This is an era of disruption. Technology innovation, the intensifying march of digitization, and the cumulative effect of the “ big exponentials ”—the laws of accelerating growth governing processing power, storage, and bandwidth—are shattering, reshaping, and redefining economics in and across industries.

Companies in the technology, media, and telecommunications (TMT) sectors are in the vanguard, bringing these new opportunities to market—even as their legacy businesses are threatened by them. TMT companies have begun to digitize their core businesses and enter new disruptive businesses, often through M&A and partnerships. Still, they are subject to massive dislocation and attack.

In this age of exponential growth, value creation remains the best metric of superior strategy, transformation, and execution. TMT companies have done a good job of rewarding their shareholders in the first half of this disruptive decade. Still, the gap between winners and losers remains large, and speed is critical.

How TMT Companies Created Value During the Past Five Years

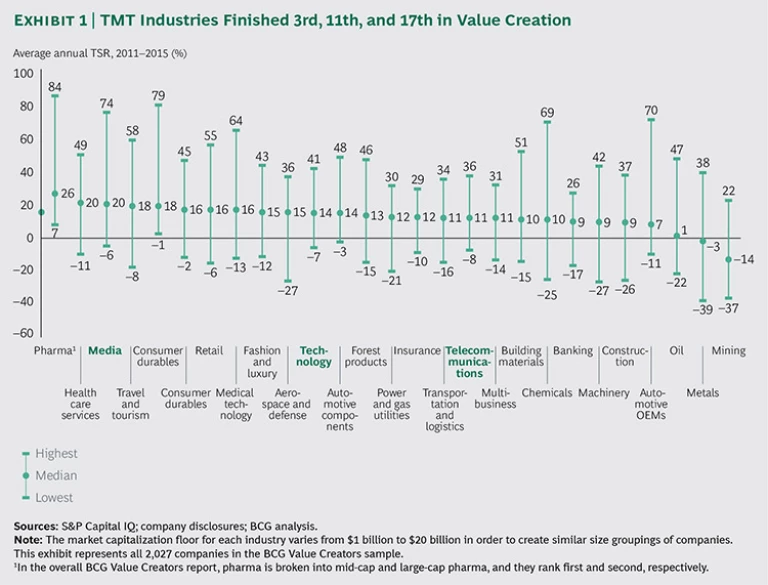

In our study of total shareholder return (TSR), we cover a five-year period—2011 through 2015—to identify, among the 238 companies analyzed, the winners over the medium term. We also examine how the three TMT industries fared across the 27 industries in the overall BCG Value Creators report. (See Exhibit 1.)

- Technology, with a median annual TSR of 14%, moved up two spots from the prior five-year period, which covered 2010 through 2014, to number 11. The top ten’s performance was powered by a regionally diverse group of small- and mid-cap hardware companies.

- Media’s median annual TSR of 20% brought it up three spots to number 3—and a bronze medal. The top ten in media were dominated by small-cap companies. Eight are based in emerging markets—six of them in China. If we narrow the field to companies whose market capitalization exceeds $20 billion, eight US companies, two of which tied for the number ten spot, appear in the top ten.

- Telecommunications, with a median annual TSR of 11%, moved up one spot to number 17. Of the three industries, telecommunications was the most stable, with six companies retaining their top-ten spots from the 2010–2014 ranking. Integrated operators and cable companies that offer customers triple- and quadruple-play services dominated the top ten. In addition, nine of the top ten are from mature markets, and the market capitalization of five of the companies topped $50 billion, signaling that scale and incumbency matter in telecommunications.

