Over the past decade, the manufacturing networks at many medical technology companies have gotten bigger but not necessarily better. Although medtech companies have grown dramatically, both organically and via acquisition, few companies have altered their fundamental manufacturing strategy—largely owing to regulatory hurdles and the cost of changing production sites or processes. Meanwhile, the manufacturing environment is evolving rapidly. Medtech manufacturing networks are emerging in low-cost countries, technology is improving production processes, and contract manufacturing organizations (CMOs) have become far more capable. Companies in other industries have capitalized on similar shifts, yet most medtech firms have not. Today, it is essential that medtech companies rethink their manufacturing strategy in light of these changes.

The medtech industry faces slower growth in mature markets, declining rates of innovation, pricing pressure from payers and providers, and increased competition from low-cost players in developed and developing markets. Medtech manufacturing is therefore at an inflection point. Optimizing the manufacturing network is one critical way to manage these challenges.

To get a clear picture of the industry’s progress over the past decade, we conducted a detailed analysis of medtech companies’ manufacturing networks. We found that most companies should seize the opportunity to rethink their manufacturing strategy in order to produce goods more cost effectively and thus maintain margins. Smart changes in strategy will also improve companies’ responsiveness and flexibility, and better position them to meet their larger strategic goals. To capture this opportunity, companies need to consider a range of complex factors, including labor and logistics costs, labor capabilities, CMO capabilities, and new manufacturing technologies.

Growing Challenges

From 2000 to 2008, the medtech industry enjoyed tremendous sales growth and extremely high margins. Since then, however, it has settled into a period of significantly slower growth—about 4% per year since 2008—and increased pricing pressure. Clinicians have less influence on purchasing decisions as providers consolidate and as centralized procurement entities negotiate for larger purchases at volume discounts. The shift to value-based care affects margins across health care systems, for providers and manufacturers. R&D productivity has declined, and established commercial models—most of which rely heavily on well-compensated sales reps with deep product expertise—are giving way to new models that depend less on relationships and more on product attributes and pricing. In the aggregate, these changes are exerting sustained pressure on medtech companies’ profit margins. (See “ Medtech Companies Need to Transform While Times Are Still Good ,” BCG article, July 2016.)

At the same time, new market entrants are bringing increased competition. Many of these newcomers are from low-cost countries and have devised extremely lean business models that emphasize low prices—a critical advantage for tapping into demand growth in emerging markets.

Despite the pressure to improve efficiency and thus sustain margins, medtech suffers from relatively low operational efficiency. Among similar industrial-goods companies in the S&P 500, medtech finishes at or near the bottom on several key operating metrics, such as asset turnover, days of inventory on hand, and cash-conversion cycle.

Key Findings from Our Analysis

Our recently completed study of the medtech manufacturing landscape analyzed a comprehensive database of FDA registration filings from 2009 to 2016 across all device classes and assessed how those filings had changed over time. We also surveyed medtech executives, asking them about their manufacturing strategies. Several key findings emerged:

- Medtech companies have not realigned their networks to take advantage of scale benefits. The number of FDA-registered sites has grown roughly in line with volume growth of the overall industry.

- Product and part complexity remains a challenge in the industry, as the number of registered products grows faster than overall industry volume.

- Companies are slowly shifting some of their operations to lower-cost countries, but medtech still lags behind other industries in adopting this strategy.

- Outsourcing to CMOs has increased significantly in the industry, particularly in therapeutic areas such as orthopedics, cardiovascular care, and neurology.

Manufacturing in Low-Cost Countries

As part of our analysis, we examined production sites for medtech products across geographic markets and therapeutic areas. In 2016, the medtech industry’s share of production in low-cost countries (24%) was lower than that of similar industries (35% on average). In 2009, its share was even lower (18%).

Increasing the percentage of manufacturing sites that a company operates in low-cost countries is not always the right strategy. The economic viability of a specific site depends on multiple factors, including lead time, the volatility of demand, the share of total production costs that labor accounts for, and logistics costs related to transferring products to customers. Often, manufacturing locally in developed markets is the optimal solution. (See “ Honing US Manufacturing’s Competitive Edge ,” BCG article, January 2017.) Yet for many medtech companies, manufacturing in low-cost countries to reduce costs is an attractive option.

During the period from 2009 to 2016, FDA registrations for sites in low-cost countries increased most significantly for low-tech commodity-type products that receive relatively little regulatory scrutiny. As of 2016, the medtech product categories with the largest share of manufacturing in low-cost countries were physical medicine (40%), general hospital products (36%), anesthesiology (29%), and ophthalmology (20%). By contrast, 3% or less of microbiology, hematology, and immunology products were manufactured in low-cost countries. The data indicates that companies tend to prefer low-cost countries for less complex, easy-to-manufacture (and potentially long-tail) products, especially if the manufacturing process involves a lot of manual labor.

