Tapped by governments for their ability to design, manage, and operate infrastructure projects , concessionaires are uniquely positioned to use smart technologies such as the Internet of Things (IoT) and data analytics to their advantage. These long-term private operators have greater incentives than governments to proactively invest in innovative technologies that can help reduce the cost of operations and maintenance over a project’s life cycle. In a field where it can be hard for companies to stand out from the competition, concessionaires can use smart technologies to outbid competitors, secure lucrative projects, and develop new and innovative service lines.

The time is ripe. From smart hospitals designed for faster workflows to sensor-embedded bridges that lower maintenance costs and reduce risks, digitalization offers the chance to revitalize a budget-constrained industry that has been limited by flat productivity and slow adoption of new technologies. And the need is great: the Global Infrastructure Hub estimates that $15 trillion will be required over the next 20 years to support the world’s growing infrastructure needs. Governments will be unable to fully fund this demand.

Seizing the smart-technology opportunity requires a step change in the way concessionaires develop and operate infrastructure. But with a series of carefully considered actions, executives can ensure a successful pivot while minimizing the risks of digital initiatives.

Megatrends Shaping the Future of Infrastructure

A combination of forces is challenging concessionaires to rethink the way they design, construct, and operate infrastructure. The explosive growth of major cities, the emergence of data-gathering devices, and a global focus on sustainability are redefining the way people work, live, and get around. Concessionaires must find innovative ways to navigate this new world, as they address increasingly important issues such as traffic flow, interconnectivity, and energy consumption. Three trends are critical for concessionaires in this shifting landscape.

Urbanization. Two-thirds of the world’s population will migrate to large urban areas by 2050. And according to a report from the Cities Climate Finance Leadership Alliance, more than 70% of the global demand for infrastructure over the next 15 years is expected to come from major metropolitan areas.

Connectivity. Gartner forecasts that 20.8 billion connected things will be in use worldwide by 2020. Using sensors to tie objects into interconnected networks, tech-savvy concessionaires will be able to monitor and interact with their assets and predict maintenance issues at a depth and scale previously unattainable. Analyzing data generated by connected networks and sensors can help concessionaires improve the user experience and create new business models. And as the amount of data produced by the IoT grows, so too will demands for cybersecurity measures. Meeting these needs with their own cybersecurity platforms and capabilities could create additional revenue streams for concessionaires.

Sustainability. Climate change will have an effect not only on ecosystems and economies but also on how concessionaires build and manage infrastructure. To design and construct more sustainable infrastructure and minimize carbon emissions, concessionaires must incorporate renewable energy systems; innovative methods of heating, cooling, and lighting; and more efficient consumption of raw materials.

Key Smart-Infrastructure Technologies

Each of these megatrends creates a new set of challenges: how to develop infrastructure that can support rapidly growing populations, how to protect infrastructure from cybersecurity threats, and how to design huge facilities while minimizing carbon emissions.

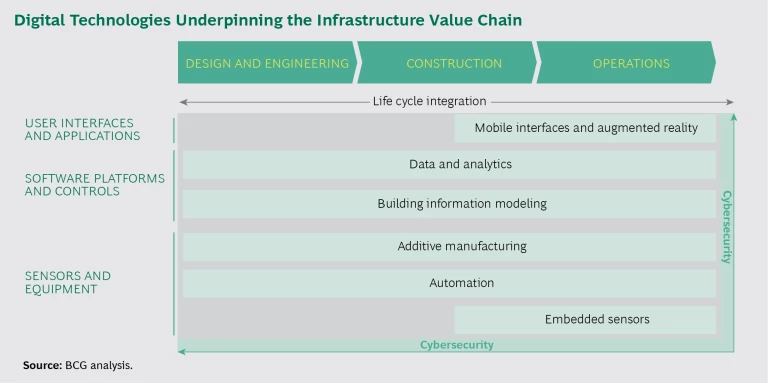

Many concessionaires are turning to new and innovative technologies for answers. These technologies can be mapped according to their position in the infrastructure value chain. (See the exhibit below.)

Embedded Sensors. Embedded in everything from roads to bridges, sensors that respond to light, heat, and motion are driving greater efficiencies and cost savings for concessionaires. For instance, Chinese concessionaire EcoGreen is using GPS-enabled sensors to track the timing and location of garbage collection vehicles to ensure that trash is being collected more effectively, preventing a costly and dangerous buildup of solid waste at the treatment plant.

Sensors can also switch road lighting and overhead signs on and off; gauge the effects of weather, corrosion, and temperature changes on bridges; and guide drivers to available parking spaces.

