Across industries, digital innovators are pushing customer service standards higher every day, offering ever-expanding arrays of cutting-edge, digitally enabled services and features. Prominent examples include

These new offerings and enhancements are driving customers’ expectations higher for all businesses, including banks and insurers—and these institutions are being forced to respond. The need for banks and insurers to improve their digital capabilities is becoming even more urgent with the emergence of new market entrants and services (such as Apple Pay) from the “fintech” and technology sectors, which are attacking banks’ and insurers’ core businesses and reshaping those industries.

To meet these challenges, banks and insurers are embarking on a comprehensive digitization journey, one that is different from the path they were on just three years ago, when their efforts were confined largely to isolated initiatives such as division-focused big data projects, the launch of individual apps, and improvements to their online and mobile channels. Today, banks and insurers are changing the ways that they interact with customers, giving customers a wider range of choices and greater control over the interaction itself. Banks and insurers are also providing customers with new, value-added, digitally enabled functionalities, such as

But banks and insurers are not focusing solely on improving the front end. Several institutions have also started to upgrade their back-end operations, which is often a much more complex challenge. A number of banks, for example, have begun to establish multidimensional master-data-management capabilities, strengthening their ability to leverage big data, meet regulatory requirements, and ensure consistent and timely reporting. Others are adopting agile ways of working, deploying

Some financial institutions are enhancing these efforts by increasing the standardization of their infrastructure as well as their use of automated deployment, measures that can support a more rapid software-release cycle and better leverage front-end development. GE Capital, for example, developed its innovative Fleet Optimizer application, which is aimed at optimizing spending and utilization rates for clients of the company’s Fleet Services business, within 70 days—from whiteboard to production—aided by continuous delivery and greater standardization.

Some banks and insurers are also experimenting with new and evolving digital technologies, such as robotics process automation and self-learning machines, which together have the potential to deliver step changes in speed and efficiency. Arago’s AutoPilot, for example, can complete 80% of all IT service management tasks autonomously. In addition, these institutions are experimenting with new, customer-facing technologies. Deutsche Bank, for example, has added to its online investment platform a “robo advisor,” which uses algorithms to create portfolios for investors.

Overhauling their digital capabilities promises to have a transformative effect on banks’ and insurers’ business. But getting there will put a significant strain on IT departments and, especially, chief information officers, who can play a determining role in ensuring that their companies are ready and able to become truly digital enterprises. (See

Recasting IT for the Digital Age

, BCG Focus, March 2016, for a deeper look at opportunities and challenges related to corporate IT’s role in digital transformation.)

