The fashion industry has a clear opportunity to act differently, pursuing profit and growth while creating new value for the world economy. This opportunity comes with an urgent need to place environmental, social, and ethical improvements on management’s agenda.

In the past decade, the global fashion industry has been an engine for global development and has made progress on sustainability. Awareness of the need for continued improvement is growing, and individual companies are optimizing business practices to limit their negative impact. But to maintain its current growth trajectory, the fashion industry as a whole must address its environmental and social footprint. The earth’s natural resources are under pressure, and while the fashion industry is not the most obvious contributor to this stress, it is a considerable one. Moreover, social conditions in the fashion industry are far from those set forth in the United Nations’ goals for sustainable development.

The need to act differently is clear. The good news is that by changing practices, the industry can simultaneously stop the negative impact, generate a high amount of value for society, and safeguard its long-term profitability. We estimate that the industry has the theoretical potential to create €160 billion in annual value for the world economy by 2030.

Today the industry’s environmental and social pulse is weak. The newly developed global Pulse Score, a measure of sustainability for the industry, is only 32 out of 100.

Matching what the industry leaders are doing is not enough. Even under optimistic and ambitious assumptions, a catch-up strategy will capture less than half of the €160 billion of potential 2030 value. The industry needs to consolidate and realign its efforts and resources toward high-impact levers, with fewer and stronger initiatives. To get there, it must promote new operating standards and boost innovation across companies, geographies, and supply chains. In bringing together participants at every stage of the value chain, fashion can ensure strong growth far into the future.

The Case for Change Is Indisputable

Given current trends in population and GDP growth, The Boston Consulting Group (BCG) and Global Fashion Agenda (GFA) expect annual global apparel and footwear consumption to rise from 62 million tons to 102 million tons by 2030—a total that is the equivalent of 500 billion T-shirts. A number of planetary boundaries are already stretched, and this growth in fashion production will increase the environmental stress.

In our report Pulse of the Fashion Industry 2017 , we assess each major natural and social resource to project the fashion industry’s impact if it develops along current trajectories of production and consumption. If the industry manages to grow at the projected rate without producing a deteriorating environmental and social footprint, it may succeed in generating the total projected annual value of €160 billion—in human economic activity and in social and natural capital—for the world economy.

- Water is a key resource in fashion, both in cultivating the sources of natural fibers and in processing fabric. BCG and GFA project that the industry’s annual water consumption under current practices will rise by 50% by 2030—at which point the World Bank expects the global shortfall between demand and supply to reach 40%. If fashion can innovate and overhaul its practices in a way that keeps its water consumption constant, it will generate €32 billion in annual value for the world economy and protect itself from higher prices and supply disruption.

- Energy emissions, especially during the processing stages, represent an even bigger area for improvement. Already, the level of atmospheric CO2 is 20% beyond what is considered safe, and we expect fashion’s annual emissions to increase by 60% by 2030. Adopting measures that kept fashion’s emissions at 2015 levels would yield a €67 billion gain for the global economy.

- Chemicals are more challenging to track and assess. In fashion, relevant types include fertilizers, pesticides, dyes, and processing agents. Looking at occupational illnesses caused by carcinogens and airborne particles, we estimate an opportunity of €7 billion annually that could be achieved through advanced chemicals management.

- Waste constitutes a largely hidden opportunity. If the fashion industry continues its current practices, by 2030 its annual waste from production and consumer disposal will have increased by 60%. Today, only 20% of apparel is recycled at end of use, and most of that is downcycled into lower-value materials, as a consequence of inadequate technology. Assuming a linear production model, the industry could save society €4 billion per year by keeping the total amount of waste constant at 2015 levels. Far more savings are possible through closed-loop recycling.

- Wages are an immediate opportunity for betterment on the social side. In major textile manufacturing countries such as India, half of all workers are not paid the mandated minimum wage, which in many areas is well below a subsistence-level wage. The International Labour Organization reports on “extreme compliance” with minimum wages in the fashion industry, which it defines as 120% of what is legally required. If the industry were to keep the number of workers paid less than 120% of the legal requirement at its 2015 number while expanding its workforce to support the projected growth in volume, it would add €5 billion annually to the world economy through greater local consumption and private investment.

22 2 We do not recommend viewing 120% of minimum wage as representative of a living wage. Rather, we use the 120% level to show the general insufficiency of minimum wages as a guide to the level of wages needed to make a living. The 120% level is also advantageous because of the data available in ILO reports on wage compliance.

