the importance of understanding customers to stay relevant in today’s fast-changing competitive environment. Why, then, do many companies focus inward and, as a result, overlook or underestimate change signals?

In previous research, we showed that the pace of change in business has increased

To survive and flourish, it follows that companies must continually match strategy and implementation

The Customer Insight Series

Many Companies Are Not Customer Centric

We recently surveyed 45 business executives to understand their firms’ approaches to capturing and using insights into customers. To start, we asked about their top five strategic priorities. “Customer” was by far the most-mentioned word.

But many companies are not walking the talk. To be truly customer centric, companies must use customer insights in most major business decisions and core processes , not just customer-facing ones. Our analysis indicates that this is rarely the case.

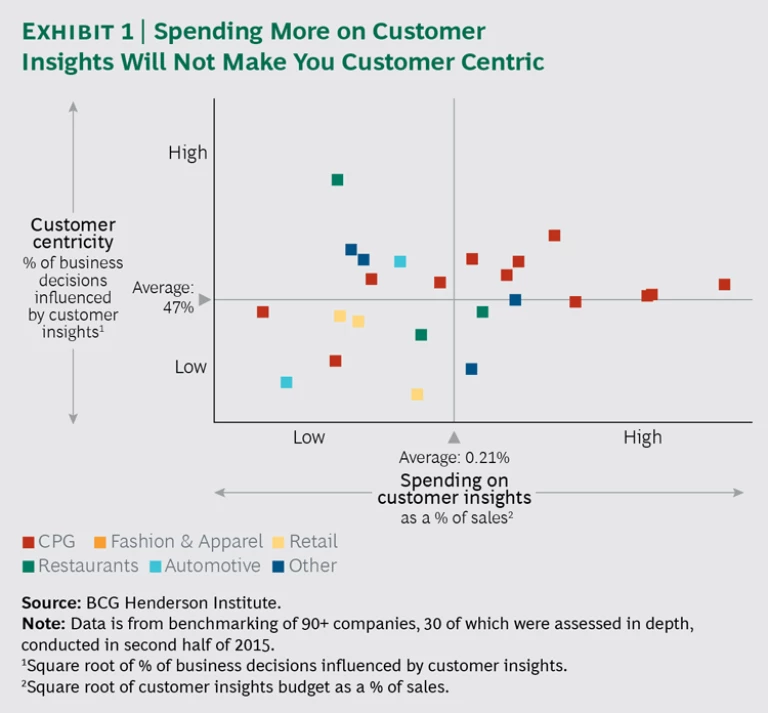

In a recent study involving more than 90 companies, we benchmarked 32 types of business decisions and found that in practice less than half (47%) reflected customer insights. Surprisingly, for more-strategic decisions in areas such as strategic planning, portfolio strategy, capital investments, and mergers and acquisitions, that figure dropped to one-third (35%).

Interestingly, devoting more resources to customer insights does not necessarily improve customer centricity. We plotted customer centricity (measured as the percentage of business decisions influenced by customer insights) against spending on customer insights (as a percentage of sales). (See Exhibit 1.) Companies vary in their degree of support for customer insights (x-axis), but we see no correlation between this and customer centricity (y-axis).