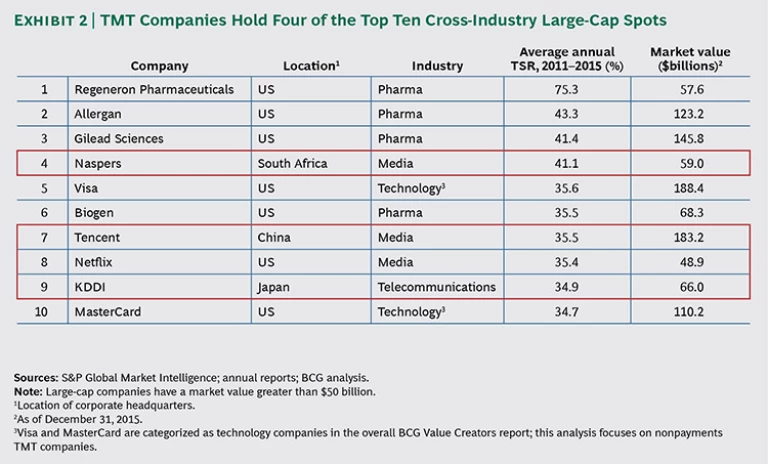

While small- and mid-cap stocks drove the performance of technology’s and media’s top ten, the performance of the largest companies overall was stronger. Across all three TMT industries, the median annual return for companies with market caps exceeding $50 billion was 18%, compared with 14.9% for smaller companies.

As in the past, a few companies generated outsize shareholder returns. Only ten companies were responsible for 37% of the $5.3 trillion in value created by the TMT companies analyzed.

Compared with the 2010–2014 period, when stocks were coming off the bottoms of the Great Recession, the TSR of all three industries was slightly lower, but the decrease was smaller than the 2.8 percentage point drop in median TSR for all companies in all industries. Low interest rates and lack of alternative investments undoubtedly helped overall equity performance. Even so, the largest TMT companies continued to excel, with four TMT companies, three of them disruptors, making the

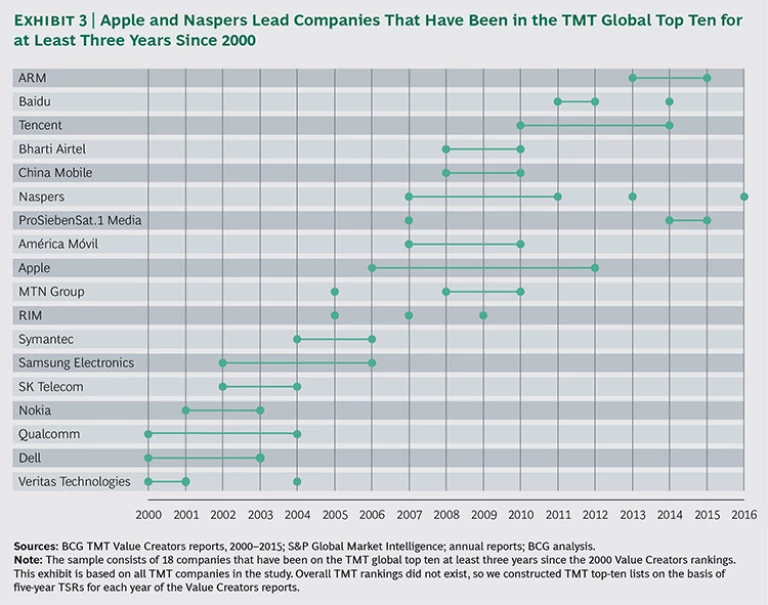

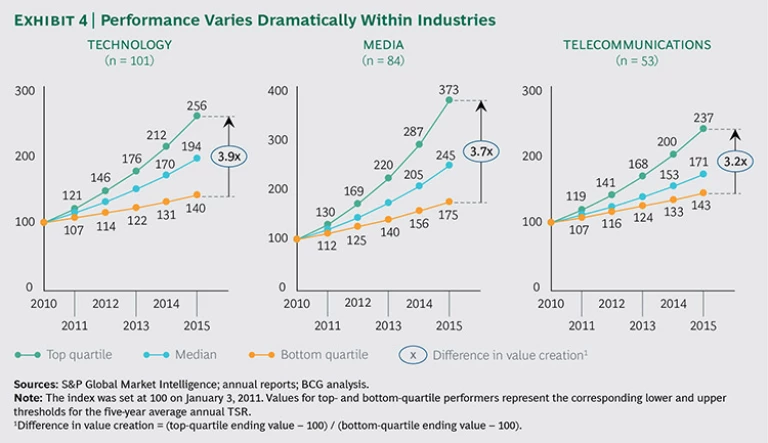

Medians and averages, of course, mask individual performance. Most companies cannot realistically aspire to become an Apple or a Tencent, both of which had remarkable runs, making the TMT top ten seven and five years in a row, respectively. (See Exhibit 3.) But most should strive to be top-quartile TSR performers in their industry. As Exhibit 4 shows, the weakest company in the top quartile generated returns more than three times those of the strongest bottom-quartile company. A $100 investment in that bottom-quartile technology company, for example, would have grown to $140, compared with $256 for the top-quartile company.

