Additive manufacturing (AM), commonly known as 3D printing, is on the verge of being widely adopted in industrial manufacturing. The world’s top companies have taken notice and are making ambitious moves to capture their share of its potentially huge value. General Electric, for example, has acquired two of the leading companies that specialize in metal-based AM technology. BMW, GE, Google, and Nikon are among the investors that are funding a Silicon Valley startup’s efforts to develop a new polymer-based AM technology. And Hewlett-Packard has developed its own polymer-based AM process.

Such moves point to the need for players across the value chain—including materials suppliers, equipment providers, and end-user manufacturers—to determine how they can successfully shape the AM ecosystem, participate in the industry, and make industrialized AM a reality.

To inform strategic discussions, BCG has developed a unique proprietary model to evaluate the size of the market for AM and forecast its growth. The model provides insights on combinations of vertical industry segments and subsegments, the parts of the value chain, materials, and regions. It can, for example, forecast the market down to the level of polymers used in aircraft interiors and the market for equipment that utilizes metal-based technology to produce orthopedic implants.

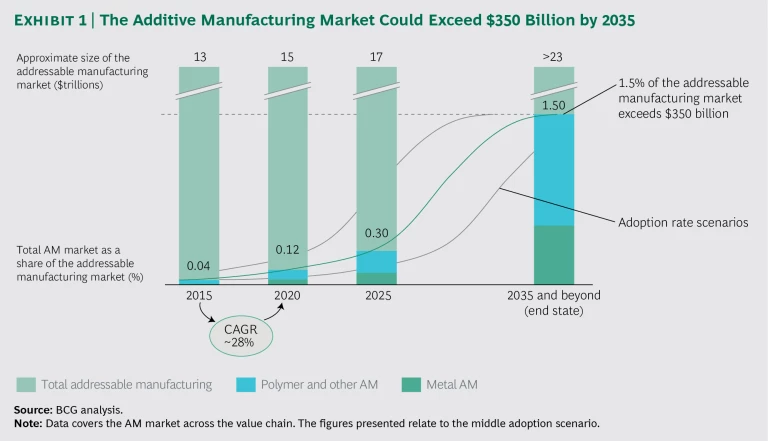

Our analysis found that the AM market is booming. By 2015, it had grown to approximately $5 billion. We forecast that it will grow at a compound annual rate of almost 30% through 2020, achieving a greater than threefold increase in size. If AM processes were adopted for approximately 1.5% of the total addressable manufacturing market by 2035, the AM market would exceed $350 billion. (See Exhibit 1.) We expect metal-based AM technologies to capture an increasing share of the total AM market.

Three industries—aerospace, medical and dental, and automotive—will account for approximately 50% of the AM market in 2020. The attractiveness and adoption of AM vary significantly among industries. In terms of their application of AM proc-esses, aerospace and medical and dental are the most mature industries. For value chain participants, the differences point to the need for an industry-level analysis that clarifies the relevance of AM technologies and how to create value by applying them.

In this report, we first assess the state of AM adoption in the aerospace, medical and dental, and automotive industries. We then discuss the actions that materials suppliers, equipment providers, and end users must take to realize the vision of industrialized AM.

AM Adoption Across Industries

AM technologies have tremendous potential to address unmet needs in industrial manufacturing. (See the sidebar “AM Addresses Unmet Needs, but It’s Not a Panacea.”) To assess an industry’s state of adoption, we categorize existing AM use cases into three maturity stages:

- R&D and Experimental. In the earliest stage of AM adoption, manufacturers conduct tests that let them become familiar with AM technologies and explore the limitations (such as material strength) of using each of several methods.

- Prototyping and Making Spare Parts and Small Series. Next, manufacturers advance to using AM to produce single parts or parts in small volumes. In general, they use existing conventional designs for these parts rather than redesigning them to capture the benefits of AM. Because they produce only small volumes of each application, these companies typically use one machine to print different applications.

- Industrial Series Production. In the most advanced stage, manufacturers produce up to 100,000 parts per year. To take full advantage of AM, they radically redesign parts or produce customized parts in large volumes. Moreover, because they produce large volumes of each application, these users typically run multiple AM machines and build dedicated AM factories. AM enables manufacturers to digitize the entire production process—down to the level of powder particles. Indeed, AM technologies are critical to realizing the vision of the factory of the future, in which manufacturers improve production by applying new design principles, implementing digital technologies, and integrating processes across the value chain. (See The Factory of the Future , BCG Focus, December 2016.)

