Spend a day with the Hollister family. As a restaurant brand, think about how involved you are in all the food and beverage decisions they make.

Pasadena, California, Thursday morning: Halfway through his six o’clock run, George Hollister uses his smartphone to order black coffee for himself and a cappuccino for his wife, Melissa, to pick up on the way home. The app flashes an offer for double loyalty points if he adds a blueberry muffin. Cool. Blueberry is Melissa’s favorite. George activates the link, which also pays for the purchase. It’s as if they knew he’d be coming.

Melissa is rousting three sleepy teenagers as she gets ready for work. The Hollisters haven’t had a sit-down breakfast in years. On the bus, twins Wendy and Selena, aged 17, will order smoothies from a juice bar near their school. Stephen, 19, has an app that gives him choices from a dozen quick-service and fast-casual restaurants near his college campus.

At lunchtime, Stephen and his friends sit at campus picnic tables eating sandwiches and salads ordered on their phones. Some have their meals delivered. A few miles away, the twins hit a new organic-salad restaurant, where they use their phones to order—from the table. They use customer feedback to guide their selections from a continuously updated digital menu board. At his office, George scans menus on the Amazon restaurant website before deciding on gazpacho and a wrap from a place he hasn’t tried before. He orders and pays using his Amazon Prime account.

The Hollisters try to maintain the discipline of family dinner together at least two nights a week, but tonight is not one of them. George is working late. He orders dinner from UberEATS, this time from a local fish restaurant where he has been building up major loyalty points. He gets a special (and double points) on seared tuna—one of his favorites.

Melissa hosts a dinner meeting of her book club. She’s already ordered eggplant Parmesan, salad, fresh baked breads, and infused olive oils from a new farm-to-table restaurant with its own delivery service that she discovered on her go-to recipe storage app. She specifies the time of delivery for halfway through the book discussion.

Stephen is on his way to a friend’s apartment to watch a football game when his favorite pizza place pings him with an SMS reminder about its two-for-one game night special. He tells the phone’s voice-enabled assistant to order dinner for the guys.

Wendy and Selena eat on the run. Wendy and a friend order tacos and guacamole while they work on a science project. They take time out to play the restaurant’s new video game. Selena grabs a burger from her favorite quick-service place after soccer practice. The drive-thru camera recognizes her; she is offered a free dessert.

One day, five people, 15 meals (plus some for friends)—all searched for, selected, ordered, and paid for digitally. The Hollisters are fictional, but their dining habits are real—and practiced by millions of US consumers every day.

Digital Restaurants 2.0

Welcome to Digital 2.0 for restaurants—the next phase for the dining industry. Digital is disrupting every segment of the restaurant value chain—whether it’s in-store or consumer-facing technology or third-party insurgents, such as digitally enabled delivery services and aggregators. (See How Digital Delivery Puts the Restaurant Chain Up for Grabs , BCG Focus, January 2017, and Dining and Dollars: Directing Restaurants’ Digital Investments , BCG Focus, November 2015.) Many brands already find themselves playing catch-up, trying to meet rapidly evolving consumer expectations. And the experience of other industries shows that as digital penetration increases, from 5% to 10% to 20% and more, the rate of growth accelerates. The pace of change speeds up, too, with the emergence of new technologies such as artificial intelligence (AI) and new interfaces that will further redefine how brands interact with consumers, as well as the sources of competitive advantage.

This new digital reality can unlock significant opportunity. Brands that develop a digital game plan—and put the necessary investment behind it—open a big lead over the competition. Brands that fall too far behind will lose touch with the Hollisters and the growing number of consumers like them.

