Two key themes emerge from BCG’s ninth annual investor survey—with ramifications for senior executives as they develop and execute their value creation strategies. First, investors are increasingly concerned about valuation levels and potential macro headwinds. Second, investors want management teams to focus more strongly on creating long-term value than on generating near-term EPS growth. They are also clearly giving priority to increased investments in organic and M&A-driven growth over other uses of capital.

Over a two-week period during late October and early November 2017, BCG surveyed 250 investors who oversee approximately $500 billion in assets, soliciting their outlook on and expectations for the global macroeconomic environment, equity markets, and the continued ability of companies they invest in or follow to create value. Almost three-quarters of the survey respondents were portfolio managers; 63% focused on the US, while most of the others invested globally. Here is what we learned. Our findings are consistent with the consensus views expressed by investors in several hundred interviews conducted over the past year and in an investor panel discussion at BCG’s annual CFO conference in late September.

Growing Investor Concerns

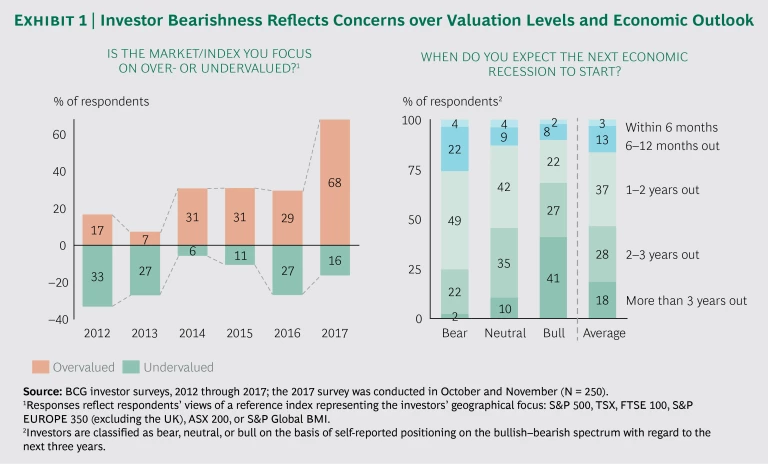

Overall, 68% of respondents think the market is overvalued—by an average of 15 percentage points. (See Exhibit 1.) This is more than double the 29% of investors in last year’s survey who thought the market was overvalued. Among self-described bears in the 2017 survey, 79% cited market overvaluation as the reason for their pessimism. Overall, more than a third of investors (34%) are bearish about the market’s potential for the next three years, more than doubling the 2016 survey’s percentage of self-described bears (16%).

Investors’ concerns are not limited to valuation levels. Almost a decade after the financial crisis struck, nearly 80% of investors expect a recession to start within the next three years, and more than half of all respondents expect one to occur within the next two years. (See Exhibit 1.) The most frequently cited reasons underlying this pessimistic outlook are macro factors such as rising interest rate levels (45% of bears), the US political climate (40%), and unstable geopolitics (31%).

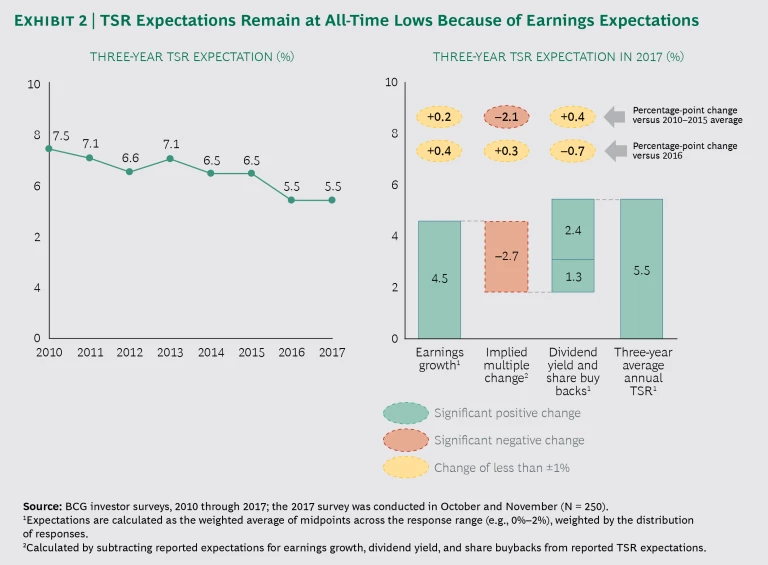

Perhaps the most striking statistic of all is that investors’ average three-year expectation for total shareholder return remains at last year’s record low level of 5.5% a year—the lowest percentage we have recorded since we began asking about TSR expectations in 2010, and close to half the long-term average TSR of 10% that companies have achieved over the past 90 years. Investors anticipate that 4.5% of the 5.5% expected TSR will come from earnings growth and about 3.7% will come from dividend payouts and share buybacks, which implies a 2.7% decline in valuation multiples on average. (See Exhibit 2.) Although these expectations are consistent with what we saw in last year’s survey, the expected multiple compression indicated by survey respondents this year is more than 2 percentage points higher than the average that investors projected in the surveys from 2009 through 2016.

