One of the most powerful trends in the US consumer packaged goods (CPG) industry over the past few years has been the surging popularity of convenient, nutritious foods and beverages—everything from nut bars to protein drinks. But this does not mean that American consumers’ craving for indulgences has diminished. Sales of ice cream, spirits, wine, and salty snacks, for example, all grew by 4% to 5% at measured retail channels in 2016. That pace was about three times faster than growth in the overall US CPG industry, which experienced its most sluggish year since 2011.

Companies that satisfied one or the other of these seemingly conflicting desires were among the strongest performers in the US CPG industry in 2016, our research found. Some of the fastest-growing companies, such as Blue Diamond, Califia Farms, Bragg, and The Wonderful Company, are makers of plant-based beverages and snacks—one of the CPG industry’s hottest categories. Companies that satisfy Americans’ continued appetite for indulgences were also among the winners. Mars, Hershey’s, PepsiCo, Hostess, and Constellation Brands were top performers in 2016.

To capture these growth opportunities, large and midsize CPG companies stepped up their acquisitions of small, popular food and beverage brands in 2016. Johnson & Johnson, Hershey’s, Unilever, Constellation Brands, and PepsiCo were some of the top-performing CPG companies that acquired smaller players, especially makers of foods and beverages that contain natural ingredients and meet the needs of consumers in niche markets.

Growth Leaders Come in All Sizes

These findings are based on research by Information Resources, Inc. (IRI) and The Boston Consulting Group. For the past five years, IRI and BCG have analyzed the growth performance of more than 400 CPG companies with annual US sales of more than $100 million in the retail channels measured by IRI. These channels include grocery, drug, mass-merchandise, and convenience stores.

IRI and BCG generated three lists of growth leaders: small companies ($100 million to $1 billion in IRI-measured retail sales), midsize companies ($1 billion to $5.5 billion), and large companies (more than $5.5 billion). The analysis covered both public and private CPG companies and focused on what consumers actually buy in measured channels, as opposed to what factories ship. Companies were ranked on a combination of three metrics: dollar sales growth, volume sales growth, and market share gains. The study also analyzed the trends driving performance in the sector.

Among large companies in the analysis for 2016, the top growth leader, for the second year in a row, was Reynolds American (which recently acquired Lorillard), followed by Johnson & Johnson, Tyson Foods, Grupo Bimbo, and Mars. The leaders among midsize companies were Chobani, Hostess, Energizer Holdings, Constellation Brands, and Starbucks. Topping the growth leader list of small companies were BodyArmor, Idahoan Foods, Bragg, Bai Brands, and Daisy Brand. (See Exhibit 1.)

Our research also found that companies with sales of less than $1 billion boosted their share of the US CPG market from 25.1% in 2015 to 25.6% in 2016. Over the past five years, large companies have ceded over 3 percentage points in share—or about $20 billion in industry sales—to smaller ones. (See Exhibit 2.)

We found significant overlap between IRI/BCG growth leaders and CPG companies that are among the best performers in delivering total shareholder return, which measures the combination of the change in share price and dividend yield for a company’s stock. Of the top five US CPG companies in BCG’s most recent Value Creators series, which ranks companies by TSR over a five-year period, four are also on the IRI/BCG growth leader lists: Constellation Brands, Monster Energy, Reynolds American, and Tyson. (See “ Three Ways Nondurables Companies Can Create Value in a Tough Market ,” BCG article, December 2016.)

