Powerful industry trends—including growing international competition, industry consolidation, and heightened customer expectations—continue to put pressure on chemical manufacturers to improve their efficiency and effectiveness, particularly in the end-to-end supply chain . As these trends strain industry revenues and margins, supply chain excellence can make a powerful difference in chemical companies’ performance.

Chemical companies have already invested considerable resources to improve their supply chains, but many need to go further in their efforts to establish a well-oiled end-to-end process—including best-practice customer service.

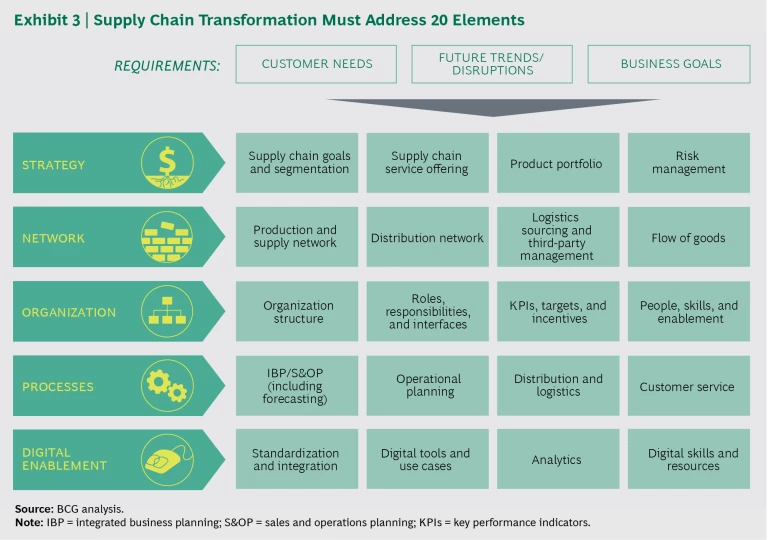

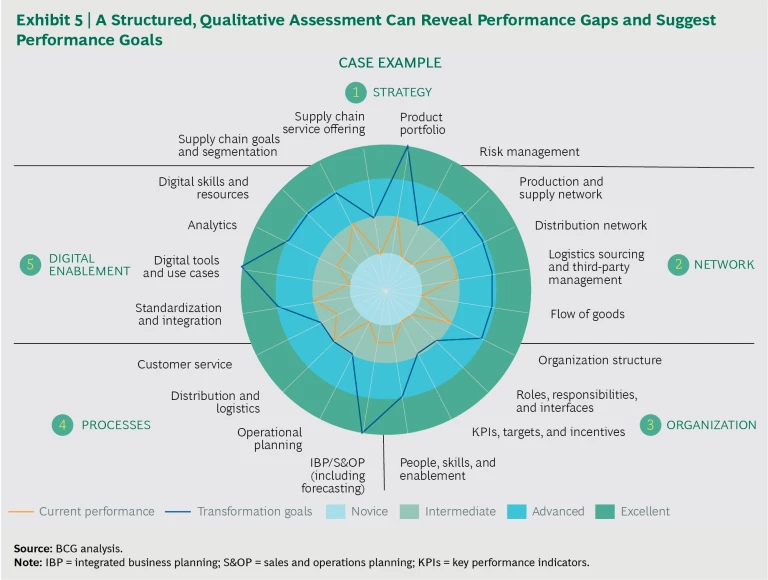

Drawing on our extensive work with leading chemical companies, we have developed a concise framework to help other companies move forward. The framework consists of 20 elements in five categories: strategy, network, organization, processes, and digital enablement. A focus on any single element will not create excellence. Instead, companies must conduct a comprehensive assessment of the supply chain, determine which elements best serve their needs, and work within those elements to reach performance and customer service goals.