Digital Restaurants Today

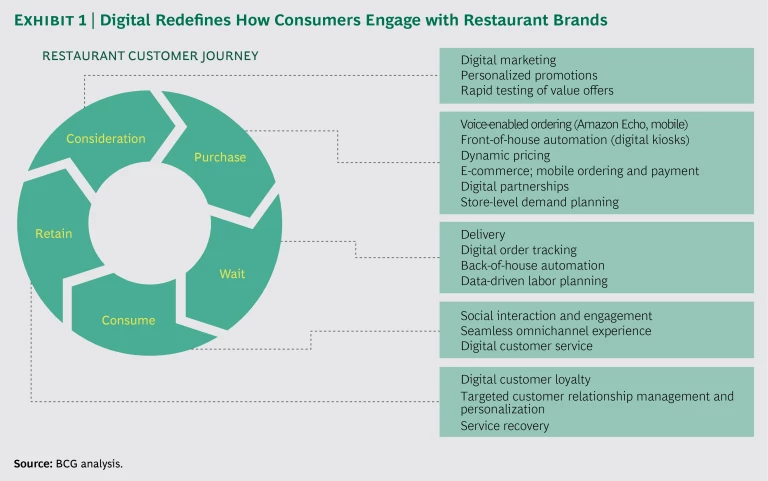

Digital is redefining how consumers engage with brands—and how brands interact with their customers—at every stage of the customer experience. (See Exhibit 1.) Consider some digital realities.

Responding to BCG’s 2017 survey of the restaurant industry, more than one-third of restaurant users ranked a digital source as most influential for discovering information about restaurants. And research has demonstrated that digital reviews have a real impact on sales.

Nearly 60% of restaurant users have downloaded one or more restaurant apps, and around 15% have downloaded at least three. In the two months before BCG conducted the survey, nearly 20% of all restaurant users had made purchases using a brand’s website, and nearly 15% had ordered using a brand’s mobile app. Four in ten restaurant users purchase food for delivery at least once a month.

Almost two-thirds of restaurant users are members of at least one restaurant loyalty program, up from 55% in 2014. Leading brands use the data gleaned from their loyalty programs to develop personalized offerings and experiences.

How about some first-mover facts?

Domino’s Pizza gets about 60% of its orders through digital channels. It has seen double-digit same-store sales growth in 8 of the past 12 quarters (and same-store growth of 6% or more in the remaining 4 quarters). On average, its share price has increased 40% a year since July 2012.

One-quarter of Panera Bread’s orders are digital. The company has an internal IT team that numbers in the hundreds. Panera 2.0, launched in 2014, was backed by nearly $100 million in the early years of rollout (including both corporate and franchise investment), with significant funds dedicated to both front-of-house (FOH) and back-of-house (BOH) technology and new customer-facing platforms such as mobile ordering and pickup. Panera 2.0 technology investments formed the backbone of the company’s rapid and successful entry into the delivery business, which is expected to be available in as many as 40% of Panera’s 2,000 locations by the end of 2017. Since mid-2015, same-store sales growth has exceeded the market average in all but one quarter. The company’s share price rose, on average, 30% annually from July 2014 through July 2017.

Starbucks makes nearly 30% of its sales digitally. The company has invested significantly in technology over the past eight years, including investments to build its mobile ordering and payment capabilities and to fund digital partnerships. It now offers a fully personalized experience for loyalty program members, including a curated concierge experience across every stage of the customer journey, from consideration to purchase—and even after purchase. On the company’s mobile app and website, each customer’s browsing experience is individualized with personalized product recommendations, deals, and offers. The average appreciation of the company’s shares was approximately 20% a year from July 2012 through July 2017.

Digital Restaurants Tomorrow

More change is coming. Restaurant brands must increasingly go head-to-head with digital natives as the competitive set expands. The rapid rise of delivery services is bringing third-party and digital-first players, such as delivery aggregators DoorDash, Postmates, and Grubhub, into the market. Delivery has also introduced competition from logistics and digital giants such as Uber and Amazon through UberEATS and Amazon Restaurant.

Most recently, Facebook announced the launch of a US food order and delivery service. Services such as OpenTable are disrupting the reservations process and inserting themselves between brand and customer. Meal kit operators such as Blue Apron and HelloFresh blur the lines between restaurants and in-home dining. Amazon’s $13 billion acquisition of Whole Foods shows how quickly the lines dividing e-commerce, grocery, and restaurants continue to blur.

In response, restaurant leaders are spending more on digital marketing and shifting money and resources from traditional digital channels (such as banner and display advertising and search engine optimization) to mobile and social channels with a focus on performance and targeted marketing. Best-in-class restaurant brands are spending 30%, 50%, and even as much as 90% of their marketing budgets on digital.