AM Addresses Unmet Needs, but It’s Not a Panacea

Using a process that successively deposits thin layers of material, AM creates 3D objects that are based on digital models. Over the past three decades, manufacturers have applied a variety of AM processes that use a selection of polymers, metals, composites, and other materials. Manufacturers have most commonly used AM processes to create prototypes, thereby reducing development cycles and lead times. Indeed, AM means “rapid prototyping” in the minds of many industry participants. Today, technological advances have enabled companies to experiment with AM in industrial manufacturing, including series production, bringing AM to the threshold of industrialization.

Users can apply AM technologies to produce designs that are not achievable with traditional manufacturing methods or that are too costly to manufacture using conventional approaches. Such complex designs include bionic lightweight and hollow structures. Moreover, AM allows users to consolidate multiple functions in a single part—say, integrating cooling channels into a mold—thereby reducing, or streamlining, assembly steps. Users can also customize products, making, for example, patient-specific implants.

Additionally, users can capture the benefits of greater flexibility with respect to production volume, location, and time. Manufacturers can use AM technologies to produce parts cost-effectively without regard to batch size. Because no additional tools are required regardless of the project, a one-off part is produced at approximately the same cost as a high-volume part. AM technologies enable decentralized production at remote locations as diverse as hospitals and battlefields.

Notwithstanding these valuable benefits, however, AM will not simply substitute for conventional manufacturing. Traditional methods will still be widely used for high-volume production. (See “Prepare for Impact: 3D Printing Will Change the Game,” BCG article, September 2013.) Companies do not have to choose between AM and conventional manufacturing, but they should find ways to combine AM advantageously with traditional methods and identify applications for which the combined methods are best suited.

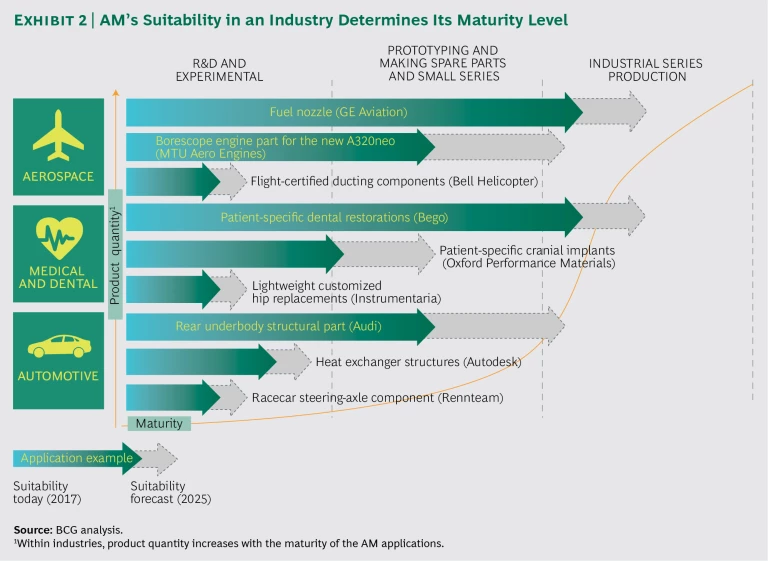

The adoption rate of AM at these three stages of maturity varies among industries. Adoption depends on a complex interplay of the advantages that AM brings to each industry and the pros and cons of using AM technologies for any specific application. Consequently, value chain players need to examine the AM ecosystem industry by industry. We explore the state of adoption in each of the industries we studied, in the order of their AM maturity. (See Exhibit 2.)

Aerospace

Aerospace manufacturers use AM processes to optimize the shape of parts and create lightweight structures in order to reduce fuel costs. These objectives are, by far, the most important drivers of AM adoption in the aerospace industry.

Additionally, manufacturers can customize interior designs for individual airlines and rapidly complete upgrades and refurbishments. AM enables manufacturers to make spare parts readily available throughout the world—quickly, efficiently, and cost-effectively. The advantages that AM technologies bring to aerospace manufacturing are especially relevant for making components of propulsion systems and jet engines; cabin interiors; air conditioning, hydraulic, and pneumatic systems; drones; and satellites.

