Personalization is causing a seismic shift across the landscape of consumer-facing brands, and we are only starting to feel the shocks. Already brands that create personalized experiences by integrating advanced digital technologies and proprietary data for customers are seeing revenue increase by 6% to 10%, according to our research—two to three times faster than those that don’t. As a result, personalization leaders stand to capture a disproportionate share of category profits in the new age of individualized brands while slow movers will lose customers, share, and profits. Over the next five years in three sectors alone—retail, health care, and financial services—personalization will push a revenue shift of some $800 billion to the 15% of companies that get it right.

Here’s what the leaders are doing.

Digital Natives Have Built an Early Lead…

Digital natives have a head start because they have built their business models around collecting data and responding to customer needs. These companies build strong customer loyalty using both traditional vehicles, such as loyalty programs, and new models, like “free” and short-notice delivery, automatic replenishment, and other forms of convenience. The deeper direct connection enables digital natives to more fully understand what customers need and create new ways to serve them, both independently and by working with suppliers. Personalization will take another big evolutionary step as voice recognition and cognitive-computing systems gain mainstream traction.

In many consumer categories, high-value customers drive 70% or more of the value for companies. Brand individualization unlocks the ability to enhance loyalty with these (and other) customers by tailoring the brand experience to each contextual user journey. Even before Netflix made the jump from mailing DVDs to streaming movies and TV shows online, for example, the company was collecting data and using it to engage with customers about their viewing preferences. In March 2017, Amazon asked customers to choose its next online original series for production from five video pilots. Leading e-commerce players such as Amazon and Alibaba use customer data to continually tailor interactions and create powerful feedback loops. (See the sidebar, “Getting Personal at Alibaba.”)

GETTING PERSONAL AT ALIBABA

Tech giant Alibaba is known for being an e-commerce leader (the company had almost 450 million active buyers on its sites in the last quarter of 2016), but the company’s operations also include social media, e-payments, location services, and video and mobile offerings. Alibaba uses the data collected from billions of transactions across its platforms to create a variety of personalized experiences for customers.

For example, the company offers:

- Tools that enable merchants to tailor storefronts and products to individual customers

- Personalized search results, offers, and product recommendations

- Personalized newsfeeds, display ads, product reviews, and user-generated content to keep shoppers engaged

- Personalized sales experiences, with instant chat connections between sellers and buyers

- A mobile app, Miao Street, that lets merchants’ physical stores send personalized offers to customers who are in or near the store

- Personalized offers from stores and restaurants for users of Alipay, the payment app of sister company Ant Financial Services

Ant Financial, an Alibaba-affiliated company, has built a user base of 500 million consumers, 80% of whom were involved in two or more “consumption scenarios” in 2015 that focused on products and services from Alibaba and Ant Financial. Ant Financial aims to serve 2 billion customers globally in ten years.

Alibaba also provides personalized video recommendations and sharing on its social-messaging service, Sina Weibo, and personalized travel recommendations and experiences through the travel service Qingtingke, which uses data from Alitrip and Weibo.

Companies doing business on Alibaba’s platforms use these capabilities to boost their conversion rates. For example:

- German personal-care brand Nivea displays different storefronts depending on whether a shopper is a first-time visitor, new buyer, or loyal fan. First-timers and new buyers are shown low-cost products to trigger engagement; fans are presented with higher-value products bundled together to increase basket size. A/B testing found that after the personalization was implemented, Nivea’s browsing conversion rate improved by 70% and transactions increased by 150%.

- In a completely different category, Pampers saw a threefold increase in its conversion rate with targeted offers tailored to existing customers and new parents.

…But Traditional Brands Are Catching On Fast

Starbucks is in the coffee business, but since 2014, the company has had its customers playing games. Starbucks sends interactive games to loyalty program members through email and its mobile app. The games provide a fun way to reward loyalists and motivate them to try new products and visit stores more often. Since 2016, the games have been personalized—one customer at a time, using data gathered from past visits and digital interactions.

It’s a smart move and a profitable way to engage customers with the brand. The personalized games have helped to triple Starbucks’s marketing campaign results, double email redemptions, and generate a threefold increase in the incremental spending of customers who redeem offers. The results come with increased marketing effectiveness, enabling Starbucks to reduce its mass-marketing spending and invest more-personalized marketing dollars with the right customers, thus incentivizing the right behaviors. But Starbucks has bigger plans: it is developing one-on-one relationships at scale. It is individualizing its brand by giving each customer his or her own personalized experience that encompasses in-store visits, digital interactions, and even, potentially, products offered.

