The consumer nondurables industry has delivered robust value creation over the past five years, but it faces aggressive headwinds that will require companies to seek a more balanced approach and to strengthen their portfolios and capabilities as they pursue scale.

In 2016, The Boston Consulting Group conducted its annual analysis of the total shareholder return (TSR) of nearly 1,620 publicly traded companies in 28 industries. Eighty-five of the companies were in nondurables. (See Creating Value Through Active Portfolio Management , the 2016 BCG Value Creators report, October 2016.)

During the five-year period from 2011 through 2015, the nondurables companies in the sample returned an annualized TSR of 16% (down slightly from 17% in the 2015

The relatively strong value creation by nondurables companies over the past five years came despite significant challenges. Competition from smaller players is on the rise, because the barriers to entry that once protected large companies are eroding. Small, agile players are bringing innovative brands and products to consumers at a rapid pace, aided by the availability of contract manufacturing and new routes to market. Rather than relying on traditional advertising, these small players are using digital marketing and social media to establish their presence in the market and engage customers.

Large, well-established players are feeling the effects disproportionately. A recent BCG analysis found that large nondurables brands in the US have lost 2.7 percentage points of market share to smaller competitors since 2011—a loss that is worth $18 billion in sales. (See “ How Healthy Foods Are Nourishing Growth in the CPG Industry ,” BCG article, April 2016.)

As a result, the performance of the large players is lagging behind that of the overall nondurables industry. The sample’s ten largest companies (by market capitalization) posted an average annual TSR of 12.7%, compared with 16.3% for the entire group. Many of the largest players are actively reducing costs and focusing on cash flow, but they are not investing in growth.

In the past, large multinational companies were able to mitigate some of these factors by moving into emerging markets. Most global nondurables companies still sell most of their products in developed markets, yet positive economic forecasts led to very bullish hopes about growth opportunities in developing markets. Today, however, growth is slowing across the largest developing markets, especially Russia and Brazil. These are still key regions, but economic contractions are forcing nondurables manufacturers to scale back their growth prospects for the next several years at least.

Multiple Expansion Drives TSR

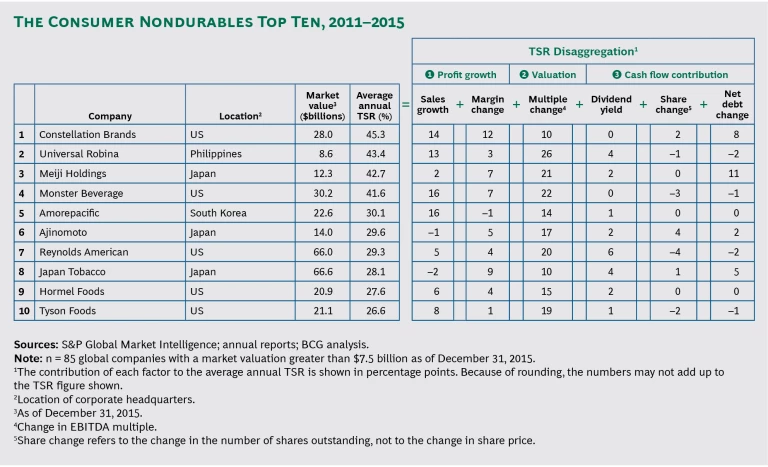

The performance of the top ten nondurables companies shows these trends in stark relief. Overall, the median TSR of these top performers was 29.6%, slightly lower than last year’s 31.3%. Notably, only one company from the top ten is based in an emerging market: Universal Robina, a snack food conglomerate, is headquartered in the Philippines, though it operates in developed markets, including Australia and New Zealand.

In terms of individual contributors to value creation, growth was far less a factor than in the past. For the ten-year period from 2006 through 2015, sales growth represented more than half (52%) of the total TSR for the top quartile of nondurables companies. For the five-year period from 2011 through 2015, growth was 44% of TSR. And a look at 2015 alone shows that growth represented just 26%.

Among the top ten performers in our analysis, multiple expansion was the biggest contributor to TSR. (See the exhibit below.) Why? In today’s extremely low-interest-rate market, some institutional investors can no longer generate yield through bonds. They see nondurables companies as sources of stable returns—thanks to the dividend most pay—with minimal risk. This situation is acute in Japan, where interest rates are at 0%. Not coincidentally, three Japanese companies are included among the top ten, and all of them are new to this list.

The direction interest rates will take in the near term—and the potential impact on the multiples of nondurables companies—is unclear. But in the long term, the value contribution from multiples is simply not sustainable. Multiples are likely to return to historical averages as other industries become attractive again and investors rotate out of nondurables. In that situation, multiple compression could hurt companies’ ability to generate returns for investors, requiring a value creation strategy that relies even more heavily on the fundamentals—particularly sales growth and margins.

Three Levers for Balanced Value Creation

Successful value creation over the long term is the result of a balanced approach. Given the market’s current headwinds, we suggest three levers for achieving this balance. These three are not mutually exclusive: to generate long-term, sustainable results in a dynamic market, companies need to apply as many of them as possible.

