A rocket attempting to escape earth’s gravity must achieve a speed of 25,000 mph, or it will fall back to earth. This escape velocity is nonnegotiable. Companies attempting to achieve breakout, value-creating growth often fight their own gravitational pull: stagnant demand, weak ideas, capability gaps, cultural inertia, and skeptical investors.

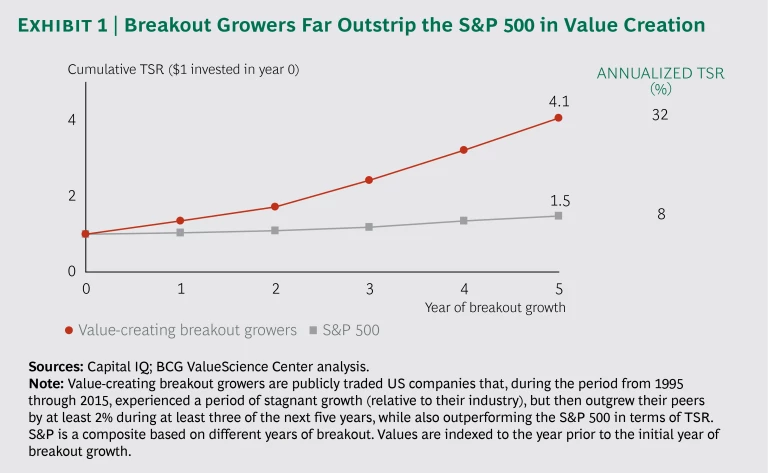

Making the pivot to growth is not easy and not optional. During the 20-year period that began in 1995, only one in eight mature companies achieved peer-beating, sustained, and value-creating growth. But the rewards of growth justify the attempt. We studied 199 companies that overcame stagnant growth to outgrow their peers by more than 2% in at least three of the next five years, creating value in the process. A hypothetical investment in these companies just prior to their period of breakout growth would have beaten an investment in the S&P 500 by a factor of almost three. (See Exhibit 1.)

Making the pivot to growth is not easy and not optional.

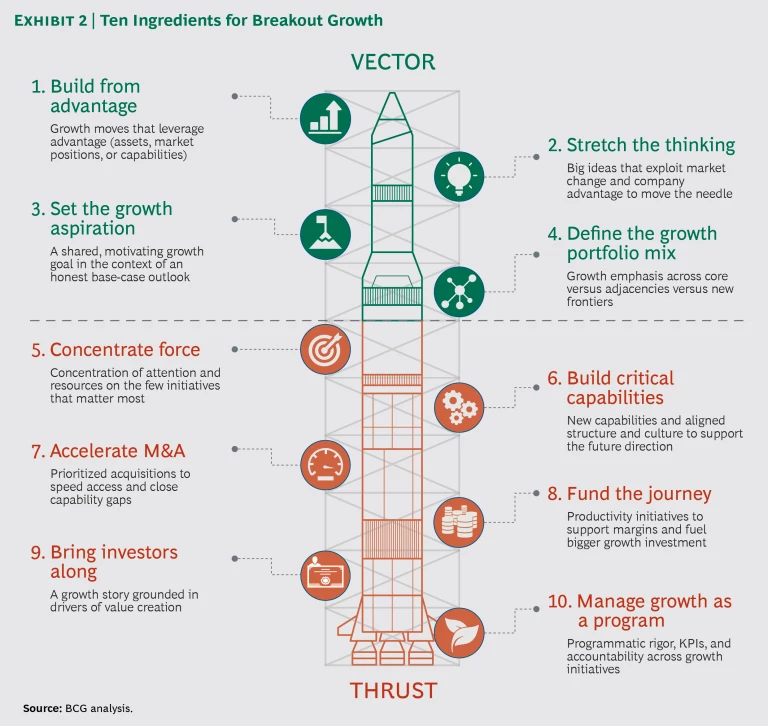

A company’s growth trajectory, like a rocket’s, is a function of vector (its direction or heading) and thrust (the propulsive force behind that heading). Across the 1,700 companies and 300 growth attempts we studied, we found that paying close attention to both parts of this flight plan makes the difference between achieving escape velocity and stalling out.

Consider Deluxe, a check and forms printing company. In 2000, companies in this sector printed 42 billion checks in the US. Twelve years later, the number had fallen to 18 billion. Despite this broad collapse, Deluxe CEO Lee Schram, beginning in 2006, aspired to and delivered value-creating growth. He set a clear vector to counteract core erosion: selling digital marketing services to smaller businesses and providing outsourcing and marketing services to regional banks. Crucially, Schram also put powerful thrust behind the new direction: reducing costs by a cumulative $1.8 billion, making the tough call to invest at earnings-dilutive levels, and completing 24 acquisitions to build capabilities and gain customer access. In 2009, the company’s revenue began to turn around. From 2009 to 2016, Deluxe’s revenue grew by 5% per year, and its market cap more than quadrupled. By 2017, marketing services were accounting for nearly 40% of the company’s revenue.