In this industry’s best-known example of AM, GE Aviation makes fuel nozzles for its next-generation turbofan engines. (See “ Is It Time to Take the 3-D Plunge? Hope Versus Hype in Additive Manufacturing ” BCG article, December 2015.) MTU Aero Engines uses AM to make metal borescope parts for jet engines designed for improved functionality. The approach—which entails tool-free manufacturing—reduces the time required for development, production, and delivery, as well as the quantity of materials and tools required in development and production.

The technology is advancing rapidly, and many more successful aerospace uses will soon emerge. We forecast that by 2030, AM will be used to make approximately 20% of critical engine parts that are produced by conventional casting today. We expect AM to be widely adopted in the production of aircraft cabin interiors as well. For example, we estimate that, in 2025, 5% to 10% of aircraft seat components will be produced by AM. We also expect that manufacturers will use AM to make drone components, bringing the AM market for commercial and military drones to $600 million to $700 million in 2025.

Medical and Dental

Using AM, manufacturers can cost-effectively produce medical and dental implants and devices. Patient-specific customization facilitates surgical procedures and promotes better health outcomes. Furthermore, AM optimizes materials usage and reduces lead times. Manufacturers can create porous implant surfaces for superior bone ingrowth and integrate multiple functions, such drug release, within a single part. (See “ Biomedical 3-D Printing: A Niche Technology or the Next Big Thing? ” BCG article, September 2015.) For example, Oxford Performance Materials applies MRI scan information to an AM process that rapidly produces patient-specific cranial implants using high-performance polymers. Patients benefit from fewer side effects, as well as lower surgical costs.

AM’s advantages are especially beneficial in hearing aids, orthopedics and prosthetics, and surgical guides and models. Already, approximately 90% of hearing aids sold in the US have AM custom-fitted shells, and 3D printing produces more than 17 million clear aligners for orthodontics each year.

By the end of 2025, AM will likely be in wide use in the production of orthopedic implants, dental applications, surgical guides, and medical instruments. For example, we forecast that the AM market for orthopedics and prosthetics will exceed $3.5 billion in 2025. Looking further into the future, we expect that the use of 3D printing to produce drugs, tissue, and organs will become a reality.

Automotive

Automotive manufacturers have started using AM to produce tools and components. For example, to build the Rolls-Royce Phantom, BMW has used AM in series production to make more than 10,000 parts, such as plastic holders for center lock buttons as well as electronic parking brakes and sockets. The main benefit is the reduction of time and costs associated with product development. Using AM, manufacturers can both enable customization and lower costs that arise from the increasing number and complexity of product variants. Additionally, AM allows manufacturers to reduce the number of assembly groups, integrate multiple functions into a single part, and produce lightweight designs. And, by using AM to make spare parts and tools for discontinued product variants, manufacturers can reduce the need to maintain inventories of infrequently requested items.

These benefits are especially advantageous for producing interior components (for which polymers are predominantly used), structural and exterior vehicle body components (for which metals are predominantly used), and systems for climate control and engine cooling. AM in these vehicle areas is, therefore, the most mature.

However, because automotive production generally entails large volumes, we expect that prototyping will remain the predominant use in the near term. AM will be applied in series production involving relatively small volumes, such as for high-performance cars and spare parts.

We expect AM to be most widely adopted in the production of high-performance engine components (such as turbochargers), metal structural body and chassis parts (such as steering knuckles), and decorative elements composed of polymers (such as emblems). German automotive makers, in particular, appear to be moving decisively to AM, setting up engineering teams and investing in the technologies.

Making Industrialized AM a Reality

In the evolving AM ecosystem, stakeholders along the value chain have a role to play in making industrialized AM a reality. We discuss challenges that key stakeholders—materials suppliers, equipment providers, and end users—face and actions they must take to succeed. In addition to the key stakeholders, there are many other participants in this ecosystem, including service bureaus, software companies, and design and engineering providers. We will address these other participants’ strategic challenges in another publication.

Materials Suppliers

Many large, established chemical and metal powder companies are already supplying the AM industry. We anticipate that even more materials companies will enter the AM business. Suppliers should participate in shaping the ecosystem and accelerate efforts to promote the industrialization of AM. To succeed, materials suppliers must address several challenges.

- Developing a Broader Range of Materials. The list of viable AM materials is growing, but many polymers and metal alloys are not yet available or not fully developed for AM. (See the sidebar “The Materials Spectrum.”) Because industrialization requires an extensive materials portfolio, suppliers must develop a broader range of printable polymers and metal alloys. The available materials should match the requirements of specific target industries. Moreover, materials suppliers will need to provide not only standard materials, but also materials tailored to the specific needs of applications and customers.

