First thing, one Monday morning, a relationship manager (RM) at a leading commercial bank receives an alert concerning one of her clients, a midsize parts manufacturer. The manufacturer’s attrition risk rating has jumped from low to moderate. The RM logs into her client tracker to find out what has triggered the change and learns that the client’s ratio of outbound transaction volumes has fallen nearly 20% since the start of the quarter, meaning less business for the bank. The drop comes on the heels of other subtle shifts, such as news that the client’s CFO has recently declined an invitation to speak at a bank-sponsored event. There have been a couple of persistent service problems, too. The tracker, which churns through a host of client, market, and other data to uncover predictive indicators, suggests that the client might be showing signs of attrition. The RM knows from her training on client retention that it takes time to exit a cash management product and that if the bank intervenes early there is a good chance that it can mitigate the situation and ensure continuity with the client. She shoots a note to her boss, and they convene an all-hands account-planning session.

At many corporate banks, sophisticated capabilities such as risk alerts and trackers might be mere fantasy. But the application of advanced analytics to manage churn is now a mainstay in many industries, including some retail banks. Given the current low-growth market, it’s likely to become a defining attribute for corporate banks as well, because traditional growth tactics, such as adding new clients and selling more to existing ones, no longer suffice. For one thing, there aren’t a lot of new clients to be had within the corporate banking space. For another, client acquisition is expensive. But with all the focus on those avenues, banks continue to overlook the most significant area of near-term revenue growth: retaining their existing clients.

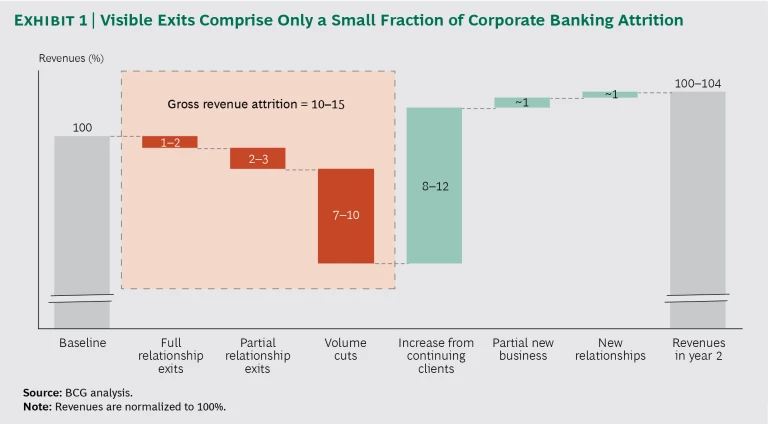

BCG research shows that corporate banks annually lose 10% to 15% of gross revenues to attrition. Stemming even part of this loss could improve bank revenues dramatically—especially since revenue growth across corporate banking segments has hovered in the 0% to 4% range for the past few years.

Still, most banks are unaware of the extent of their retention problem because of blind spots in their approach. Banks generally track only the most visible forms of attrition, client exits, because these are easy to monitor. Most fail to track and manage the less visible forms that account for the majority of revenue leakage: the partial exits and the gradual winnowing back of business by continuing clients. This failure creates a huge missed opportunity. BCG’s research and client work show that attrition risk can very often be reversed if issues are detected early enough for relationship teams to engage proactively.

Furthermore, the right tools and approaches can address hidden attrition. Our research shows that by employing predictive analytics and arming RMs with data-driven insights and enablers, corporate banks can reduce total attrition by 20% to 30%—a result that would nearly double most banks’ average revenue growth.

Attrition Is Widespread

In our analysis, we found that full relationship exits account for an average 1% to 2% of gross revenue loss. Other forms of attrition, such as partial defections (clients close a few accounts or stop buying some products) and volume cuts (clients rein in the amount of business conducted across the portfolio as a whole) do the most damage. These more gradual relationship exits account for 9% to 13% of gross revenue loss per year. (See Exhibit 1.)

Annually, according to our research results, attrition affects 30% to 50% of a corporate bank’s client base and spans all products and segments, though in different ways. For instance, small businesses that have relatively simple banking arrangements account for the greater share of total exits, while large-cap clients, with more complex banking needs, are more likely to signal their discontent by reducing the volume of business conducted.

Our research also revealed that the main factors driving attrition aren’t always what banks expect. Pricing and market conditions, such as an economic slowdown, are often assumed to be the primary reasons for revenue attrition.

But our analysis found that 60% to 80% of retention problems stem from service issues, product gaps, and other factors, most of which are internal bank concerns and within the bank’s purview to control.

What’s more, most clients would rather not change banks. Unwinding a banking relationship is tedious. What usually brings clients to the brink is not one particular issue but a confluence of events that go ignored over a period of time. The bank’s failure to react or ineffectual response to recurring problems is attrition’s primary catalyst. Even so, clients can be slow to change. Our data reveals that it can take 6 to 18 months of mounting discontent for things to spill over and prompt clients to start changing their buying behavior.

Attrition Is Reversible

The good news is that banks have the ability to turn things around. But doing so takes timely insights, thoughtful and proactive engagement, and action on three imperatives.

Use predictive capabilities to identify at-risk accounts. Today, most banks learn that they’ve lost a client only after the final decision has been made and it’s too late to make a difference. They’ve missed out on the months-long gestation period, when issues were brewing and account teams could have intervened meaningfully. Our data shows that even if the bank doesn’t spot signs of trouble until late in the game—say, three to six months before the client decides to exit or curtail business—it still has a good shot at intervening and retaining the client.