In other words, a TMT company can control its own destiny by actively managing its businesses for value creation amid technology disruption.

Future Opportunities for TMT Value Creation

Exponential growth has a sneaky way of taking people by surprise. Early on, growth seems manageable. But the slope steepens quickly. As Ray Kurzweil put it, “Our intuition about the future is linear. But the reality of information technology is exponential, and that makes a profound difference. If I take 30 steps linearly, I get to 30. If I take 30 steps exponentially, I get to a billion.”

We have witnessed the building of a new, global digital ecosystem that is based on the exponential growth of smart devices, high bandwidth connectivity, data analytics, and cloud computing. This ecosystem is maturing fast and allowing organizations to benefit from many disruptive technology waves, such as 3D printing, augmented reality (AR), and virtual reality (VR).

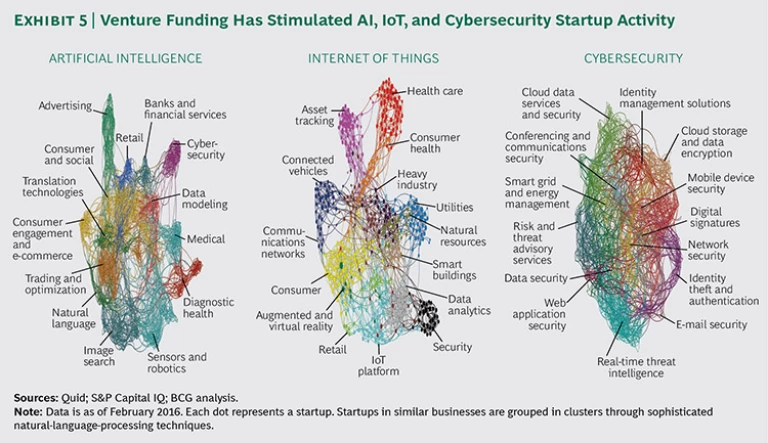

In this report, we shine a light on three trends: artificial intelligence (AI), the Internet of Things (IoT), and cybersecurity. Although these trends have not yet figured prominently in past value creation strategies, they are all active targets of venture funding and will undoubtedly shape future performance. (Exhibit 5 shows the specific areas within AI, IoT, and cybersecurity that have been receiving the most venture funding.)

Artificial Intelligence. AI will be instrumental in the next wave of technology disruption in business. “In five years, there’s no doubt in my mind that cognitive solutions will impact every decision made,” Ginni Rometty, chair, president, and CEO of IBM, said at Code Conference 2016, referring to AI. “If it’s digital, it will be cognitive.”

Companies that are transforming their value chains to take advantage of AI will have a competitive advantage in improving business productivity and deepening customer engagement. AI applications under development will offer emotional as well as cognitive intelligence. They will be able to detect individuals’ moods, anticipate how people are likely to react in a given situation, and know how to motivate them to act.