Enabling Transformation

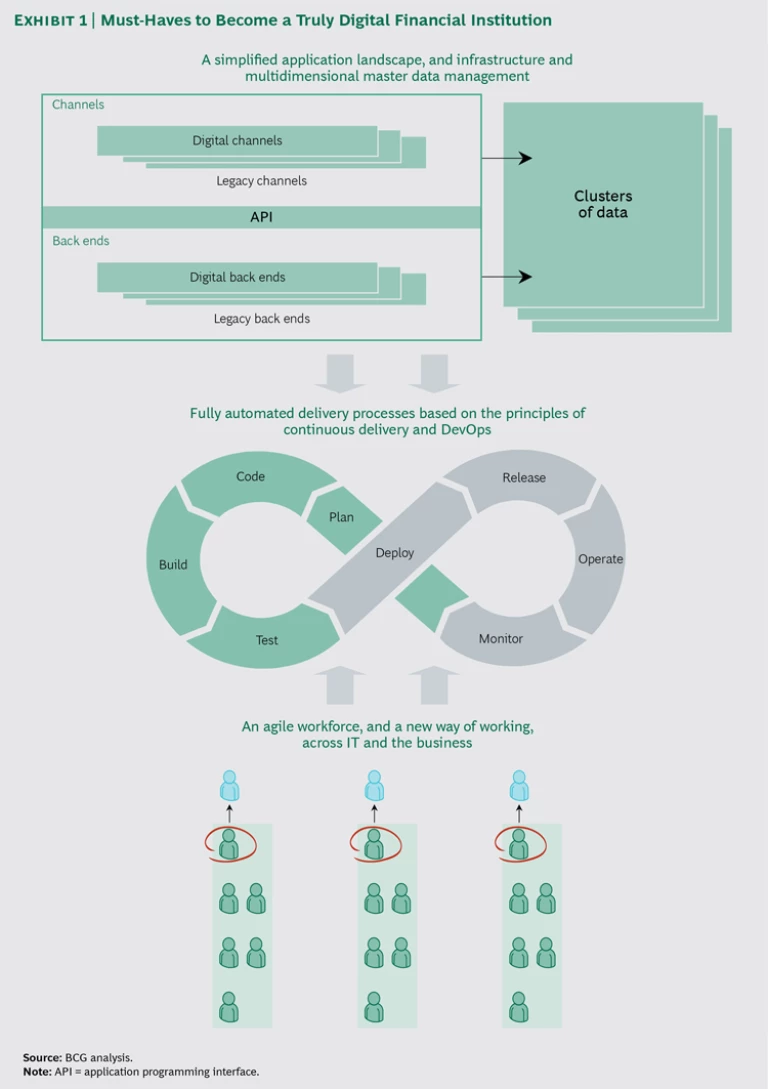

To successfully transform themselves into truly digital enterprises, banks and insurers must adopt or develop four critical elements or capabilities (see Exhibit 1):

- A simplified application landscape and infrastructure.

- Multidimensional master data management.

- Fully automated delivery processes based on the principles of continuous delivery and DevOps.

- An agile workforce, and a new way of working, across IT and the business.

