With chemicals generating so little growth, investors must continue to navigate the sector carefully for the chance to earn even average equity market returns. The 14% average total shareholder return of large chemical companies in the period 2012–2016 was the seventh-lowest among 34 industries tracked by The Boston Consulting Group. And it was the fifth consecutive five-year period in which chemical TSRs fell in BCG’s rankings.

From a subsector perspective, investors who navigated carefully would have ended up in focused-specialty companies. This is where the above-average TSRs have been in the chemical sector, not just in the most recent period studied but in most of the five-year periods dating back to 2007–2011. In a surprising turn, focused specialties have in some cases become darlings of Wall Street—perhaps even more so than multispecialty companies, which generally have greater name recognition, more resources, and significant advantages in recruiting.

What is focused specialties’ recipe for success? Part of it is these companies’ ability to understand and respond to customer needs. In a way that a more diverse or more basic chemical company might not be able to do, focused specialties speak the customer’s language and are attuned to opportunities and challenges that are specific to the customer. When they talk about the innovations they are working on, the conversations are less about isolated product breakthroughs and more about how the innovations can meet customers’ needs. Enabling this dialogue and relationship, a revolving door between focused-specialty companies and their customers is relatively common. That is, more and more R&D staff on the customer side are ending up in sales or account management positions at focused-specialty companies.

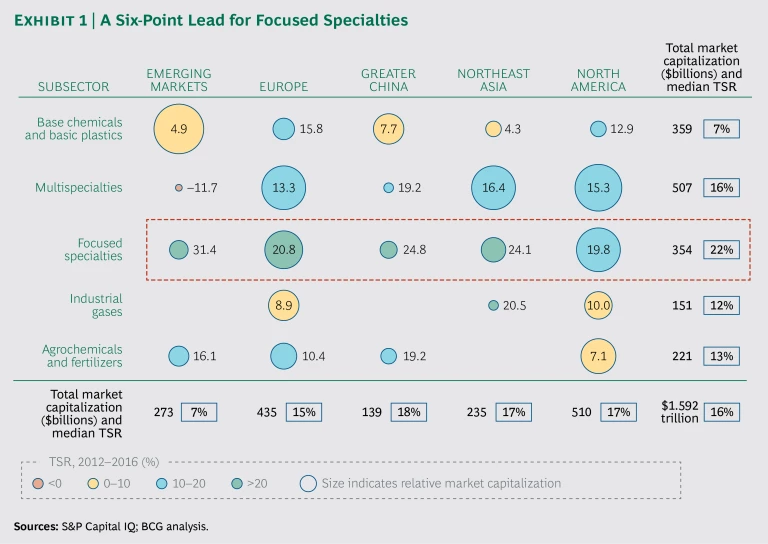

Focused-specialty companies’ strength, compared with other chemical subsectors, is evident in the numbers. Focused specialties had a median TSR of 22% from 2012 to 2016, 6 percentage points higher than the next-best-performing chemical subsector. (See Exhibit 1.)

Moreover, a lot of focused specialties’ TSR growth came from revenue increases and improved margins. No other chemical subsector came close to focused specialties in terms of operating gains, and one—agrochemicals and fertilizers—would have had no TSR growth at all had investors not awarded it a higher valuation multiple. (See “How We Define the Different Chemical Sectors.”)

How We Define the Different Chemical Subsectors

How We Define the Different Chemical Subsectors

The global chemical industry is highly complex. BCG divides the industry into five subsectors, which account for about 150 segments. Most companies are active in multiple segments. The subsectors are:

- Agrochemicals and Fertilizers. This group includes companies with substantial but minority specialty-chemical operations. For some in this sector, mining is an important activity.

- Base Chemicals and Basic Plastics. The companies in this subsector generate much of their revenue from cracking products and basic derivatives, such as polyolefins, solvents, and surfactants. Some of the companies are invested in the chloro-vinyl chain, and some have another product focus (such as other polymers), but their business models resemble those of petrochemical companies. A few have large specialty-chemical businesses as a portion of the portfolio.

- Focused Specialties. This subsector consists mainly of companies in the areas of coatings, adhesives, flavors and fragrances, construction, chemical distribution, and electronic materials. All focus on highly refined chemical products with a clearly defined industry or functional application.

- Industrial Gases. This is a highly consolidated subsector with just a handful of public companies. Even those that engage in other businesses derive the overwhelming share of their revenues from gas sales and distribution.

- Multispecialty Chemicals. The companies in this subsector have diverse portfolios and earn a substantial portion of their revenue from specialty chemicals. Compared with companies in the focused-specialties subsector, multispecialty chemical companies serve a broader range of industries and their products have more functional applications. Nearly all dedicate a significant part of their business to so-called semispecialties or narrow commodities, and some are also active in petrochemicals, agrochemicals, and pharmaceuticals.

