Manufacturers recognize that Industry 4.0 creates significant opportunities to reduce their costs and improve flexibility, productivity, quality, and speed. Yet implementing digital industrial technologies has proved to be challenging. Many companies have struggled to design a transformation program that captures the benefits and creates value.

To help manufacturers develop their initiatives, we have distilled insights from the frontlines of Industry 4.0. (See the sidebar “About This Report.”) The result is a set of five lessons:

- Use Industry 4.0 to accelerate operational improvements.

- Integrate new and existing capabilities and technologies.

- Manage information architecture as a critical enabler.

- Thoughtfully design the transformation roadmap.

- Approach Industry 4.0 as a change management project.

About This Report

The insights presented in this report were gleaned from BCG’s client work, its research and analyses of Industry 4.0, and a recent client discovery tour. Facilitating a discovery tour is often part of BCG’s multifaceted support of an industrial company’s digital transformation. The tour enables a client to gather information about the challenges and advantages of implementing a set of digital technologies. The client’s team—including the CEO and leaders of regions, business units, and functions—visits or has discussions with companies that have pertinent experience. The tour includes companies that represent a diverse set of industries as well as vendors that can provide perspectives on breakthrough technological solutions and trends.

During a recent discovery tour on Industry 4.0, the client’s team visited or held discussions with 33 companies. In addition to representing a diverse set of industries, the companies included well-established multinational players that have implemented Industry 4.0 technologies and startup technology vendors that have innovative solutions. The team also held discussions with several BCG experts around the world.

To gain hands-on experience with new technologies, the team visited a BCG Innovation Center for Operations that includes a model digital factory. The team also participated in BCG’s SCM iLab, a workshop and assessment that helped the leaders understand and evaluate their opportunities to apply digital technologies in supply chain management.

BCG supported the client’s team in capturing and distilling the insights gained—some of which we present in this report—and then applying them, developing an Industry 4.0 strategic roadmap. This plan specified the initiatives to implement, a set of concrete recommendations for how to pursue the initiatives, and the timeline for execution.

Companies that follow these guiding practices have emerged not only as frontrunners in adopting Industry 4.0 but also as organizations well positioned to capture the benefits of digital technology in all aspects of their business.

Use Industry 4.0 to Accelerate Operational Improvements

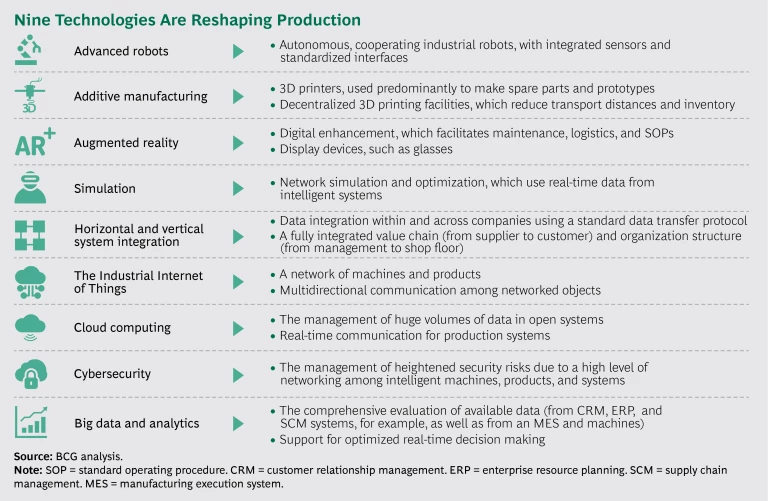

Industry 4.0 comprises multiple digital technologies that are reshaping production and facilitating the digitalization of core processes. (See the exhibit.) Leading companies are implementing these technologies to accelerate the business impact of operational improvement programs, such as lean management. In fact, frontrunners do not typically regard Industry 4.0 as a new production paradigm, but rather as a lever to maximize and accelerate the benefits of other programs. Implementers most commonly make processes more efficient (remove “waste,” in lean terminology) and then deploy Industry 4.0 technologies within these processes to maximize performance and sustain it at a high level. We have seen companies generate the most value by implementing lean management and Industry 4.0 together, rather than independently or sequentially.

