This is our second and final publication on sustainable financial inclusion. In the first, we unveiled a new framework—one that is both comprehensive and practical—to help executives, policymakers, and officials improve financial inclusion. (See How to Create and Sustain Financial Inclusion , BCG Focus, March 2017.) In this publication, we examine the root causes of financial exclusion in South Africa and suggest a path to higher inclusion.

South Africa is a nation of well-known promise and peril. In BCG’s most recent Sustainable Economic Development Assessment (SEDA), the country scored relatively poorly—ranking 149th of 162 countries—in its ability to

One way to improve well-being is through financial inclusion—the adoption, usage, and sustainability of financial services. As shown in our recent SEDA report, family prosperity, GDP growth, and reduction of poverty rates are closely linked to financial inclusion, which should feature prominently in building a more promising future for South Africa.

Existing methods for assessing financial inclusion are either too simple or too academic. In our first financial-inclusion publication, we presented a new framework for assessing financial inclusion and gave an overview of the situation in South Africa. In this publication, in which we unearth the root causes of exclusion in South Africa and recommend paths toward inclusion, we show how South Africa can become more financially inclusive.

BCG’s framework is noteworthy in two important ways. First, it covers the full suite of basic financial services, including transaction, credit, insurance, and savings. These elements are integral to national and household prosperity. Second, it measures usage and sustainability, not just adoption. Adoption without usage is of limited benefit, and usage that is unsustainable—either because the offering is unprofitable or too risky for the financial institution or too costly or inflexible for the customer—can lead to personal bankruptcy and financial crises.

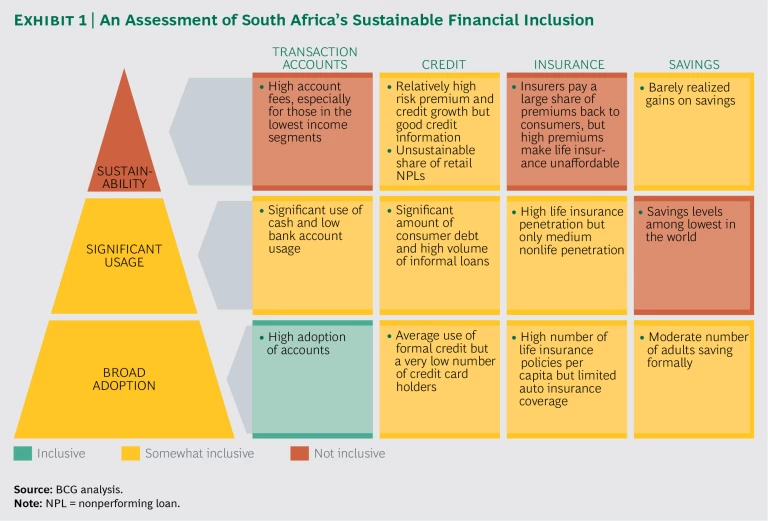

As Exhibit 1 illustrates, the framework is built on 12 assessments related to adoption, usage, and sustainability among the four product categories. These assessments are based on 23 KPIs. Most of them are in the public domain; a few that are based on proprietary BCG methodologies use public data and are comparable across countries.

Understanding South Africa’s Financial Inclusiveness

Of the 12 individual assessments, South Africa receives one inclusive ranking, eight somewhat inclusive rankings, and three not inclusive rankings. Broadly, adoption is stronger than usage, which is stronger than sustainability. In terms of sustainability, transaction accounts and credit are slightly stronger than insurance and savings.