What Multispecialties Can Learn from Focused-Specialty Companies

Multispecialties have been underperforming focused-specialty companies on a TSR basis by between 6 and 9 percentage points in recent years. The last time multispecialty companies had faster revenue growth than focused-specialty companies was in 2011. Multispecialty companies do more capital spending (about 6.9 cents for every $1 in revenue in 2016, versus 5.1 cents for every revenue dollar for focused specialties), because the upstream portions of their portfolios require it. Yet their average return on capital employed is about 5 percentage points lower than that of focused specialties.

In some cases, multispecialties struggle with their own complexity, especially when it comes to their reaction time in the market and to forging and executing unique strategies for their diverse businesses.

There are several practices of focused-specialty companies that we believe multispecialty companies should consider as a route to increased value:

- Unwavering Discipline About Market Position. Focused-specialty companies don’t have the option of applying strategies from other business units; the strategies they implement must reflect their customers’ needs. Focused-specialty companies also tend to react decisively to changes in their markets and competitive environments and to quickly identify profitable niches and opportunities where they have a sustainable advantage. This discipline keeps them from following trends that may not play to their strengths and from investing in noncore capabilities. And it explains why many focused-specialty companies can have above-average profit growth even in markets that are slow-growing or shrinking.

- Continual Deepening of Expertise. One of the presumed advantages of multispecialties is the breadth of their operations and sources of revenue. This allows them to allocate resources to their fastest-growing businesses, including by moving their best talent to those businesses. However, this conglomerate-minded approach can also cause multispecialty companies to overlook and underserve certain end-user segments and applications.

By contrast, focused-specialty companies have no choice but to keep developing their expertise in the areas where they compete. This explains their ability to spot nearby adjacencies and the relative frequency with which they hire sales and application development staff from their customers. As a result, focused-specialty companies tend to do the best in their market segments both when those segments are struggling and when they are growing.

- Customer-Centered R&D. With their resources focused on a narrower set of opportunities and customers, focused-specialty companies are more apt to direct their R&D efforts at solving specific customer problems. Focused-specialty companies face less temptation, and perhaps have less opportunity, than multispecialty companies to pursue generic product improvements—to spend for the sake of spending. This approach to R&D reinforces the leading positions that focused specialties have in their chosen markets.

The Best Returns Have Been in China and North America

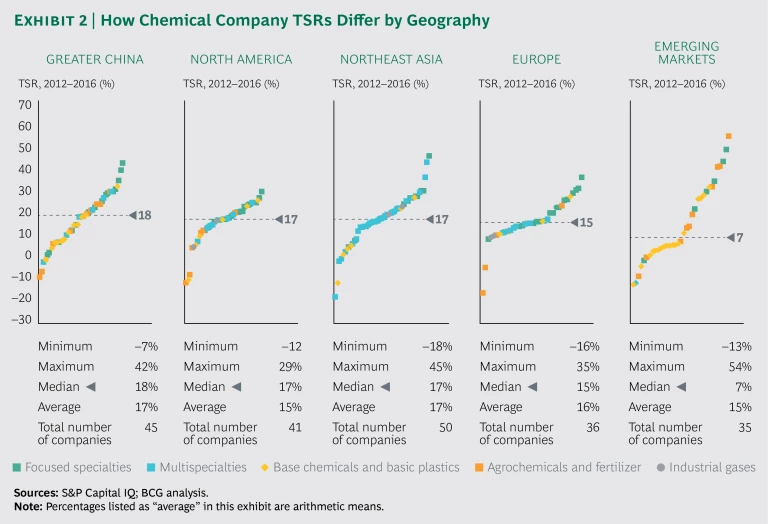

BCG’s study also highlighted the differences in TSR performance between different geographies. At the top were chemical companies in Greater China (the People’s Republic of China, Hong Kong, and Taiwan), with a median TSR of 18%. Just behind were North American chemical companies, with a median TSR of 17%. (See Exhibit 2.) North American companies also had the narrowest TSR distribution of companies in any region.

The biggest drag on chemical company TSRs came from emerging markets, where publicly held chemical companies had median TSRs of only 7% between 2012 and 2016. A lot of emerging-market chemical companies are in the base chemicals and basic plastics subsector, which has been hurt by the drop in petrochemical prices.

Still, the lesson for chemical companies is not necessarily to reduce their participation in emerging markets. The lesson, as in other regions of the world, may be that they need to have a very focused strategy when setting out to compete in emerging markets and adjust their business model to each market’s special needs.

The fact that focus works in emerging markets is evident from the data: of the six focused-specialty chemical companies based in emerging markets that we tracked in this year’s study, five had TSRs in excess of 20%.