- Optimizing Materials Parameters. AM materials currently have limitations associated with surface quality and the properties—thermal, mechanical, and chemical—of final parts. Materials suppliers must overcome these limitations in order to meet the high-quality requirements of series production. They will have to comprehensively develop and optimize materials for AM processes, working closely with equipment providers and end users.

- Reducing Costs. Today, AM materials are more expensive—easily by a factorof 30—than materials used in conventional manufacturing processes. For broad-based industrialization, AM materials must be cost competitive. Reducing the cost of materials production is essential to making cost competitiveness a reality.

- Enhancing the Supply Chain End to End. To succeed, materials providers must create an end-to-end supply chain solution for their materials that includes ensuring full traceability back to the source and offering to recycle used materials. In powder-based AM processes, a substantial amount of material remains in the powder bed after layering. Materials suppliers must further develop processes that test, reuse, and recycle this unfused powder. The ability to reuse recycled materials will help lower overall manufacturing costs, thereby promoting AM adoption.

The Materials Spectrum

Materials for industrialized AM include both polymers and metal powders.

Polymers. AM processes use a wide variety of polymer materials. At one end of the spectrum are such basic- performance polymers as acrylonitrile butadiene styrene (ABS), a low-cost engineering plastic. At the other end are high-performance polymers, such as those of the polyaryletherketone family. They are durable, offering fatigue resistance, ductility, and chemical resistance. ABS and polylactic acid are the most commonly used polymers for the low-end filament-based processes, while polyamides are most commonly used for selective laser sintering. Some AM polymers can be reinforced with composites to create more durable parts. Not all polymers traditionally used in manufacturing are suitable for industrialized AM applications, but efforts to make them “printable” are underway.

Metal Powders. Commonly used alloys are nickel based (such as Inconel), cobalt based, titanium, or aluminum. Tool steel and stainless-steel powders are also used. Copper alloys and precious metals (mainly gold and silver) are used only in small volumes for niche applications.

In addition to addressing these challenges, materials providers must secure a strategic position in the complex AM ecosystem. They must strive to become the “spider in the web,” connecting a network of players and influencing decisions throughout the value chain. Currently, equipment providers assert greater influence in the AM ecosystem. We have, however, noticed that materials suppliers are now working to gain broader influence. To be recognized as being among the ecosystem’s most influential players, a materials supplier needs a diverse strategy that covers, for example, product development, branding and marketing, and external partnerships. In a forthcoming publication, we will detail the winning strategic moves for AM materials suppliers.

Equipment Providers

To date, companies in Europe (particularly Germany) and the US have dominated the AM industry, but we expect Asian companies will soon assert greater influence. Both established AM equipment providers and new entrants are continually improving their systems and developing new technologies that will accelerate the evolution of industrialized AM. The future of the AM ecosystem and market size will be determined largely by how these companies decide to deploy their resources to develop AM technologies. (See the sidebar “The Technology Spectrum.”)

The Technology Spectrum

Several AM technologies are available for manufacturing objects, using materials such as polymers, metals, and composites, with varying suitability for specific applications. These technologies are differentiated mainly in terms of the initial raw-material state or shape (for example, liquid photopolymer, filament, or powder) and the bonding principle (for example, melting or gluing).

ASTM International groups the various AM technologies into seven categories. We discuss them below in the order of their current relevance for use with polymer and metal materials and indicate other materials for which they are applicable.

The following categories are applicable for polymers:

- Material Extrusion. ME materials are selectively dispensed through a nozzle or other orifice. This technology is applicable for composites as well. ME is also referred to by the process names fused deposition modeling and fused filament fabrication.

- Powder Bed Fusion (PBF). Thermal energy (for example, from a laser light) is used to selectively fuse regions of powder in the powder bed. In polymer applications that use a laser, this process is called selective laser sintering.

- Vat Photopolymerization. Liquid photopolymers in a vat are selectively cured by light-activated polymerization. The most common techniques are processing digital light and using a stereolithography apparatus. Continuous liquid interface production, commonly known as CLIP, is a recently introduced technique.

- Material Jetting. Droplets of material are selectively deposited in a process similar to that used in conventional inkjet printing, and the layers of material are cured or hardened using ultraviolet light. The process is applicable for liquid photopolymers.

