Judging from the recent political furor over US factory jobs going to Mexico, one might get the impression that the US is facing another exodus of manufacturers. In fact, the opposite is true. Offshoring has dropped dramatically, particularly with regard to the world’s biggest workshop: China.

True, we still read about companies relocating some of their manufacturing to China to gain greater access to that nation’s immense domestic market. But reports are scarce about runaway shops that set up operations in that country to take advantage of its ultracheap labor and then export the manufactured goods—such as auto parts, furniture, machinery, and electronic equipment—back to the US. Indeed, the reshoring of factory work from China and other major trading partners has contributed to the increase in direct manufacturing jobs of 400,000 and to the rise in support jobs of 1.2 million since 2010. Reshoring has also preserved many other jobs that would have been offshored.

The main reason for this change is economics. As The Boston Consulting Group has documented, the cost competitiveness of US manufacturing has been improving significantly over the past decade, compared with many of its biggest trading partners—most notably China. (See Made in America, Again: Why Manufacturing Will Return to the US , BCG Focus, August 2011, and The Shifting Economics of Global Manufacturing: How Cost Competitiveness Is Changing Worldwide , BCG report, August 2014.)

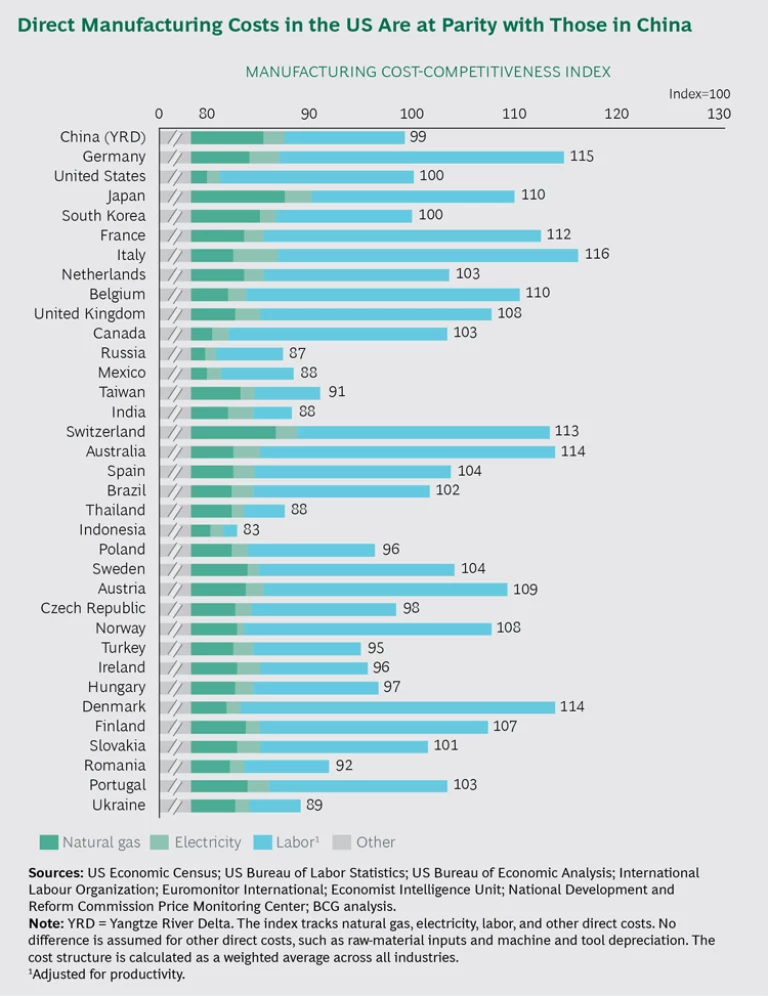

In terms of direct costs, in fact, the US playing field is essentially level with Yangtze River Delta, China’s chief production zone. Despite the recent weakening of the yuan, and factoring in the differences in productivity and energy costs, China’s manufacturing cost advantage over the US shrank from 14% in 2004 to an insignificant 1% in 2016, according to our analysis of data collected for the BCG Global Manufacturing Cost- Competitiveness Index. (See the exhibit.) When indirect costs for shipping, inventory, and other expenses are included, it is now less costly to manufacture a wide variety of goods in the US if that is where they will be consumed.