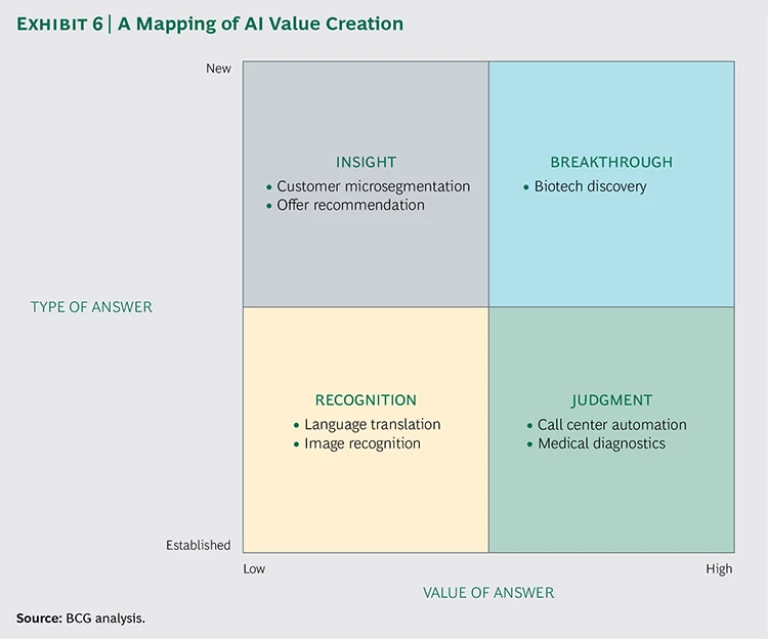

The field of AI is broad, so it helps frame where and how machines can improve performance. Along one dimension, AI can derive low-value answers (identifying a cat, for example, through basic image recognition) or high-value answers (diagnosing a stress fracture, for example, by reading a CAT scan). Along another dimension, it can generate either known answers more swiftly than humans or “unknown” answers. Humans, for example, cannot easily process hundreds of thousands of retail sales to generate insight. Plotting these two dimensions reveals clusters of business challenges and opportunities of varying degrees of sophistication and insight. (See Exhibit 6.)

TMT companies have an opportunity both to use AI to reimagine their own business models—by, for example, automating customer support or network operations or gaining customer insight—and to sell AI solutions to other companies. TMT companies should consider the following four questions:

- How can AI provide effective decision support for strategic decisions, such as entering new markets, engaging in M&A, and finding prospective customers?

- How can AI drive productivity by automating routine white-collar responsibilities such as compliance and technical support?

- How can AI enhance customer engagement?

- What role can we play in contributing to AI itself?

The Internet of Things. With market revenues projected to exceed $300 billion by 2020, IoT is a big deal for TMT. “You cannot connect 50 billion things that have never been connected before and not achieve tremendous new value,” according to Chuck Robbins, the CEO of Cisco.

Technology companies will have opportunities to create applications and platforms for specific industry uses. Manufacturing, transportation and logistics, and utilities are expected to be the largest customers for IoT products and services, accounting for a combined value of $135 billion by 2020. Services, apps, and analytics at the top of the IoT stack are expected to grow by 40% annually, faster than sensors and hardware at the bottom, reaching roughly $150 billion by 2020. In addition, the growth of blockchain technologies is being propelled in part by the opportunity to become the ledger for IoT transactions.

IoT has the potential to widen media companies’ content distribution so that many more devices and surfaces—such as refrigerators and tables—can display digital content. IoT can also enhance storytelling through AR and VR .

The rollout of 5G infrastructure in the next five or so years offers telecommunications operators the chance to embed their networks with more intelligence and help facilitate the development of services built around AR and VR, the tactile internet, and connected cars. Verizon’s hum service, for example, provides speed alerts and vehicle location, monitors vehicle diagnostics, and can connect with live mechanics.

TMT companies should consider the following four questions:

- Given the developments in IoT, to what extent are we at risk of disruption?

- Do we have a product or service we can leverage to capitalize on IoT? In which areas of the stack should we play, given our assets and strengths?

- Do we have the infrastructure in place to succeed? Where do we need to partner, and what do we want to own?

- Which services should we monetize, and which should we give away or subsidize?

Cybersecurity. Barely a week goes by without a news report of yet another security breach at a major company or government agency. These breaches damage credibility, brand, and trust. More than 4.8 billion records have been lost or stolen since 2013, so security breaches represent an existential threat to all companies.

Given the reach of the new digital ecosystem, cybersecurity is growing ever more critical, and companies from many industries are rushing to enter the field. Private equity firms and other companies have also gone on buying sprees , and companies have been “snapped up for the technology or in-demand security engineers,” according to the Financial Times. With their global reach and vast stores of customer data, TMT companies are especially vulnerable to such breaches, but they can also help provide the solutions that will fortify their networks, protect their customers, and generate value and competitive advantage.

Symantec’s acquisition of Blue Coat, for example, drove Symantec’s share price from $17.30 prior to the announcement to nearly $20 within a week and to more than $21 within a month—a stark contrast to the sinking stock performance of many acquiring companies. In this case, investors were betting on the improved long-term growth potential of the combined company, which enhances Symantec’s security offering in the cloud.