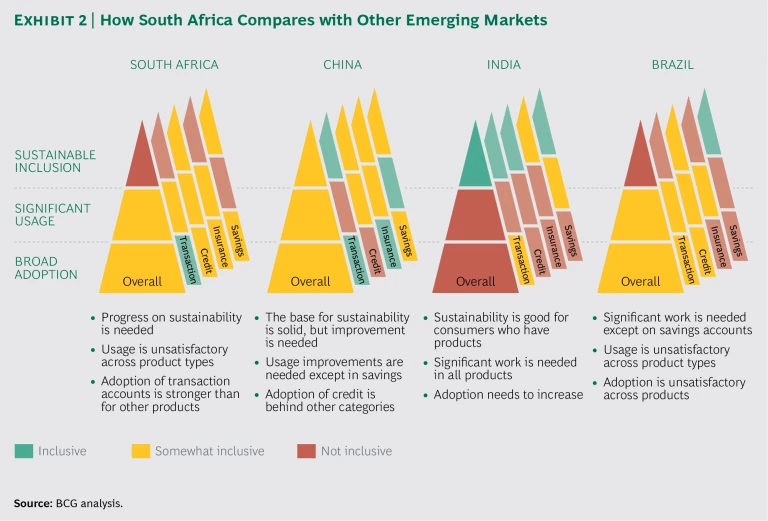

On the surface, South Africa appears fairly inclusive compared with other emerging markets, but appearances can be misleading. (See Exhibit 2.) More than 70% of South African adults, for example, have a transaction account—more than in Brazil, Chile, India, Mexico, and Russia—and its life insurance adoption rate is higher than that of far wealthier countries such as Italy and Spain.

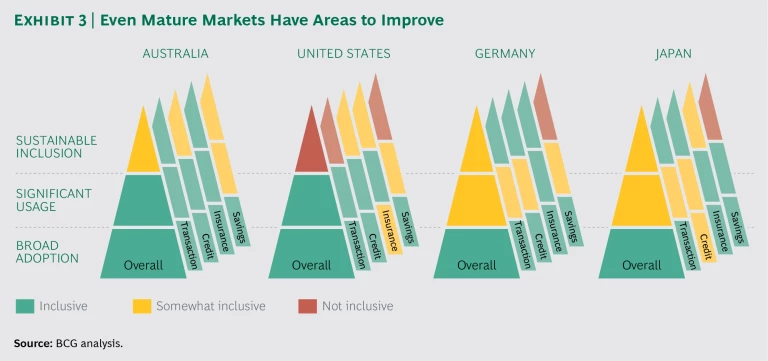

However, BCG’s framework uncovers serious gaps in the usage and sustainability of those products and in South Africa’s overall state of inclusion compared with mature markets. Australia and Germany, for example, come up green in nine and eight of the assessments, respectively. (See Exhibit 3.) Let’s look at South Africa’s performance in the four products.

Transaction Accounts: High Adoption but Low Usage. South Africa’s relatively high adoption of transaction accounts masks the reality: the country remains a cash-oriented society. Most South Africans use transaction accounts to park money temporarily. Many of them withdraw their entire paycheck or welfare or other public, or social, payment almost as soon as they receive it, and only 24% make more than three monthly transactions of any kind—such as withdrawals, transfers, or card swipes—through their account. About 60% of all transactions are conducted in cash. That share is almost certainly higher at low-income levels. Most of the low-income South Africans we interviewed conduct most of their transactions in cash, despite the risk of loss or theft.

One bright spot: in contrast to many other emerging markets where women and rural residents are financially excluded, financial-inclusion percentages are relatively consistent across gender lines and by location in South Africa.

Credit: Formal Channels, Only Part of the Story. South Africa, a modest borrower of formal credit issued by financial institutions, is potentially overextended in informal credit.

The nation is on a par with other emerging markets in terms of the share of adults who have borrowed from a financial institution in the past year. At 12%, South Africa is a much more active borrower than Nigeria (5%) or India (6%), but it’s below Kenya (15%) and Germany (19%). The share of adults with a credit card, 13%, is relatively low, compared with many other emerging markets, such as Brazil (32%), Russia (21%), and Mexico (18%).