- Binder Jetting. A liquid bonding agent is selectively deposited to join powder material. (This is also applicable for composites and other powders.) Hewlett-Packard has introduced its Multi Jet Fusion (MJF) technology, which uses a dual-carriage, multiagent printing process. A layer of powder, followed by a fusing and detailing agent, is deposited onto the build platform,and energy is then applied to catalyze the fusing agent. MJF can utilize chemical agents that modify material properties to enable controlled variability of a part’s mechanical and physical characteristics. MJF can also be categorized as a PBF variant.

The following categories are applicable for metals:

- PBF. For metal applications, the processes are laser melting and electron beam melting.

- Directed Energy Deposition. Focused thermal energy melts and fuses materials while materials are being deposited.

- Binder Jetting. Processes for metals are similar to those used for polymers. For improved materials properties, metal components are usually sintered after the printing process.

- Sheet Lamination. Sheets of materials are bonded to form an object. This process is also applicable for nonmetal sheet materials.

To examine how the AM ecosystem is evolving, we distinguish between providers of polymer- and metal-based technologies.

Polymer-Based Technologies. Established AM equipment providers (Stratasys, 3D Systems, and EOS, for instance) are investing significant resources in the development of polymer-based technologies for industrial applications beyond prototyping. At the same time, leading companies from outside the AM industry have made major investments to enter the industrialized AM space. For example, a group of investors that includes BMW, GE, Google, and Nikon has invested more than $220 million in support of Carbon, a Silicon Valley–based startup, in its efforts to develop continuous liquid interface production (CLIP) technology.

Companies active in the conventional two-dimensional-printing industry are ramping up their efforts to provide AM technology. Hewlett-Packard has introduced commercial 3D printers that use its newly developed Multi Jet Fusion (MJF) technology. In addition to Hewlett-Packard, other two-dimensional players are accelerating efforts. Ricoh, for example, is marketing machines developed by Aspect, a Japanese company. Other printing companies are likely to introduce systems soon.

To determine which polymer-based technologies have been receiving the most attention, we analyzed more than 15,000 news and blog articles published during the past three years. The technologies mentioned most frequently were vat photopolymerization, 44% of articles, material extrusion (ME), 38%, and powder bed fusion (PBF), 34%.

To understand which AM technologies will become most relevant in the near term, we conducted a detailed analysis of the intellectual property landscape. We examined AM patent activity from 2000 through 2015 by investigating 8,145 patent families. We found a significant increase in patent applications since 2011 for both types of thermoplastic-based processes: the number of PBF-related patent applications rose by more than 60% per year, and the number of ME-related patent applications more than doubled annually. Because patent activity is a good indicator of a technology’s future relevance, our findings suggest that PBF and ME will continue to gain importance.

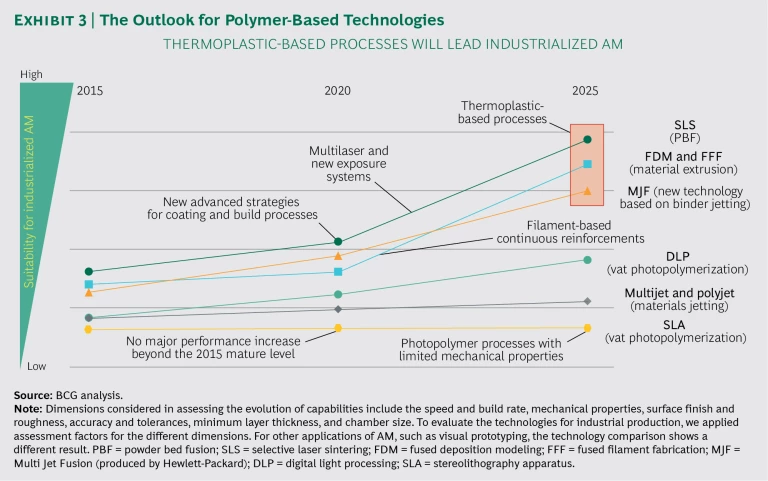

To examine how the effectiveness of polymer-based technologies will evolve through 2025, we applied insights from our research and more than 150 interviews with AM industry stakeholders to develop a technology roadmap. (See Exhibit 3.)

Today, selective laser sintering (in the PBF technology group) and fused deposition modeling and fused filament fabrication (in the ME technology group) are the most effective polymer-based processes for industrialized applications. MJF, the newer technology, also seems very promising for industrialized applications. Our analysis found that these three thermoplastic-based processes will become even more dominant through 2025, as groundbreaking innovations enhance their effectiveness for manufacturing functional parts.

