The airline industry is dominating the travel and tourism sector—outpacing hotels, cruise lines, and others in the sector in terms of value creation. North American carriers in particular have benefited from restructuring, scale efficiencies, and consolidation over the past decade, giving them a strong position and lower costs in a robust market.

The 2017 Consumer Value Creator Series

In 2017, The Boston Consulting Group conducted its annual study of the total shareholder return

From 2012 through 2016, the global travel and tourism sector delivered an average annual return of 19%. It ranked ninth among the 33 sectors we analyzed and second among the five consumer segments. (The others were durables, retail, fashion and luxury, and fast-moving consumer goods.)

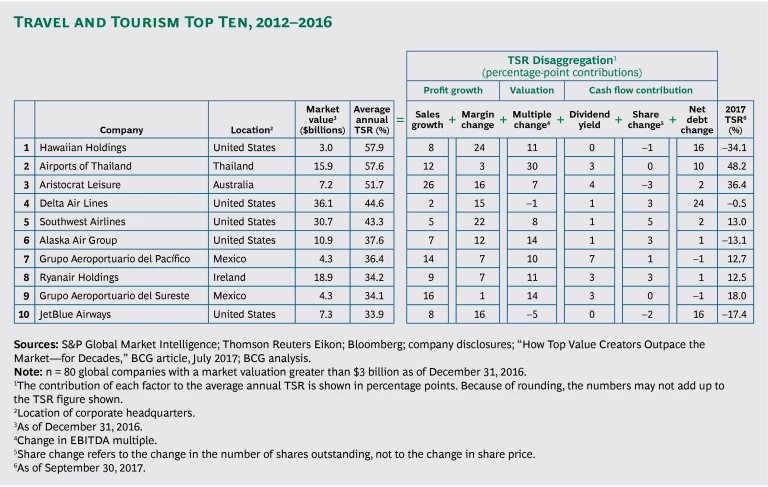

The Top Ten

Of the top ten performers on this year’s travel and tourism list, nine are in the airline industry and seven are based in North America. (See the exhibit.)

That includes five US carriers:

- Hawaiian Holdings, parent company of Hawaiian Airlines (which finished first)

- Delta Air Lines (fourth)

- Southwest Airlines (fifth)

- Alaska Air Group (sixth)

- JetBlue Airways (tenth)

It’s tempting to cite lower fuel costs as the reason for this collective strength, but that’s likely a subordinate factor at best. Lower fuel prices affect all carriers worldwide, not only those in the US.

Rather, the strong value creation has come more from increased scale efficiencies. Most US carriers have undergone restructuring efforts (some before the beginning of our five-year analysis period) to reduce labor costs and other expenses, and they are continuing their cost reduction efforts. In addition, they are currently much larger than most other airlines worldwide—in both fleet size and passenger miles—allowing them to capture significant scale efficiencies. For most of these US carriers, improved profit margins were the biggest element in value creation, with double-digit contributions to TSR.

(Notably, two smaller US carriers on the list, Alaska Air Group and JetBlue Airways, are both seeking to expand and capture scale advantages themselves. In 2016, Alaska bought Virgin America, an acquisition that JetBlue had been interested in as well.)

Over the past several years, Delta has posted extremely strong operational performance. According to industry yardsticks such as revenue per available seat-mile, on-time performance, and completion factor (which gauges the number of canceled flights), Delta has consistently been at or near the top of the airline industry. As a result, the company has achieved higher margins than its peers, and management has used the profits to pay down debt and buy back shares. Delta generated an average annual TSR of 44.6% over the five-year period of our analysis—24 percentage points came from reducing net debt, and 15 percentage points came from improved margins. It is an old formula but a reliable one: operational excellence leads to strong financial performance.

In addition to the several airlines on the list, three airport operators finished in the top ten: Airports of Thailand (second) and two companies in Mexico, Grupo Aeroportuario del Pacífico and Grupo Aeroportuario del Sureste (seventh and ninth, respectively). Although most airports in the US are operated through municipal authorities, many major airports in other countries operate as publicly held companies, which must attract capital and reward investors. For all three airport operators, valuation multiples were among the biggest sources of value from 2012 through 2016.

Lodging Companies: Slow and Steady

Notably absent from the top ten are lodging companies such as hotel chains. Within that category, the best performers were Marriott International (29th) and Inter-Continental Hotels Group (30th). Most hotels have an asset-light business model—they make a majority of their money from licensing their name and, in some cases, managing and operating properties that they do not own. This approach leads to stable, predictable financial performance—strong but not superlative value creation. And for the five-year window we analyzed, airlines simply outperformed hotels.

One issue that hotel operators need to contend with is pricing. Although hotel companies have started to consolidate, the segment is still highly fragmented, in the supply of rooms as well as in distribution channels.

Cruise Lines: A Need to Capitalize on Assets

As with lodging companies, no cruise lines finished among the top ten. Royal Caribbean Cruises was the best performer, ranking 22nd. There are several explanations for this moderate performance in terms of value creation. Cruise lines took longer than other travel and tourism companies to emerge from the financial crisis, and in 2012 (the first year of our analysis), the industry experienced several safety incidents and one major accident, all of which made headlines worldwide and reduced demand among passengers.

Since then, sales growth has come primarily from capacity increases, which lead to incremental gains but do not provide the kind of operational reboot that many US airlines underwent. In general, cruise lines are extremely asset-heavy operations, and they need to better capitalize on those assets. For example, they can generate more revenue from passengers through ancillary offers (as airlines have done) that increase the amount customers spend on their vacations and cruise lines’ share of that outlay.

Imperatives for Value Creation

Given the current market, travel and tourism companies that are seeking to improve their value creation should focus on three imperatives.

Own the customer relationship. Companies need to establish and develop a direct connection to travelers. That is harder in segments that generate much of their leisure and small-business volume through travel aggregators like Expedia and Priceline. The providers get the booking, but aggregators capture the underlying data—and thus the opportunity to build insights and develop richer customer profiles.

Capitalize on data to improve the customer experience. While most companies realize the value of data and are getting better at capturing it, few have taken the steps needed to use that data to improve the customer experience in meaningful ways. Most companies will likely start with their most frequent travelers—the ones they have the most data on and where the biggest potential opportunities lie. Ultimately, success will require that companies develop more sophisticated marketing and targeting capabilities. In addition, companies need to engage their frontline employees—the people who have the most direct contact with customers. Even with the best data, travel is still a service business, and employees can make or break the overall experience.

Improve operational performance. Companies in all travel and tourism segments should use North American airlines as a model. By taking dramatic steps to improve their operational performance, these airlines have sprinted to the top of the category in terms of value creation. As with the efforts to improve customer experience, this also requires concerted initiatives to engage frontline employees.

The travel and tourism sector’s strong value creation from 2012 through 2016 shows the power of getting back to basics. By improving their operational performance, North American airlines delivered outsize returns to their shareholders. The sector is going through dramatic changes—owing to technology and evolving consumer preferences—yet the fundamentals remain as important as ever: deliver a superlative experience for customers, informed by data, with efficient internal operations. As long as companies get that formula right, value creation will inevitably follow.