However, informal channels, such as loan sharks (mashonisas), grassroots credit unions (stokvels), and friends and family, make up a larger share of the credit market than formal channels. Unsecured personal credit is growing faster than GDP. Defaults on unsecured personal loans are in the red zone at 12%—far higher than in risk-averse nations such as Germany (2%) and China (1%). Consumers are paying the price for all this credit. The risk premium on personal loans is 4%, just one tick away from putting South Africa in the red zone on that KPI.

Consumers told us that they frequently borrow to buy household goods, such as televisions, and that they even borrow money so that they can get to work when they are having cash flow difficulties. Credit, in other words, is more often aimed at consumption and immediate gratification than at productivity, say, starting a business or getting an education.

Insurance: Funeral and Burial Coverage, the Main Attraction. Funeral and burial coverage dominates the life insurance market, while the property and casualty (P&C) market is still undeveloped.

For every ten adults in South Africa, eight life insurance policies are in place, a share that is higher than that of many mature markets. But there is an essential split within the life insurance market. The coverage of most of these policies is limited to the costs of funerals and burials, important cultural events in sub-Saharan Africa. According to the FinScope survey of consumers, only 12% of the population is covered by full life policies that provide long-term benefits for survivors.

Many South Africans devote a large and unsustainable share of their disposable income to these life, funeral, and burial polices. In interviews, we discovered that many of these policies would make economic sense only if there were a death in the household every 2.5 years. Other policies were better deals, but rarely were consumers better off having funeral and burial coverage instead of saving their money.

South Africans do not have the same enthusiasm for P&C insurance. Fewer than half of the autos on the road, for example, are insured. However, the level of claim payouts suggests that the P&C market is more sustainable than the life market.

Savings: The Weakest Link in Financial Inclusion. South Africans do not have a culture of savings, and traditional savings products are unlikely to encourage greater adoption.

Only one-third of adults had set aside money in a formal savings account in the year preceding our study. The long-term savings rate in South Africa, as a share of adjusted GDP, is among the lowest in the world and less than one-half India’s rate and one-quarter China’s. The low savings rate reflects economic uncertainty, an emotional desire to spend, and a rational choice: the inflation-adjusted return on savings in South Africa is barely above zero. The incentive to save is minuscule, and the savings products offered are largely unsustainable for the average South African.

Digging Into Root Causes

If the purpose of the first publication was to unveil a new way of assessing financial inclusion, our purpose in this report is to explore how South Africa can create sustainable financial inclusion. This exploration involves understanding both why consumers shy away from various products and why financial institutions are not offering a greater range of products suitable for the market’s low end.

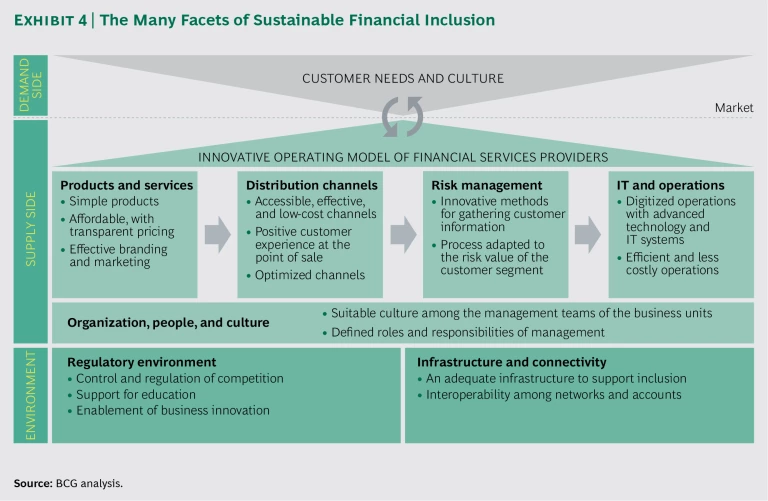

For those explanations, it is necessary to look at what is not working in the current system. Sustainable financial inclusion has to address supply (what financial institutions provide), demand (what consumers want), and the overall environment (how the public sector and private sector support and facilitate financial services).