Being ready to act preemptively, however, requires teasing out the data that might indicate attrition risk. That’s where predictive modeling comes in.

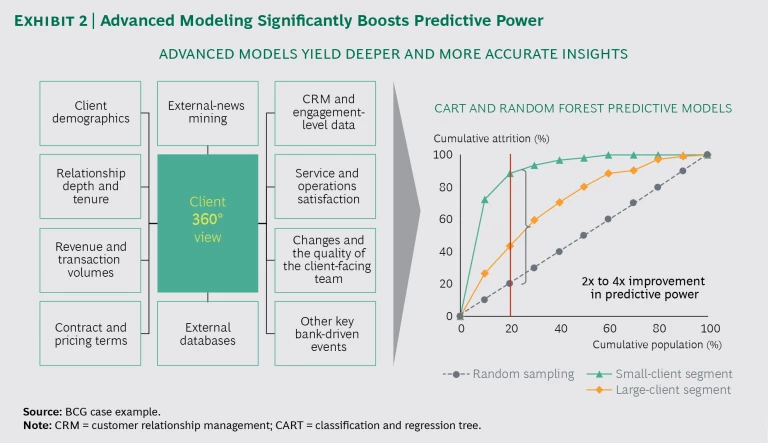

To get a 360-degree view of a customer, banks need to gather a deep, well-rounded data set. We recommend three to five years of data, including client revenues, volume, service, and customer relationship management information from across the bank. An analytics team of data scientists and business analysts should test different predictive algorithms, working first with a control group to get a more detailed baseline on how clients respond to known attrition triggers. Building on those results, the analysts can see other patterns and triggers that are revealed when advanced predictive techniques are applied. For example, classification and regression tree analysis, random forest modeling, and neural networks can be used to tease out subtle signals and patterns. The team can use these insights to design and refine predictive risk-scoring models. The attrition model can leverage client information, as well as product, transactional, and service data and generate risk scores that identify which clients are most likely to defect. (See Exhibit 2.)

The bank can then prioritize the most valuable of its at-risk clients and engage with them effectively. BCG’s “smart retention” approach allows banks to determine which accounts are at risk and provides an informed fact base that can help banks address underlying issues proactively.

Act on predictive insights to stem attrition. If an attrition model detects that data related to a particular client indicates a combination of red-flag events—including service errors, unusual volume patterns, and certain demographic markers—the RM would receive an alert that would include the client’s profile and risk score and high-light possible root causes. The alert would also provide recommendations based on techniques shown by modeling algorithms to have worked well with similar clients and incidents in the past. In situations involving especially large or valuable accounts, the RM might meet with counterparts and business leaders from across the bank to deploy a coordinated playbook in response to the attrition risks cited.

A nimble and proactive response is critical. Clients understand that service and product glitches do occasionally happen. Blemish-free service is not generally an expectation, but blemish-free responsiveness is. Our analysis found that the speed and effectiveness with which a bank acknowledges and addresses a negative experience are leading factors in client retention. Furthermore, a client that has a good run during the six to nine subsequent months is likely to disregard the rocky patch experienced earlier.

To ensure that smooth experience, the initial rapid response must be backed by targeted structural improvements so that problems don’t recur. Advanced analytics can help isolate common trouble spots and patterns—such as specific product gaps that cause the most dissonance with customers’ expectations for standards of care—at both the individual client level and, more broadly, across groups of clients and segments. Those insights can help arm RMs with persuasive talking points, tools, and guidance and can help the bank focus its fast-track solution development. We have found that banks that use predictive intelligence in these ways sharply reduce revenue loss related to attrition.

Put the right enablers in place. Stemming attrition at scale involves bankwide discipline, coordination, and energy. That starts with leveraging the wealth of data that corporate banks have at their disposal, significantly improving data hygiene, and acquiring skilled resources—including data scientists and engineers with deep predictive-modeling experience—to sort through the most relevant indicators of attrition. All this requires leadership focus and a willingness to experiment as teams fine-tune the analysis, investigate drivers of attrition, and improve the quality of risk-scoring models.

Capturing regular, ongoing client feedback is also essential to determining what works, what needs to be improved, and how market and competitor developments are changing customer behavior and expectations. Third-party surveys or those run by a specialized internal business unit can be helpful if they are designed to capture unbiased and unsanitized reviews at a level that is granular enough for use in the attrition model. Well-designed surveys can provide context on the quality of the client experience on both the microlevel (such as whether fees, a lack of RM subject matter expertise, or some other factor may be impacting a client’s experience) and the macrolevel (such as whether a significant number of the bank’s clients complain that documentation requirements are excessively cumbersome). With the results, bank leaders can determine the most pressing retention threats and assign dedicated “SWAT teams” with the right mix of skills to address those threats quickly.

Training and development are integral parts of the process. Attrition management is not a report card on the effectiveness of an RM. It is a toolkit that can help RMs use an analytics-based approach to engage with their clients in a timely and effective manner and prevent revenue loss. RMs and client teams need to be taught how to use and interpret risk scores and coached so that they understand which types of proactive interventions prove most helpful in addressing specific types of attrition issues. Finally, banks must put the right performance incentives in place to underscore the importance of retention management and reward RMs for success in mitigating attrition.

For corporate banks, there’s a bright note in what has been a challenging hunt for revenue growth. Targeted client retention efforts can boost revenues by 2% to 3%. That’s a faster rate of reve-nue growth than banks earn in the normal course of business. To capture those revenues, corporate banks need to get smart about retention and become truly customer-centric in their philosophy.