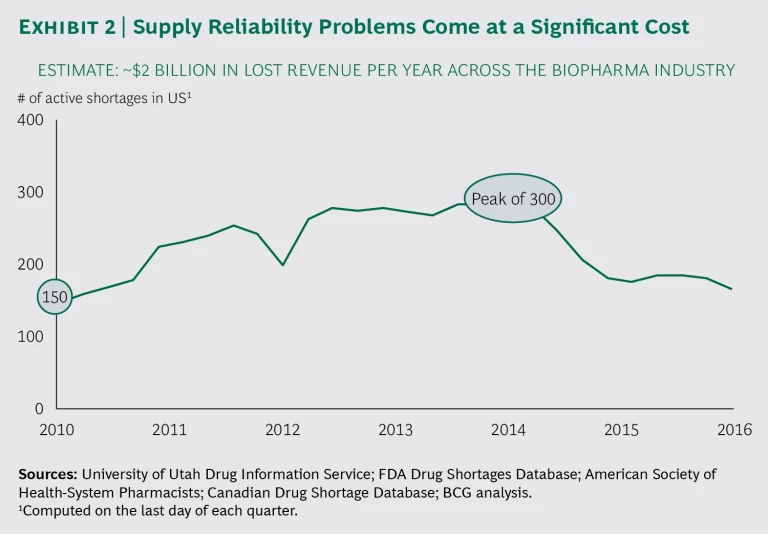

Drug shortages persist around the globe—at a steep cost. In the US alone, there have been 150 or more every quarter from 2010 through the third quarter of 2016. We conducted in-depth interviews with the operations heads of leading global pharmaceutical and biotech companies and analyzed these companies’ data, and we found that such shortages cost the industry roughly $2 billion annually in lost revenue. Moreover, research into the industry overall shows that companies continue to invest in efforts to address supply chain issues, with too little to show for it over the long term. And beyond generating costs at the company level, product shortages can have a significant impact on the well-being of patients who rely on medication.

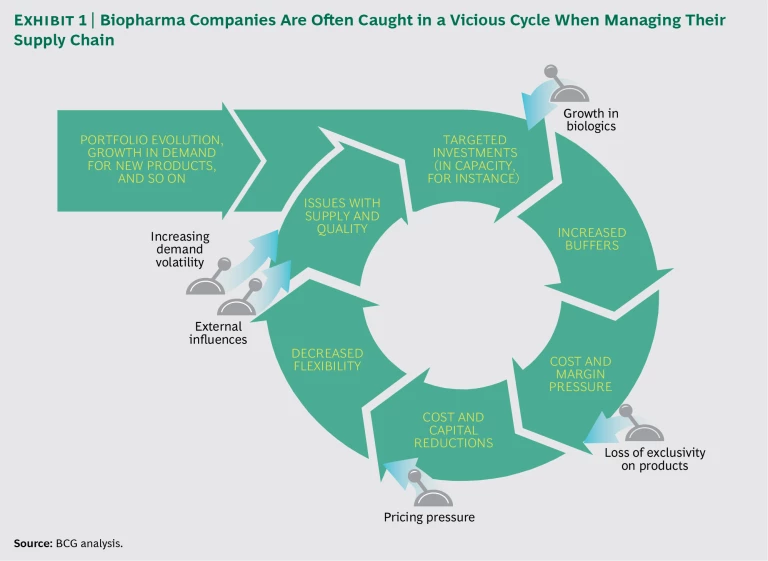

The challenge in addressing drug supply issues reflects a vicious cycle in the industry. Major investments in manufacturing capacity to support new products are inevitably followed by overcapacity and cost pressures, which trigger cost and capital reductions. The result is a manufacturing operation that is not flexible enough to meet demand consistently.

Addressing this issue requires a new mindset. Rather than falling victim to the vicious cycle—and responding with Band-Aid fixes such as quality remediation efforts or changes to standard operating procedures—biopharma companies need a comprehensive approach for ensuring the reliability of their supply chains. We have identified six strategies that, when deployed in concert, help companies create a world-class supply chain and manufacturing operation.