Among other objectives, brands are looking to digital and other technology innovations for help dealing with rising costs. Those that have implemented basic efficiency enhancements in BOH technology are now experimenting with advanced automation of other in-store tasks. BOH technology, a mobile app, and a digital loyalty program have become table stakes capabilities. To stay relevant to consumers, brands need to invest in the next phases of digital development in e-commerce and personalization.

To improve operations planning, top players are using data science and advanced algorithms based on a broad set of inputs to more precisely predict throughput times, often within seconds. A few companies are experimenting with AI algorithms that use real-time store-level reporting and data on weather, local events, and traffic to improve demand forecasting for better efficiency and to control customer expectations through more accurate predictions for when orders will be ready.

Multiple brands have already incorporated voice-enabled ordering capability into their mobile apps. It’s not a big stretch to imagine voice technology redefining the drive-thru experience. Drive-thru is especially relevant for quick-service restaurant (QSR) brands, for which it can represent as much as 70% of the sales mix. Labor savings for a large brand could run into nine figures.

Small brands, which can innovate rapidly without being constrained by legacy systems, are pushing digital applications even further. For example, Zume Pizza’s Baked-on-the-Way trucks, which have intelligent ovens on board, deliver hot, freshly baked pizza to customers. Briggo sells made-to-order coffee beverages at automated coffee-vending kiosks. CaliBurger, a California-based QSR chain, is replacing staff with burger-flipping robots at 50 of their units. It’s too early to know which initiatives will be successful, but some of these changes are all but certain to shake up the market.

More distant, though no less likely, is the prospect of delivery using autonomous vehicles—either the brand’s own or those of a third party, such as Uber or Lyft. Or robots: Domino’s, which has tested robot delivery in Germany, recently announced a partnership with Ford to test delivery using driverless cars in the US, and Yelp’s Eat24 delivery service has tested robots in select San Francisco neighborhoods. Drone delivery is also being tested by multiple players.

A Widening Gap

The restaurant brands that are pursuing digital as an offensive strategy are seeing bottom-line benefits and opening up leads over the competition. BCG’s 2015 Digital Strategy Survey of digital decision makers found that restaurant brands that used digital as an offensive play had seen, on average, 5% annual growth over the previous five-year period, while those that used digital as a defensive necessity had seen only 2% annual growth over the same period.

Faster growth is one big reason why more brands are getting into the digital game—and playing offense. McDonald’s, for example, has invested significantly in digital technologies and plans to offer mobile ordering and payment capabilities, including an option for curbside pickup, throughout the US by the end of 2017. The company is digitalizing the in-store experience through its Experience of the Future initiative, which will include in-store ordering kiosks: about 2,500 stores will have Experience of the Future by the end of 2017.

Earlier this year, McDonald’s announced a delivery partnership with UberEATS. Approximately one-quarter of its restaurants are already using the delivery platform, and the company estimates that about 70% of deliveries will represent incremental business. In many of McDonald’s markets worldwide, average delivery order amounts total 1.5 to 2 times overall restaurant averages.

Chick-fil-A One (the company’s mobile app) offers pay-in-advance capability and free food through personalized offers. The company uses GPS to track orders so that they are cooked and ready when customers arrive for pickup. Wingstop Restaurants’ virtual ordering assistant, Wingbot, lets customers place orders with text messages, Twitter, Facebook, or Alexa. More than 20% of Wingstop’s orders flow through digital channels, and the company is testing delivery partnerships in pilot markets.