Medtech companies vary widely in their use of low-cost countries for production. Some, including Teleflex, Roche, Stryker, Smith & Nephew, and Johnson & Johnson, have positioned at least 25% of their manufacturing networks in low-cost countries. Others, including Thermo Fisher Scientific, Siemens, and Tecomet, have placed no more than 5% of their networks in such countries.

China dominates low-cost medtech manufacturing, accounting in 2016 for about 78% of all low-cost sites for these products worldwide. That figure has more than doubled since 2009. Mexico, India, and Malaysia are distant runners-up. Overall, the US still accounts for the biggest share of FDA-registered manufacturing sites worldwide: approximately 40%.

Our analysis indicates that the impact of a country’s tax rates on where medtech companies choose to manufacture their products is negligible. The number of sites in low-tax countries has grown in line with overall industry growth. It may be that companies are addressing tax efficiency across the broader value and supply chain, and optimizing through tolling (executing some stages of production in favorable countries), locating purchasing organizations in such countries, or similar measures. Another factor is ongoing uncertainty about potential changes to global trade policies.

Contract Manufacturing on the Rise

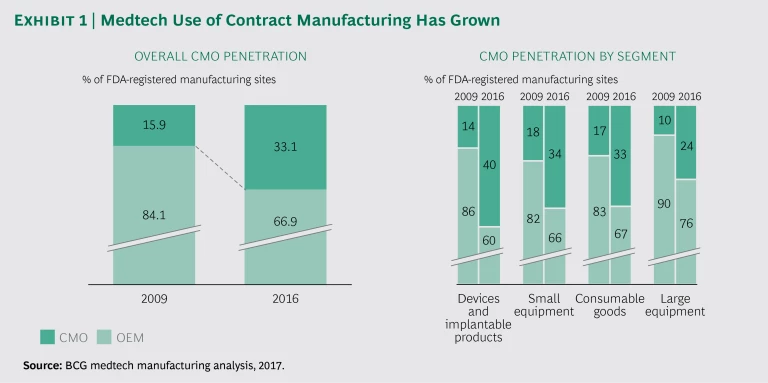

One significant trend is an increase in the share of CMOs in medtech manufacturing, from an average of 15.9% across all segments in 2009 to an average of 33.1% in 2016. All medtech segments saw an increase in outsourcing during that period, with the highest growth occurring in devices and implantable products. (See Exhibit 1.) The therapeutic areas that saw the fastest growth in CMO sites were orthopedics, cardiovascular care, and neurology; those where the growth was lowest were radiology, microbiology, and immunology, with growth well below the industry average in 2009 and remaining so in 2016.

Among the countries showing the fastest growth in FDA-registered CMOs were two low-cost countries (Poland and the Czech Republic) and two historically low-tax countries (Ireland and Switzerland). Yet all four are close to existing European manufacturing locations, suggesting that companies treat proximity and logistics costs as significant factors when deciding where to outsource production.

As a whole, the CMO market has grown faster than the overall manufacturing market, and the increased penetration is likely to continue, for several reasons. First, as smaller manufacturers increase their reliance on outsourced production, CMOs will respond by developing enhanced capabilities and turn-key solutions. Second, ongoing consolidation among CMOs is reducing the number of players overall but also creating a few relatively large players with strong capabilities and scale advantages among those that remain, and their improved features and extended reach make those CMOs more attractive as manufacturing partners. Third, some large, diversified CMOs (such as Celestica, Flex, and Jabil) are aggressively pursuing medtech—which has been a relatively small piece of their overall business—including through partnerships in early-stage product design and development. In the aggregate, these trends make CMOs an attractive option for larger medtech manufacturers that are looking for ways to outsource more volume, more complexity, and a greater range of functions across their supply chains.

The Challenge for Leadership

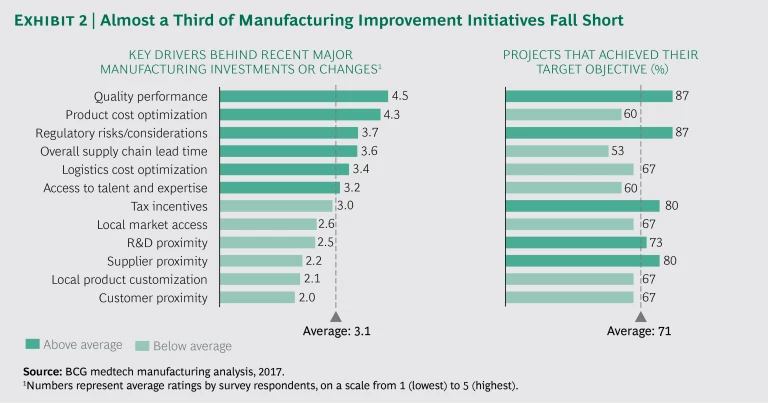

In our survey of medtech executives, 100% of respondents said that they evaluate their manufacturing strategy at least annually, and 80% said that they expect their networks to change in the next five to ten years. The main considerations shaping recent manufacturing network decisions are cost, quality, regulatory factors, and lead time. Yet despite the considerable attention companies are devoting and the measures they are taking to improve their manufacturing networks, these initiatives often fell short of their targets. Overall, only about 71 percent of such projects meet their objectives. (See Exhibit 2.) The upshot is that companies are trying but not consistently succeeding in this area, and they need to change their approach.