A Vicious Cycle Creates Multiple Problems

Biopharma’s manufacturing challenges do not reflect a lack of attention to this area. On quality alone, the industry has invested hundreds of millions of dollars in programs and initiatives to address observations from regulatory agencies. But our research found that despite such spending, multiple problems continue to arise across the supply chain. The question is why these problems have proven so difficult to tackle. The answer lies in the industry’s well-known cyclical trends.

Challenging Pendulum Swings in Supply Chain Improvement Efforts. Biopharma companies tend to move from a state of minimum manufacturing flexibility (so as to reduce costs) to a state of excess buffers (to ensure supply and quality). (See Exhibit 1.) The result is persistent, pervasive supply chain problems that undermine supply performance and industry profitability.

The vicious cycle typically starts with an increase in demand for new products, such as biologics, or from new regions, such as emerging markets (or both). This prompts broad investments, primarily in capacity and capabilities. The result is often excess capacity in the form of manufacturing buffers, which ensure that the organization can meet rapid shifts in demand. Such shifts are particularly acute during the launch of new biologics.

Excess capacity naturally leads to cost pressures, which intensify when companies lose exclusivity on a number of top brands. Strong cost pressures then lead to cuts in capacity and resources, typically without improvements to process effectiveness and efficiency. Finally, those cuts reduce buffers and flexibility across the manufacturing network, leaving companies vulnerable to supply reliability challenges. Those problems typically prompt investments in capacity, thus restarting the cycle.

As problematic as the pendulum swings are, the way companies generally address manufacturing issues exacerbates the situation. The typical mitigation approach is a reactive “spot solution.” This addresses the problem in the short term, but it does not prevent the issue from arising again in the medium to long term, nor does it prevent other (often similar) problems from arising in other parts of the organization. As a result, organizations apply Band-Aids without systematically tackling the root causes of supply reliability issues.

The vicious cycle is particularly problematic right now. Portfolios at many companies are increasing in complexity, thanks in part to the growth in biologics. Moreover, there is less flexibility on the supply side as many biopharma companies face flat manufacturing capacity and declining inventories, and thus do not have a significant buffer against shortages. On the demand side, meanwhile, biopharma companies are relying more on emerging markets, where demand is volatile. At the same time, companies face mounting competition from generics players (which intensifies the pressure to cut costs) and increased scrutiny from regulatory agencies.

The Biggest Supply Chain Problems. BCG’s in-depth study of biopharma supply chain reliability uncovered 20-plus issues. Some are driven by internal factors involving planning, systems, and capabilities, for example; others are the result of external factors such as geographic shifts in demand or catastrophic events. (See the sidebar “The Ins and Outs of Supply Chain Headaches.”)

THE INS AND OUTS OF SUPPLY CHAIN HEADACHES

The vicious cycle within biopharma supply chains underscores the fact that reliability issues are driven not only by internal manufacturing challenges but also by external trends. While regulatory agencies indicate that roughly 90% of drug shortages are the result of internal challenges such as quality issues, delays, and raw material shortages, our analysis shows otherwise.

In fact, our research demonstrates that approximately half of all supply reliability issues are triggered by external factors. These include demand for specific products or technologies (such as sterile injectables) that outpaces supply, increased oversight through regulatory reviews, and the shift of demand to emerging markets.

Our research and our extensive work with biopharma companies point to six issues in particular that account for the majority of drug shortages. These issues have resulted in considerable lost revenue and a large investment of time and money that has yielded too little in the way of progress.

- Quality Pressures. Growing regulatory scrutiny, evolving regulatory standards in certain emerging markets, and the increasing complexity of the manufacturing process have made it more difficult to meet quality standards. Despite substantial investments of time and resources in compliance and remediation, the rate at which companies pass FDA quality inspections has held steady at roughly 50% over the past eight years.

- Capacity Constraints. Limited manufacturing capacity continues to challenge the industry, particularly for products such as sterile injectables, which are produced in aseptic facilities, and for products and markets for which demand outpaces supply. These constraints stem in part from manufacturing network restructuring aimed at minimizing costs, and they are exacerbated by the relatively long lead times for approval of new capacity, particularly in biologics.