- Health and safety are areas of great opportunity as well. The industry has already made strides in improving the working environment in processing and manufacturing. But annual recorded injuries are still likely to rise by about 15% by 2030, and each injury risks shortened life expectancy and diminished family support. If the industry could reduce the incidence of injury to near zero, society would reclaim €32 billion per year.

- Community engagement is often overlooked, but each euro spent by brands on local spending initiatives increases the return to society through multiplier effects. If the industry raised its community spending ratio from the current 0.2% of sales to 0.7% (the UN-recommended level for governments in wealthy countries), society would gain €14 billion annually by 2030.

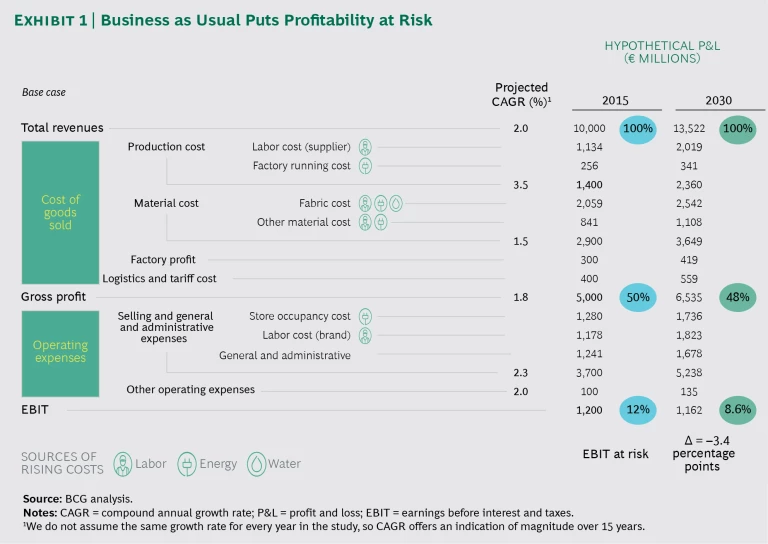

In addition to generating value for the world economy, such improvements would reduce the industry’s exposure to rising prices for scarce natural and human resources. Fashion brands' profitability levels are at stake if they do not take measures against likely price hikes in energy, labor, and other inputs. Their EBIT margin could fall by 3 percentage points, equal to €45 billion in monetary value, across the industry. (See Exhibit 1.) Hence the opportunity and the need for the industry to intensify and combine its efforts.

Variations in Performance

Not all fashion brands are equally responsible for the industry’s current status—and not all are equally equipped to reap the value opportunity outlined above.

GFA and BCG developed the Pulse Score to assess the fashion industry’s performance on environmental and social issues across companies and stages of the value chain. It includes a survey of industry executives to confirm and refine the Sustainable Apparel Coalition’s quantitative Higg Index, thus permitting an extrapolation of its findings to the entire industry. Fashion’s overall Pulse Score is 32 out of 100, indicating the large opportunity for improvement.