Higher processing speeds for PBF will be promoted by advanced strategies for recoating the powder bed and better fusing processes (for example, the use of new diode laser arrays to fuse powder). ME enables continuous reinforcement with composite materials, so it has high potential for producing parts that require superior mechanical properties. However, the technology is limited in terms of speed, quality, and the realizable complexity of part geometries. Because there is significant potential for multicolor and multimaterial printing at high speeds, we expect MJF to be more widely adopted.

In contrast, traditional vat photopolymerization processes (such as stereolithography), which are already mature, will most likely not see significant improvements in their ability to produce, for example, parts that require superior mechanical properties. CLIP technology has the potential to enable higher speeds by moving beyond a layer-by-layer process. However, the technology faces challenges with respect to mechanical properties.

Metal-Based Technologies. Established machine tool makers, such as Trumpf, have entered—or reentered—the market for AM equipment, seeking to lead the development of new technologies. Large manufacturers, including Siemens, are making significant investments that will accelerate the adoption of these technologies. Moreover, GE’s moves to acquire Concept Laser and Arcam, which are among the leading equipment providers for metal-based AM, are likely to promote the industrialization and widespread adoption of AM. GE’s combined investment of $1.3 billion in these two companies signifies a strong endorsement of the potential for metal AM, which will attract other companies to the technology. GE’s recent acquisitions also allow it to span the AM value chain from end to end. For example, Arcam includes AP&C, a leading AM powder manufacturer, and GE separately acquired Morris Technologies, a leading service bureau.

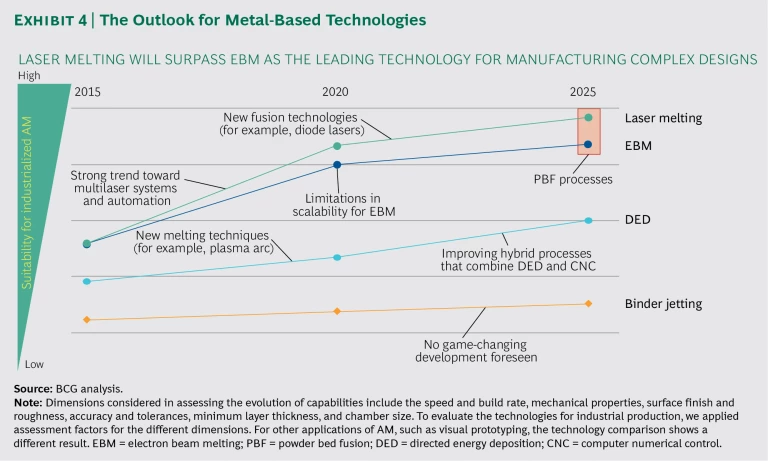

Metal PBF processes—laser melting and electron beam melting (EBM)—have emerged as the leading metal-based AM technologies for industrial part production. Both technologies are used for aerospace, medical, and automotive applications. Our analysis indicates that, owing to the use of faster fusion technology and better process automation, these technologies will maintain their dominance through 2025. (See Exhibit 4.) For example, we expect the next generation of laser-based systems, using diode laser arrays, to increase melting speeds by as much as a factor of 30.

EBM and laser melting are not competing processes. Rather, they offer different advantages for different types of applications. End users must understand the pros and cons of each process in order to decide which to adopt. For example, while laser melting enables greater accuracy, EBM currently has the advantage in terms of build speed. EBM’s higher build temperature means that parts encounter minimal internal stress, but the higher temperature requires long periods of heating and cooling before and after the build process.

Directed energy deposition (DED) is an established and well-known process for coating applications. However, its AM use is limited to producing simple shapes. We expect that DED will stay relevant for specific applications, such as repairs. New variations of DED (for example, those that use a plasma arc to melt alloy wire) enable high-speed production and the manufacture of large parts. However, DED processes cannot be used to create complex designs. Hybrid processes that combine DED and conventional computer numerical control face challenges with respect to accuracy and process stability.

Equipment providers will likely continue to improve binder-jetting processes for metal powder. Even so, these processes will still compare somewhat unfavorably to PBF in their ability to produce strong parts. We expect that binder-jetting processes will be relevant for niche applications.

New metal processes being developed—for example, particle-jetting or filament-based methods—are not expected to offer game-changing advantages in the short or medium term. We see multiple new startups targeting a new field of low-cost metal AM, a trend that could have implications for the industrial segment in the long term.