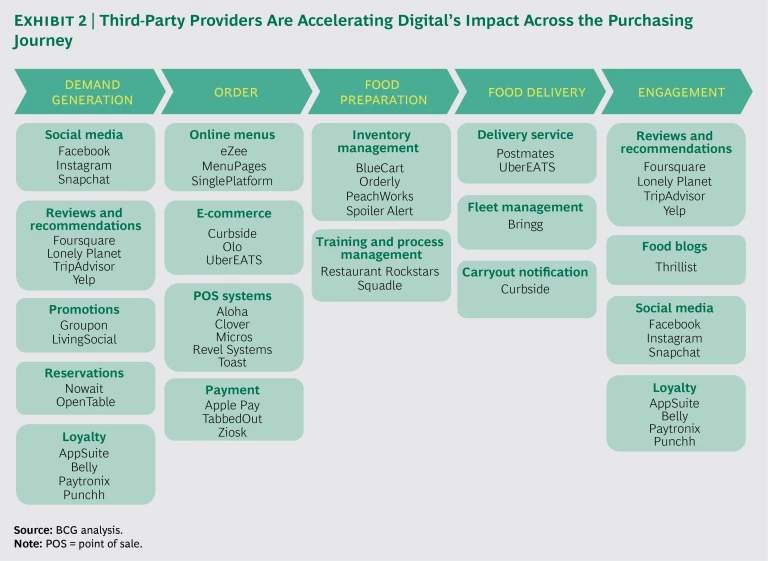

While the high costs of digital innovation have, in the past, made it the preserve of larger brands, the rising speed and falling costs of technology development are bringing many third-party players to the table and enabling small brands to get into the game. Across the value chain, third parties are putting digital innovations into the hands of brands that may lack the scale to make their own large investments. (See Exhibit 2.) Digitally enabled deliveries are the source of up to 10% of the sales at Mendocino Farms, a regional restaurant chain in southern California. Olo, a mobile ordering platform, provides white-label e-commerce solutions for brands with 40 locations or more. Under a recently announced partnership with Amazon, Olo’s restaurant clients will be listed in the Amazon Restaurants delivery section of Amazon.com.

Competing in the New Digital Game

These digital realities are causing restaurant brands to consider, or make, changes in a number of core functions. For many brands that face the challenge of attracting and retaining digital-savvy millennials and Generation Zers, marketing is the function in which digital activities, such as loyalty programs and mobile marketing, are finding a home. Digital leaders are looking to go further, however, by digitalizing their operations and tying what is happening in the store to customers’ digital behavior in real time. Websites and mobile apps reflect current store menu items—by store—for example, so customers can’t order out-of-stock items. Real-time inventory data also helps determine discounts and special offers. Store data can enable real-time decision making related to staffing, inventory, and deliveries.

Leaders use digital data to determine pricing as well. Digital technology enables dynamic, personalized pricing models that can boost margins with a company’s most valuable customers.

Digital restaurant innovators are establishing new roles that mirror those in place at e-commerce brands, such as chief digital officer, chief data scientist, and chief analytics officer. They are blurring the lines between what was traditionally the territory of the chief information officer or chief technology officer and other executives: digital is fast becoming a top priority across all C-suite functions.

These changes are all good steps, but they are only the beginning. Companies that aim to be digital leaders need to rethink their operating—if not their business—models, and they need to build or acquire capabilities that, most likely, they do not possess. They can look for guidance to other industries in which digital technologies are widely applied. (See Designing Digital Organizations , BCG Focus, December 2016.) Restaurant companies need to lay the groundwork in several areas, but for their technology initiatives to be successful, they should be sure that they have specific goals in mind (such as attracting new, younger customers or furthering new-product adoption).

Core Technology. Digital brands require a unified technology platform and a well-defined IT stack. A single point-of-sale (POS) system that is installed across the full store network is essential for enabling consistent data flow to facilitate advanced analytics and to establish a platform for future development. Such a system must have consistent hardware standards at the store level—including minimum wireless and broadband service levels—and a single, central data warehouse that aggregates data from all stores.

At the same time, brands need to build flexibility into their tech stack to accommodate ongoing rapid evolution. Best-in-class brands do this through the use of application programming interfaces, or APIs, and microservice layers that allow them to adapt to inevitable innovations and integrate new third-party platforms (for example, incorporation of digital ordering through Amazon Echo or Google Home). Although most brands today are operating with on-premise enterprise solutions, tech leaders are shifting to cloud-based platforms that support real-time data reporting and analytics. (See Recasting IT for the Digital Age , BCG Focus, March 2016.)