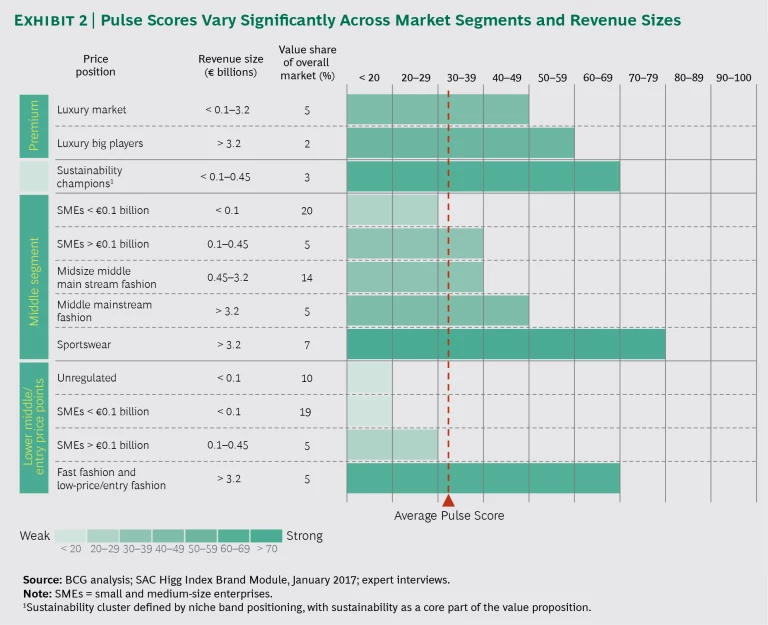

The disparity in performance on this measure from one fashion company to another is considerable. Conventional wisdom notwithstanding, sustainability is not a luxury that only premium-priced brands can afford. Company size, far more than price positioning, correlates with a higher Pulse Score. Nor is so-called fast fashion necessarily a threat to the environment and society: the high-street brands, typified by large entry prices, all achieve solid scores. The same is true for a few sustainability champions whose value propositions center on these concerns. (See Exhibit 2.) In contrast, small and midsize fashion brands (which collectively make up more than half of the industry) rate poorly. They constitute a massive blind spot and an opportunity: half the industry has done little to address these concerns and is not on track to do more.

European brands tend to score higher on environmental dimensions, while their US counterparts are more likely to follow social best practices. By type of ownership, family-owned firms perform better on these issues, while most (but not all) public companies tend to focus on maximizing short-term shareholder value.

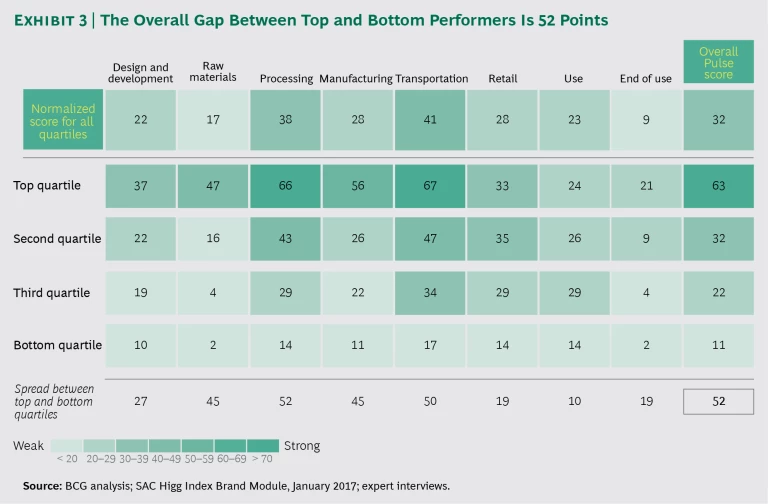

As for stages in the value chain, the beginning and end offer the most opportunity for improvement. (See Exhibit 3.) Design scores 22; raw materials, 17; use, 23; and end of use, 9. All of these areas typically get little attention from media, consumers, and even industry participants such as the designers.

At the middle stages, where the scores are higher on average (as the exhibit shows), the gaps in Pulse Score between the leaders and the following brands are large. On the transportation and manufacturing measures, the gap between the top and bottom quartiles is 45 and 50 points, respectively.

Brands perform relatively well within health and safety, which are subject to media and regulatory scrutiny. The chemical area is another relative bright spot, with a Pulse Score of 37, owing to regulatory restrictions. Waste and water management, meanwhile, receive little attention and are both at 20. In areas where good technology for addressing problems already exists, large differences emerge: the gap between the top and bottom quartiles is 58 points in energy, whereas in waste it is only 12. Such gaps show that considerable improvement is possible using current technologies and practices. To bring all of the industry to the level of best practices visible today, a number of immediate actions are possible. But even if the entire industry caught up to the best-practice front-runners, the full €160 billion theoretically available cannot be captured.

To move toward the level of improvement that the industry needs, it must undertake actions beyond what individual players can accomplish. The main challenges that it must meet in order to achieve this ambition are not individual commitment and action but leadership, collaboration, consolidation of resources, and innovation. In some instances, progress will become practical only in the aftermath of widespread industry adoption. It’s not enough for a few leading brands or sustainability champions to show proof of concept. The industry as a whole needs to demonstrate broad commitment and coordinated participation.

The Landscape for Change

To realize the large opportunity for the world economy and to safeguard future profitability, the fashion industry needs to take two kinds of steps. The first kind involves pragmatic, concrete actions that are already economically viable—and that leading companies already practice, as shown in numerous proofs of concept. The second consists of two leaps forward: innovating on the basis of exciting developments now being explored in research centers and test facilities, and collaborating to drive change throughout the industry faster and with more impact. To guide this work, the report presents a landscape for change that will support smart growth for the industry.