Taking Action. As the technologies evolve, equipment providers must do the following to promote success:

- Increase the scale of production. Today’s AM machines are still rather slow, and they cannot make large parts. A typical build chamber of a large industrial machine is approximately 400 millimeters wide by 400 millimeters high by 400 millimeters deep. The chamber size of the largest PBF machine available today, the Concept Laser X Line 2000R, is 800 millimeters high by 400 millimeters wide by 500 millimeters deep. Machines with these dimensions are large enough for prototyping, but they are too small for industrial production. Equipment providers will need to design machines that are faster and have larger build chambers.

- Automate processes. The existing procedures for printing and component finishing require a significant amount of manual handling, and first-time-right production is far from a reality. The individual steps in the AM process chain—build job preparation, machine loading, printing, part removal, and postprocessing—are not automated, and an operator responsible for quality control must be present to conduct each step. To minimize the manual labor required for industrial and large-scale production, equipment providers need to further automate AM processes and develop solutions that allow for an industrialized production setup. Providers can increase the reliability of production by improving process monitoring and quality control during the production process. Identifying irregularities through process-monitoring systems is just the first step. Equipment providers must also develop interpretation systems that can determine how irregularities affect the reliability of processes, as well as systems that then trigger corrective actions without the need for human intervention.

- Develop an end-to-end process. Part production is an end-to-end process that includes design, simulation, monitoring, and data management. So far, these value chain steps have not been well integrated into AM processes. Equipment providers need to work closely with software providers to develop an integrated AM process that covers the end-to-end value chain. In this environment, an equipment provider would do well to identify the source of its competitive advantage and to protect and defend this core value by bringing together all aspects of its competence. To gain a competitive advantage, equipment providers must ensure that process engineering and machine intelligence are well integrated in the AM equipment design. Process engineering refers to the optimized setup and interaction of the machine’s elements—for example, the laser, scanners, optic system, and material handling system—as well as the value chain steps of part design, material production, and postprocessing. Machine intelligence includes the control of the build process (such as the build path strategy and the laser algorithm) and the corresponding monitoring software. Collecting and using process data (such as big data analytics) will be essential to reach an industrial production level.

- Provide lower-priced machines. Printers that are suitable for industrial production are very expensive—easily $500,000. Equipment providers need to offer lower-priced machines in order to promote broader acceptance and adoption of AM technology. Several trends will promote lower prices. First, standard components and front-end software, including machine and materials parameters, are becoming commoditized. Second, the cost of key components, such as lasers, scanners, and optics, will decline as suppliers produce higher volumes and the entry of new suppliers into the market leads to more competition. Third, providers can, to a great extent, outsource the assembly of equipment, performing only the final assembly and setup of the machine in-house. Many providers have already expanded their use of outsourcing, and we expect this to continue. Finally, prices for equipment will fall as machine designs and configurations become more specific to the needs of a particular industry or application. Today’s machines have functionality that is not required by every user, and this means that users pay for features that they do not need or want.

Additionally, equipment providers must address their strategic position in the AM ecosystem. To date, most AM equipment has been sold within a closed system in which manufacturers provide both machines and materials to the users. The manufacturer calibrates the machine to a specific material and sells the material at a significant markup. Customers are willing to accept such a system in the early—small-scale—stages of adopting a new manufacturing process. In the future, however, customers for industrialized AM will demand an open system in which equipment providers sell the machines and materials suppliers have direct access to customers.

The trend toward an open system is already evident for equipment that uses metal-based AM processes, but a closed system still predominates for polymer-based processes. As AM processes become more widely adopted for high-volume industrial production, open systems will likely prevail throughout the industry. To adjust to that shift, equipment providers should seek ways to maintain their margins. They could, for example, leverage their knowledge base and expertise to offer advisory services to companies seeking to adopt AM processes. It is imperative that they be established as strategic partners—not simply equipment suppliers—in the transition to AM.