Data. Big data is a big deal: the ability to capture and use massive quantities of store-level, company, and third-party data is the foundation for such digital capabilities as personalization, demand forecasting, labor forecasting, and order accuracy. And because AI starts with “naked” algorithms that become intelligent only upon being trained on large amounts of data, particularly company-specific data, it’s also essential for building an AI capability. Recent research by BCG and MIT Sloan Management Review found big differences in companies’ understanding of, and approach to, AI data and training. (See “ Is Your Business Ready for Artificial Intelligence? ” BCG article, September 2017.)

Many restaurant brands do not have regular access to either data on customer-level purchase behavior and characteristics or online metrics (such as clicks on websites, page views, and conversions). Furthermore, they lack the robust analytics capabilities that can turn data into plans, programs, and initiatives. In our experience, the best data-centric restaurant brands have between five and eight full-time-equivalent staff whose primary responsibility is data analytics for every $1 billion in systemwide revenues. These are typically a combination of in-house and dedicated vendor personnel, and they are not only data scientists; they have functional specialties that include customer loyalty, digital marketing, and supply chain management.

Test-and-Learn and Agile Capabilities. Digital enables companies to try new things (menu items or delivery options, for example) quickly and inexpensively. Digital natives build testing and learning from consumer response into their organizations from the outset, and the best companies use a test-and-learn approach as the basis for continuous improvement in their product and service design. For example, one leading restaurant company that has established a position with specific responsibility for managing the A/B testing of digital content is able to quickly identify what works and what doesn’t and adjust course in real time.

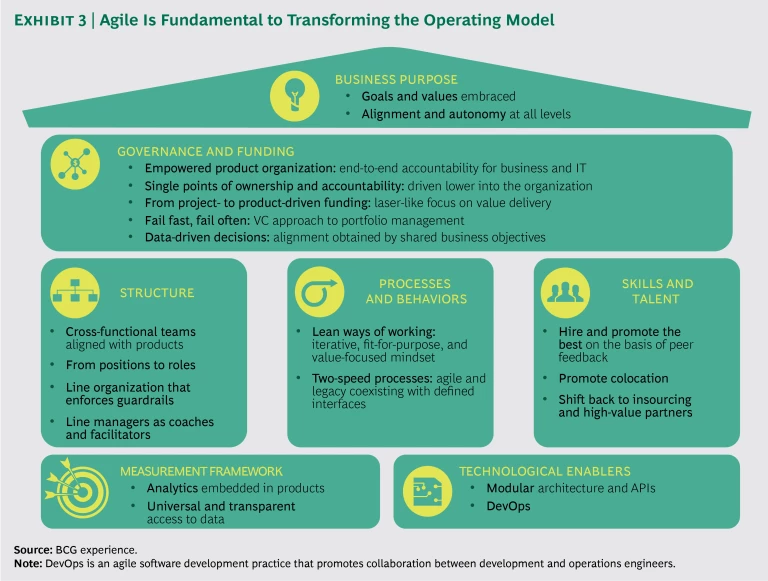

Most traditional companies have to build such capabilities, which require new ways of working and more agile processes to bring innovation quickly to market. (See Exhibit 3.) Siloed employees no longer perform discrete, predefined tasks in isolation. Instead, cross-disciplinary, colocated teams collaborate in innovative ways to enhance the customer experience. Working iteratively in short-term “sprints” and incorporating feedback to continually improve, agile teams across all functions have the potential to transform the business from the inside out. (See “ Taking Agile Way Beyond Software ,” BCG article, July 2017.)

New Metrics. The operating metrics of digital organizations are different from those of traditional companies. For example, the critical success factors in ecommerce include page views, conversion rates, site load speeds, and the number of clicks required to place an order. Loyalty programs have their own P&Ls and their own specialized accounting for their point-based currency. Success at delivery requires tracking such operating metrics as total elapsed time between order and delivery, driver utilization, and customer satisfaction, as well as greater agility and real-time attention. Instead of being reviewed monthly or quarterly, metrics should be monitored and acted upon on a daily basis.

New Partnerships. Restaurant brands can count on plenty of help. Many specialized vendors and partners with digital expertise are developing industry-specific products and services. No one vendor offers a full solution; top restaurant brands are working with a variety of partners, including specialists in digital marketing, data and analytics, cloud-based platforms and services, and digital supply chains. There can also be value in building some capabilities and keeping key responsibilities (such as data strategy) in-house. Companies need to be adept at vendor management and avoiding contractor proliferation—especially at the business unit level—while not relying too much on a single end-to-end vendor that may not have all the expertise required.