The landscape for change lays out a series of goals, each of which combines immediate actions with disruptive actions that depend on innovation and collaboration.

In terms of environmental changes, the following goals should be pursued:

- Closed-Loop Recycling. No value leakage; aim instead for measures such as one garment recycled for every garment produced.

- Sustainable Material Mix. For example, 100% sustainable fibers with a low footprint, to replace conventional cotton.

- Reduced Energy Footprint. Minimized energy consumption and 100% carbon neutrality.

- Chemical and Water Optimization. No hazardous chemicals and no water pollution.

- Production to Demand. No overproduction.

Social goals include:

- Rebalanced Industry Economics. Fair and equal pay and skill development for all workers.

- Health and Safety Excellence. 100%-safe workplaces fostering well-being and good morale.

- Advocacy of Human Rights. No human rights abuses and full rights advocacy.

Overarching goals include:

- Transparency and Traceability. Full visibility on all tiers’ supplier performance and conditions

- Consumer Engagement. Complete customer information on a garment’s life-cycle impact, environmentally and socially

- Novel Business Models. Full utilization of purchased fashion products

Moving toward these goals will help achieve the €160 billion annual opportunity for the world economy. In contrast, staying on the current path will put the industry at risk of significantly higher costs.

Assessments of business cases involving sustainability measures, along with a multitude of proofs of concepts, show that improving a fashion brand’s impact need not jeopardize profitability—and this is true without any calculation of the positive effect of such upgraded processes on risk management and brand building. For example, calculating the business case for energy efficiency reveals an improvement potential of about 1 percentage point EBIT.

A Call for Collaboration

The landscape for change is bold and ambitious, going well beyond what individual players have accomplished thus far and can accomplish going forward. The main challenge to achieve this ambition is not individual commitment and actions but leadership, collaboration, and innovation. How can the industry manage the collective effort to develop new solutions and scale promising technologies to commercial viability? Many of these ideas will become practical only with widespread adoption. It’s not enough for a few leading brands or sustainability champions to show proof of concept. We need the broad commitment and coordinated participation of the industry as a whole. With help from industry associations, consumers, and regulators, fashion can achieve the vision of a better industry.

The Regulator as Amplifier. Until now, aside from minimum wages and chemicals, fashion has faced little regulatory intervention. But this could change—and change suddenly—if public opinion begins to blame the industry for sustainability shortfalls. It is far better for the industry to take the lead and favorably steer the needed changes. Doing so would not only preempt unilateral restrictions, it could prompt supportive regulation that reinforces sustainability targets and incentivizes change.

The Consumer with the Power to Tip the Scales. Studies show that consumers are far more sensitive to environmental, social, and ethical concerns today than in previous decades. Farsighted fashion brands can join forces with consumers in a long-term push for better practices and transparency in the value chain. And through education, information, and incentives, consumers can gradually change their fashion consumption habits to reduce their own footprint.

Collaboration and Innovation Needed on an Unprecedented Scale. Individual brands, retailers, and stakeholder initiatives have shown impressive commitment and have achieved great progress. Best practices are available across all segments of the industry, and substantial innovations are emerging. Applying and implementing these advances will do much to improve the industry’s impact. But these alone are not enough. A collective effort with critical mass would enable the industry to make progress on major goals, such as establishing a unified standard for recycling.

An effort of this type would require a unified agenda with clear goals. It would be led by the large industry brands, which are ahead of the game with regard to environmental and social issues. The key is to set up an ecosystem that encourages all parts of the industry to collaborate on the major issues. Multiple-stakeholder initiatives, acting beyond commercial interests, can offer guidance and promote cohesion. But today’s scattered, fragmented array of initiatives, memberships, certifications, and so on can be confusing for brands, suppliers, innovators, and donors. Consolidation is inevitable as a means to focus time, energy, and money.

United around an agenda for change, the fashion industry can drive the needed systemic change and work jointly on disruptive innovation. As promising ideas emerge, companies can support pilot programs and then quickly scale them up to commercial viability. Such collective investments would drive down costs and enable the magnitudes necessary to move the needle—as can be seen in other industries where such practices are common.

Since its beginning—and certainly since the development of mass markets—the fashion industry has had its eye on the clothing lines to be launched next season. In the context of a world timed by seasons altered already by the heavy hand of humankind, the industry must now look still further forward.