End Users

Across industries, AM technology end users—that is, manufacturing companies—are extending the scope of AM processes beyond R&D. Their success stories will help create excitement and promote wider AM adoption, accelerating its industrialization. To make the vision of industrialized AM a reality, end users must undertake the following:

- Evaluate the economics comprehensively and understand the bigger picture. In evaluating the business case for industrialized AM, some users take a narrow perspective, considering, for example, only manufacturing costs or failing to consider the value of creating higher-quality parts. With industrialized AM, users can comprehensively rethink their production processes and change the design of their parts. Rather than simply looking at the economics of replicating conventional processes, users should develop a business case that takes into account AM’s advantages in reducing the costs of using, repairing, and replacing parts as well as the functional improvements. They should also consider AM’s benefits in terms of life cycle advantages, supply chain simplification, and greater flexibility in production. Finally, they should account for the ability to capture competitive advantage through superior performance.

- Build and apply AM expertise. To maximize the benefits of AM, users must reconceive the way they design parts and not use AM simply as an alternative means to produce conventional parts. The limitations of traditional manufacturing processes play a major role in determining the design of components. AM gives engineers greater freedom to design for function rather than for manufacturing. Users must also determine which AM technology and method are best for achieving their objectives. They need to know when these methods should complement, rather than fully replace, conventional processes. In order to apply AM effectively, engineers must build their knowledge of AM technology and design principles.

- Participate in drafting new regulations. Government bodies have not yet developed regulations that cover the uses of AM processes for the diversity of industrial applications—making products as different as medical implants and engine parts. End users are, therefore, operating in an uncertain environment as they seek to employ AM in innovative ways. Companies and their industry organizations must strengthen their efforts to educate regulators about the safety and efficacy of AM parts, and they need to participate in drafting standards and regulations that promote the evolution of industrialized AM.

To address these challenges, users should answer the following questions:

- Do the scope and range of parts we produce offer opportunities to adopt AM? Are there any part families that AM would be well suited to produce?

- For which of our production applications is AM most advantageous? Which AM technology is best suited for each of these applications?

- For each potential AM application, what is the size of the prize, including reductions in manufacturing costs and total life cycle costs and improvements in functionality and quality?

- What is the best approach for integrating AM into our production processes? How can we optimize AM production and ensure that it provides the appropriate level of quality?

The answers will provide the basis for pursuing the following four-step, structured approach for transitioning to industrialized AM and quantifying the economic benefits.

- Creating Transparency. Compile a fact base for an analysis of industrialized AM applications. Identify the part families that should be included in the scope of the analysis and choose a representative component from each family to focus on. For each representative component, collect all relevant data (including computer-aided design drawings, specification sheets, and production quantities and costs) and select the AM technologies to evaluate.

- Assessing the Opportunities. Perform a detailed assessment of the opportunities for using AM to produce the representative components. To capture the full set of suitable applications, the assessment should include consideration of the new designs enabled by each relevant AM production process. Compare the costs of those processes with the costs of the conventional methodology and assess the potential for improvement in performance characteristics (such as weight, stability, and customization). On the basis of any part’s function, the assessment will likely suggest opportunities for rethinking its design to most advantageously combine additive and conventional methods. Simply replacing a conventional method with an additive method will be the right move only in rare cases. For prototyping, a one-for-one substitution without modifying the traditional component design might be a reasonable approach to reduce production time. However, when using AM technology in series production, a simple substitution will most likely lead to significantly higher costs.

- Quantifying the Potential. Develop the business case by extrapolating results from representative components to selected part families. Quantify the total size of the prize, considering all relevant factors. Apply the results to the development of a detailed business case for implementing AM processes for all suitable applications.

- Implementing the Technology. Identify a suitable application for piloting the rollout of AM technology and define the roadmap for transitioning from conventional to AM processes. For some companies, it’s best to purchase AM equipment and build in-house capabilities for designing and implementing AM processes. For other companies, the right choice is to rent capacity from service bureaus.

Now is the time for players along the value chain to investigate the opportunities that AM offers and make industrialized AM a reality. BCG supports these efforts through a unique network of experts and external partners that includes major research institutions and specialists in materials, processes, and equipment. For example, a materials supplier that aims to become a leading player in the industrialized AM ecosystem worked with our experts in workshops and day-to-day projects to develop an ambitious strategy and accelerate its achievement of aggressive targets. In another instance, an end user’s team visited the Paris model factory in BCG’s Innovation Centers for Operations (ICO) to learn about the potential of industrialized AM. In the ICO’s model factory, the executives and staff experienced and tested new AM technologies, as well as other Industry 4.0 technologies. Gaining hands-on experience helped the team understand the advances that AM has made possible and how these use cases can be applied to their own operations. By understanding the state of the AM art and how the technologies will likely evolve, companies can seize the opportunities and take part in shaping the industry.