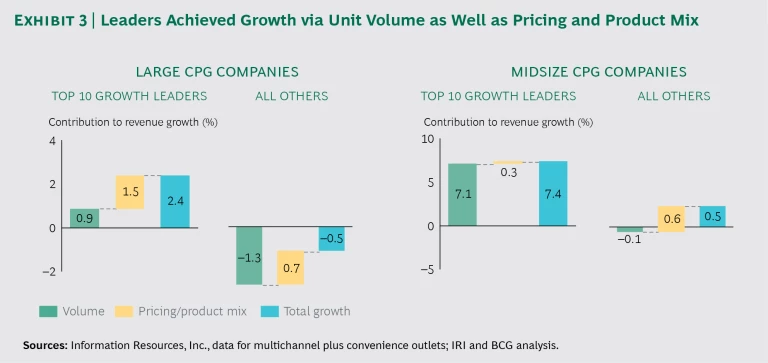

A number of companies that capitalize on the consumer trends we identified were able to achieve growth in an otherwise lackluster year for consumer packaged goods. US CPG retail sales rose by only 1.4%, to $681 billion, compared with 3.0% in 2015. Lower growth in prices—rather than lower unit sales—was a significant driver. Price growth dropped to 0.8% overall in 2016, largely because of shifts in prices for commodities such as milk and eggs, after rising to 2.3% on average in the previous four years. Rising online purchases also contributed to slower CPG sales growth in conventional retail stores. In sharp contrast to the rest of the field, the growth leaders were able to boost their revenue with growth in unit volume, as well as through pricing strategies and management of their product mix. (See Exhibit 3.)

Natural and Wellness Products Made Healthy Contributions

Plant-based food and beverage brands are also well represented on our lists of growth leaders. Califia Farms, for example, markets beverages with ingredients such as almond and macadamia milk, ginger, turmeric, and Central American coffee sourced by direct trade, as well as fruit drinks such as kiwi cactus and strawberry basil.

“Functional beverages”—nonalcoholic drinks promoted as improving health, boosting energy, or managing weight—also took off in 2016. Sales of convenient refrigerated yogurt drinks rose by 12%, ready-to-drink coffee by 20%, and refrigerated “other juice” drinks (a category that includes coconut water) by 24%. In contrast, sales of salty snacks and snack bars increased by only 4% and 3%, respectively, in 2016. The best performer among small CPG companies, for example, was BodyArmor, a premium sports drink brand distributed by Dr. Pepper Snapple that is promoted as natural and in which basketball legend Kobe Bryant is a major shareholder.

The desire for wellness carried over into personal care products; 2016 was a strong year as well for health and beauty aids and household products that boast natural ingredients. Personal care and household products with natural ingredients are projected to continue growing at a compound annual rate of 7% to 9% through 2020—roughly double the expected growth rate for such products overall. Aveeno Active Naturals skin and hair care products, for example, helped Johnson & Johnson become a growth leader in 2016. Huggies Nature Care diapers and Dove’s Men+Care Elements body washes and antiperspirants, which contain “ingredients inspired by nature,” contributed to the strong performance of Kimberly-Clark and Unilever, respectively.

Many of the 2016 acquisitions by large and midsize companies were of personal care or food and beverage brands with healthfulness and natural-ingredient themes. Unilever, for example, acquired Seventh Generation, a brand of eco-friendly cleaning and personal care products. Johnson & Johnson bought OGX, whose line of personal care products includes ingredients such as coconut oil, bamboo fiber, and tsubaki blossom. Dr. Pepper recently completed the acquisition of Bai Brands, whose line comprises enhanced water, carbonated flavored water, coconut water, and premium ready-to-drink teas. PepsiCo announced the acquisition of the KeVita brand of plant-based probiotic drinks.

Growth Leaders Know Their Customers Well

Our research shows that even in a sluggish market, growth opportunities abound for companies that understand evolving consumer preferences and build a strategy to capture the opportunities. Allying with or acquiring innovative small brands that have hit consumers’ sweet spot is one way for large CPG companies to stay in the game. The key to sustained success in this rapidly evolving market, however, is to follow consumers around the clock. Identify which goods they want—and when, where, and why they buy them. Then compete in the marketplace with the mentality of a startup, both through conventional channels and through e-commerce and social media. The CPG growth leaders of 2016 exemplify these strategies and traits.