Building a Category-Leading Portfolio. One, companies can create a portfolio that is tailored to meet consumers’ needs and oriented toward high-profit and high-growth segments. Tailoring a portfolio in this way can involve organic growth—for example, by targeting existing brands or developing new ones through innovation to capitalize on “demand spaces” of unmet need. Rather than marketing to large demographic blocks, companies that understand demand spaces can target specific customer needs and adjust their brand proposition accordingly. Large companies have an advantage in this area, in that they have the resources to analyze and better understand consumer behavior. (See “ Demand-Centric Growth: How to Grow by Finding Out What Really Drives Consumer Choice ,” BCG article, September 2015.)

A company can also expand its portfolio to meet new demand spaces, potentially through tuck-in acquisitions that complement its current holdings. And it can rev up innovation activity to get new products that can meet untapped demand to market.

Many companies in the top ten are actively managing their portfolios in this way (through M&A, capital infusions to existing brands, or innovation) in order to reorient the portfolio around higher-growth segments. For example, Constellation Brands, the top performer in this year’s analysis, has been a leader in the imported-beer category in the US for some time. But recently, it conducted a series of acquisitions to expand into the high-end wine and whiskey markets. (In the alcoholic-beverage category, approximately 80% of growth is in the premium segment.)

Constellation acquired Meiomi Wines and Ballast Point Brewing & Spirits, both premium brands, and the Prisoner Wine Company, a collection of super-luxury brands. In addition, Constellation acquired High West Distillery, a maker of craft whiskey. As a result of having reoriented its portfolio around higher-end offerings, Constellation’s TSR contribution from margins was higher than that of any other company in the top ten.

Similarly, Universal Robina (number two of the top ten nondurables companies) acquired the Griffin’s Food Company, a New Zealand cookie maker, in 2014, because of its strong brand position. Universal Robina now boasts a top-three position in 20 product categories for the four countries where it operates.

Building Global Capabilities That Win. Two, another approach to balanced value creation is to capitalize on the company’s breadth of operations and experience to build global capabilities and systems that allow it to reliably outperform the competition. This entails developing and relying on talent, tools, and systems in high-value areas such as innovation, revenue management, category management, and digital technology.

Monster Beverage (number four) is a good example. Monster consistently develops new flavor profiles and products, and it routinely appears in Forbes magazine’s rankings of the most innovative companies. (The company recently announced a new bottled-water energy drink called Hydro.) To build up its innovation capability, Monster acquired its primary flavor supplier, American Fruits & Flavors, earlier this year. The move toward vertical integration represents a big step in the company’s evolving business model.

Amorepacific (number five), a South Korean manufacturer of beauty products, invests 3% of annual revenues on R&D directed at future products. One of its biggest hits is a cushion compact, which combines foundation, skin care, and sunscreen products in an easy-to-use package.

Leading players develop and capitalize on these capabilities in a number of areas across their organizations. And compared with smaller players, multinational companies have an advantage in developing these capabilities. Large players have considerable breadth of operations from which they can draw experience, as well as the ability and resources to invest in capabilities. Furthermore, they can pilot capabilities at the edges of their operations—markets, brands, and price points—without putting the core business at risk.

Creating Advantage Through Business Systems. Three, companies can create advantage through business systems—including operations and processes—that enhance their agility and speed or lower their cost to get goods to market. Companies succeed in this area by building scale in R&D, sourcing and manufacturing, and go-to-market processes, and by doing a better job of managing costs. In addition, regular initiatives to increase efficiency and effectiveness through outsourcing, zero-based budgeting, and changes to the organization structure make companies more agile and lean, giving them an edge.

Several companies among the top ten have adopted this approach. Tyson Foods (number ten) bought Hillshire Brands in 2015 for $8.5 billion, a move that helped Tyson create strong value. Initially, Tyson projected that by integrating the two companies, it would save $500 million by the end of fiscal 2017. Already, it has raised that target to $600 million. Similarly, Reynolds American (number seven) acquired Lorillard, tying up approximately 35% of the US cigarette market.

Many of the advantages of scale enhance companies’ go-to-market approaches. Highly efficient, low-cost distribution systems allow a company to extend its reach—its ability to get products to more retailers and outlets. In addition, companies that have brands in numerous categories can capitalize on scale efficiencies in their marketing. Most important, such efficiencies in the supply chain improve companies’ agility and ability to respond quickly to marketplace changes. The best performers manage complexity to speed their decision-making processes, and they can reallocate the capital that they’ve unlocked by implementing efficient supply chains into higher-growth opportunities.

Cutting Costs Is Not Enough

Significantly absent among this year’s top performers is any kind of formal cost reduction initiative. While virtually all companies, and especially the best value creators, are conscious of costs, they are also inclined to increase margins by revamping their product mix to emphasize their most profitable products and brands.

Moreover, although the nondurables industry overall created more value through investor multiples than in the past, that approach is not sustainable. Instead, as this year’s top performers clearly illustrate, the levers we’ve highlighted here—a category-leading portfolio, differentiating capabilities, and business system advantages— offer far longer-lasting means of creating value over the long term.