It is essential that a company implement only those technologies that are valuable for addressing specific pain points and improving operations and processes. Yet evaluating the benefits of individual Industry 4.0 technologies in a particular context and deciding which to implement first can be challenging. The common approach is to use a traditional business case to quantify the potential return on investment and determine the time frame for achieving a positive return. Business cases are effective for evaluating both the direct and indirect benefits of many Industry 4.0 technologies, including advanced robots, augmented reality, and cloud computing. For some technologies, such as horizontal and vertical system integration, a qualitative assessment is also required to fully understand the value, because it is harder to quantify the benefits that improved collaboration will ultimately yield.

Manufacturers should implement some technologies that will produce rapid returns to demonstrate the value and build momentum as well as some that will have longer payback times but help the company achieve its overall strategic vision. As we discussed in Sprinting to Value in Industry 4.0 (BCG Focus, December 2016), companies should approach the race to Industry 4.0 as a series of sprints, but they should manage their program as a marathon.

Implementers have already captured impressive benefits from Industry 4.0. (See the sidebar “Industry 4.0 Drives Tangible Advantages.”) New ways to generate value from Industry 4.0 are still being discovered, and the value will increase as solutions become more mature and widely adopted. Indeed, some of the technologies, such as the following ones, are still at an early stage in terms of maturity or adoption.

Industry 4.0 Drives Tangible Advantages

Implementers of Industry 4.0 technologies are creating value. Examples of companies using cloud computing, additive manufacturing, and the Industrial Internet of Things demonstrate how.

Cloud Computing. Seeking to reduce the number of data centers by a factor of nine within three years, an energy company migrated services and applications to the cloud. The migration included several hundred applications related to approximately 9,000 work activities. The company needed to implement the massive migration without interfering with day-to-day business operations. It also had to motivate and train the entire organization to properly use the new cloud-based systems. Additionally, the mix of skills in the IT function needed to change. Skills related to server administration and maintenance became less relevant, while those related to the development of algorithms and applications gained in importance. Although total migration costs reached approximately €25 million, the investment was recouped rapidly—in less than two years—because cloud computing reduced operating costs by 20% and the total cost of ownership by 52%. Operational efficiency improved because requests to address IT-related issues declined by 50% and the type of IT outages and incidents that would significantly affect the business fell by 98%.

Additive Manufacturing. An industrial company uses additive manufacturing (also known as 3D printing) to produce approximately 70,000 metal products per year. The total production cost is 50% lower than the cost to produce these products using the traditional manufacturing process, and the time to market is significantly faster. Product characteristics are also superior—for example, printed products are 30% lighter than traditional ones. That is possible because the additive manufacturing process applies materials only where it is required to reinforce the structure (a technique known as a “topological approach”). The company’s transition to additive manufacturing entailed significant costs and challenges. The machines used for additive manufacturing cost from €500,000 to €1 million, depending on the technology and capabilities. The company also needed to obtain new software and automation skills, which replaced the blue-collar skills used in traditional manufacturing processes.

The Industrial Internet of Things. A large multinational corporation with businesses as diverse as automotive components and consumer products adopted several Industry 4.0 technologies in its operations, including deploying the industrial internet to manage energy consumption. The company implemented an energy management platform to continuously measure the energy consumption of its equipment, machines, and other systems. The platform also monitors a plant’s total energy consumption, which includes energy used for heating, cooling, pressurized air, and lighting. By tracking real-time consumption, managers have been able to reduce peaks in consumption and optimize energy management. In each plant that deployed the platform, the company added a team comprising ten engineers and support staff to manage tasks such as developing algorithms, analyzing data, and defining improvement initiatives. The platform has enabled the company to reduce its annual energy costs by 2.3% (€1.65 million per year). Additionally, compressed air costs have fallen by 40%, because the platform allowed the company to reduce the amount of compressed air that leaked during the manufacturing process from 30% to 4%. The company was also able to improve resource efficiency by implementing condition-based maintenance on equipment and machines.