At a slightly more granular level, sustainable financial inclusion is built on a foundation of regulation that facilitates innovative services and supportive infrastructure, such as mobile networks, point-of-sale devices, and ATMs. It is, then, largely the responsibility of financial institutions to create operating models that produce desirable services and products. (See Exhibit 4.) All of these elements must come together in innovative ways to meet consumers’ needs.

To understand the gap between existing goods and services and consumers’ needs, we interviewed

THE HUMAN FACE OF FINANCIAL EXCLUSION

Financial inclusion is often described in dry language, as if it were an arcane academic discipline. In fact, financial inclusion helps drive household and national well-being. Without affordable and flexible access to financial services, consumers can quickly lose their economic equilibrium, as the following stories from South Africa demonstrate.

Vusi, 30, has a transaction account that his former employer required him to open. He now works in construction and is paid in cash so he never visits the bank. He keeps his money hidden in his house, even after an electrical fire damaged many of his personal possessions, including his stash of cash.

Dumisani, 25, borrowed money to buy a television, which carried insurance as part of the purchase. When he lost his job and the television was stolen, he stopped making loan payments. However, owing to regulatory requirements, the insurer denied coverage because he had not purchased a TV license, which he could not afford without a job. He is now without a TV and is blacklisted from borrowing again.

Nhlanhla, 42, seems like a success story. He moved to the city from the country and started selling goods informally from the side of the road. He saved his money and purchased a small convenience store and food stand, which now support his wife and two children. However, he cannot get a bank loan to expand unless he registers his business. And, without the loan, he cannot afford to pay the registration fee and get the necessary documents.

Phumelo is a 23-year-old homemaker who cares for her two children while her husband works. Their monthly household income is about R3,500, or slightly more than $250. She would like to open a savings account but cannot afford the R10,000 minimum balance.

Cost and convenience hinder transaction account inclusion. South Africa’s relatively strong adoption of transaction accounts must be marked with an asterisk: the existence of these accounts is often a condition of employment or receipt of social payments, and many view them as constraints rather than enablers.

Against that backdrop, it should not be surprising that usage and sustainability are weak. Transaction accounts are too expensive—40% of consumers without an account say fees are too high—or bank branches are too far away. Sonta, a 31-year-old who works at Shoprite, told us, “The mattress doesn’t charge for small withdrawals.”

Forty percent of survey respondents said that cash is easier to manage. ATMs and mobile banking are two less costly and more convenient options than in-branch banking, but they both run into consumer resistance. Consumers told us that they do not trust ATMs and find them too complex. More than one-half, or 51%, of survey respondents told us that they do not own a smartphone, and only 15% of the smartphone owners use a banking app. The number one reason, for 33%, is fear of fraud. “A lot of scams happen over the internet,” one respondent told us.

This distrust of alternative channels leads to the unsustainable proposition that the least profitable consumers are drawn to the most expensive channel, brick-and-mortar branches. Banks clearly have a tall advertising, marketing, and education challenge. Banks need an alternative operating model to reach these consumers. Nearly one-half of households earn less than R3,800, about $270, a month. As a share of disposable income, current bank fees are in the red zone in the sustainable-financial-inclusion framework—at a level four times that of many mature markets and even an

Capitec Bank, founded in 2001, currently controls about one-third of the low-income market with a no-frills offering. This offering is possible because the bank’s operating costs per customer are about R640, or $45, a year, about one-fifth the level of traditional full-service banks in South Africa.

Flexibility and speed are the keys to unlocking credit. Formal lenders face an array of challenges in creating more inclusive and sustainable credit products. Fewer than one-third of low-income consumers, or 29%, have borrowed money. Consumers fear default, which was cited by 37% of survey respondents, and they are concerned about high fees, cited by 24%. These are understandable concerns for people, many of whom work seasonally or have fluctuating informal earnings. In interviews, consumers said that they frequently experience an unpredictable need for credit, such as a family emergency, that traditional lenders cannot easily satisfy. Several interviewees said that they had had to borrow money on short notice—as little as an hour—to buy food or commute to work.