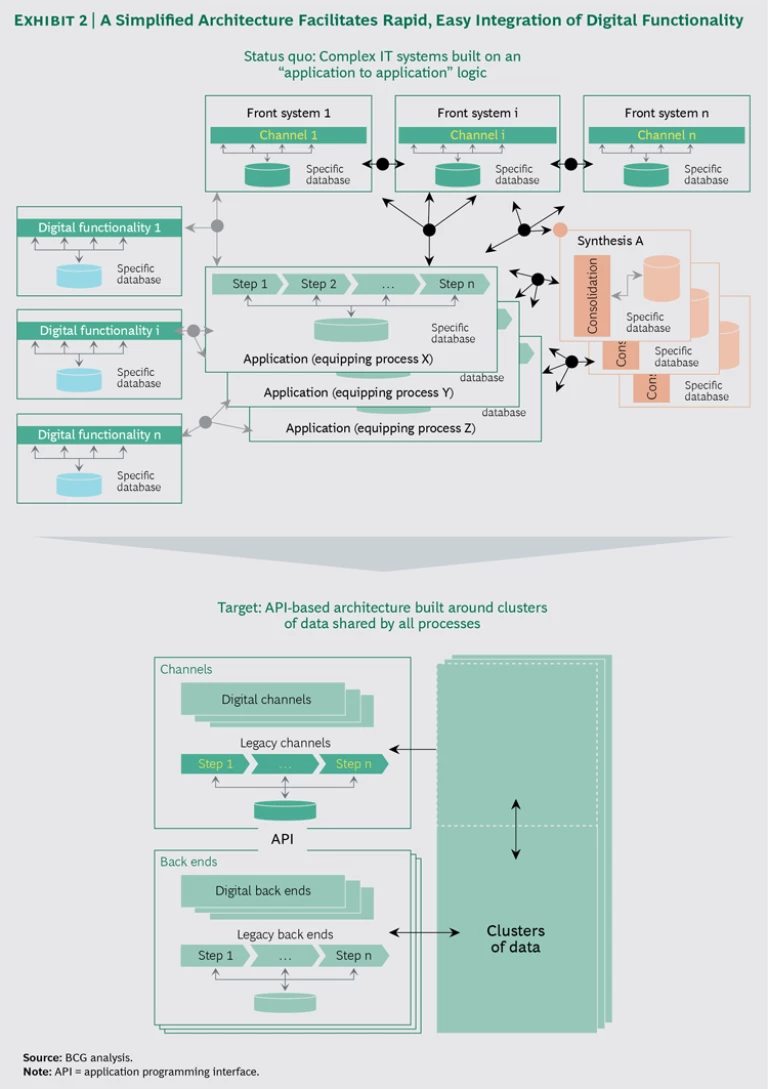

A Simplified Application Landscape and Infrastructure. The application landscapes and infrastructures of most banks and insurers are complex, fragmented, and full of legacy assets. They were built application by application over time and now include various platforms, infrastructure stacks, technologies, and customized or home-grown applications, often with several versions or variations of each. As a result, they are typically incapable of real-time responsiveness. They are also difficult and expensive to maintain, which ultimately means less value delivered per dollar spent on IT.

In addition, these environments are susceptible to broad reductions in service availability if one part of the chain breaks down. This is a huge liability in a world where customers expect digital services to be available 24/7. Further, the mix of technologies and methodologies employed—for example, batch and dialog components—makes it very difficult to implement real-time, end-to-end processing (a critical component of digital services such as real-time loan verification and payments).

To remedy this and ready themselves for digital transformation, banks and insurers are striving to simplify their application and infrastructure architectures and decouple their application landscapes. Following the lead of Web-born companies such as Spotify and Netflix, they are replacing complex interfaces and centralized service buses with more flexible, decentralized interfaces, such as

Financial institutions are also replacing their legacy applications with new technologies to enable straight-through processing. Our experience suggests that banks and insurers can gain outsized benefits by decommissioning not just some applications but entire platforms—for example, replacing mainframe hardware and software with a fully automated (and hence considerably cheaper) x86-based cloud server.

A success story here is Australia’s ING Direct, the country’s first fully cloud-enabled bank, which transformed itself with its Bank in a Box platform. By replacing its legacy infrastructure with “zero touch,” cloud-based hardware, ING Direct has gained several critical advantages, including greater automation and scalability of processes. This encapsulation of infrastructure is allowing the bank to focus on the development of digital services—a core competitive differentiator—rather than on infrastructure, which is essentially a commodity. The effort has been such a success in Australia that ING Direct is deploying it globally. The availability of new virtualization technologies, such as those produced by Docker, will make it easier for other financial services companies to go down this path.

Leading IT organizations at financial services companies are supporting these measures with significant efforts toward standardization and complexity reduction. We have observed that standardization works best when it is driven centrally and when it is mandatory for all parties. This approach translates into accelerated automation, leading to faster, more efficient development of digital services (as well as greater value per dollar of IT spending).

Collectively, actions such as these can create a simple, decoupled architecture that allows quick changes and reduces the need for testing. Infrastructure costs fall significantly because cheap, automated commodity hardware replaces costly legacy hardware, freeing up budget to develop digital services. And the use of APIs and microservices reduces dependencies among applications. This, in turn, improves service availability—a core differentiator in a digital business model. Such an architectural foundation is also a good starting point for unleashing the full power of agile methodologies and continuous delivery, which can enable rapid releases to production and accelerate the company’s digital transformation. (See Exhibit 2.)

Multidimensional Master Data Management. A consistent view of the company’s data—meaning that all data related to a particular service, customer, or other business-related object or process, as well as relevant data from third-party providers, is stored together in a consistent way—is a foundation for most digital applications. For example, integrated customer journeys (with the customer initiating a transaction or process in one channel and continuing or finishing it in another) require a high degree of data consistency to permit seamless switching among channels.