- Simulation. Simulation technologies, such as digital twin (which enables creating virtual representations of physical objects, processes, and systems), have the potential to reduce commissioning time, facilitate the coding of machines, and improve quality. Companies can use simulation technologies to troubleshoot potential issues on a production line even before putting it in place.

- Advanced Robots. Today, the use of advanced robots is mainly limited to collaborative robots, which work in close proximity to humans and are easily programmable. As the technology progresses, robots will be able to apply the output of algorithms and make decisions appropriate for the context. For example, a US technology startup has designed robots that use vision systems and artificial intelligence to analyze the shape and dimensions of a product and apply this information to determine how to pick it up. This is the initial application of a potentially disruptive change.

- Big Data and Analytics. Manufacturers are building experience in applying big data and analytics to enable predictive maintenance and energy management. A very promising development is the use of big data and advanced analytics to control a production process and identify potential errors and quality issues early on. Ultimately, manufacturers should seek to use advanced analytics to fully automate decision making, with human intervention becoming an exception.

Integrate New and Existing Capabilities and Technologies

To implement Industry 4.0 effectively, companies must develop a new, nontraditional set of capabilities and integrate it with their existing one. But adding capabilities can pose challenges. For example, a company implementing additive manufacturing cited the difficulty of integrating software programming and other new capabilities with traditional manufacturing skills. To integrate new and traditional capabilities, companies often need to first change the mindset of managers so that they are more receptive to pursuing new technologies and opportunities.

In many cases, companies are struggling to hire employees with the capabilities required for Industry 4.0. Significantly, we have found that technical capabilities relating to data science are not sufficient by themselves, because applying new technological solutions and algorithms requires in-depth experience with a company’s specific processes. Although the breadth of capabilities required means that an implementer will need some degree of external support (from suppliers and consultants, for example), it cannot rely solely on external resources. Developing certain capabilities in-house will be much more effective and sustainable given that personnel have company-specific experience and knowledge. The question companies must answer is which capabilities should be built in-house.

Capabilities that are essential to a company’s future competitive advantage should be developed internally. Strategic partnerships with research institutes and universities can be effective for building in-house capabilities and gaining an insider’s perspective on the development of breakthrough innovations. We found that the vast majority of implementers and technology vendors are collaborating with such external partners. Some companies are also developing incubators and making investments in startups.

A related challenge is the convergence of the traditionally separate domains of information technology (IT) and operational technology (OT), mainly driven by the adoption of the Industrial Internet of Things. (Industrial companies use OT, such as computerized control systems, to monitor production processes and equipment and make adjustments to improve performance.) Going forward, the IT function will need to be strongly involved in operational excellence programs, because IT will be integral to initiatives aimed at improving operations.

The IT function will need to be strongly involved in operational excellence programs.

Obtaining new capabilities and combining IT and OT will have major organizational implications for industrial companies. Some companies have started to experiment with “digital organizations” that combine IT, technological, and manufacturing capabilities. For example, a tier-one automotive supplier (with approximately €13.5 billion in revenue) created a multidisciplinary digital organization led by a chief digital officer who reports directly to the board. At a steady state, the organization will employ 100 employees at its headquarters and across regional locations. Its mission is to design, develop, and roll out digital initiatives across the company. The company also created specific roles for leading the digitalization of regional plants that are at a distance from its headquarters.

Regardless of the organizational setup, a company should expect the convergence of IT and OT to increase complexity in its operations. For example, an absence of automation standards across a manufacturer’s production lines and plants creates a tangible risk of higher complexity. When responding to complexity, companies must avoid the trap of creating what BCG refers to as “complicatedness”—the counterproductive proliferation of cumbersome structures, processes, and systems. (See Mastering Complexity Through Simplification: Four Steps to Creating Competitive Advantage , BCG Focus, February 2017.)

