For retail banks navigating a still-challenging business environment, business as usual no longer works. Despite a concerted effort to stabilize performance following the financial crisis, long cycle times, inconsistent channel experiences, and generic customer propositions remain pervasive. Unless retail banks make deeper, bolder changes, profitability and competitiveness will suffer.

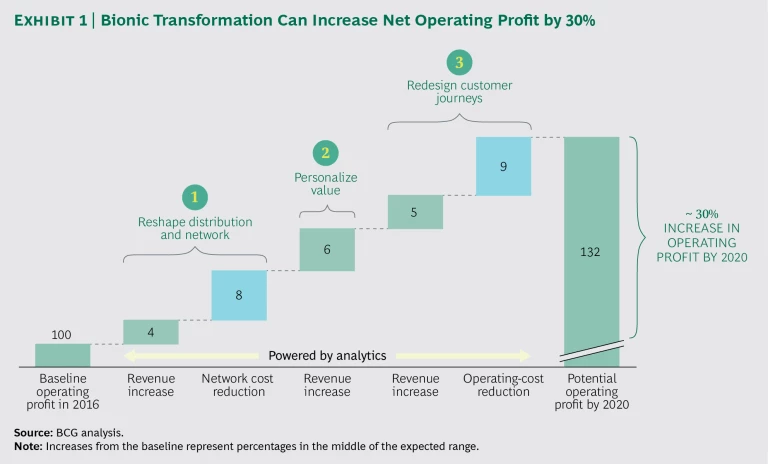

To improve performance, banks need to fuse digital functionality and personalized, human interaction. Since 2015, when BCG identified how customer, competitor, and market forces were pushing banks to harness the best of digital and physical environments, the need for bionic transformation has intensified. (See The Bionic Bank , BCG Focus, March 2015.) This year’s study provides further evidence of that imperative. Leading banks will diffuse bionic capabilities beyond their front end to encompass the whole value chain. Data from our Retail Banking Excellence (REBEX by BCG) benchmarking, Banking Pools database, Fintech Control Tower, and our latest Retail Banking Customer Survey, combined with insights from client work, suggests that by accelerating bionic transformation in this way, retail banks can generate a 30% increase in net profit by 2020. (See Exhibit 1.)

Key Findings

Retail banking remains an essential part of the financial services industry, accounting for 45% of all banking revenues. But while the sector has recovered from the financial crisis, the growth picture globally is mixed. Banks are seeing a return to precrisis levels of revenue growth, but economic, demographic, competitive, and technological changes will continue to exert downward pressure through the end of the decade. As a result, retail banks will need to get creative to sustain profitability.

Fueled by rising discretionary incomes, robust GDP growth, and a larger population of banking customers, retail banks in emerging markets, including Asia-Pacific, Latin America, the Middle East, Africa, and Eastern Europe, will continue to experience strong growth and are expected to account for 75% of the industry’s CAGR over the next several years, according to our forecasts. It is a different story in Europe and North America, however. While banks in these markets will still account for half of retail banking revenue globally, growth through 2020 will remain tepid as banks struggle to shake off the constraints posed by historically low interest rates, sluggish GDP gains, and cautious spending appetites.

Across regions, the data shows a widening gap between top banks and the rest of the field. Since 2015, top-quartile banks have extended their already sizable 53% net operating profit lead over the median performer by an additional 3 percentage points.

Customers have made it clear that they want choice in how to engage with their bank and that they expect service to be consistent, streamlined, and engaging no matter what channel they use. While 43% of survey respondents indicated a preference for digital-only experiences, the same percentage said they want a mix of physical and virtual interactions—a hybrid banking experience in which digital tools and capabilities combine with human input and advice at the moments that matter. More than half of all customers surveyed in China, Colombia, Italy, Russia, Spain, the United Arab Emirates, and the United States said they prefer this type of hybrid banking relationship. Only in the Netherlands—whose payments landscape is one of the most cashless in Europe—did respondents overwhelmingly embrace all-digital banking. No matter their favorite channel, banking customers indicated that they want advisors to have relevant data at their fingertips and digital processes that support a convenient, responsive, and customized experience. To enable that kind of experience, banks must go bionic.

The Bionic Transformation

A bionic transformation consists of three interrelated elements. First is the blending of digital and personal interactions to create a more responsive and cost-effective distribution model. Second is the articulation of a value proposition that combines human judgment with data power. And third is the adoption of a customer journey mindset with end-to-end processes that are supported with robotics and machine learning to reduce process intensity and improve customer satisfaction.

- Reshaping Distribution for Superior Efficiency and Service. To enhance the quality of customer relationships, banks must seamlessly combine human interaction with digital and self-serve functionality. One of the most important challenges in the move toward bionic distribution is reforming the branch network, which accounts for roughly 30% of total operating costs. Instead of a uniform branch model, banks need to create multiple branch formats, embedded within a well-rounded multichannel experience. They can use data and customer behavior analyses to determine which types of services customers prefer to access in person at a physical branch and which they prefer to use over online channels. They must also continually optimize coverage. Data-enabled location models allow banks to forecast expected changes in customer behavior, product mix, and profitability in order to optimize their footprint, serve more customers per branch, and achieve higher margins. Finally, relationship managers and salespeople must be equipped with the right digital and analytical tools. Customer relationship management systems, next-best-action tools, and other digital enablers can improve the quality and quantity of customer interactions. Our research shows that banks that move to this type of bionic network can see revenue gains of 5% to 15%, network cost reductions of 15% to 35%, and increases in customer satisfaction of 10% to 15%.

- Personalizing Value to Support Growth. Our research confirms that customers expect great, simple products at a fair price from a bank that knows and understands them. But accustomed to the ease and immediacy of digital channels, they also expect a high degree of personalization, differentiation, and localization from their retail banking partners across channels. To meet that demand, banks need to ratchet up product and service innovation and enrich the quality of banking interactions. In the near term, more effective value-based pricing practices could allow banks to add as much as 15% in revenue over 6 to 12 months, while improving customer impact—revenue that goes directly to the bottom line and can help fund the rest of the bank’s strategic agenda. Instituting such practices starts with understanding what customers value most and aligning product and service components accordingly. It also requires factoring in price elasticity and sensitivity in order to differentiate pricing where appropriate, and improving price realization.

- Adopting a Journey Mindset. While retail banks have made significant progress deploying sleek front ends in the form of user-friendly apps, websites, and mobile interfaces, they have made less progress integrating them with the rest of their operations. This means that banks are not getting the growth they need. For instance, while 80% of all customer touchpoints are digital, banks are struggling to convert that traffic into increased sales and efficiency. Compared with traditional banks, all-digital banks support twice as many new-account openings per operations FTE and serve 155% more customers per operations FTE.

To truly be customer led, retail banks need to approach process design in a fundamentally different way. They need to identify the customer journeys that matter most and redesign them end to end, leveraging artificial intelligence, robotics, and other service enablers to improve both speed and decision making. Our data shows that retail banks that digitalize their most important customer journeys can see a 5% to 20% boost in revenue from improved service, increased relationship manager (RM) capacity, and enhanced data-enabled offerings. They also reduce costs 10% to 25% through improved cycle times, automation, and faster and more-accurate decision making.

Banks that apply this way of thinking to their distribution network, value proposition, and end-to-end processes have the potential to significantly increase their operating profits.