- Lack of Manufacturing Robustness. Our research indicates that roughly two-thirds of FDA observations can be attributed to gaps not only in manufacturing execution but also in process robustness: the ability of a manufacturing process to function with acceptable quality and performance levels despite variability in inputs such as raw materials and operator expertise. Biopharma continues to lag behind industries such as semiconductor manufacturing as well as best-in-class consumer goods retailers in this area. The problem is particularly severe in aging facilities and for late-life-cycle products that are made using older processes, and so there is limited incentive to make improvements.

- Portfolio Complexity. Two factors have contributed to the increase in biopharma portfolio complexity. First, biologics—which are much more complex than chemical-based medicines—account for a growing share of the portfolio, about 25% of total revenue. Second, demand from emerging markets—which comes with higher volatility and varying local production requirements—is increasing. As a result of these factors and the continued demand for older products, biopharma companies manufacture a growing number of SKUs using legacy manufacturing and supply processes.

- Commercial and Supply Planning Challenges. Three trends make planning more difficult. First, reliable demand forecasts for products are more difficult given the complex market dynamics. Second, product launch delays are becoming more common. And third, manufacturing lead times are getting longer, primarily because of the increased production of biologics. At the same time, manufacturing and supply organizations are often not fully prepared to respond rapidly to changes in demand. The problem is insufficient coordination between commercial and supply functions due to factors such as misaligned incentives, the inconsistent tracking of data, and the use of different systems.

- Supplier Risk. The market for contract manufacturing organizations, which has increased at twice the rate of the biopharma industry over the past two years, now accounts for approximately one-third of global biopharma manufacturing. The increased reliance on external suppliers for active pharmaceutical ingredients (APIs), excipients, intermediates, packaging, and final products puts biopharma companies at risk should those suppliers fail to deliver. Numerous examples of supply breakdowns stemming from third-party disruptions have become headlines in the biopharma industry.

Some may argue that drug shortages and the supply chain issues that contribute to them are old news—many of the industry trends described above have been apparent for well over a decade. But the key difference today is that these pain points are more intense and are happening simultaneously. And the costs are significant: we estimate that biopharma companies lose approximately $2 billion in revenue each year as a result of persistent supply reliability challenges. (See Exhibit 2.)

Six Factors for Supply Chain Excellence

The biopharma industry needs to overhaul its supply chain strategy. Instead of resorting to spot solutions, company leaders must deploy an approach that engages the organization end to end and attacks the root causes in concert.

We have drawn on publicly available data on supply reliability and BCG’s global body of work to identify six strategic actions for constructing a best-in-class supply organization:

- Understand customer needs (this must start at the executive team level) and communicate them throughout the organization. This includes tracking market demand signals, rapidly translating them into supply needs, and effectively communicating this information all the way to the shop floor.

- Restructure the supply chain to meet evolving customer and product needs. Service, cost, and agility requirements should be clearly understood for each market and each product, and companies must design the supply chain to meet those requirements. (See the sidebar “Customizing the Supply Chain Model.”)

CUSTOMIZING THE SUPPLY CHAIN MODEL

In our work with clients, we have encountered situations where commercial requirements were not appropriately transferred to plant operations, supply chains were optimized at the asset level (such as production and packaging lines) but not the product level, and supply chain strategies were focused on the short term. In those environments, one-size-fits-all supply chain models typically do not work, particularly given the growing complexity of product portfolios. To address these challenges, BCG identified four supply chain models, each of which suits a particular product segment:

- Service Model. Suitable for products for which the cost of unavailability is very high, such as products that have high margins and serve a critical medical need. This segment operates with excess capacity, inventory buffers, or both.

- Cost-Effective Model. Suitable for products with shrinking margins, which indicate the need to eliminate inefficiency and waste. This segment requires lean operations in low-cost locations and high asset utilization.

- Agile Service Model. Suitable for products, such as newly launched therapies, for which volatility and margins are high and availability is critical. This model achieves flexibility through inventory buffers and external partnerships for noncore activities.