Manage Information Architecture as a Critical Enabler

To capture the benefits of digital technologies, companies must manage their information architecture effectively. The following are three examples of information architecture’s critical role in enabling the successful adoption of Industry 4.0:

- Integrating Legacy Systems. Companies are uncovering valuable information by integrating machines, equipment, and plants that have traditionally operated separately. System integration enables companies to establish virtual operations, monitor the shop floor, and optimize operations within the factory and along the supply chain. (See the sidebar “The Objectives of System Integration.”)

- Migrating to the Cloud. Many companies are using the cloud to collect, store, analyze, and distribute data in an effort to improve the flexibility of production, increase the speed of making calculations, and reduce costs. However, the migration of data and systems to the cloud must be rigorously managed. A company should establish migration criteria—for example, data’s age and level of importance—to guide decisions on whether data is stored on the premises or in the cloud. The criteria should also consider issues related to protecting the intellectual property of the company and the confidentiality of customers and suppliers. Moreover, the migration of applications to the cloud creates the need to change the mix of capabilities in an IT department. Because this often leads to staffing reductions, it is often a challenge and a source of resistance from IT managers.

- Building Cyberresilience. A high level of integration among systems, both internal and external, means that a company must intensify its focus on securing its data and systems. Companies that have implemented Industry 4.0 technologies have expressed a high level of concern about cyberattacks and other issues that could arise from extensive integration. Leading companies are building their organization’s “cyberresilience” by understanding the actions to take before, during, and after an attack. (See “ Building a Cyberresilient Organization ,” BCG article, January 2017.)

The Objectives of System Integration

Industry 4.0 technologies can help manufacturers improve quality and performance while reducing lead times and costs. However, companies must integrate legacy systems in order to take actions that will help them reap these and other rewards.

Establishing Virtual Operations. Virtual operations solutions connect traditional engineering solutions (such as product life cycle management or computer-aided design and manufacturing) with manufacturing, maintenance, and quality systems. Digital twin and other simulation technologies facilitate the creation of these digital representations. Some companies are already using virtual operations to substantially reduce costs and cycle times (such as commissioning time).

Monitoring the Shop Floor. By using sensors to connect machines and equipment on the shop floor, companies can collect and analyze information that can be applied to improve uptime and quality and reduce lead times and costs. For example, a leading white goods company connected legacy systems on the shop floor in order to collect data from multiple sources, identify opportunities for process improvement and scrap reduction, and find previously undetected interrelationships and correlations among variables. The main challenge is to convert the collected data to actionable information. At two industrial goods companies—a producer of components for the oil and gas industry and a major supplier of components of industrial electric motors—specialized plant engineers and operators were the first users to make decisions on the basis of such information.

Optimizing the Factory. Companies should integrate systems to enhance data visibility in the factory. By applying the insights, they can improve performance in terms of output, inventory turns, and lead time. For example, a company that assembles printed circuit boards implemented an IT platform to track products in real time throughout the production process, including their current stage, sequence, and next routing. The platform displays actionable information regarding the production process, analyzes the performance of processes, creates KPIs and dashboards that are accessible from mobile devices, and supports quality analyses. This solution has enabled the company to improve productivity by 4% to 5% year-over-year, reduce the plant’s inventory by 30%, and cut lead time by 50%.

Improving the Supply Chain. It is also critical to target improvements along the supply chain. For example, a large contract manufacturing company ($18 billion in revenue) that manages 17,000 suppliers and 101 plants worldwide developed a data and analytics solution to optimize its complex supply chain. The solution, which is now on the market, enables the company to use analytics to make smarter decisions relating to, for example, delivery times and inventory levels. Such a solution can reduce costs by 30%, lead times by 30%, and inventory levels by up to 50%.

