In the B2B marketplace, mobile is moving fast. Despite the complexity of B2B purchasing, more and more buyers are using smartphones, and mobile’s influence is reshaping the B2B purchase pathway. This is creating substantial opportunities for marketers who get it right. Still, many have been slow to adapt.

New BCG research indicates that mobile’s effect on B2B buying, already significant, is set to accelerate. B2B marketing leaders are using mobile to engage customers, and it is having an evident impact, including reduced purchasing time and higher customer loyalty. Our research shows that for these leaders, mobile is already driving, or influencing, an average of more than 40% of their revenue—in industries that traditionally have depended much more on sales than marketing to generate revenue. Mobile speeds up time to purchase, particularly in more complex transactions, and a positive mobile user experience increases repurchase rates.

While many marketers point to a lack of direct evidence of mobile’s impact—citing factors such as insufficient research and customer insight, difficulties measuring mobile marketing performance, and low mobile conversion rates—it is becoming increasingly apparent that those not engaging customers on their smartphones risk losing sales and share. More shrewd and aggressive companies are establishing enduring customer relationships through mobile engagement that will be difficult for latecomers to dislodge. Since mobile plays a big role as buyers formulate their intent, slow-moving companies are in danger of being eliminated from consideration before they’re even aware that buyers are contemplating a purchase.

B2B mobile leaders are opening early and notable advantages by defying conventional wisdom about mobile’s influence in B2B, and what others need to do to catch up.

The New B2B Buyer

As prior BCG research has shown, there’s a new generation of B2B customers out there who do not expect, and in many cases do not want, to deal with a salesperson until it’s time to close the deal. (See “ How Digital Leaders Are Transforming B2B Marketing ,” BCG article, April 2017.) These new buyers look for the same digital experiences and features—including on their smartphones—that they encounter as consumers. Decision makers are increasingly supported by young, tech-savvy researchers, who commonly use mobile for work and multitask on more than one screen.

Today’s B2B buyers look for the same digital experience they encounter as consumers.

BCG recently researched the behaviors of both B2B buyers and marketers to assess the extent of mobile’s impact on buying behavior and the nature of the changes that mobile is driving. (See “About Our Research.”)

ABOUT OUR RESEARCH

ABOUT OUR RESEARCH

To better understand the impact of mobile (which for the purposes of this article means smartphone use) in B2B markets, Google commissioned The Boston Consulting Group to research and analyze the opinions and behaviors of B2B buyers and the current strategies and activities of B2B marketers. The industry sectors researched include hosting, networking, and cloud services; enterprise software; business services; industrial supply and electronic components; promotional products and printing services; and transportation and logistics services. BCG’s research included the following:

- An analysis of Google B2B search query trends

- A broad-based survey of nearly 3,000 B2B buyers, supported by in-depth buyer interviews

- Interviews with leading marketers, in-depth assessments of marketing performance in cooperation with select marketers who agreed to share their Google Analytics data, and a brief marketer survey with 140 respondents

In our research, BCG identified a small number of mobile leaders, defined as companies who met at least five of the following six criteria:

- They spend more than 25% of their advertising budget on mobile. (In fact, leaders’ mobile spending averages more than 50% while laggards’ spending is typically less than 10%.).

- They describe their mobile experience as strong or very strong.

- They use a revenue attribution methodology to measure ROI.

- They employ some level of mobile personalization.

- They invest in made-for-mobile content.

- They invest in site optimization for mobile (including test-and-learn strategies).

The results of our work have been discussed with Google executives, but BCG is responsible for the analysis and conclusions.