In our 1,700-company study, 18% of the included companies made a significant growth drive. In assessing the success of these efforts, we looked for patterns at both extremes of value outcome. Our research, combined with executive and investor interviews and our experience serving the Fortune 1000, suggests ten practices—four related to vector and six to thrust—that are responsible for building or destroying value in the quest for growth. While inadequacy in any one of these practices can doom the whole effort, a company must take its own measure to determine which practices matter most.

Ten practices—four related to vector and six to thrust—are responsible for building or destroying value in the quest for growth.

Setting Vector

Vector defines the target future shape of the business: the basis for advantage, segments of play and avoidance, the mix of core and adjacent growth, and critical supporting initiatives. Deluxe took care to choose product and service adjacencies that exploited its advantages in customer relationships and processing efficiency.

Errors in vector can be costly. Global sanitation and services company Ecolab acquired ChemLawn, a consumer services business, in a bid to tap growth beyond its core B2B model. But lacking expertise in consumer-facing businesses, ChemLawn failed to deliver anticipated synergies and Ecolab ultimately divested the business, taking a $260 million write-off. Later, Ecolab’s “circle the customer” strategy, based on a clearer logic for adjacent B2B growth, earned it breakout growth and delivered top-quartile shareholder value.

Our analysis of breakout growers distills four best practices for setting vector.

Build from advantage. Our value-creating breakout growers consistently developed a candid assessment of their strengths—key assets, positions, and capabilities—and based their vector on advantage. For example, Brooks Automation, a maker of semiconductor manufacturing equipment, sought opportunities to drive a growth pivot. Deep analysis and management reflection led to a critical insight: the company was good not just at producing semiconductor equipment, but also at controlling motion in cryogenic manufacturing environments. This subtle shift in perception opened a new, on-trend growth adjacency: the storage and transfer of biological samples (such as tissue samples for cancer research). That business has grown at a rate of 60%, compared with flat growth in the core, and now represents 20% of Brooks Automation’s revenue.

Stretch the thinking. A growth pivot calls for home run ideas, but companies often come to the task with incremental thinking that is geared toward bunts, walks, and the occasional base hit. Big ideas, as in the Brooks Automation example, emerge at the intersection of deeply understanding advantage (looking in) and deeply understanding the marketplace (looking out). Finding these ideas may require deep customer insight to trigger growth in the core. In other instances, it may entail seeing between or beyond the current lines of business to envision opportunities in close adjacencies or, as Brooks did, in more distant ones. It also demands an assessment of likely disruptions and the opportunities and challenges that they will present. To illuminate this intersection, management teams can employ a number of lenses and tools, including traditional consumer insight, state-of-the-art demand science, future scenarios, megatrends analysis, smart money flow, and intellectual property citations.

Set the growth aspiration. One early decision in any growth strategy involves prioritizing revenue growth relative to other value drivers. Leaders who skip this step will struggle to align their teams when risk/return tradeoffs come into relief across growth scenarios. Leadership opinions often diverge with regard to how much growth is wise, necessary, or possible. Too often, a mechanical extrapolation of the past defeats breakout growth before it can begin, or the company identifies a stretch target so disconnected from reality that executives, managers, and workers never seriously embrace it. Properly grounding the growth aspiration requires a brutally honest view of the current business’s baseline growth, absent heroic action. It also requires a common view of the aspirational rate of growth and of the gap between the two. This view must be both empirical (forward analytical estimates, value modeling, and competitor and trend observations) and emotional (a spectacular view from the summit).

Define the growth portfolio mix. Another critical strategic choice involves the shape of growth: how much must come from the core, near adjacencies, and new frontiers, and which specific initiatives will deliver it. Our empirical study of breakout growers shows that a company’s starting position— which our framework categorizes as fortress, fading, or fluid—can suggest the right mix. (See “ When the Growing Gets Tough, the Tough Get Growing ,” BCG article, October 2014.) In general, breakout growers drive incremental improvement from the mathematically critical core, while concurrently pursuing new adjacent growth exposures.

Calibrating Thrust

Thrust is the propulsive force that drives a company toward a chosen vector. It is the conviction and alignment of a senior team. It is the magnitude, concentration, and persistence of investment supporting a few critical initiatives. It is the organization structure and governance systems that coordinate action and hold actors to account. And in our experience and research, thrust—whether too little or too much—is often more decisive than vector. All too often, a company establishes the right vector, condenses it into a tidy graphic, and communicates it to employees and board, but critically fails in the calibration of thrust.

Thrust, whether too little or too much, is often more decisive than vector.

For example, Radio Shack, which recently declared bankruptcy for the second time in two years, suffered three failures of thrust. First, management launched new formats in response to the rise of big-box retailers, but failed to build the necessary operational capabilities to run them profitably. Second, it only cautiously embraced the growth of e-commerce, in the form of ship-to-store options. Third, despite having identified the burgeoning maker market and its resonance with the Radio Shack brand, management failed to deploy the cash, capital, and capabilities necessary to bring it to life in stores. In each instance, the miss was due not to strategic direction or vector, but to force or thrust.