Connected, these sensors power the IoT—the interconnected system of data-producing devices. From lighting-management systems that provide immediate updates on outages to smart roads that alter speed limits using data on real-time traffic flows, the interconnectivity of devices and the data produced by these networks will have a profound impact on the management of infrastructure assets.

Data Analytics. According to IDC, the amount of data across the globe will grow from 4.4 zettabytes in 2013 to 44 zettabytes, or 44 trillion gigabytes, by 2020, when machines will produce about 10% of all data. And concessionaires are already capitalizing on some of this data. Vinci Concessions, for example, is converting a section of road in Birmingham, England, into a smart highway using sensors that collect information on traffic flow. The data is then sent to a control center where speed limits are adjusted accordingly to improve traffic flow for thousands of motorists daily.

Other applications of data analytics include monitoring a building’s energy consumption to reduce utility costs and tracking the wear and tear on a bridge to predict maintenance issues.

Building Information Modeling. Building information modeling (BIM) is a cloud-based platform that lets users collaborate on specifications and performance requirements in the design and building of infrastructure assets. (See The Transformative Power of Building Information Modeling , BCG Focus, March 2016.) The result is a virtual yardstick that concessionaires can use to measure asset design, construction, and performance.

In addition to keeping highly complex and time-sensitive projects on track, BIM helps designers, architects, project managers, and operations and maintenance staff flag potential construction hurdles and predict maintenance issues. For example, a concessionaire that uses BIM to identify areas of concern in the early design stages of a project can shave months off construction time, reduce costs, and improve safety conditions.

Automation. Automation is redefining industries such as transportation. For instance, in Milan, a consortium of concessionaires constructed and deployed a fully automated, driverless urban light-rail system that can carry 26,000 people per hour. Concessionaires are also discovering a wide variety of applications for unmanned aerial vehicles including traffic management, pollution monitoring, crowd control, and checking the progress of new builds.

Cybersecurity. As infrastructure becomes more connected—and subsequently more vulnerable to cyberthreats—cybersecurity is an opportunity for concessionaires to expand their offerings across all the aforementioned technologies. Case in point: a request for proposal from a government agency in New Delhi, India, asked concessionaires to bid on providing interactive digital panels for advertising, with the proviso that the panels must also offer protection from cyberattacks on the system. In fact, some concessionaires are using their investments in cyberdefense technologies as a competitive differentiator when bidding on projects.

Other Technologies. Among the other technologies helping to redefine infrastructure are augmented reality, additive manufacturing, and mobile interfaces.

Unlocking the Business Opportunities in Smart Infrastructure

Concessionaires are always looking for ways to generate a greater return on their infrastructure investment. Smart technologies offer a powerful approach to cutting costs, generating new revenue streams, and mitigating risk.

Cost Advantages. Smart infrastructure promises to substantially reduce costs across the entire life cycle of an asset. Consider, for example, the construction of the new Royal Adelaide Hospital in Australia, a joint venture between builder Hansen Yuncken and CPB Contractors. Relying on BIM technologies, contractors gathered data from 2D installation drawings and 3D models to review, analyze, and perform virtual tests on its design proposals before entering the field, thereby reducing the time required to fix poorly executed work. Estimates indicate that BIM can help reduce project duration by 22% and construction costs by 30%.

Transportation, public services, energy—they’re all sectors in which concessionaires are using critical design and construction data in the early stages to reduce ongoing operations and maintenance expenditures. Other cost-cutting applications of smart technology include the automation of energy and lighting systems, predictive maintenance of bridges and roads, and reduced consumption of resources such as water and electricity using smart-metering systems.

Revenue Generation. Smart technology can help concessionaires generate revenue on retrofits and new builds. For example, as part of a 22-program smart-city initiative, Barcelona installed a sensor system that guides drivers to available parking spaces. Embedded in asphalt, these low-power devices detect whether a parking space is open or occupied by a vehicle. Drivers simply access a mobile app to receive up-to-date information on parking availability. Since its launch, the initiative has increased parking revenue by $50 million annually while reducing congestion and emissions.

Similarly, using technology to strengthen relationships with end users can help generate revenue. For example, airports can create new revenue streams by using beacons to send information—such as details on local restaurants or digital coupons for nearby designer clothing shops—to passengers’ smartphones. The deeper the customer engagement, the greater the opportunity to monetize smart-infrastructure investments.

Risk Mitigation. Mitigating the risks of infrastructure can be as critical to a concessionaire’s bottom line as revenue-generating strategies. For example, when the I-35W Mississippi River Bridge in Minneapolis, Minnesota, collapsed in 2007, it killed 13 people. And according to a Minnesota Department of Transportation study, the disaster had an economic impact of $43 million in 2008.