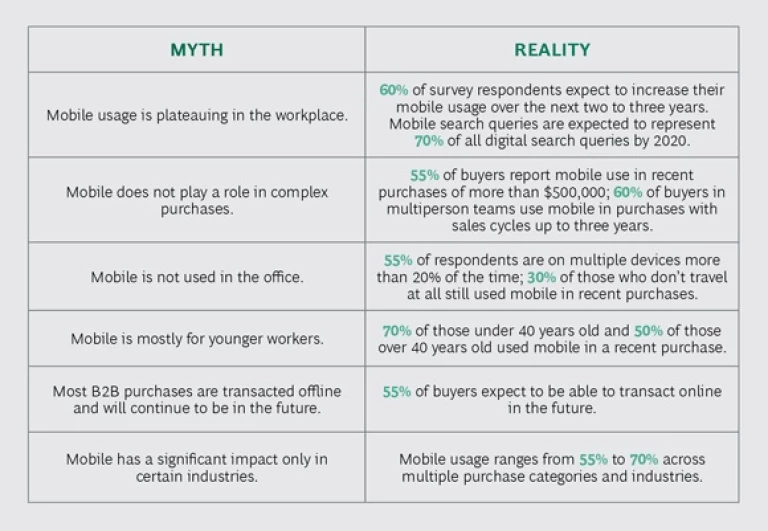

We found that the use of mobile is playing a central, and increasingly critical, role with buyers, particularly in the early stages of formulating intent. Overall mobile internet usage surpassed desktop and laptop usage in 2016, a trend that is spilling over to the workplace in both B2C and B2B. Increasing mobile use is blurring the lines between personal and work time as more employees work from home and people try to stay productive while commuting, traveling, or just away from their desks. As one senior vice president said, “Even when I’m at work in meetings, I’m searching on my phone while talking to vendors so I can move more quickly.” (See “Mobile Myths Dispelled.”)

MOBILE MYTHS DISPELLED

MOBILE MYTHS DISPELLED

BCG’s research found that 80% of B2B buyers are using mobile at work, and more than 60% report that mobile played a significant role in a recent purchase. Moreover, some 70% of B2B buyers increased mobile usage significantly over the past two to three years, and 60% expect to continue to increase their mobile usage.

At the same time, B2B online queries are shifting rapidly from the desktop and laptop to the smartphone. Google has found that about 50% of B2B queries today are made on smartphones. BCG expects that figure to grow to 70% by 2020. One reason: the amount of time spent on mobile devices at work is increasing. We estimate that mobile usage per B2B worker will increase by as much as 50% (from two hours a day to three) by 2020, driven by a combination of more “digital generation” (millenials, Generation Z) workers and the increasing use of smartphones by older workers.

While the number of actual B2B purchases made on smartphones today is still small, it’s growing steadily. Forrester Research projects that B2B e-commerce will exceed 12% of all B2B revenue by 2020. More important to remember, though, is that the majority of B2B purchases are already influenced by internet research, an increasing percentage of which is conducted on mobile.

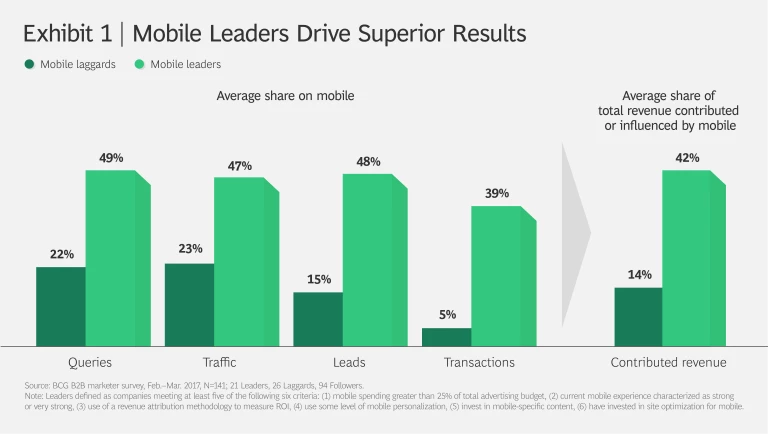

Early Leaders Show Results

BCG’s research clearly shows that B2B mobile leaders are generating higher levels of mobile engagement, as measured by search queries, site traffic, lead generation, and transactions. They are ultimately seeing a greater share of revenue that is mobile driven or influenced—42% on average. (See Exhibit 1.)

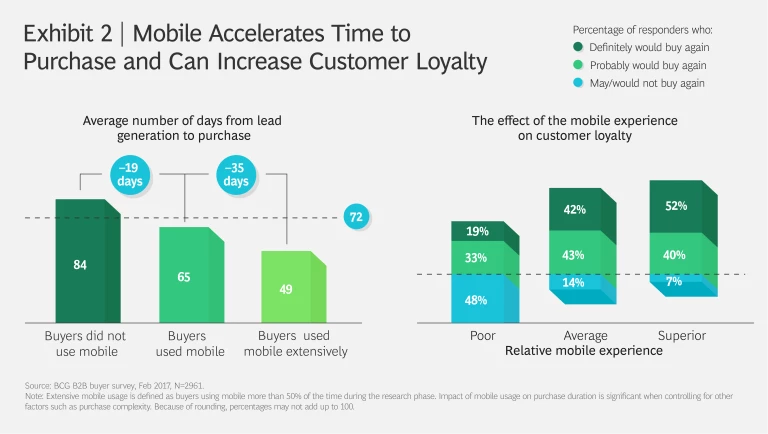

Our research also indicates that mobile speeds sales, which both accelerates revenue coming in and reduces costs. Mobile can accelerate time to purchase by 20% by increasing efficiency in decision making and enhancing team collaboration, particularly in more complex purchases. Buyers working through traditional channels who use mobile extensively spend an average of 49 days from lead generation to purchase; that figure rises to 84 days for those who don’t use mobile at all.