Powerful Trends Pressuring the Supply Chain

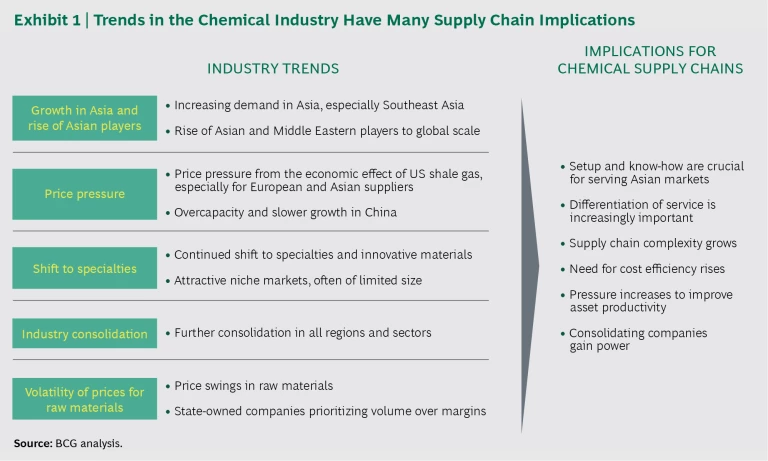

As the chemical industry globalizes, competition—particularly from Asia and the Middle East—is rising and the cost of raw materials is becoming more volatile, increasing the pressure on pricing. Simultaneously, customers are demanding better service from their chemical suppliers, a trend undoubtedly encouraged by service improvements that they have experienced when dealing with other industries. In addition, the industry is consolidating rapidly, as evidenced by pending mergers between industry giants Bayer and Monsanto, Dow and DuPont, and (most recently) Clariant and Huntsman. And chemical companies are moving toward increased segmentation in the way they manage their products, whether these are commodity products or innovative specialty products.

As they face greater pressure to reduce prices, companies must find new ways to make their supply chains more cost efficient.

These industry shifts put growing stress on chemical manufacturers and, in particular, on their supply chains. (See Exhibit 1.) As they face greater pressure to reduce prices, for example, companies must find new ways to make their supply chains more cost efficient. As new competition and harder-to-satisfy customers affect sales, chemical manufacturers must improve their customer service performance in order to differentiate themselves from their peers—and in particular from lower-cost players. And as leading players merge, other companies must respond to the consolidating companies’ greater market power by differentiating their service performance, reducing their working capital, and increasing their asset productivity.

The Supply Chain Differential

BCG has found that supply chain excellence and a strong customer orientation are true performance differentiators, creating substantial value for industry leaders. While chemical producers have invested significant time and resources in supply chain initiatives in the past, however, many still have considerable room for improvement, owing to the industry’s legacy infrastructure and its growing market and product complexity. Moreover, many companies have devoted inadequate attention to developing an in-depth understanding of their customers’ perspective. As a result, chemical companies often have high logistics and inventory costs, along with weak performance on supply chain metrics that directly affect the customer experience, such as lead times and delivery service. In contrast, leaders in supply chain excellence today incur lower costs and achieve higher levels of growth than their peers, with more efficiency and greater customer satisfaction.

As an example, we find that industry leaders in supply chain performance turn over their inventory 14 times a year, compared with only 6 times for those at the lowest performance level. Transportation costs are equal to 2.2% of revenue for top performers, compared to 3.6% for those in the lowest tier.

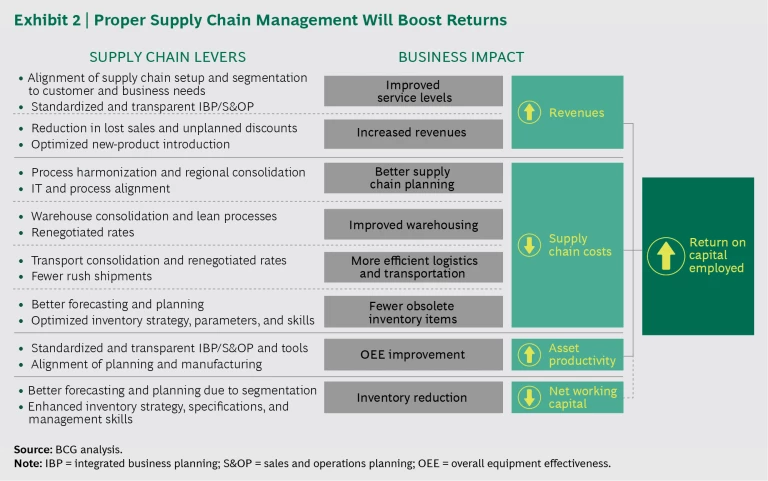

Although some of this variation reflects differing business models, regions, or product focuses, differences in the way chemical companies operate their supply chains are the primary determinant. By introducing lean processes, improving forecasting and planning, and consolidating their regional operations, companies significantly reduce their supply chain costs. Achieving unhindered alignment between planning and manufacturing enables companies to improve their asset productivity. And developing better inventory strategies helps businesses reduce their working capital, freeing up substantial cash. (See Exhibit 2.)