The Role of Scale

All of this requires significant investment in technology platforms, hardware, software, and new capabilities (although the vibrant marketplace in cloud-based services brings the level of investment down substantially from what it would have been even a few years ago). Leading players are investing 30% to 50% of their annual capital expenditure budgets in IT and digital innovation (over and above the costs of system maintenance).

In the face of rising technology-related investments, scale, which has long helped drive performance at large restaurant companies, will take on added significance. The need to invest in technology creates clear advantages for large companies with strong balance sheets. But, as digital investments become more important, the nature of scale shifts. Many restaurant portfolio companies have pursued a refranchising strategy and a shift to an asset-light model. This has enabled significant cuts in corporate G&A expenses. With the rise of Digital 2.0, scale enables companies to spread big IT investments across a large number of units. It also allows for establishing systemwide data platforms and IT systems (a single POS system, for example) that facilitate the quick and efficient development and implementation of future technology investments throughout the network.

If restaurants follow a path similar to that of the lodging industry, the investment-driven need for greater scale will fuel further consolidation and create opportunities for portfolio companies to both grow and unlock value by acquiring smaller, high-growth brands. (See the sidebar, “Lessons from Lodging.”) Some consolidation is already occurring at the hands of private equity players that have entered the industry, but it is unclear yet whether gaining commercial-platform scale is a driver of this activity.

Lessons from Lodging

Hotels are a few years ahead of restaurants in terms of digital’s impact and the need to build scale, centralize certain functions, and ramp up technology investments. It appears as though restaurants may follow a similar path.

A couple of trends drove the lodging industry toward consolidation and centralization in the 1980s and 1990s. One was the development of loyalty programs. The early programs were tied to individual brands, but as programs began spreading across multiple brands in a portfolio, the complexity of managing customers’ accounts and loyalty points across multiple properties and brands created the need for central management.

The other trend was the rise of online travel agents, such as Expedia and Orbitz, which might be seen as the restaurant business’s hotel equivalent of third-party aggregators: both disintermediate brands’ relationships with customers and put pressure on brands to offer dynamic pricing and a best-in-class e-commerce experience, capabilities that traditional operators in both industries lack.

In response to these pressures, over the past 15 years, major hotel brands have centralized most key commercial functions. These include their core technology investments in central reservation systems, property management systems, customer relationship management, loyalty programs, e-commerce, and digital and mobile apps to create competitive advantage. They also include functions traditionally handled by the brands, such as revenue management, digital marketing, and social-media management, which are now offered under a central umbrella as opt-in services for individual properties or franchisees as a benefit to operators.

Building the commercial engine has required a fundamental shift in how hotels engage with their franchisees, which may also have relevance for restaurants. The major hotel companies have made the following changes:

- Redefined fee structures and undertaken clear communication of the value and return on investment that franchisees receive from centralized commercial services

- Updated franchisee contracts and developed communications to manage trade area overlap (two hotels in the same neighborhood) as new brands are added to the portfolio

- Clarified the portfolio strategy with defined “swim lanes” and trade areas

This commercial engine opened opportunities for multibrand portfolio companies to use differentiated growth strategies to build even more scale. These included the acquisition or launch of smaller innovative brands that would attract the next generation of travelers, the development of new revenue streams from licensing loyalty points, and the introduction of opt-in commercial services.

Restaurant brands—in particular, portfolio companies—would do well to take a page from the hotel playbook. We believe that in the near term, there will be opportunities for restaurant brands to take the lead in digital innovation. But in the same way that third parties moved quickly to gain power over hotel brands, delivery aggregators and other digital players such as OpenTable are rapidly establishing a foothold across the restaurant value chain. Brands need to invest and move quickly to maintain competitive advantage.

