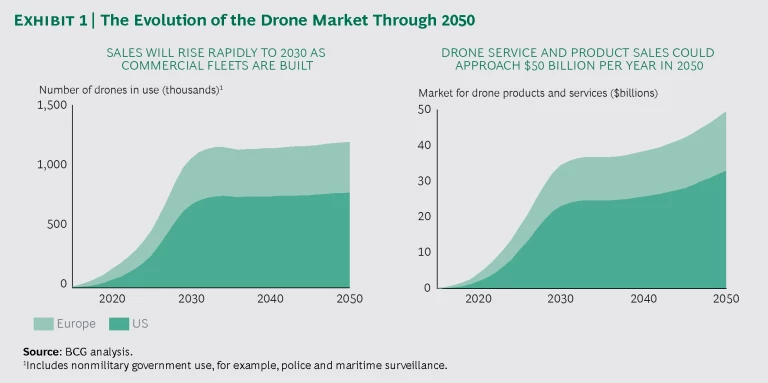

Companies have only scratched the surface of what airborne drones can do. Over the next two decades, businesses will put industrial drones to work monitoring facilities, tracking shipments, and, perhaps even delivering groceries to your doorstep. BCG estimates that by 2050, the industrial drone fleet in Europe and the US will comprise more than 1 million units and generate $50 billion per year in product and service revenues.

Services that operate drones and manage drone data for end-user companies, rather than drone manufacturing, will generate most of the value because most end-user companies will turn over actual operation and maintenance of drones to third-party services. And the data that drones capture will create value for end users by helping identify new operating efficiencies. In some industries, drones will enable new business models and business opportunities. In agriculture, for example, next-generation drones could fly over fields, analyze conditions, and identify spots where more fertilizer might be needed to raise crop yields. DHL, Amazon, and Google are among the companies that are developing drones to automate deliveries. Insurers will sell drone coverage and are considering the use of drones for inspecting damage from storms and natural disasters. Telecom companies may sell drone data communications services for guiding drones and relaying the data that they collect.

Today, nobody can anticipate the full range of industrial drone applications. Some are obvious: sending a drone rather than a human to inspect the machinery atop an offshore oil rig, for example. But in many industries, companies have yet to discover specific applications for drones. Companies can start by thinking about the kinds of data that could be captured more efficiently with drones than with current methods and how they could use that data. Then they can determine how much drone expertise they wll need to reap the business benefits that they identify. Now is the time for companies to learn about drone capabilities and start building drone strategies.

The March of the Drones Begins

Around the world, hobbyists and military forces have been using airborne drones for years. Now, drones are poised to become common in all sorts of businesses. Compact drones with cameras are being deployed to inspect oil rigs, monitor agricultural fields and mines, and check on telecom towers. Next-generation industrial drones will be dispatched to fly beyond the visual line of sight so that they can scan hundreds of miles of pipeline, deliver packages, or support search-and-rescue operations. Eventually, full-size pilot-optional cargo and passenger planes could join the airborne-drone fleet, which has important implications for aerospace companies that are planning next-generation products.

We see the use of industrial drones unfolding in three waves. The first, currently underway, involves line-of-sight applications in which an operator guides a drone and maintains visual contact. The second, ramping up within 5 years, will introduce remote applications, such as observation of ocean-going ships. The third wave, which could be up to 25 years away, would introduce full-size pilot-optional aircraft.

We expect very rapid unit growth of wave 1 and 2 drones through 2030 as companies build up drone fleets in Europe and the US, followed by steady growth through 2050, when the industry will be well established. (See Exhibit 1.)

- Wave 1: Line of Sight (Now). Industrial drones are most often used to inspect production sites and equipment, helping measure performance and avoid breakdowns. These drones are restricted to very low-level airspace—typically, up to 500 feet—and require human operators to watch and guide them. Oil and gas producers use drones to inspect offshore platforms and refineries, offloading a dangerous job from humans. In mining, drones are involved on a daily basis, for example, monitoring stockpiles, and in farming, drones are producing detailed maps that make it easier to manage fields. Telecom carriers use drones to inspect transmission towers, and in media and entertainment, drones are getting breathtaking shots that were almost impossible to capture in the past.

- Wave 2: Remote Monitoring (Within 5 Years). Today, most countries, including the US, permit only line-of-sight operation. But we anticipate that in the next few years, increasing numbers of jurisdictions will permit drone flights that go beyond that limit, creating demand for larger, more sophisticated craft. Once the technology is proved safe, we expect that regulators will allow remote operation, making it possible for drones to inspect hundreds of miles of power lines and deliver mail and parcels. However, we estimate that drone parcel delivery will remain relatively limited, accounting for just 1% of package deliveries.