Thoughtfully Design the Transformation Roadmap

Implementers must recognize that an Industry 4.0 transformation is a long journey that requires a systematic approach. We have identified the main steps of a transformation.

Understand the value of making the change. Management must gain an in-depth understanding of how it can apply Industry 4.0 to improve its operations and the value that the shift to Industry 4.0 can generate. It is essential to reach out to a broad set of experts—ones with functional acumen (in manufacturing, technology, IT, and HR, for example) and those with product knowledge (about automotive supplies, for instance)—to obtain a variety of perspectives on Industry 4.0 and evaluate the potential from different angles.

Management must gain an in-depth understanding of the value that the shift to Industry 4.0 can generate.

Assess the current state of systems and operations. To understand its starting point and business needs, a company should assess its current systems and identify pain points in its operations. BCG has developed a structured Industry 4.0 health check, supported by tools, methodologies, mobile applications, and a comprehensive database of more than 200 use cases from a wide variety of industries. Performing an Industry 4.0 health check can highlight areas for improvement and suggest specific use cases on the basis of the assessment results.

Define a roadmap and vision. A company can use the assessment results to create a strategic roadmap for Industry 4.0. The roadmap should set out the transformation’s priorities with respect to the technologies and use cases to implement. Initiatives to implement use cases should be sequenced so that the company can start pursuing “no regrets” moves that unlock value rapidly, thereby generating momentum and funds to support the overall journey. The resource requirements for each stage should also be identified. Government incentives for implementing Industry 4.0 should be considered, but they should not determine the strategic roadmap. (See the sidebar “Governments Are Creating Incentives for Industry 4.0.”)

Governments are Creating Incentives for Industry 4.0

BCG has supported governments worldwide in defining strategic plans for using Industry 4.0 to improve industrial competitiveness. As a component of these plans, some national governments have created incentives for companies to adopt Industry 4.0.

For example, France and Italy offer significant financial incentives to companies to invest in new technologies and R&D. More specifically, the Italian government allows companies to depreciate 250% of the value of Industry 4.0 equipment. Other countries, including Germany, Japan, and the US, have established public-funding schemes and incentives that, among other things, encourage companies to invest in technology startups.

We have seen government incentives strongly influence companies’ investment decisions related to Industry 4.0. However, not all companies take a strategic path toward capturing the benefits of these incentives.

In some cases, companies take a tactical approach in which they accelerate their Industry 4.0 investments to capture the benefits of the incentives. These companies seek to maximize short-term gains because they lack a long-term strategic roadmap for their Industry 4.0 investments. In other cases, companies take the strategic approach we have discussed: they first define a strategic roadmap and then apply Industry 4.0 incentives to invest in the most valuable technologies and solutions. Companies taking the strategic approach may sacrifice some short-term gains, but they are better positioned to succeed in the future.

At the same time that leading companies pursue the first initiatives to unlock value, they also define a bold vision for how they will apply Industry 4.0 technologies and establish ambitious, step-change objectives across the organization. It is critical to avoid the trap of having independent initiatives scattered throughout the company, without a clear vision and coordination from the top.

Improve existing processes. Existing processes typically offer the best opportunities for capturing rapid value through the deployment of Industry 4.0 technologies. The deployment should occur in three phases:

- Conduct proof-of-concept pilots. A company should use proof-of-concept pilots to test a set of technologies in specific processes. By analyzing the pilots’ results and benefits, a manufacturer can validate the business case for full-scale implementation and identify the requirements for managing the new technologies.

- Create a reference factory. Before rolling out a set of technologies in all facilities, a company should evaluate the potential overall impact by implementing the set across the end-to-end processes of one factory. For example, a leading white goods manufacturer designated a main plant as a reference factory in which to test and develop technological solutions before standardizing them and rolling them out. Alternatively, a company can create reference processes, implementing a set of technologies end to end for specific processes. Reference processes are a simpler way to continuously test the impact of integrating different technologies, but less effective than creating a reference factory.