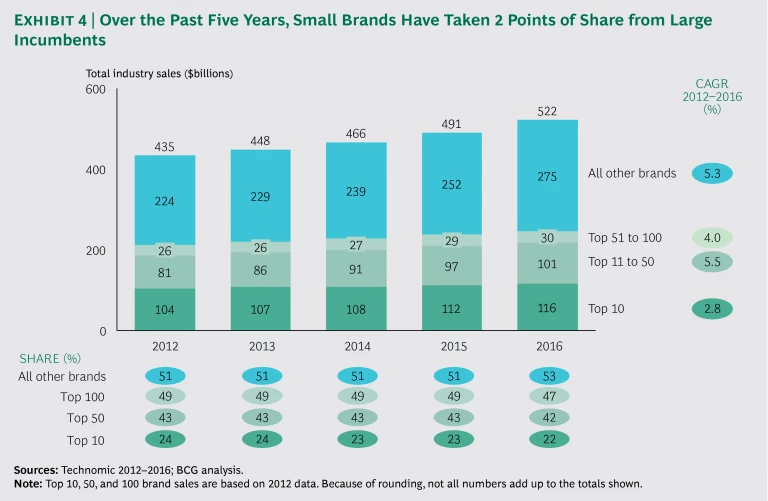

Scale advantage does not guarantee victory, however. In the digital environment, fast-moving digital insurgents can restructure the value chain, needing far less time and money than traditional companies to build digitally advanced brands. Over the past five years, small restaurant brands have taken two points of restaurant industry share while the largest brands have given up share. (See Exhibit 4.) Other startups with new models, offerings, and value propositions are doubtless just over the horizon.

How the competition between the big and the small plays out remains to be seen. On one hand, the need for big investments in digital favors large brands. But to take advantage, large players must become more agile and flexible. On the other hand, consumers are clearly attracted to smaller, more nimble brands that offer perceived authenticity and new manifestations of convenience and fun. What is clear is that midsize regional players will feel the squeeze. No two industries are the same, of course, but in lodging, the midsize players were on the receiving end of the consolidation trend.

A Digital Game Plan

For restaurant brands looking to raise their digital game, the experience of companies in related industries, such as hotels, as well as those of restaurant early movers, provides a roadmap.

Understand consumer needs. Brands should begin with a clear understanding of consumer needs in the market and where the brand can play and win. Consumers choose brands and experiences, not industry dining segments. No brand is going to serve all the daily needs of the Hollister family, for example. The questions are, Which needs can a brand best meet? And which needs will George, Melissa, Stephen, Wendy, and Selena look to the brand to fill? (For a discussion of consumer decision making in the casual-dining sector, see Casual Dining: How Brands Can Pivot from Irrelevance to Growth , BCG Focus, November 2014.) The answers to these questions provide the basis of the brand position and strategy, which should be the starting point for all brand priorities, including digital.

Understand the digital value chain. The full management team needs to develop a shared understanding of digital capabilities, digital potential, and the prospects for digital disruption. If digital is to play a key role, the development of digital capabilities cannot be handed off to a digital team or to digitally focused functions. Since digital approaches require cross-functional collaboration, this may require rethinking the organization structure to make sure companies are digitalizing across the full organization rather than in silos.

Match digital ambitions with brand vision. The next step is the development of a clear understanding of the brand’s digital starting point and its place in the brand’s vision and strategy. For example, if Starbucks’s vision is to be the most personalized brand in the world, digital is by definition central (you can’t personalize without data), and digital interactions with customers shape everything the company does online and in the restaurant. For other brands, the decision to emphasize delivery, dine-in service, or both will be a big factor in determining the role of digital. Digital expands a brand’s value proposition beyond the four walls of its restaurant. So just as they carefully make customer experience decisions in the restaurant, companies need to do the same in digital channels.