More than one-quarter of respondents, or 26%, cite urgency as an important factor in selecting a lender. However, banks have much longer decision cycles and require more paperwork than informal lenders, and their branches are often farther away.

Formal lenders face stiff competition in the credit market. Unlike the savings market, in which banks are essentially competing against mattresses and hiding places, the credit market competes with a large collection of informal lenders, including friends and family, loan sharks, and informal credit unions. Of the borrowers in the survey of low-income consumers, 34% had borrowed from a bank, while 32% had turned to friends and family, 18% had used a mashonisa, and 7% were members of a stokvel.

One-third of the consumers with whom we conducted in-depth interviews have used mashonisas, accepting the usurious rates because mashonisas are responsive. Nkosana, a 34-year-old mover and electrician, for example, borrowed R200 from a mashonisa to get to work one day—and was forced to pay back R300 just one week later.

With challenges that are similar to those they face with transaction accounts, banks and other formal lenders must find ways to radically lower operating costs to reach potential borrowers. They also should strive to build speed into the decision-making process, flexibility into the terms, and smaller loans into their offering. Our survey showed that the average loan from a bank is about R17,500, or about $1,250, more than three times the size of an average loan from a mashonisa.

There is a need for sustainable insurance products. The popularity of funeral and burial policies means that when South Africans die, their families will likely have money to pay for a proper funeral and burial. However, there will likely be no proceeds remaining for survivors. Likewise, South Africans are not adequately covered against theft or damage.

The challenge for insurers is to migrate consumers from funeral and burial coverage to broader life and P&C coverage. As noted above, only 12% of South Africans have full life insurance. Among low-income consumers, the share shrinks to 8%. Auto coverage is even lower.

It will be hard to sell more insurance to these people or to reach the uninsured using business-as-usual approaches. More than half of the insured, 56%, said that they did not have enough money to buy additional insurance. For example, Phumulani, a 38-year-old part-time electrician, is covered by two funeral policies. He does not, however, insure his house: he considers it to be on a safe street, even though it is in a dangerous neighborhood of Soweto.

South African regulators have taken steps to reduce commissions and hold insurers responsible for honest marketing. But, as our research results suggest, insurers still need to do more to lower costs, improve flexibility, and increase consumers’ trust. Despite a strong knowledge of financial services, Felicity, a 53-year-old caterer, has purchased three funeral insurance policies because she lacks confidence that any one will pay out.

To promote savings, banks face a challenging climb. In the current economic environment of limited growth and high unemployment, South Africans are not in the habit of saving. Of the 60% of respondents who had not saved in the year before the survey, one-half said that they did not have money to save, and 20% said that they were out of work. Only 8% said that they didn’t save because they would rather spend their money.

When they do save, according to the survey, South Africans tend to focus on medium-term goals such as purchasing a household appliance or building a rainy-day fund. But few can afford to save for long-term goals, such as retirement: only 4% said that they were actively setting aside retirement savings. In the current environment, these are daunting challenges for financial institutions, and it does not help that the returns on their current lineup of savings accounts struggle even to keep up with inflation.

Banks face competition that is similar to that in the credit market. Nearly one-third, 30%, of consumers have used a lay-buy, or layaway, plan to purchase an item, while 27% have used stokvels.

The Path to Financial Inclusion

South Africa has a long way to go toward becoming a more financially inclusive society, but stakeholders should see promise rather than peril. In the SEDA report, South Africa was one of four countries—along with India, Rwanda, and Serbia—that were highlighted for being significantly more inclusive than their incomes would suggest.

Stakeholders should build on the existing base—especially in transaction accounts and life insurance—to extend the benefits of financial inclusion more broadly. Other nations have successfully put in place programs across the full suite of financial services. As part of our research, we examined about 30 such interventions in other emerging markets.