- Wave 3: Self-Piloting Planes (Within 25 Years). The final frontier of airborne drones—pilot-optional planes—is still a ways off. But aerospace companies and aviation agencies are already thinking about how these drones could work. This planning—two decades in advance—reflects both the long product cycles of the aerospace industry and the magnitude of the challenges. For example, pilot-optional planes would need totally reliable long-distance wireless data communications. We expect that the evolution of self-driving cars and trucks will help refine needed technologies and pave the way for consumer acceptance.

The Value Is in Services and Data

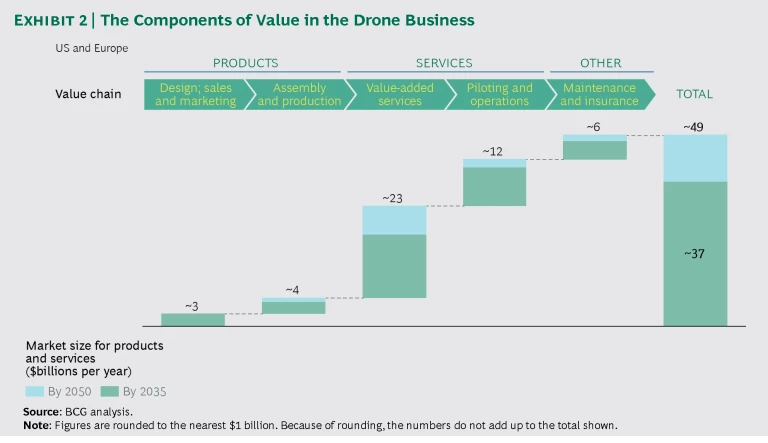

As drone adoption accelerates, the value will quickly shift from drone makers to the providers of drone-related services. The shift will include drone operators that outsource drone work for companies and companies that can analyze the big data flows from drones. (See Exhibit 2.) It will also include telecom carriers: even as drones grow in sophistication and capabilities, we expect that most of them will remain low-flying craft, which means that they will likely rely on mobile-phone networks for communications, expanding demand for cellular service. There will also be opportunities for software developers, for example, to create user interfaces and operating systems for drone flight control. Systems integrators will have opportunities to help companies bring drone data into IT systems.

Industrial drones will create employment opportunities, too. Initially, there will be demand for drone operators to work for drone services or directly for drone users. But these jobs will become less necessary as drones become more autonomous. There will be steady demand for drone maintenance workers, and the growing prevalence of drones could contribute to employment in insurance, IT consulting, and other businesses that serve the drone industry and drone users. A recent report by the European Union’s Single European Sky ATM Research (SESAR) initiative describes employment opportunities and other economic effects of industrial drones, as well as the various regulatory and technical challenges that are associated with the evolution of drone use. See the sidebar “Clearing the Hurdles.”)

CLEARING THE HURDLES

Unlocking drones’ potential to contribute to growth and productivity will require a regulatory and technological framework that makes it possible for drones to fly wherever they need to go. Achieving this goal will take a great deal of cooperative effort by government aviation authorities, the drone and aerospace industries, corporate drone users, the public, and other stakeholders. Wdespread drone use depends on a holistic regulatory framework that will allow drones to operate alongside other forms of aviation. This will require digitization of infrastructure—including a new traffic management system that parallels and is integrated with the systems that now guide airplanes—as well as changes to other infrastructure, such as cellular networks, to enable communication with drones flying at low levels. And new standards will be needed to ensure interoperability.

A necessary first step is the creation of a regulatory framework and an infrastructure that anticipate all the possibilities and ensure a future-proof design. These foundational steps will allow investors and innovators to move ahead with their work on the technical and business issues, help the industry ecosystem flourish, and build public support.

Identifying the actions needed to clear the existing hurdles was a major focus of a recent report about the European drone market.1 The report, supported by BCG analysis, identifies three priorities:

- Establishing a Transnational Legal Framework. Consistent regional and international regulations and standards are needed to allow the industry to scale up and ensure a high level of safety and security for a single competitive drone market.

- Adapting the Air Traffic Management System. For the drone industry to develop, air traffic management systems must support unmanned aircraft traffic, which will require further R&D. For example,vehicle-to-everything and detect-and-avoid systems must be made invulnerable to cyberattacks.

- Creating a Mechanism That Brings Stakeholders Together. Key public and private stakeholders need to work together to advance commercial drone development. Private-sector stakeholders include leading aviation players, drone makers and operators of drone services, and leaders from drone user companies.

SESAR, working with the European Commission, is now preparing to convene European drone stakeholders and has sought cooperative arrangements with the US Federal Aviation Administration and the US National Aeronautics and Space Administration to establish international collaboration. This effort is intended to accelerate development of the large drone market that the EU believes will generate new sources of growth for European economies. In a recent speech, Violeta Bulc, the European Commissioner for Transport, said, “Drone technologies are a unique opportunity for the European economy to generate additional growth and prosperity: they open the door to new markets for innovative services with immense potential. I want the EU to remain on top of this, to steer and lead the global development of this technology.”