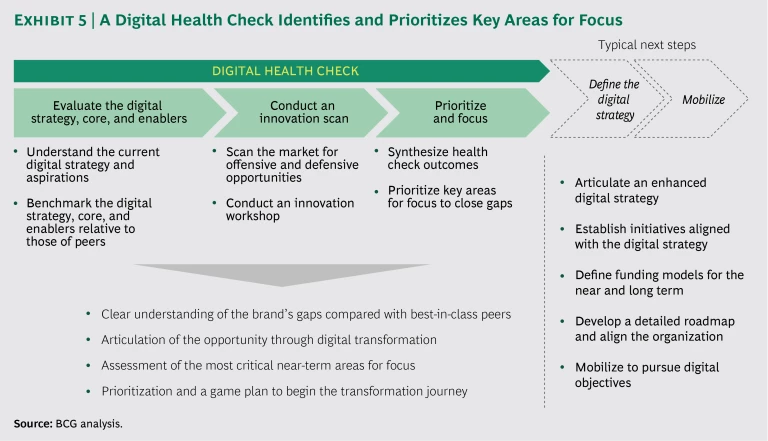

In this context, it’s important for companies to cast a vision for the brand’s digital evolution in the medium to long term. Technologies—and business and operating models based on technologies—evolve. Flexibility should be a watchword. Companies must be careful that decisions made for near-term considerations do not lead to medium-term constraints or problems. They will also want to set themselves up for the long run with platforms and capabilities that allow for brand differentiation. Tools—for example, a digital health check—can provide clear perspectives on how the brand stacks up digitally compared with peers and can expose the critical gaps. (See Exhibit 5.)

Put the right technology foundation in place. Getting one’s arms around the IT challenge is a complex task. This is due, in large part, to the sheer number of technology trends and developments that have an impact on IT architectures today, including social media and mobile technology, the Internet of Things, open ecosystems, big data and advanced analytics, and cloud computing. While no one gets excited about IT investments, the technology fundamentals are critical to everything that follows, and trying to layer digital innovations on a haphazard, or jury-rigged, technology foundation is likely to result in higher costs—and compromised functionality—in the long run. It will also stifle agile digital innovation.

Tackle digital table stakes. In today’s digital world, there are certain tools, capabilities, and skills that every company needs. Four of the most important, from the perspectives of engaging consumers and generating data, are a mobile app with a consumer-friendly user interface, a well-designed loyalty program, an easy-to-use e-commerce function, and a strategy for delivery. Behind these customer-facing tools, though, brands also need the ability to collect, “clean,” and use data from multiple internal and external sources (such as social media). Most companies also need to bolster their ability to extract value from their data assets by building proprietary data sets, securing permission from customers to collect and use their data, and entering partnerships to acquire complementary data assets. In addition, they have to build or acquire the tool sets, talent, and processes for extracting signals from the data to drive greater customer engagement and, ultimately, personalized interactions.

Plan for future digital differentiators. Technologies continue to advance quickly, and capabilities that are on the horizon today—advanced automation, machine learning, and new interfaces such as voice—will enter the mainstream sooner than many expect. Brands need to plan for the future while addressing the present.

Pursue partnerships. To compete in the Digital 2.0 world, companies will need a broad base of capabilities that can be applied to digitalizing all corporate functions. No company can go it alone. Brands need to determine where partnerships can fill gaps in the value chain, where they can access external capabilities, and where it could be more valuable to build rather than buy. For example, many brands have already expanded their universe of marketing partners beyond traditional creative and media agencies to include companies, such as Optimizely or Movable Ink, that can support A/B testing of digital content. One course could be selective acquisitions of technology players; another, a strategic acquisition of a brand that has already developed the desired digital capabilities.

If Not Now…

Consumers are increasingly blurring the lines between online and offline dining decisions. They make choices not only about what to eat and drink but also about where and how to buy it, depending on circumstances. As the Hollisters illustrate, consumers use a variety of models in the course of a single day.

Clearly, there will be no one-size-fits-all digital strategy for restaurants. Variances in consumers’ preferences and purchasing occasions, as well as differences in restaurant business models and economics, mean that multiple permutations and combinations will coexist. The number of options and variants will increase as forward-looking brands use customer data to individualize relationships and dining experiences and as their own ability to personalize at scale becomes more of a marketplace reality.

The key for winning brands will be the development of an integrated digital capability that meets, for example, the FOH, BOH, and delivery needs of the brand; engages consumers across the purchasing journey; and unlocks value operationally. Getting there will take patience. Some companies started their technology journeys a decade or more ago. Those that have not started need to get going—today. There is no quick fix for digital, and the cost of delay rises daily as more brands begin to act.