- Roll out the new technologies. Applying the knowledge gained from the pilots and a reference factory or reference processes, a company should roll out the set of technologies to all facilities, integrating it with existing systems and processes. A successful rollout requires establishing governance mechanisms and receiving clear guidance from the project’s steering committee.

Expand capabilities along the value chain. Beyond improving internal processes, a company should explore opportunities to use Industry 4.0 to better integrate its operations with those of customers and suppliers. Expanding Industry 4.0 capabilities along the value chain is a higher level of maturity because it is often more challenging to set up common systems and platforms for exchanging data with other parties. Integrating operations with suppliers and customers can produce significant benefits in terms of better planning and production management, supply chain transparency, and inventory optimization.

Approach Industry 4.0 as a Change Management Project

The adoption of Industry 4.0 requires a sophisticated approach to change management, involving many functions at a site and implementation across multiple plants. Several imperatives should define the approach:

- Pursue the adoption of Industry 4.0 as a strategic business topic, not an IT megaproject. Although the IT function plays a pivotal role, it should not lead the adoption effort.

- Rigorously manage the transformation and coordinate activities. Leading companies accelerate the adoption of Industry 4.0 by establishing a steering committee in the operational excellence or innovation department or a program management office (PMO). Frontrunners also implement rapid feedback loops and require frequent updates, so that the steering committee can stay informed and make course adjustments. A multinational company emphasized the importance of having a PMO with visibility across functions and plants. This visibility helps to ensure standardization among solutions and avoid duplicate spending by plants that are developing similar technological solutions.

- Strike the right balance between central control and local delegation. This is particularly important when designing pilot projects, evaluating the results, and deciding which technologies to roll out. Central control enables standardization and cost control, while local delegation encourages innovation and increases local entities’ commitment to implementation. For example, a manufacturer of automotive components distributed decision making about pilots both locally and centrally: plants proposed which pilots to undertake and managed their implementation, while headquarters made the “go or no-go” decision for the proposed pilots, evaluated the pilots’ results, and decided whether to roll out solutions to other plants.

- Identify the best budgeting method. Companies must decide whether to fund Industry 4.0 investments through a centralized or decentralized budget or a hybrid approach. A centralized budget promotes coordination and standardization, while a decentralized budget is typically more effective for generating short-term returns and promoting the implementation of local initiatives. Some companies use a hybrid approach to pursue all of these objectives. For example, an executive of an automotive company suggested using a centralized budget for digital initiatives that need to be standardized, regardless of the overall approach used for budget allocation. He also suggested dedicating a portion of each local operating budget to Industry 4.0 initiatives in order to encourage local initiatives.

- Stay informed about Industry 4.0 innovations. Some of the most advanced companies have created partnerships with research centers, financed startups, participated in open innovation initiatives, or built ecosystems in order to monitor and study new technologies.

Time to Get Started

Industry 4.0 holds both great promise and significant challenges for industrial companies. To succeed, companies should implement only those technologies that are valuable for accelerating operational improvements, considering both quantitative and qualitative benefits. They must also integrate new capabilities and technologies into their ways of working and manage information architecture as an enabler of Industry 4.0 adoption.

A transformation must be carefully structured, with special attention given to change management. A company can use proof-of-concept pilots to rapidly test Industry 4.0 technologies and showcase the potential value. At the same time, the company should define a roadmap for deploying these initiatives at scale across the entire organization and articulate a bold vision for how it will deploy Industry 4.0 over the long term.

A broader lesson about the digital future has also emerged. The most innovative companies regard Industry 4.0 adoption as only the first phase of a full-scale digital transformation that extends beyond operations. These companies are investigating how they can use digital technologies to create new revenue streams—such as by reinventing the customer journey, defining new business models, and developing new go-to-market approaches. A strategic analysis that identifies a comprehensive set of digital opportunities, touching all aspects of the business, is the first step companies should take to discover the next digital frontier.