Starbucks is not alone. At Walt Disney’s Orlando resort, visitors use MagicBands to reserve rides, unlock hotel rooms, and make purchases; guests at Disney’s new Shanghai resort can do the same things with their smartphones. Disney gathers data from every interaction and uses it to serve up targeted offers to guests. Carnival is introducing “smart medallions” that use similar technology on its hundred-plus cruise ships.

Personalized marketing is a good starting point, but ultimately personalization is more than a marketing challenge. For incumbents to defend—and expand—share, they need to reimagine their business with an individualized value proposition at the core, merging physical and digital experiences to deepen their customer connections. They need to put brand individualization at the forefront of their strategy agenda to influence everything that they do, including marketing, operations, merchandising, and product development. (See, for example, “It’s High Time Airlines Got Personal,” BCG article, August 2016.) Many incumbents have significant strategic advantages over many digital players: they can merge digital and physical channels to deliver an integrated personalized experience, as Starbucks, Disney, and others are doing. (This is one reason why digital natives such as Amazon and Bonobos are establishing outposts in the brick-and-mortar world.) Brand individualization is about the future, but it’s taking place in the present; companies that are slow to act will see customer loyalty and sales decline.

Early Days, Big Expectations, and High Barriers

Expectations from personalization run high, and some companies are achieving eye-opening results—and establishing big leads of their own. Because personalization is about establishing individualized brand relationships, early leaders tend to lock in customers, heightening the barriers for those that try to follow.

A recent BCG survey of personalization programs at more than 50 companies in ten industries not only underscored the potential value to be achieved but also highlighted the execution challenges. The survey focused on companies’ personalization practices, capabilities, and value delivery. Two-thirds of respondents said that they expect at least a 6% incremental annual revenue lift from personalization, with companies in several sectors—apparel, financial services, grocery and wholesale clubs, and technology—anticipating increases of 10% or more; about a quarter of companies in those sectors have already achieved revenue increases of 6% or more. Many companies are making significant investments in personalization: half of the survey respondents have more than 25 employees dedicated to personalization programs and are spending more than $5 million a year on personalization campaigns.

At the same time, there is plenty of room to improve. Only about 15% of companies can be considered true personalization leaders , and most of them are tech companies and digital natives. Another 20% are experimenting with one-to-one campaigns (but only 13% say they deploy truly customer-specific individual messages, and only 7% manage fully integrated tailored communications across all channels). The remaining 65% are still using segmented marketing or even mass-market approaches.

Companies do face significant hurdles to realizing the full potential of personalization. These include the technical barriers that one might expect, such as poor data centralization (companies collect ample data, but struggle to aggregate it and form one universal view of each customer), legacy technology that doesn’t support one-to-one communication at scale, and insufficient measurement capabilities. Almost 60% of companies struggle to effectively measure and attribute the impact of campaigns, limiting their ability to learn from customer feedback and adapt accordingly—which is at the core of individualizing the brand experience.

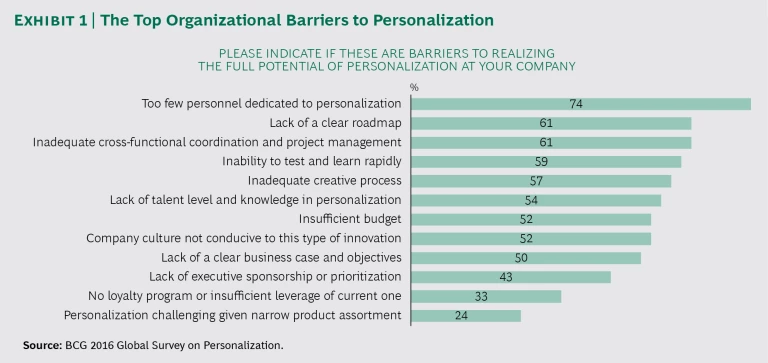

A lack of dedicated personnel is the most-oft-cited barrier (74%), but the majority of companies also face hurdles that are organizational and cultural in nature. These include insufficient cross-functional coordination (61%), inadequate creative processes (57%), lack of talent and knowledge (54%), and cultures that are not conducive to innovation (52%). More than 60% feel that they lack a clear roadmap, and half cite the absence of a clear business case and objectives. (See Exhibit 1.)

Four Keys to Getting Up Close and Personal

Our experience working with a number of personalization leaders shows that companies can overcome the hurdles and develop the ability to personalize at scale by executing an integrated personalization approach that is built on four pillars. (See Exhibit 2.)