Two themes emerged from our examination of these interventions:

- Financial institutions have to consider radically changing their business models in order to reach and hold on to low-income-segment customers. South African banks need to be much leaner. To reach the bottom quintile, for example, banks’ operating costs per customer would have to drop by more than one-half.

- The government has a constructive role in loosening regulation, encouraging usage, and promoting inclusion. Our informal analysis shows that government mandates were responsible for about one-third of successful initiatives in other countries and that legislation was responsible for another third. Only one-third, in other words, were initiated solely by the private sector.

Obviously, governments cannot do this alone, but they alone can catalyze a much broader effort by financial services firms, telecom operators, retailers, credit bureaus, financial-technology firms, and NGOs. In India, Pakistan, and the Philippines, either the finance ministry or the central bank has taken the lead in pushing for financial inclusion.

For South Africa, we recommend that the Ministry of Finance, the South African Reserve Bank, or both acting together start a multiyear journey of sustainable financial inclusion. Our experience in other countries suggests the following steps:

- Setting the context in order to understand the current state of affairs, identifying root causes, and beginning to build support

- Developing a vision for the future that addresses root causes and has broad support among all relevant parties

- Developing a tangible, realistic plan that allocates responsibility and power for individual initiatives

- Establishing an implementation, monitoring, and feedback system that relies both on a centralized program management office and fast feedback that facilitates course correction

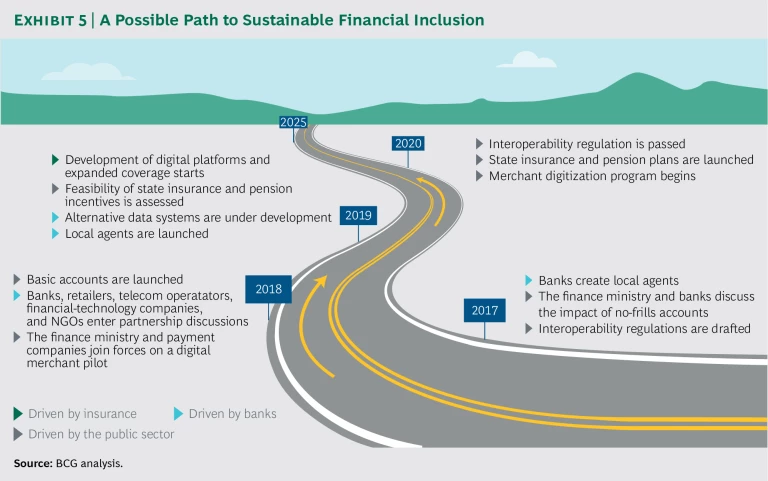

This multiyear journey will require the collaboration and support of multiple private and public parties. (See Exhibit 5.) We certainly do not have the final set of answers for South Africa, but we do have some ideas, derived from successful interventions in other countries, about how the government, banks, and insurers can improve overall financial inclusion. As a first step, these stakeholders need to join forces and decide how and where to start.

How the South African Government Can Support Financial Inclusion

We see four primary areas in which the government can play a constructive role in helping financial institutions become more inclusive.

Encouraging Adoption. Governments elsewhere have helped encourage people to adopt financial services. In India, for example, the government is working with banks and other partners to create no-frills financial services that will appeal to the low end of the market. The government provides five years of matching funds to people who put money into their pensions.

In Indonesia, where only about one-third of the 250 million people have access to a bank, the government allows more than 100,000 agents to provide financial services. These agents are subject to regulation and documentation requirements that are more streamlined than those that govern bank employees, and the agents may transact business over their phones. In its first two years, Indonesia’s Laku Pandai initiative has added 2 million customers.

Most efforts elsewhere are focused on transaction accounts, an area of relative strength in South Africa. The nation’s challenge will be to increase adoption across the full suite of financial services products.