Keys to an Effective Manufacturing Strategy

Rethinking the manufacturing strategy in medtech is not an easy task. Each product category within each portfolio is unique, and no single strategy or approach is universally applicable. Yet maintaining the current approach simply because it is familiar is no solution either. Companies that systematically improve their manufacturing strategy can gain a sustainable advantage and thus mitigate some of the pressures they face.

As companies begin thinking about how to improve their manufacturing strategy, COOs and manufacturing leaders will need to consider several factors.

Labor and Logistics Costs. A decade or so ago, a clear line separated low-cost countries from the rest of the world. More recently, those lines have blurred. Although most of the growth in low-cost production sites since 2009 has been in China, wages in that country are rising, which is closing the cost gap and eroding the country’s advantage. Over the past ten years, China’s labor cost competitiveness has declined by about 36%. And when calculations include productivity gains, countries such as India and Mexico begin to look more attractive, as does the US.

For non-labor-intensive categories, other costs may be paramount. For example, utility costs are more than twice as high in some European and Asian countries as in the US, offsetting any potential savings on labor. And logistics issues—for example, the impact of long supply chains on lead time and reliability—can easily cancel out the benefit of lower production costs. For many products, proximity to the customer can offer additional advantages, such as input in new-product development.

Labor Capabilities. Besides gauging costs, manufacturers need to assess the capabilities of the labor force in a given region. This entails looking at factors such as level of training in production technologies, development programs for the future labor force, and proximity to research centers.

CMO Capabilities. As discussed above, the contract manufacturing landscape is evolving rapidly. In planning changes to their manufacturing networks, medtech companies should factor CMOs into the equation as potential partners capable of handling some elements of the process or a portion of the portfolio.

Manufacturing Technologies. A wave of new technologies is transforming the way factories work. Artificial intelligence, additive printing, augmented reality, the Internet of Things, and big data and analytics—technological advances collectively known as Industry 4.0—are upending traditional models for asset valuation and supply chain performance. These technologies have the potential to significantly improve medtech firms’ performance in these areas, making them more agile, more efficient, and better integrated across business units, geographic markets, and product lines. (See Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries , BCG Focus, April 2015.)

Many medtech companies have not yet embraced these technologies—in part because of the regulatory challenges they pose, and in part because the technologies themselves are advancing very rapidly, with new tools and players constantly entering the market. But staying on the sidelines is growing less attractive by the month, and forward-thinking firms have the opportunity to gain a first-mover advantage. In many cases, the new tools offer medtech companies greater manufacturing flexibility in dealing with variable demand (such as changing staffing requirements), adjusting manufacturing capacity, and accelerating the time to market for new products.

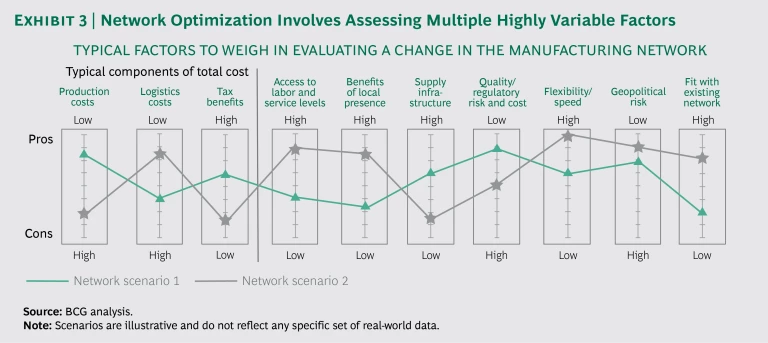

Because these factors are so complex and unsettled, companies need to develop a structured approach to developing and analyzing various scenarios and options. The goal is to determine not the universally “best” manufacturing strategy, but the strategy most compatible with the company’s objectives. The right scenario for a company aiming to optimize speed and responsiveness will differ from the right scenario for a company seeking to optimize cost. Exhibit 3 shows the factors that a typical manufacturer should consider in assessing potential changes in the network.

Incorporating technology and data analytics into manufacturing network decisions can help companies speed up the process and identify potential scenarios that they might not otherwise have considered. Best-in-class companies have incorporated big data optimization tools to run scenarios rapidly against bespoke criteria.

Although the medtech industry has changed dramatically in the past decade, many companies continue to take a status quo approach to their manufacturing networks. The resulting missed opportunity is significant and, increasingly, unsustainable, given the changes underway both in health care and in manufacturing. As they rethink their manufacturing strategy, companies have many factors to consider—and many ways to get it wrong, but also many ways to get it right. In short, it’s time for medtech companies to become more proactive and systematic about building the manufacturing network they need to thrive in a more dynamic and competitive market.