Most banks and insurers, however, still struggle to get consistent, high-quality sets of data that are free of redundancies. They employ several different database management systems and data models. Legacy applications are often connected to their own databases, translating into a high level of redundancy in physical and logical data storage across the organization. Typically, such systems can store, process, and analyze only structured data—meaning that these institutions can only leverage approximately 20% to 30% of the data potentially available to them. (This is because their legacy systems typically cannot store unstructured data, which includes such things as pictures, movies, tweets, and Facebook posts.) And the high cost of proprietary storage systems drives up data-related costs materially.

Some banks and insurers, however, have substantially elevated their capabilities on this front. They are working to revamp their data management practices and provide a digital-ready data infrastructure. They aim to replace inconsistent data pools with shared-data clusters to ensure data integrity and data access by all systems, enabling seamless customer journeys and end-to-end processing. Note that these efforts do not entail replacing all existing data stores; rather, they require the use of technical and conceptual layers to eliminate or manage redundancies and ensure consistency.

Several leading banks and insurers are also considering the use of

Fully Automated Delivery Processes Based on the Principles of Continuous Delivery and DevOps. Banks and insurance companies often release software according to fixed, unyielding schedules. Testing is often still performed manually or in semiautomated fashion and primarily occurs at the end of projects or “sprints,” after hundreds to tens of thousands of lines of code have been written. There are long cycle times for deployment and lengthy lead times for infrastructure provisioning.

These institutions can take their development practices to the next level by using continuous-delivery software engineering and DevOps to fully automate their delivery processes. But this requires a change in the demarcation line between development and operations and infrastructure: developers and operations staff must work together in joint teams, and teams access standardized infrastructure based on an infrastructure-as-a-service (IaaS) model.

To be sure, most banks and insurers will not be releasing software to production on a daily basis. But a daily error-free build in the development environment can lead to a zero-defect mentality among staff and eliminate the need for huge testing cycles at the end of projects or sprints. It also increases the quality of the software produced and therefore the stability of digital-service provisioning. This can reduce errors by as much as 50%, freeing up funds that can be used for digital transformation. Another advantage of such an environment is that developers can self-deploy using self-service portals (rather than having to engage the infrastructure department), which can increase speed to market for new services by up to 20%. The resulting rapid-release cycles also enable fast deployment of new functionalities, which can further differentiate the institution from competitors.

Multiple companies can attest to the benefits of this approach. Union Bank, for example, has realized an 80% reduction in testing costs and slashed the time necessary for setting up development environments from 42 to 3 days. Nationwide Insurance has reduced critical defects by 80% and increased system availability by 70%.

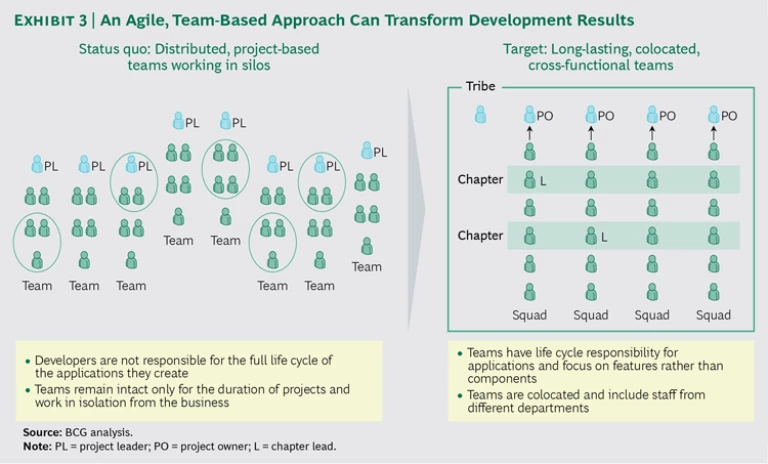

An Agile Workforce, and a New Way of Working, Across IT and the Business. Our observations indicate that the software development process in many banks and insurance companies is far from optimal. Development teams remain intact only for the duration of their respective projects and work in isolation from the business. Developers focus on completing projects and take no responsibility for the full life cycle of the applications they create; instead, they pass their work along to operations, which takes care of maintenance and fixing bugs. Team members are often geographically dispersed, making it difficult to react to changing market requirements.