Enabling Usage. Mexico has been a leader in helping create a more inclusive payment system. The government, for example, worked with the Chamber of Commerce and Visa to put subsidized payment devices in stores. Under the initiative, 20,000 devices were added in just three months.

Protecting the Consumer. Our research shows that low-income consumers often have unfounded fears about financial services, mobile banking, and even ATMs. The government can take a lead role in promoting the safety of alternative banking channels.

Supporting the Process. In many cases, government can play a productive role in “priming the pump,” giving a nudge to encourage adoption and usage. In India, the Ministry of Finance is encouraging usage by funneling welfare and other public payments through no-frills accounts. These accounts also come with built-in affordable life and accident protection.

How Banks and Insurers Can Encourage Adoption and Usage

Financial institutions can encourage greater inclusion in six broad areas.

Creating Flexible and Tailored Products. The results of the survey, focus groups, and interviews made it abundantly clear that consumers need more flexibility in loan payments and better tailoring of products to their specific needs. Repayments for farmers and seasonal workers, for example, can be geared toward harvest and working seasons.

In Nigeria, Diamond Bank partnered with Visa and two NGOs—Enhancing Financial Innovation & Access and Women’s World Banking—to open no-frills savings accounts for women, 40% of whom are part of the informal economy. There are weekly rewards for meeting savings goals. In the first six months, the product generated $1.5 million in savings in 38,000 accounts. One-quarter of the account holders had never banked before.

Leveraging the Ecosystem to Localize Channels. Other markets provide numerous examples of financial institutions that have created alternative channels to reach consumers. The Center for Agriculture and Rural Development Mutual Benefit Association (CARD MBA) in the Philippines, for example, has licensed more than 50 grassroots community organizations to sell microinsurance. These programs cover nearly 3 million people, including 600,000 low-income individuals, at affordable rates.

Embracing Technology-Enabled Solutions. Many of the interventions in other countries have a technological component. Banking agents in Indonesia, for example, transact business on their mobile phones. Consumers who may be wary of technology can conduct face-to-face transactions that are facilitated by technology.

Such initiatives can serve as a bridge to full mobile banking. Equity Bank Kenya offers a 0.1-millimeter-thin card that sits on top of a traditional SIM card and enables its Equitel mobile-banking service. This service grew to 1.4 million customers in just three months. More than eight of ten of the bank’s new loans were processed through Equitel. Equitel is a direct competitor of Safaricom’s well-known M-Pesa mobile-payment system, suggesting that inclusive financial services can be competitive ones, too.

Simplifying Risk Processes. Banks and insurers can take the lead from financial-technology startups that have simplified the heavy-duty back-order processing typical of many financial institutions. Just as they have responded to tiered know-your-customer requirements, financial institutions can segment their risk processes on the basis of such factors as loan size and knowledge of the borrower.

Removing Intermediary Friction. Particularly in the insurance industry, brokers and agents can extend distribution, but they can also engage in unscrupulous behavior. So that consumers have a better understanding of how much they are paying for advice as opposed to protection, several European countries, especially the UK, have clarified the role of agents and have strengthened the professional standards under which the agents operate. In South Africa, such reforms are underway but are progressing at a very slow pace.

Improving Transparency. Every financial institution can improve its communications related to topics such as fees, services, and repayment schedules. In numerous interviews, consumers expressed surprise about changes in policies or loans that they said had not been fully described to them.

Plain-language disclosures are necessary but insufficient to create trust among low-income consumers. One innovation of the CARD MBA program in the Philippines is allowing policyholders to select the field agents as a way to increase overall trust in the insurance system.

Bringing people into the financial system can quantifiably improve household and national well-being. By acting as the catalyst, the South African government can do good for its people and the overall economy. It’s a noble pursuit that should be on every nation’s economic and social shortlist.

Acknowledgments

The authors thank their colleagues Vassilis Antoniades, Davide Corradi, Dinesh Khanna, Ian Walsh, and Enrique Rueda-Sabater for their thoughtful contributions and feedback.