In contrast, Deluxe’s choices with regard to thrust—leadership accountability, serial acquisitions, efficiency-driven funding, and earnings diversion—stand out not because of their innovative nature, but because of their magnitude and persistence.

Common practices of our breakout growers suggest six lessons for calibrating thrust. (See Exhibit 2 for a summary of all ten vector and thrust lessons.)

Concentrate force. Carl von Clausewitz, the 19th-century godfather of modern military strategy, offered this maxim: “Pursue one great, decisive aim with force and determination.” At some companies, decentralized or siloed governance, weak strategy, or inadequate accountability processes can cause subscale initiatives and experiments to proliferate. Conversely, good growth strategies focus on supporting a central cohesive aim with a few well-funded initiatives. An approach that forces choice and prunes the portfolio of opportunities on the basis of the size of the prize, the right to win, and the path to achieve enables the company to concentrate its force on a handful of needle-movers.

Build critical capabilities. Gannett, a leading print and broadcast media company, successfully pivoted toward growth. Its strategy for competing in the digital future involved exercising a number of underdeveloped muscles: always-on M&A, digital demand generation, integrated account coverage, cooperative offer development across print and broadcast silos, bundled pricing optimization, and a retooled sales force. Similar action is no less important for organizations with ambitious growth agendas in more stable industries. To position itself for longer-term resilience and growth in diesel engines, Cummins is strengthening its skills in such areas as M&A, the qualification of adjacent product lines through its dealers, and digital informatics. Breakout growers frequently run two-speed portfolios, keeping exploratory and adjacent growth initiatives separate from core initiatives, with distinct management teams, oversight, investment structures, and expectations.

Accelerate M&A. Our research shows that breakout growers disproportionately leverage M&A to achieve their escape velocity. Their average M&A investment relative to enterprise value is 40% higher than that of the S&P 500. M&A can help resolve a common conflict between core and adjacent investment. Core initiatives often contribute quickly and substantially to revenue, but they may not position a company well for the future. Adjacent initiatives provide new growth exposure or build needed future advantage, but they carry higher risk and take time to develop and displace adjacent incumbents. Strategic, tightly executed M&A can build new strength to improve future core relevance, accelerate the impact of the adjacent initiatives’ contribution, or both.

Our research shows that breakout growers disproportionately leverage M&A to achieve their escape velocity.

Fund the journey. Under pressure to deliver growing and smooth quarterly earnings, some companies fail to fund their growth ideas at the levels necessary for success. Over the full plan horizon, breakout growers generally hold or expand margins as they grow. Apart from pricing moves, growth is rarely free, so it is essential to find fuel for growth—meaningful cost savings that the company can reinvest in the growth strategy, or divestitures that release capital and create needed focus.

Bring investors along. In far too many instances, we have seen well-vetted strategies get lost in the wilderness—perpetually deferring the hockey stick of growth into the future. Sometimes this occurs because attractive M&A targets are unavailable or because the company faces an imperative to prioritize critical operational improvements. Often, however, management simply feels uncomfortable about making the case for growth to the board and investors, preferring the safer route of further efficiencies and small growth increments. Indeed, arguing for substantial growth investment can be tough in the face of demand headwinds or investor activism. But our analysis shows that breakout growers often showed volatile earnings ahead of growth, with higher and stable earnings following investment deployment. These growers made the case for change in advance, offered investors distinct and transparent metrics to evaluate the run-the-business and grow-the-business initiatives at the heart of their growth strategies, and delivered against explicit milestones. This approach made it easier for investors to distinguish between anticipated volatility and surprise volatility.

Manage growth as a program. Many growth initiatives lack rigorous program management, the de facto approach for cost restructuring or postmerger integration. On one hand, this is understandable. Traditional program offices are ill suited to the task of growth, and the bigger the growth ambition, the worse the fit. Growth initiatives are more probabilistic and less defined, have a longer gestation period, and require more short-cycle adaptation over time than most cost or synergy initiatives. Yet major growth efforts are no less complex, given the substantial changes in investment profile, business portfolio, organization structure, talent, and culture they entail. And the need for accountability and results is at least as great. BCG research shows that more than 80% of cost-focused restructurings deliver cost savings, while only 20% of growth-focused transformations yield the desired growth. We recommend creating a growth program office to segment the design and delivery of growth initiatives into distinct tracks with different structures for executive engagement, progress measurement, revision, and enterprise coordination.

Breakout growers exist in virtually every sector and circumstance: incumbents stretching to address disruption, successful growers planning a second act, strong operators seeking a new value driver as returns from efficiency diminish. In each of these settings, companies must identify and address their own unique constraints across vector and thrust. With attention to both, leadership can design and deliver a flight path to breakout growth.