Mobile can accelerate time to purchase by 20%.

A positive mobile user experience can also build customer loyalty. More than 90% of buyers reporting a superior mobile experience say they are likely to buy again from the same vendor, compared with only about 50% of those reporting a poor experience. (See Exhibit 2.) For a B2B vendor with $2 billion in annual revenue, BCG estimates that the benefits from faster cycle times, (including the time value of money and sales and marketing efficiencies) plus higher customer retention, could be worth $30 million to $60 million in bottom-line impact, or 1.5% to 3% of revenue.

How Leaders Capture Value…

Leading B2B mobile marketers take a fundamentally different approach than other companies. They invest substantial time and energy in understanding their customers’ purchase behaviors and the role that mobile plays, including such factors as key engagement points, the roles of individuals on the buying team, and what kinds of content are most effective for each engagement point and role. These companies also typically pursue a well-articulated, mobile-first strategy (or at least put mobile on an equal footing with other channels).

Leaders focus on developing simplified mobile experiences designed expressly for smartphone users. They create content that is mobile friendly, including less text, a square and vertical (as opposed to horizontal) format, and an emphasis on video, infographics, and podcasts. User engagement also takes advantage of the unique capabilities and features of smartphones, such as location data, the camera, and the ability to make calls easily (by embedding click-to-call links). “Mobile is different than desktop—mobile is a distinct site with its own experience and content,” one executive said. “We use mobile as the hook. Desktop is a more of a research tool to do the tire kicking.”

Leading marketers also recognize that the volume of customer data available from mobile and other channels enables them to engage customers and shape the purchase journey from the earliest stages. A company can combine its own data—including from its mobile app and website—with relevant data from third parties, such as business partners and social media, to compile a comprehensive picture of accounts and of individual customers, including their priorities, needs, and interests. The best marketers have figured out how to handle personalization in this complex environment. They use data, technology, and advanced analytics to create sophisticated profiles for each customer (or team member, in the case of committee-based purchasing approaches). For this reason, they invest early in building an advertising and marketing technology backbone that can facilitate collecting, storing, analyzing, and acting on customer data.

…While Others Struggle to Climb the Mobile Curve

Most B2B marketers realize that they trail their customers’ adoption and use of mobile. One senior executive put it this way: “Our mobile site traffic is very low because we have not built a great mobile experience. We have at least moved to responsive design to ensure it renders properly on mobile—but that is clearly not enough.”

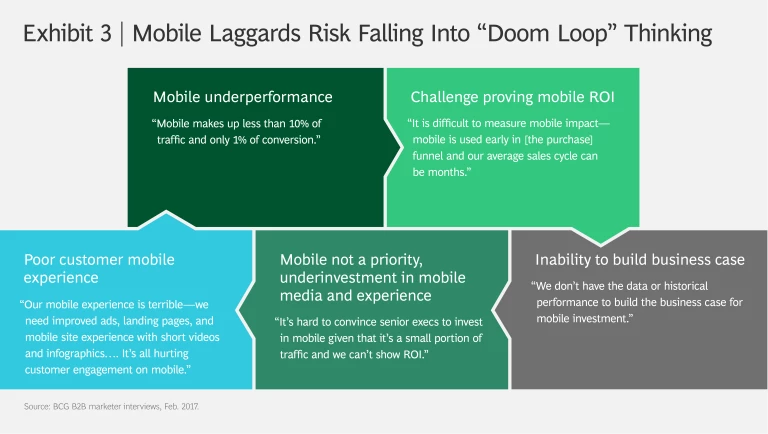

Determining how to respond to this shift in buying behavior is challenging, and few B2B marketers are satisfied with their current mobile strategy. These marketers typically say they are hampered by a lack of data, ineffective measurement, and inadequate mobile capabilities, skills, and tools. Many suffer from “mobile doom loop” thinking, which leads to flawed attempts to integrate mobile into the marketing mix. (See Exhibit 3.)

Marketers are also frustrated by lower conversion rates on mobile and the difficulty of tracking its impact across channels and devices. Focusing only on conversion rates will underestimate mobile’s impact by ignoring the platform’s particular effectiveness at generating leads, which are often later converted on a desktop, laptop, or offline. Some innovative leaders are using their internal business intelligence efforts and external B2B attribution technologies (such as BrightFunnel) to measure mobile’s impact more fully.