The last link in the supply chain, the customer experience, offers tremendous opportunities for improvement. In the past, R&D and the effective use of production assets—rather than market and customer orientation—have been the most prominent engines of success in the chemical industry. Today, however, positive customer experiences in more customer-centric sectors such as industrial services and online retail have raised expectations regarding customer service. As a result, all aspects of customer interaction—from making products and product information more readily available to providing updates on order status—are promising grounds for increasing differentiation and customer retention. Perhaps most important, the introduction of innovative business models and services enabled by digitization (many of which, such as shipment tracking, are already standard in other industries) can dramatically change the customer experience.

Note that supply chain excellence matters in both commodity and specialty chemical businesses, albeit for different reasons. Cost-efficient supply chains help maintain market share in commodities by keeping costs low, while strong customer service and short lead times support growth in specialty businesses.

Achieving Supply Chain Excellence

Companies that want to improve their supply chain performance need to understand the attributes of a truly excellent chemical supply chain. These attributes pertain not only to day-to-day performance but also to culture and leadership.

Outstanding day-to-day performance in chemical production naturally means complying with regulations and standards formulated to avoid health and environmental problems. It also means meeting customers’ needs and exceeding peers on critical performance metrics, which is why industry leaders make customers a strategic priority. Leaders also put a great deal of thought and effort into managing the distribution and placement of their products, identifying the optimal number of warehouses to maintain, and retaining control over their processes. Such efforts often go hand in hand with establishing clear responsibilities and interfaces in the supply chain organization. And finally, leading companies increasingly rely on digital technologies and data analytics to help run their supply chains efficiently and effectively.

Outstanding supply chain culture and leadership, in turn, translate into alignment within the company on strategic direction, goals, and performance initiatives across all functions. We also find that leaders in supply chain performance have a forward-looking mindset that allows them to focus on continuous improvement. Because they understand supply chain dynamics well, they can build teams that have the skills and knowledge to take the supply chain forward.

Outstanding supply chain culture and leadership translate into alignment within the company on strategic direction, goals, and performance initiatives in all functions.

For a company seeking significant performance improvement, a fundamental redesign of supply chain structures and processes will be necessary.

The Five-Layer Framework

To help companies determine how to achieve excellence in their supply chains, we have devised a framework of 20 elements arranged in five layers: strategy, network, organization, processes, and digital enablement. (See Exhibit 3.) The elements of this framework, which we developed on the basis of our experience with numerous supply chain projects across the chemical industry, cover all aspects of a world-class supply chain.

The elements demanding special focus will vary depending on the business context, the level of supply chain maturity, and the company’s ambitions. Companies should therefore consider the entire 20-element framework rather than simply targeting the most obvious or accessible opportunities.

Some of the most critical actions likely to be necessary are described below.

Strategy. Within the strategy layer, companies can take a major step toward supply chain excellence by creating appropriate product segmentation and then outlining segment-specific goals, policies, and processes. We recommend going beyond standard segmentation by commodity or specialty to differentiating by volume, margins, and life cycle stage. For example, companies can differentiate between stable high-volume products and sporadic smaller-volume products. Segmentation is particularly helpful in managing a large, diverse product portfolio because it allows the company to emphasize the most critical products and avoid devoting disproportionate resources to others.

Network. In many chemical businesses, the warehousing network, transportation flows, and insourcing and outsourcing of logistics have developed over an extended period, without review in light of today’s logistics marketplaces and service providers. For example, many companies operate on-premises warehouses at most of their manufacturing plants and use direct shipments to customers even for small orders. But companies that consolidate warehouses, introduce regional hubs, and develop clear outsourcing strategies can create substantial value by decreasing logistics costs and delivery lead times, and increasing product availability.

Organization. Two aspects of the organization layer are especially important. One relates to the roles, responsibilities, and interfaces in the end-to-end supply chain. Although many chemical companies have worked to improve key functions involving logistics, manufacturing, procurement, and sales and marketing, the interfaces between these functions are in many cases vaguely defined, which can create needless conflicts. Even within functions, we find that companies sometimes have misaligned local, regional, and global responsibilities. To counter such problems, we recommend that companies clearly define roles and contributions to essential processes and assign distinct accountability for goals and metrics. Doing so will create a strong basis for proper alignment of responsibilities and will support smooth operation of the supply chain from end to end.