NOTE

1. See European Drones Outlook Study: Unlocking Value for Europe, SESAR Joint Undertaking, 2016. For more information, please contact Alain Siebert, chief economist and master planning, SESAR Joint Undertaking, at alain.siebert@sesarju.eu.

Companies Can Prepare for the Drone Era

How can companies benefit from the use of aerial drones? And what should they be thinking about to prepare for the introduction of drones into their businesses? We look at these questions from two perspectives: how drones can enable new ways of doing things for companies that use them and how drones can drive growth in existing businesses.

How do drones enable new approaches and operating models? In many industries, companies can use drones to reinvent processes and raise productivity. Drones, for example, fit into evolving digital models for managing mines and farms and the equipment used in the energy sector. In other industries, such as insurance, they may enable all-new operating models. The following are prominent examples of emerging operating models that rely on airborne drones:

- Mining Operations. Drones will be used in conjunction with Internet of Things (IoT) sensors to manage mine operations digitally. Drones can provide data about the flow of trucks, ore, and supplies in and out of a mining site to optimize daily operations. They can also provide data for pit design decisions.

- Agriculture. In farming, drones may complement or replace other technologies, such as IoT sensors. Today’s drones can be used for land surveys and other data-gathering activities. In the future, they may be used to support precision farming, which relies on data about conditions in different parts of the field to more precisely manage irrigation and pesticide use, for example. The goal is to increase crop yields, while reducing the use of costly inputs.

- Energy and Utilities. With their great potential to reduce risk and improve operations, drones can be used to automate inspection of offshore rigs and refineries, enabling preventive maintenance and avoiding costly interruptions due to equipment breakdowns. For utility companies, drones can not only provide better and more timely monitoring of transmission lines and solar fields, they can also be used to reduce theft.

- Insurance: Reinventing Claims. The process of filing and approving claims is costly, time-consuming, and labor-intensive. Drones can help transform this process. They can be dispatched to make digital videos of the damage to homes and buildings after storms and of automobiles at crash sites, a procedure that police are testing to gather data for their reports. Such capabilities would not only cut claims-processing costs but would also accelerate customer service and generate additional underwriting data.

Where will drones drive growth in existing businesses? Large-scale drone utilization could create new demand in such widely diverse industries as telecommunications and aerospace.

- Telecommunications. Since most drones will continue to be low-flying craft and therefore capable of communicating over cellular-phone networks, carriers may be able to sell data services to drone operators. Depending on the potential size of the market, it may even be worthwhile to invest in additional infrastructure and modify antennae to accommodate drone traffic.

- Technology Providers. There will be considerable opportunities for technology providers to tap drones as a new revenue source. Suppliers of cloud services, for example, may develop new lines of business for drone service providers and their customers. Drone services will need operating platforms for managing drones, and end users will need services for data management and analytics.

- Insurance. Drones, which will need to be insured, could provide a new market for carriers. Fully autonomous drones will provide a new underwriting challenge.

- Retail. Delivery drones could be a growth opportunity for retailers. Automated delivery might increase sales in certain categories, such as apparel, pharmaceuticals, and groceries.

- Post and Parcel Services. Despite high-profile R&D projects such as Amazon Prime Air, DHL’s Parcelcopter, and Google’s Project Wing, many questions remain about automated package delivery. It is not clear that drones will be practical for last-mile delivery. It’s possible that they will be deployed for delivery to drop boxes or even just to help out in distribution centers. Or delivery could be reserved for premium or urgent-delivery service for consumers and businesses willing to pay for the ultimate in speed and convenience.

- Aerospace and Defense. Aerospace will be the final frontier for drones. Aerospace manufacturers should continue to review their R&D pipelines to assess the implications of offering pilot-optional aircraft. They should also be working with airlines, freight carriers, and regulators to understand which applications will be wanted and permitted. Another consideration for companies is whether pilot-optional aircraft will be a part of their mainstream business or a standalone business that requires more fundamental changes in capabilities.

Companies of all kinds should be thinking about what drones could mean for their businesses and competitive environments. Leaders should consider taking the following steps:

- Determining the Kinds of Information That a Drone Can Collect. In addition to ascertaining the types of information that drones can collect, companies should identify the processes in which drones could do the job better or more efficiently than an employee or another technology.

- Estimating the Potential Investment Payoff. Understanding both the potential financial and the strategic payoffs from investments in drones will help companies determine whether they need in-house capabilities or can farm out drone activities.

- Engaging with Regulators. If drones are important to a company’s future, it may want to help boost the adoption of industrial drones by encouraging authorities to build flight control systems and supporting relevant safety regulations.

The march of the drones into industry is an exciting development. An industrial drone is a remarkable tool, combining IoT-like data-gathering capabilities with almost limitless mobility. Soon, drones will also be permitted to transport objects. We are just beginning to understand how companies can use this powerful combination of talents to function more efficiently and even to find entirely new ways of doing business. Today, companies should learn as much as they can to determine whether they need to be on the cutting edge of this emerging phenomenon.