In our experience, many companies are underinvesting in mobile marketing, which can provide a much higher ROI than spending directed at desktops and laptops because of mobile’s underpenetration in B2B. Marketers can benefit by taking a test-and-learn approach to expanding their mobile marketing until they identify from actual experience the best mix of mobile versus desktop and laptop spending.

Mobile marketing can provide a much higher ROI than spending directed at desktops and laptops.

Because the effect of mobile marketing extends beyond the smartphone to the desktop or laptop, tablet, and offline sales, it’s important that this testing include these other channels. For example, the e-commerce division of one large industrial company was seeking to drive higher marketing ROI and determine the right amount of spending to dedicate to mobile. Using a regression-based approach to estimate mobile search’s contribution to overall revenue growth, including conversions that took place in other channels, the company found that ROI from mobile search was twice that from desktop and laptop paid search, after controlling for other factors. Because mobile search was making significant contributions to increasing sales, the company could increase its mobile spending and continue to improve overall ROI.

Developing the right employee skills can be a big challenge. Many B2B companies often don’t have the technical and analytical talent they need to design, execute, and track mobile strategies and campaigns, and these skills are in high demand in the market. Separate BCG research has found that most marketers give their companies poor scores on their mobile capabilities, as well as on their approach to testing, learning, and adjusting campaign execution systematically on the basis of this. (See “ A Disconnect and a Divide in Digital-Marketing Talent ,” BCG article, March 2017.)

Little wonder then, that in both B2B and B2C markets, the share of ad spending on mobile is considerably lower than the percentage of time users spend on the devices. Users spend about 25% of their total offline and online media consumption time on mobile, yet advertisers devote only 12% of their budgets to mobile, according to the annual report on internet trends by Mary Meeker of Kleiner, Perkins, Caufield and Byers. This gap is likely even larger in B2B, given that B2B typically lags B2C.

How Marketers Can Accelerate Mobile Efforts

Mobile will clearly play different roles in different B2B business models, which vary by company and industry. But no B2B marketer can afford to ignore mobile’s expanding influence. It’s increasingly clear that mobile will have a transformative impact across all industries.

B2B marketers need to integrate mobile into the overall buying experience. Smart marketers recognize that the smartphone user experience is different from that of the desktop or laptop. BCG’s study found that B2B buyers want a fast, efficient, and productive mobile experience. This means quick-loading mobile websites and app features, more B2C-like content, and a more seamless and integrated experience across channels. Mobile web and app experiences need to be simpler, data entry needs to be limited and easy, and content should deemphasize text in favor of other formats such as video, infographics, and audio (such as podcasts).

Other factors come into play as well. Since B2B buyers use their phones to engage early in formulating buying intent, search, video, email, and social media are all important functions for marketers to get right in a mobile context. The B2B purchase process can be long and complex, so high-quality, personalized content, delivered throughout the buying journey, is an important differentiator. And because B2B purchasing is often team-based, mobile can play an important role in enhancing team communication and collaboration as well as decision-making efficiency.

The success of B2B mobile leaders, and the approaches and techniques that they employ, illustrate clear calls to action for B2B companies that don’t want to be left behind. These include:

- Address buyers where they are spending their time: the balance of digital usage—on-the-go and in the workplace—is shifting dramatically to mobile.

- Work to understand shifting customer behavior and mobile’s role, including key touch points and buyer expectations and needs.

- Invest in creating a great mobile experience for customers (before they find other companies that have).

- Recognize mobile’s impact, especially early in the purchase journey as customers formulate intent; last-click attribution will always undervalue mobile.

- Track the buying experience across media and devices: accurate measurement has its challenges, but it can be done, and the technology and tools are steadily getting better.

- Test increased investment in mobile advertising; learn what works and adjust strategy accordingly.

- Adapt technology and data collection to a company’s business model and size; using the right data and tech tools well can be a competitive differentiator.

The speed at which digital technologies drive change tends to punish those who follow a wait-and-see approach. As we have seen with each wave of technology adoption, leaders typically outperform laggards in revenue growth and share gain. So it is with mobile in B2B. Mobile leaders are already building stronger, deeper, and more lasting customer relationships because they are engaging with customers in the ways that the customers prefer. The data that early movers are collecting and the experience they are gaining in personalizing mobile engagement will make it difficult for laggards to regain lost ground. B2B marketers need to embrace mobile or be left behind.