Adopt strategic design. Personalization is not a series of fancy tech tricks to prove that things can be done differently; it is a solution to improve the customer experience. Disney’s MagicBands and Carnival’s smart medallions address customer pain points, such as long lines and slow company response times. Sephora offers a lipstick app that helps a customer find the best shade before going to the store and without actually having to try dozens of colors. True brand individualization requires an approach that is data-driven, consumer-centric—and grounded in everyday customer experiences.

Personalization leaders apply design thinking, a solution-based approach that looks beyond data insights to define customer value propositions that can be executed at scale; the fact that these are enabled by artificial intelligence, the cloud, and mobile technologies is secondary (although important). These leaders think across the full customer journey to identify opportunities for personalized offers or assistance. They use design thinking to help surface latent unmet needs and combine insights with analysis of the data behind behavioral and economic drivers. They can then employ the resulting synthesis to shape a differentiating set of customer value propositions that are reflected in their product and service offerings, customer experience, marketing, and membership and loyalty models. They ask questions such as, How do we reinvent the customer experience to radically reduce friction? What needs do customers have that they may not even be aware of? How should we have conversations with customers across their journey instead of pushing static campaigns? As answers to these questions accumulate, leaders prioritize opportunities for intervention based on pain points, need, or opportunity. They make sure that they are delivering personalization with a purpose, that each intervention delights or adds value for the customer.

Build data and analytics capabilities. To personalize at scale, it is essential to have the ability to both access and process large amounts of disparate data—including customer, transaction, and third-party data—on an ongoing, reliable, repeatable basis. However, harnessing data from internal and external sources and developing the necessary machine-learning algorithms to drive the right customer-level interactions are beyond most organizations’ current capabilities. More than half of the companies we surveyed believe that they collect the data they need but, to paraphrase many of the executives we surveyed, “We have the data, but integrating and using it—that’s the hard part.”

Most companies need to bolster their ability to extract value from their data assets by building proprietary data sets, securing permission from customers to collect and use their data, and entering partnerships to acquire complementary data assets. In addition, they have to build or acquire the tool sets, talent, and processes to extract signals from this data to drive personalized interactions. The lack of timely data use is also a major shortcoming: more than half of the companies we surveyed make limited or no use of real-time data. Successful companies commit significant staff and budget to multiyear projects to develop their analytics capabilities. They build internal knowledge and talent, and they work with external resources and partners across an ecosystem.

Transform technology. Part and parcel of developing the requisite data and analytics capabilities is building or acquiring a scalable technology platform. It should include a robust layer of application-programming interfaces that provide the flexibility to support existing and emerging technologies, such as voice recognition and augmented reality, and enable personalization in any channel or on any device.

This is a tough and time-consuming task, one that requires the collaboration of marketing, IT, and others. Plenty of help is available as new vendors proliferate; in the past two years alone, tech entrepreneurs have started several hundred personalization software companies. In addition, traditional tech companies continue to acquire startups and expand the roster of features they offer. The established cloud-based providers of marketing software and services are the most commonly used vendors, but no one leading player has emerged. And integration remains an issue. One retail executive told us, “We’ve ended up with technical soup—Franken-systems that don’t play well together.”

Enable new ways of working. Personalization is an inherently collaborative venture. As one marketing vice president put it, “You need to make sure the organization doesn’t get in the way.” Yet at 60% of companies, no one team is responsible for personalized cross-channel communication to consumers, and 54% of companies say they have no or low cross-functional coordination for personalization efforts. In addition, in a field where speed is essential, 57% of companies take three to six weeks to create a campaign (another 22% take several months) and up to four weeks to measure the results. More than half take one to four weeks or more to make changes based on the lessons learned.

Leading companies share some common ways of working: they collapse silos, create dedicated cross-functional personalization teams, locate all team members together, and work fast. Leaders also develop test-and-learn cultures, aligning marketing, IT development, and other functions in an agile model. Top performers run more than 20 sets of personalized-communication experiments per month and hone processes that execute and measure rapidly so that campaigns can be created in days and assessed in real time.

As always, leadership counts. Our survey found that at half of the top performers, the CEO and the board oversee personalization programs; that is the case at only about 20% of all companies.

Brand individualization offers companies the chance to engage consumers one-on-one and to build enduring—and self-reinforcing— relationships. The data and the technologies are already at work, and the quality of both will only improve. Leaders are showing what can be achieved and how to do it. The hurdles are significant, but the stakes are even higher. Companies that don’t want to be left behind should move quickly, before they discover that their best customers—the ones that drive the most value—have struck up a serious relationship with a rival.