Primary-care clinics are growing in importance and can provide significant strategic and economic value for payers. Some clinics focus solely on primary care, while others are one-stop shops that offer both primary care and specialty services. The degree of care coordination also varies. In addition, many of these clinics provide comprehensive social support, such as free transportation.

In discussions with BCG, payers have shown significant interest in owning or contracting with clinics. Yet they have also expressed uncertainty about how to assess or capture the opportunities. Indeed, a large number of payers—from regional Blue Cross Blue Shield plans to national organizations—have clinic assets that vary with respect to their objectives and scope. Many payers have not articulated a clear strategy for their clinics or have failed to take a disciplined approach to execution that is consistent with their strategy. In some cases, they have fallen into the trap of trying to be everything to everyone rather than focusing on a clearly defined clinic model designed to address the needs of a specific population, such as patients with chronic conditions.

To find the right role for clinics in their broader strategy, payers must start by understanding the sources of value in these clinics and the types of care models. They can then focus on each model’s specific value proposition and the success factors for capturing the value.

The Sources of Value

Although the goals of better quality of care, enhanced patient experience, and lower cost of care are often discussed, they are rarely delivered. Across a variety of diverse markets, primary-care clinics can help payers to achieve these three objectives:

- Better Quality of Care. Clinics support payers’ efforts to coordinate care and guide patients to the appropriate location of care in a timely manner. Payers can also use clinics to align physician incentives with payers’ objectives for quality. Moreover, clinics enable payers to support physician performance and design care management programs personalized to each patient.

- Enhanced Patient Experience. Clinics can make it easier for patients to obtain care and do business with payers. They facilitate access through longer operating hours, shorter waiting times, and convenient locations. They also enable faster appointment scheduling with primary-care physicians (PCPs) and specialists. Some clinics make it easier and more attractive for patients to receive care by providing social support, including free transportation as well as social and recreational activities.

- Improved Economics. Clinics help payers avoid unnecessary costs by reducing the inappropriate use of services and enabling access to the right type of secondary care. They also promote greater revenues by attracting more members to a plan. Additionally, clinics help to generate higher reimbursements by enabling payers to perform more accurate risk coding and receive better star ratings.

1 1 Diagnosis codes are used to adjust revenue according to level of patient risk.

Some payers are already generating substantial value from clinics. For example, a payer that implemented a team-based model captured savings of more than $1,000 per member per month compared with the expected risk-adjusted spending. In addition, the payer achieved better clinical outcomes, including fewer hospital admissions and a lower amputation rate for diabetics.

The Care Models

To realize the promised benefits of clinics, payers must make a number of choices related to the scope of services they provide and the degree to which they coordinate care. Clinics with a limited scope of services focus on providing primary care and ancillary services (such as imaging, vaccines, and diagnostic labs), while those with broader services also offer specialty care for chronic conditions (for example, cardiology, gastroenterology, or endocrinology). Clinics with a low degree of care coordination collaborate or communicate with other care providers to only a limited extent and have little or no accountability for the effectiveness and efficiency of patients’ care. At the other end of the spectrum, clinics actively participate in or lead care coordination and have high accountability for care effectiveness and efficiency.

Applying these two dimensions—the scope of services and degree of care coordination—to a large sample of payer-owned or -contracted clinics, four clinic models emerge:

- Urgent- and Primary-Care Clinics. These walk-in clinics, such as MinuteClinics operated by CVS, treat minor injuries and illnesses. They are located in either standalone facilities or large retail stores or malls.

- Specialty-Care Clinics. These clinics provide specialty care in addition to primary care. The breadth of specialty services varies. The Metro Pavia Health System operates clinics that use this model.

- Team-Based Primary-Care Clinics. In the team-based model, clinics provide high-touch care that is coordinated by a team of PCPs, nurse practitioners, physician assistants, and case managers. High-touch care is a personalized approach that aims to build an enduring, trust-based relationship with patients. ChenMed, Iora Health, and Oak Street Health are among the clinics using this model. (See the sidebar, “A Closer Look at Team-Based Primary Care.”)

- Accountable-Care Clinics. These are one-stop-shopping clinics that provide highly coordinated, holistic care. Cigna’s Central Multi-Specialty Center is a leading example of this model.

A Closer Look at Team-Based Primary Care

For some payers, team-based primary-care clinics offer a strong opportunity to support growth and cost-containment strategies. Many of these clinics specifically target patients with chronic conditions in an effort to manage their costly and often avoidable medical expenses. Approximately 50% of the US population has more than one chronic condition, and these patients incur approximately 85% of health care expenditures. However, they often receive suboptimal care, owing to social conditions (such as isolation and poor access to transportation) and frustration navigating the health system. This results in high levels of preventable expenses, including costs for emergency room visits and hospitalizations.

To minimize preventable expenses, team-based primary-care clinics provide high-touch, holistic care enhanced with nonmedical services:

- High-Touch Primary Care. Intensive primary care focuses on the prevention of acute events. These clinics offer a personalized approach to care that aims to build a lasting, trust-based relationship with patients.