Agile methodologies can help overcome these problems. Success, however, depends on how they are deployed. Agile teams perform best when they are multifunctional—meaning they include business staff, developers, product management personnel, data analytics staff, and user-interface and user-experience design personnel, among others—and when their members are co-located. They also tend to do well when they focus on features rather than components. This model gives each team a long-term mandate, fostering end-to-end accountability as well as the accumulation of deep, specific knowledge by developers, which can increase their productivity significantly. It also allows teams to operate with a relatively high degree of autonomy when it comes to handling incidents and structuring the development process. (See Exhibit 3.) This close interaction between the business and IT, combined with each team’s ownership of the digital service it is working on, boosts efficiency and ensures that only the features that the business and client really need are developed.

Most banks and insurers today are at least experimenting with agile. Many have launched pilots that deploy it or have development teams (focused on mobile apps, for example) that are using it. And some of these efforts have been quite successful. But many institutions are struggling to scale up agile across their entire organization in a beneficial way. Here, banks and insurers can learn a lot from a number of “digital disruptors,” companies that have found a way to deploy agile at scale. ING Bank, for example, has successfully adopted Spotify’s agile-based approach, which uses “squads”—long-lived, cross-functional, cross-component teams that are dedicated to specific customer features and that stay together for years, not just for a project’s duration. (For more on how banks are scaling agile, see The Power of People in Digital Banking Transformation , BCG Focus, November 2015.)

Implementing agile not only improves the efficiency of the development team, it also helps attract high-performing IT talent. BCG research shows that an agile environment fosters qualities that are highly valued by today’s top-tier talent—in particular, an appreciation for one’s work and good relationships with colleagues. Attracting the right talent could be a critical differentiator for banks and insurers in today’s rapidly evolving digital environment.

Making the Right Moves

For banks and insurers, digital transformation can be an exciting journey as well as an extremely rewarding one commercially. (See “ Building a Cutting-Edge Banking IT Function ,” BCG article, December 2015.) We believe that the following steps are critical for a strong start and ultimate success:

- Design a rough target architecture—spanning applications, infrastructure, and data—rapidly from the top down. The design effort should be a joint initiative that involves the entire IT organization: architects, application domains, operations, and infrastructure. The target architecture should be successively detailed in the months ahead.

- Be agile in planning but apply rigorous program management to ensure progress. Move toward the target architecture, even if the path is not fully visible. A wave-based approach (allotting, for example, six months per wave) can help the company deal successfully with uncertainty. It can also help it to quickly embark on the transformation and adjust to requirements that change along the way.

- Make automation of the delivery process a top priority. Strive for fast automation of core systems and the application and infrastructure delivery process. As a rule when migrating to a new target landscape, focus

first on migration and second on automation.6 6 An exception might be when legacy components will remain in place for several years. In such cases, it could be beneficial to also automate those parts of the application landscape. - Scale agile. Start with pilots and quickly roll agile out to the whole organization. We have observed that at leading companies, most pilots and agile initiatives start in IT before they are expanded throughout the business. Pilots are the starting point for building an at-scale agile organization that is aligned with the vision and aims of the company.

- Build DevOps teams. Best-practice companies break down the silos that separate development and operations by forming joint DevOps teams and applying the principles of continuous delivery, which encourage teams to be fast and flexible.

- Train your team and infuse it with digital talent. Promote an engineering culture and the development of deep technical expertise—for example, by staging events such as hackathons and discussion panels comprising the CIO and developers. Hire agile coaches and developers from fintechs, technology firms, and software vendors or offer secondments to your people. Create an appropriate physical environment (such as by colocating staff) and an IT culture in line with that of “true” technology companies—one that will attract and help retain top talent.