Investors to Management: Focus on the Long Term and Growth

Against this backdrop, investors want management to adopt a longer-term perspective. They are looking for sustained value creation, but 88% of them believe that corporate management teams are focusing excessively on the short term, a 26-percentage-point increase from 2016.

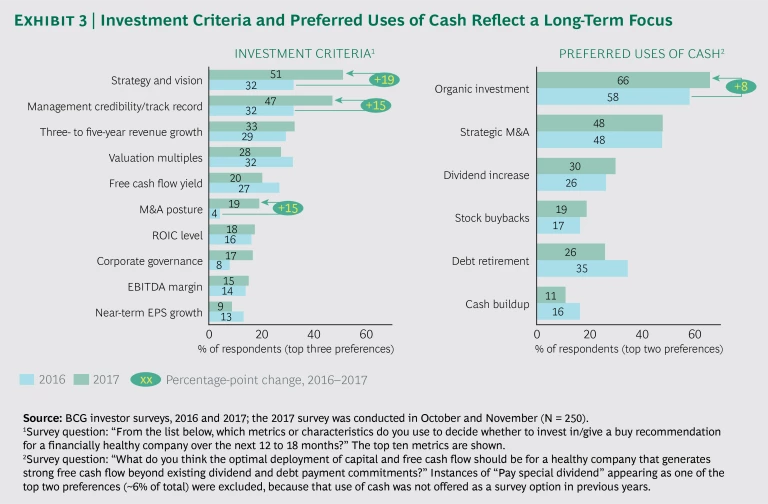

In fact, fewer than 10% of investors consider near-term EPS growth a key investment criterion; it barely makes their top-ten list. The vast majority of investors would rather see companies invest in future growth—both organic and through M&A—than have them use their excess cash flow for other value-creating purposes such as dividend payouts, share buybacks, or debt reduction. (See Exhibit 3.) The percentage of investors who cited investment in organic growth as one of their top two priorities has risen by 8 percentage points in the past year to 66%.

The reasons underlying investors’ thinking are clear. During the past year, in the face of accelerating change and disruption in many industries, investors have consistently expressed their concern over topline growth. Companies need to address disruption with investment in new growth opportunities. (See “ Creating Value from Disruption (While Others Disappear) ,” BCG article, September 2017.) In our view, the shift in capital allocation priorities toward organic and M&A growth investments reflects investors’ belief that growth will continue to be the most important driver of top-quartile TSR over the next five to ten years.

Given investors’ preference for a rebalancing of short-term performance and long-term value creation to give greater weight to the latter, qualitative considerations—such as investors’ perceptions of management’s vision and credibility, a clear strategy, and aligned processes—are playing an increasingly important role in investment decisions. In particular, investors want to see a stronger commitment from management teams to the goal of putting the company’s capital, capabilities, and resources to better use in value creation. They are looking for dedicated management teams with credible strategies and compelling equity stories based on strong fundamentals and intelligent capital allocation.

Asked to name the three most important metrics or characteristics they consider in deciding whether to invest in, or give a buy recommendation on, a company, 51% of respondents in 2017 cited business strategy and vision—the most in the survey and a jump of 19 percentage points over 2016. Almost half (47%) pointed to management credibility and track record, which is an increase of 15 percentage points over the 2016 figure.

Implications for Management

Management teams face a constant tension between meeting short-term expectations for EPS performance and taking steps—including making thoughtful investments—to set a foundation for strong and sustainable value creation over time. In today’s climate, with modest TSR expectations for the next few years, investors are looking for companies that will make long-term growth- and value-oriented moves a priority. Survey respondents pointed to specific areas in which companies they own or follow could improve, such as in capital allocation (40% of survey respondents), compensation and incentives (38%), strategy development and planning (37%), and value management (35%). And in a strong statement, 45% of respondents said they would welcome the presence of activist investors at companies they own or follow.

Almost a decade after the start of the last recession, it is more important than ever for management teams to strike the right balance between the near term and the longer term. When the next recession or correction occurs, a chasm could emerge between companies that investors believe have strong potential for value creation in the medium to long term and companies that investors feel are too focused on the short term. Investors are sending a clear signal to senior executives that aligning business, financial, and investor strategies, as well as strong management processes and systems, is essential. Companies that have shown a commitment to growth and long-term value creation are likely to be much better positioned to weather a shakeout or to outperform the competition in turbulent times.