A second essential aspect of the organization layer involves establishing clear key performance indicators (KPIs), targets, and incentives. At a minimum, we recommend finding agreement across management levels on key metrics of supply chain performance, in particular those that touch on reliability, responsiveness, and inventory levels. To achieve excellence, companies should also design—and make available—dashboards that people throughout the organization can understand. These dashboards should employ common definitions along with aggregations and drill-downs of metrics and target values.

Processes. Two aspects of the processes layer require special attention. The first is integrated business planning (IBP) or, more traditionally, sales and operations planning (S&OP)—the tactical, monthly process of coordinating demand and supply across all functions. IBP is critical in many chemical businesses because of the characteristic combination of long process times, large batch sizes, the need to avoid idling production assets, and the seasonality of demand for some products.

In our work with many chemical businesses over the years, we have noticed that companies often fail to prioritize IBP appropriately. Companies should ensure that meaningful information on previous months’ performance, demand forecasts, and supply constraints is available at the right level of detail. Advanced statistics and data algorithms are essential, as the resulting analytics can point to possible improvement in areas such as product segmentation and demand forecasting. In addition, companies should ensure that regular meetings occur, that discussions are forward looking, and that the process yields appropriate decisions.

Another critical process area for chemical companies is short-term operational planning, particularly with regard to inventory. Maintaining desirable amounts of inventory in the most suitable locations is a classic supply chain task, yet we find room for improvement at all stages—from raw materials and intermediates to finished goods. In response, we recommend building on the product segmentation devised in the business’s strategy work, establishing appropriate service levels, and applying advanced analytics models and other tools to set and manage simultaneous inventory targets at multiple stages in the supply chain.

Digital Enablement. Digital technologies play a crucial role in helping companies achieve supply chain excellence. Although IT and digital tools have supported supply chain processes for decades, today’s digital technologies provide opportunities for many innovative answers to difficult challenges. These technologies are based on a number of added-value, intelligent solutions—such as cognitive computing, the Internet of Things, and autonomous control systems—that support both decision making and operational execution. Not surprisingly, chemical companies have been adopting these new technologies at an accelerating rate in the past few years, with many large companies initiating digital programs that include a focus on supply chain topics.

We aggregate the new digital solutions into three areas:

- Transparency. These digital technologies increase transparency throughout the supply chain by linking internal and external data sources and meaningfully structuring information. They often have strong visualization and social media components that increase collaboration among supply chain workers, both inside the company and with partners. Such solutions can supply the company with dashboards and specifics on transport routes, for example—including expected arrival times, actual transport times, and on-time performance—by linking logistics providers’ data with the company’s transport orders and by giving online collaboration tools to all parties.

- End-to-End Planning. These technologies extend transparency, strengthen the planning process, and offer advanced decision-making support for the end-to-end supply chain. They can, for example, enable the company to see projected performance in specific areas of the supply chain, such as at individual distribution centers or manufacturing sites, and to determine optimal steps for improving that performance. Unlike traditional advanced-planning systems, these new tools are flexible and dynamic, allowing companies to set them up incrementally and alter them as necessary. In addition, these tools usually write planning decisions directly into the operative enterprise resource planning (ERP) systems, ensuring the execution of any adjustments.

- Specific Activities. These next-generation tools are tailored to address and execute specific supply chain processes. They include tools for warehousing, transportation management, and logistics handling and commissioning. Tools for specific activities often draw on multiple sources of data and provide intuitive, mobile-ready user interfaces. For example, new warehouse management systems gather detailed data on the status of warehouse operations and create a digital-twin model that gives operations managers visual overviews and advanced support for job scheduling and prioritization.