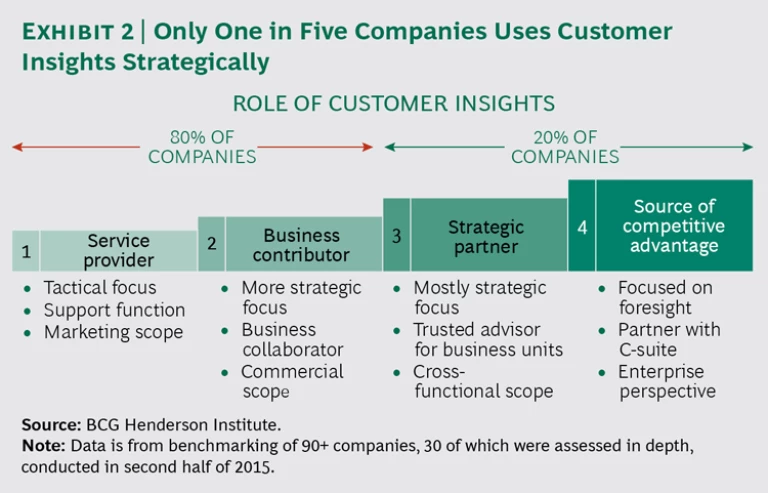

What matters more than overall spending is having mechanisms and capabilities to interpret a changing environment and translate insights into actions. To assess that, we benchmarked the role of customer insights across companies and segmented companies into four levels. (See Exhibit 2.)

Only one in five companies attained the two highest levels, in which customer insights play a strategic role. That is, in four out of five companies, customer insights are limited to providing input to commercial departments such as sales and marketing and do not directly impact the larger strategic agenda.

Our research suggests that customer insights are underexploited in business decision making; and regardless of how much a company spends on customer insights, the capability to capture and integrate them is often poorly developed. In other words, many companies are effectively “introverted,” underutilizing external information and signals from customers.

The Introversion of Large Companies

How do companies end up so isolated, even from their own customers?

We can start to understand this phenomenon using the research we presented in " Tomorrow Never Dies: The Art of Staying on Top " (BCG Perspectives, November 2015). We found that large, established companies tend to rely too much on existing business models and neglect to explore new possibilities. As a result, they generate future growth options at a much lower rate than smaller, younger companies do. The large, established companies are about 20 percentage points less exploratory than their younger peers, and as a consequence they underperform those peers by nearly 6 points in sales growth and more than 2 points in long-term total shareholder returns.

We tested this phenomenon further by comparing the organizational structures of exploratory firms with those that are more exploitative

Fortunately, this trend is not inescapable; a minority of large, established firms manages to balance exploration and exploitation. So how can such firms avoid or reverse the tendency toward introversion?

Eyes Wide Open

Think back on the last few “leadership” or “planning” meetings you attended. How much of the time was spent discussing internal issues rather than external realities? In how many instances did new customer insights change the opinion in the room?

For the many companies experiencing this common challenge of introversion, we offer four steps to renew your external orientation.

- Capture external change signals. Getting the right information in the door is the crucial first step. Invest in capturing granular, real-time, and implicit data on customer trends and preferences. Explore new methods, such as biometric, observational, and neural analysis. Look beyond the obvious: access new and underexploited data sources such as social media and usage data from smart products. In other words, create not only a signal capture capability but a “signal advantage” by doing it better or earlier than others.

- Extract novel insights. Learn to extract patterns from change signals. Again, look beyond the obvious to create advantage by leveraging new techniques such as natural language processing to mine unstructured data and machine learning to separate signal from noise. Create easily usable data visualization to facilitate the detection of patterns and the formation of insights that are not obvious. Again, strive to do so not just sufficiently but better than the competition can.

- Use insights to drive key value-adding processes such as innovation and resource allocation. Customer data and insights should be organized so that they are easily accessible to all parts of the company and can be integrated into decision making beyond the sales and marketing function. For example, customer insights can be included as a formal decision factor for strategic planning, portfolio strategy, and resource allocation, and they can be integrated into stage-gate requirements for innovation.

- Commit to an external orientation with structure, systems, culture, and leadership. Companies need to increase their surface area by exposing internal functions to external realities. Highly adaptive companies like Alibaba understand this intuitively; they set up flexible organizations to allow the constant matching of internal and external. As Jack Ma, the company’s founder and chairman, said, “In the information era, change is the best equilibrium.” (See “ The Self-Tuning Enterprise ,” BCG article, September 2015.)

We can look at Amazon as a best-practice example of external orientation. Customers are the top priority everywhere in the organization, starting with the CEO. As Jeff Bezos said

Overcoming introversion is not an easy feat, but it is imperative for a company’s long-term survival. The steps above provide a starting point to increase external orientation—namely, to capture the right information and use it more effectively.