Nevertheless, Mexico’s role as a strategic near-shore manufacturing location is likely to grow. The index shows that Mexico’s manufacturing cost advantage over the US, China, and other global manufacturing destinations is wide. This is being driven by low labor and energy costs. We see Mexico, unlike low-cost destinations in Asia, as an asset to US manufacturing competitiveness, because products built in that country tend to contain high-value, US-made components and assemblies. Mexican assembly plants, therefore, help preserve US manufacturing jobs.

The rapid advances of manufacturing technology promise to boost US cost competitiveness even further. Autonomous robots, additive manufacturing machines, digital simulation tools, and other smart systems enabled by massive data processing—a development known as Industry 4.0—have the potential to dramatically improve productivity. As the costs of these advanced manufacturing systems continue to drop, it will become increasingly feasible and economical for domestic manufacturers of all sizes to fabricate small batches of customized goods. (See “ Why Advanced Manufacturing Will Boost Productivity ,” BCG article, January 2015.)

The urgent challenge for the US is to seize this golden opportunity and translate emerging cost and technological advantages into long-term manufacturing growth. We believe that the US can be successful if it takes the following concerted actions to improve competitiveness:

-

Boost innovation. Even though the US remains the world leader by far in basic and applied research, the country’s dominance in manufacturing innovation cannot be taken for granted. Other economies have made the advancement of their manufacturing sector a priority, and they are investing more aggressively than the US to help companies translate technological developments into not only smart factories with efficient processes but also new commercial products. On an annual basis, China now invests more than the US in development research and is projected to be spending about twice as much within five years.

The US needs to get more economic bang for its R&D bucks. By removing friction that slows the transfer of technology from top-notch research universities to private industry, as well as among corporate members of industrial R&D consortia, the US can considerably advance its industrial sector and accelerate its commercialization of new products and processes.

- Build an adaptive, higher-skilled workforce. As US factories adopt advanced manufacturing technologies, demand will surge for higher-skilled, white-collar workers who can quickly adapt to new technologies and processes, and demand will lessen for blue-collar workers who are trained in specific skills. To meet manufacturers’ needs, the US must educate workers more broadly. Building this adaptive, higher-skilled workforce will require not only expanding programs in community colleges and vocational schools but also adopting a new mentality and new tools in the US education system.

- Strengthen the supplier ecosystem. Decades of offshoring have eroded the once-immense base of suppliers of critical components and materials, tooling, and industrial machinery in the US. As a result, US manufacturers in some industries find it challenging to reshore manufacturing work—even if the economics are favorable. Strengthening the US supplier ecosystem will require companies to invest significant time and money. They will have to convince existing suppliers to open up shop in the US or find, qualify, and scale existing small and midsize businesses to meet their needs. Once established, a robust supplier ecosystem will also help mitigate challenges with currency fluctuations.

-

Modernize the manufacturing infrastructure. Manufacturing infrastructure typically includes the highways, bridges, tunnels, and seaports that are used to efficiently transport manufactured goods. Although upgrading such infrastructure is clearly an urgent need, the US should think more broadly.

The US should consider how to better use the existing infrastructure. For example, it should encourage companies to prepare to use autonomous trucks that travel at night, relieving daytime congestion on major freight routes. The US should also advance next-generation mobility infrastructure, including ubiquitous high-speed wireless connectivity, to link workers, goods, and information. The US should promote the use of public transportation and consider incentivizing innovative transportation systems, such as vehicle and bicycle sharing as well as mixed-mode commuting, to help workers from underserved areas travel to their jobs. Finally, the arrival of Industry 4.0 technologies means that the US must ensure that its IT infrastructure does not fall behind that of key competitors and that state-of-the-art solutions are readily accessible and affordable for small and midsize manufacturers.

In the coming months, we will explore ways in which the US can prepare to take these four actions. We believe that such improvements will enable the US to seize the immense opportunities presented by the gains in the country’s competitive position and build a more prosperous manufacturing sector for the future.