- Supplemental Clinical Care. High-touch primary care is complemented with a full team of clinical-

care professionals, including select specialty-care providers, psychiatrists, nurse practitioners, care coordinators, pharmacists, and social workers. - Care Coordination. Providers get to know patients so that they can identify clinical or social barriers to care. They support patient compliance with care requirements and help patients navigate the health system.

- Comprehensive Social Support. These clinics also seek to remove barriers to care compliance and promote positive outcomes by providing support that includes dietary guidance, free transportation, and access to social workers. In addition, they help educate patients about how to better manage their health.

The Value Propositions and Success Factors of the Care Models

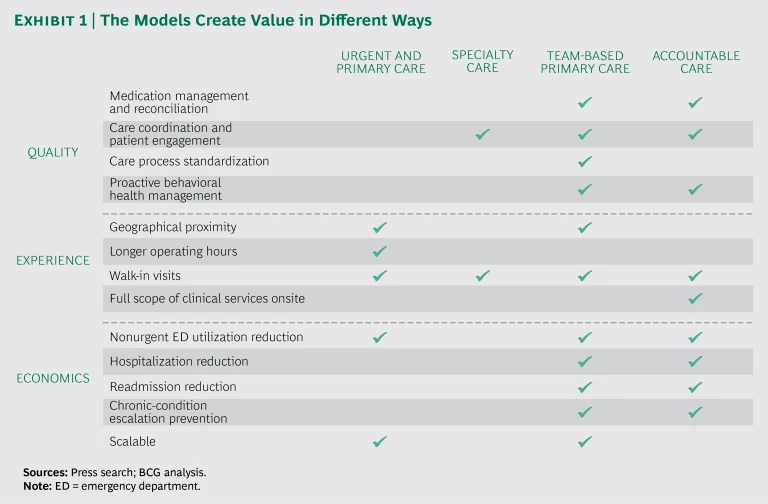

The value propositions differ among the models. (See Exhibit 1.) For urgent- and primary-care clinics, the value relates primarily to an enhanced patient experience. In specialty clinics, coordination of care helps to improve the quality of care and the patient experience. Both team-based primary-care clinics and accountable-care clinics promote a wide variety of benefits across care quality, patient experience, and economics.

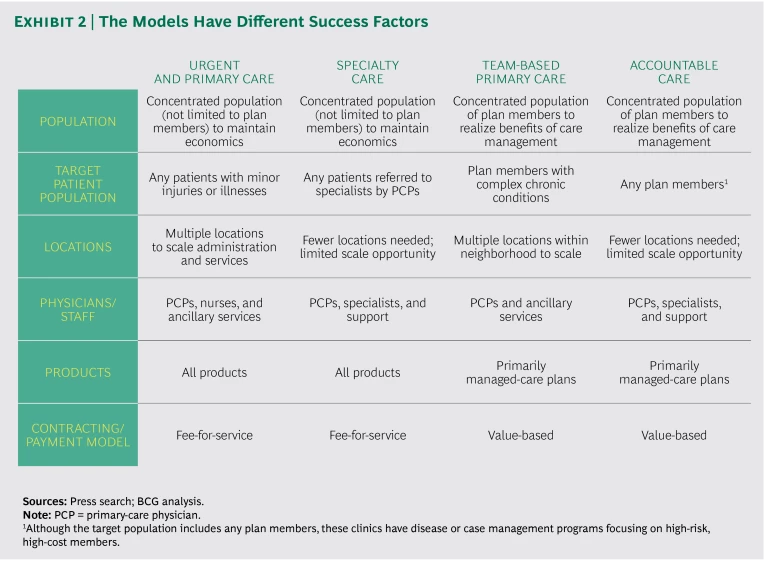

The success factors for implementing each model also vary. (See Exhibit 2.) The key distinction is that urgent- and primary-care clinics and specialty-care clinics typically serve the general patient population, regardless of the insurance product, and physicians are paid using a fee-for-service model. For these clinics to be economically viable, they need to be located in a densely populated area that provides a sufficient pool of patients. In contrast, team-based primary-care clinics and accountable-care clinics often serve only plan members. Consequently, these clinics need to be situated in an area that has a concentrated population of plan members. Physicians in these clinics are compensated through value-based payments. Scaling opportunities and staffing needs also vary across the models.

Capturing the Opportunities

To capture the value of primary-care clinics, payers must select a model that fully aligns with their broader care delivery strategy. At the outset, payers should quantify the value of implementing the proposed model and strategy as well as the key success factors involved. Over time, they should then track their progress in these areas. An ongoing evaluation enables course corrections and ensures that the clinics do not simply become a “shiny object” within a large organization.

Finally, payers must thoughtfully approach how they capture the opportunity. They need to consider the tradeoffs among the various options they could pursue—an outright purchase of existing organizations, a partnership, or in-house development. Successfully developing the chosen clinic model also requires new types of capabilities and talent within the organization. For example, payers need evidence-based clinical-care protocols, robust systems for electronic health records that enable extensive data collection, and enhanced population health management capabilities.

The prospects for primary-care clinics are bright. Payers that can find the right role for these facilities within their broader strategy stand to gain a substantial advantage in their markets.