TMT companies face several critical challenges related to cybersecurity:

- Talent. Companies need to develop strategies for building and retaining critical and scarce cybersecurity skills—by, for example, making acquisitions, hiring outside talent, training existing staff, partnering, and outsourcing.

- Vendor Ecosystems. Many products and services—a mobile base station, for example—are created using components from other companies. The security of an end product is only as strong as its weakest part.

- Culture. Finally, cybersecurity is an important organizational issue. Companies need to train their people to deal with these risks, and they have to build Cybersecurity Meets IT Risk Management that are grounded in accountability, prevention, recognition, and responsiveness. (See “ Cybersecurity Meets IT Risk Management ,” BCG article, September 2014.)

The following questions can help TMT companies assess their cybersecurity readiness:

- Do we have a structured approach to identifying, prioritizing, and mitigating cybersecurity risks?

- Is our senior leadership team actively engaged in cybersecurity issues—not just as participants in meetings but as key decision makers and doers?

- How do we manage for both speed to market and security?

- How much of our revenues do we stand to lose as a result of brand damage if the company suffers a public data breach?

- How preventive are our cybersecurity systems? For example, are our employees able to recognize “phishing” attacks and prevent accidental disclosures of confidential information?

The Current Imperative: Digital Transformation

TMT companies must simultaneously manage the low-growth cash flows of their legacy businesses and build businesses with explosive growth in new, unfamiliar areas.

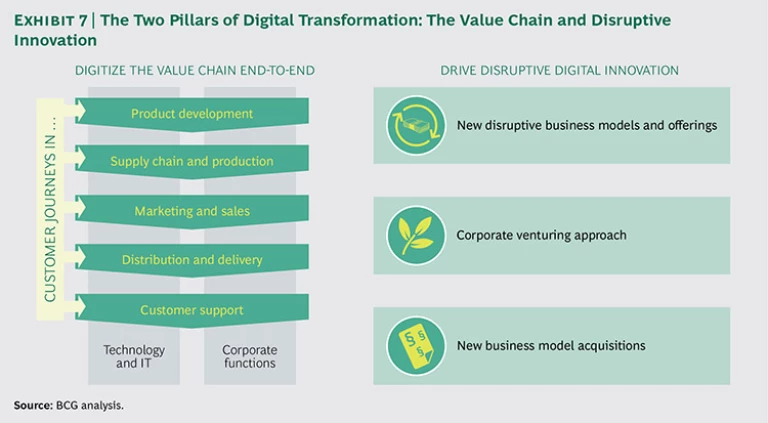

The best way for a company to do this is to engage in an end-to-end digital transformation of its value chain while creating new and disruptive digital businesses. (See Exhibit 7.) The end-to-end digital transformation will generate greater productivity and growth from the existing organization, and digital disruption will create fresh growth. Both paths themselves will require the use of advanced digital tools.

This is not an either-or choice. Some companies err on the side of new digital businesses at the expense of digitizing their existing businesses. This is a mistake: legacy businesses have valuable assets, such as brands and customers, that need to be nurtured, and digital transformation can dramatically improve performance. Others focus only on the elements of the value chain, missing the opportunity for disruptive growth.

Ackowledgments

The authors would like to thank the dozens of colleagues around the globe who assisted with the research and analysis for this report. Several partners, consultants, and knowledge team members made contributions. The authors would especially like to thank Alex Asen, Christian Bartosch, Julio Bezerra, Akash Bhatia, Walter Bohmayr, Jeff Bowden, Joseph Brilando, Alexander Dahlke, Stefan Deutscher, Hady Farag, Jody Foldesy, Billy Hart, Mohamed Hashem, Nicolas Hunke, Martin Link, Qiang Liu, Scott Maier, Ryan McKenzie, Roger Premo, Mickie Rosen, Semyon Schetinin, Barbara Schloss, Sunny Sood, Dharmesh Syal, Sebastian Ullrich, Raj Varadarajan, Antonio Varas, Maikel Wilms, and Shoaib Yousuf for their insights.