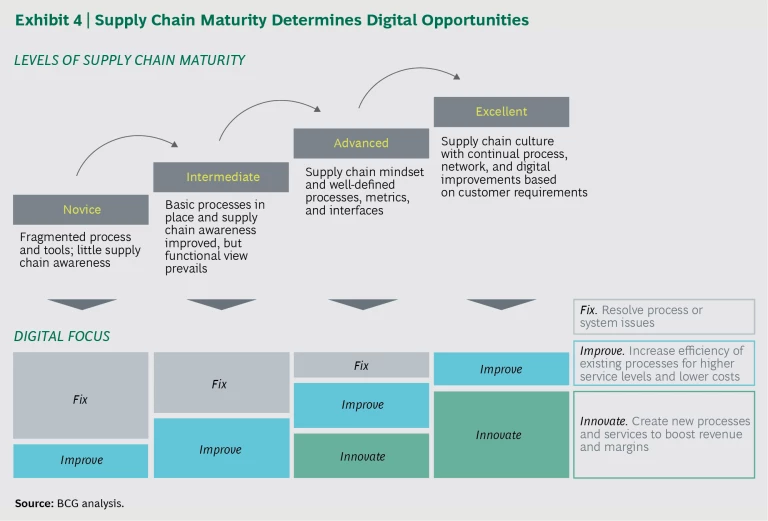

The most appropriate type and use of new digital solutions for a particular company will depend in large part on the maturity level of the supply chain.

The most appropriate type and use of these new digital solutions for a particular company will depend in large part on the maturity level of the supply chain. (See Exhibit 4.) In less mature supply chains, the infrastructure will not permit the company to implement state-of-the-art tools. Instead, the company will need to use digital solutions to handle basic tasks, such as filling in gaps in inventory or sales figures. It will also need to use digital tools to address previously ignored issues, such as poor data transparency or the need for storage repositories, or “data lakes,” designed to hold raw data in its native format.

At increasing levels of supply chain maturity and excellence, the digital focus naturally shifts from fixing process or system issues to improving existing processes. In more mature supply chains, for instance, digital tools can immediately begin to raise performance to new levels by introducing such benefits as real-time connectivity and social-media-like collaboration throughout the supply chain.

As supply chains move closer to excellence, companies will go beyond adopting measures that fix or improve existing processes to introducing solutions that create entirely new processes and services for customers. One popular example involves moving from demand forecasting to demand sensing—implementing big-data indicators and proxies to project future demand, rather than basing projections entirely on extrapolations from past demand.

Step-by-Step Transformation

Armed with a strong understanding of the 20 elements of the framework, companies should next identify priority topics for their specific situations. The first step is to comprehensively assess the supply chain on the basis of customers’ requirements, business needs, current trends, expected disruptions, and goals. This assessment will involve a thorough health check of the supply chain for each of the 20 elements and a quantitative review of performance metrics, including metrics pertaining to inventory, service, costs, and complexity.

To help perform such assessments effectively, we use standardized questionnaires, process reviews, and performance metrics that we have developed over the course of numerous projects with leading chemical companies. In addition, we rely on a comprehensive database of external benchmarks and best practices to enrich the assessment process. One specialty supplier used these tools to assess its supply chain, which had been growing increasingly complex over a number of years. The company found that three elements were critical in this transformation: product portfolio management, IBP, and digital tools. (See Exhibit 5.) But many other areas required substantial action, too, including analytics, digital skills, and flow of goods, as the differences between the “current performance” and “transformation goals” lines in Exhibit 5 indicate.

After completing its assessment, a company should estimate the size of the prize: the potential value of the overall transformation, including the financial impact of each targeted improvement in the supply chain and in customer service. Attaining the highest level of excellence in every supply chain element is rarely necessary.

The company can then outline a step-by-step transformation journey. This involves establishing a consensus with regard to performance gaps and goals, defining the levers needed to reach those goals, and then prioritizing these levers and packaging them into work streams.

We recommend approaching the transformation in waves—introducing one manageable set of actions at a time in agile sprints of six to eight weeks, followed by a broad rollout. The visible impact of these implementation waves will build powerful momentum for organization-wide change. Companies should also establish a project management office to monitor their efforts and to help coordinate work streams and track progress.

Bringing Everyone on Board

To maximize the likelihood of success as the transformation progresses, senior executives must work to alter mindsets and behaviors across the organization, ensuring that everyone is on board with new performance and customer service goals and ready to support the step-by-step supply chain endeavor.

Such efforts are more critical today than ever, given the growing importance of customer experience and of digital tools, which are now essential to achieving supply chain excellence. It will do little good for a company’s executives to implement new customer approaches or adopt new technologies if the rest of the organization has no idea why they have done so. Such changes are unlikely to endure if leaders or employees fail to see their importance. And today that importance could hardly be greater. Supply chain excellence is no longer a nice-to-have: it is a true performance differentiator.