- Agile Cost-Effective Model. Suitable for products that have large shifts in demand and require low costs, such as products for which companies have lost exclusivity. This segment depends on a consolidated network with plants that are run at a high utilization level, the outsourcing of noncore activities, and low inventory levels.

In addition to selecting the right supply chain model for each product segment, companies must strengthen the connection between manufacturing and the commercial team. They can do this by introducing streamlined processes, enhancing capabilities at all levels, and designing the organization for change.

- Ensure robust and reliable manufacturing and quality execution. Companies can achieve excellence in manufacturing by developing robust and standardized processes, embedding a lean culture at all manufacturing sites, and considering product quality as the highest priority. Success in this effort requires a sound understanding of the manufacturing operation’s process robustness.

- Create the right metrics, data, and systems to allow effective orchestration of the supply chain. Companies must deploy a well-defined set of performance metrics. Input data for the metrics should be captured, translated, and rolled up effectively. Solid data analysis requires the implementation of a robust system throughout the organization. And companies must ensure that the supply chain is operating well across the entire network—not just at the individual plant level. (See the sidebar “Creating Network Harmony.”)

CREATING NETWORK HARMONY

We have encountered manufacturing networks in which operations are optimized at the site (individual plant) level, but many of those sites operate as silos, resulting in suboptimal operations at the network level. For instance, in the journey of a product from the sourcing of APIs to shipment of the final product, there are typically wide variations in lead times at each step stemming from disruptions in the flow of information or material across sites.

BCG has created a comprehensive methodology for identifying and resolving cross-site pain points. The approach involves selecting a product with wide lead time variability and analyzing the product on three levels:

- Network Level. This analysis first maps information and material flow for the product across the network and then assesses the speed and quality of information flow at manufacturing sites or in lines with high lead time variations. That assessment includes an examination of planning processes, master data, and core ERP systems.

- Site Level. At this level, the analysis focuses on systems of interconnected assets and on functions where there are key disruptions or delays. An overall equipment effectiveness (OEE) analysis identifies problematic assets or functions where there are disruptions in material flow. This analysis can include quality control, production (drug substance or drug product), packaging, and distribution.

- Unit Operational Level. This involves an in-depth OEE assessment of key assets, such as the packaging line or a granulator. The assessment allows the identification of key sources of delays that contribute to material flow disruptions, such as changeovers, equipment maintenance, microstops, breaks, and lunches.

This end-to-end assessment has revealed major opportunities for improvement, helping biopharma companies advance orchestration within the supply chain to the next level.

- Build engagement throughout the company, including between R&D and the manufacturing and commercial organizations. Constant engagement between the supply chain and R&D ensures effective technology transfer and embeds “quality by design” in all new products. Similarly, constant engagement with the commercial arm is essential to fully understand shifts in and challenges with customers’ requirements.

- Make sure leaders at all levels are engaged and are focused on organization and culture change. All leaders must be engaged, both within and across functions. In addition, the organization’s structure and culture should support change and continuous improvement.

Some biopharma companies have begun to take these critical steps, and our observations thus far indicate that these early moves are yielding results. Despite this strong progress, however, sustained impact and value will come only when the operating model changes to recognize and implement—in a concerted, interlinked manner—these strategic actions. This has not yet been achieved in biopharma.

It’s no surprise, then, that industries such as aerospace, electronics, and automobiles, and some of the best-in-class consumer goods companies, are ahead of biopharma when it comes to supply chain reliability.

A key reason for this shortcoming is biopharma’s historical focus on the “science of manufacturing” instead of on the “science of supply chains.” The industry has demonstrated a thorough understanding of the scientific underpinnings of various drug technologies and continues making important advances on this front, such as the continuous manufacturing of tablets and modular manufacturing. However, when it comes to understanding the science of supply chains—things like balancing cost, service, and agility; ensuring seamless technology transfers; and confronting demand volatility—biopharma has lagged behind other industries.

Going forward, complexity in the industry will inevitably amplify challenges in supply reliability. This will require biopharma companies to take their mitigating approaches to the next level and embrace end-to-end strategies. The six actions we have described are essential for moving the needle. Companies that are able to do that will cultivate a powerful source of competitive advantage.