Today, the replacement span, the Saint Anthony Falls Bridge, features a state-of-the-art built-in sensor and monitoring system. More than 300 sensors gauge the effects of weather, corrosion, temperature changes, and traffic conditions, all in real time—an excellent example of how smart technology can contribute to early warnings of damage, such as changes in the curvature of the bridge, and encourage engineers to take fast action before an incident occurs.

Other risk reduction applications of smart technology include heat detection monitors and water deluge systems that protect parkway tunnels from fire and flooding, sensor-powered highways that alter speed limits to reduce congestion and prevent traffic accidents, cybersecurity systems that protect structures from attack, and air quality monitors that analyze carbon monoxide levels in enclosed spaces such as tunnels.

By preventing asset failure, smart technologies not only enhance public safety but also increase a concessionaire’s return on infrastructure investment.

A Call for Immediate Action

Even as smart technologies present concessionaires with opportunities, considerable challenges lie ahead, especially for early adopters. Smart technologies herald a dramatic departure from the slow pace of traditional infrastructure development. Moreover, smart technologies are outside the scope of expertise for many concessionaire employees, who are typically trained in finance and project management. They have no way to predict which technologies will pay off financially and which will become outdated quickly. And the revenue-generating potential of infrastructure technologies, such as sensors and automation, is still relatively untested.

Here we discuss some useful strategies that concessionaires can employ to lay the groundwork for success. They can also use these tactics to mitigate the ever-present risk of large-scale failure inherent in adopting unproven new technologies.

Plan for an uncertain future. Because concessionaires often manage infrastructure for decades, they need to anticipate changing usage patterns and remain flexible. For instance, smart roads built for autonomous vehicles are likely to experience increased capacity over time as self-driving capabilities result in more vehicle sharing and tighter groupings of vehicles on the road. Conducting extensive impact studies and risk assessments can help predict these shifts in demand and calculate the impact of such changes on profitability. Greater flexibility allows concessionaires to alter capacity and respond to new technology requirements faster and more effectively. And preliminary assessments in the design phase as well as modeling of demand-supply scenarios can help concessionaires build assets with the proper capacity from the outset, which ultimately boosts an asset’s long-term return on investment (ROI) and minimizes maintenance costs.

Shore up existing expertise. Concessionaires require a whole new set of capabilities to design, build, own, operate, and maintain smart infrastructure. The IoT, data analytics, BIM—they all demand expertise in areas typically that are typically outside the purview of traditional concessionaires.

As a first step to building the necessary expertise, many companies establish long-term partnerships. This might entail folding a partner’s offerings into a concessionaire’s own product portfolio. Alternatively, a number of concessionaires partner with venture capital groups and startups to build their own capabilities.

As an alternative to partnering, many concessionaires choose to acquire capabilities and expertise. In some cases, this may entail purchasing technology from a vendor that offers extensive support and consulting services. It’s an approach that lets concessionaries fold new technology into their portfolio while securing the expertise of a third party. Other companies acquire a target that specializes in specific technologies, such as infrastructure solutions or end-to-end cybersecurity systems.

Finally, some companies choose to develop their own in-house teams with a wide breadth of engineering experience, technical knowledge, and project expertise. The advantages of this approach include the opportunity to form research partnerships and innovation networks with industry experts and leading institutions.

Experiment with mature portfolio assets. Mature infrastructure is a prime opportunity for concessionaires to begin experimenting with smart-infrastructure projects. These well-established portfolio assets provide a departure point for concessionaries to gather knowledge, identify pain points, test new technologies, and glean practical experience that they can later use to enhance full-scale greenfield undertakings.

Early-Mover Motivation

Technology is now transforming the slow-changing world of infrastructure development. Concessionaires must embrace innovative technologies, such as sensors and BIM, to prepare for the future demands of infrastructure. Without this edge, concessionaires will lose market share to more digitally savvy competitors.

Applications of smart infrastructure vary from battling traffic congestion to slashing carbon emissions. But inherent in each of these endeavors is a business opportunity for concessionaires to bolster the return on their infrastructure investments. For some, the financial benefit will come in the form of preventing asset failure. For others, it will be new sources of revenue or enhanced abilities to cut costs.

Indeed, competition among concessionaires to maximize ROI will be steep. Smart technologies are coming down in price and are increasingly accessible in the mainstream consumer market. Gaining an edge will require fast and decisive action rooted in carefully plotted strategies for building new capabilities and pursuing experimentation. By innovating now, concessionaires can shift from a reactive to a proactive approach to digital disruption.