Businesses have long been told to think outside the box—but what about thinking outside the industry? Artificial intelligence (AI) and robotics have brought dramatic improvements in efficiency and overall quality to a wide variety of sectors, including automotive and e-commerce. Can they change the game for telecom companies, too?

The idea that what’s good for General Motors is good for telcos might seem a bit unorthodox. They are, after all, very different businesses. Yet this year’s telco IT benchmarking study (TeBIT)—a survey of European operators’ IT spending and performance that was completed in August 2017—suggests that some telcos, at least, are beginning to see how AI and robotics could benefit them. Projects now in place seem poised to lower costs and improve the customer experience—a win-win scenario for telcos still grappling with heavy competition and market challenges.

Or, perhaps more accurately, a potential win-win scenario. So far, telcos are taking a tentative approach to AI and robotics. They’re making relatively minor investments and focusing on specific projects—and not a great number of them—instead of end-to-end implementation. Strategies are few; challenges abound.

AI and robotics might indeed be able to transform the industry—but telcos will need to spark that revolution.

Payoffs and Trends

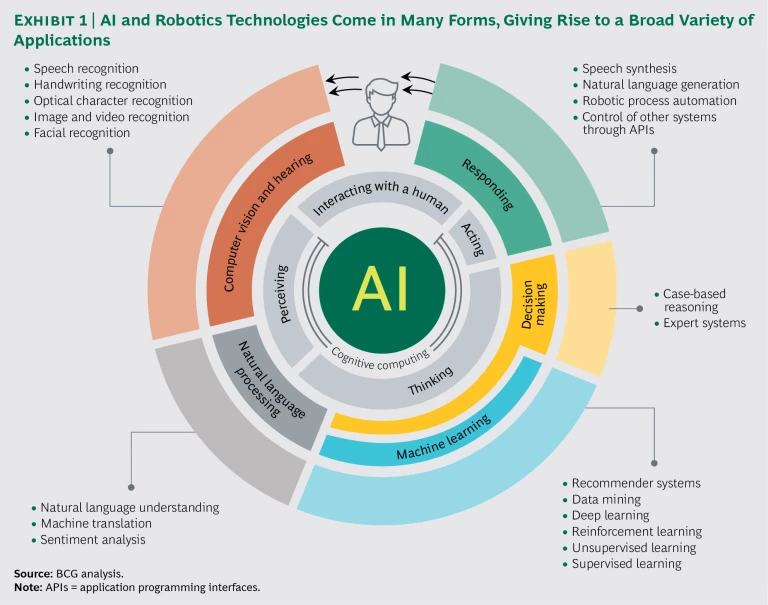

While companies in other industries have put considerable effort and funding into AI and robotics, telcos are still taking small steps and seem unsure about their path. On one hand, telcos are getting important benefits from their attempts. Predictive maintenance, for example, can identify potential failures, enabling fixes before systems—and the services that customers depend on—fail. Machine learning allows telcos to identify patterns in a user’s browsing and purchasing histories and then suggest what’s known as the next best offer—the next product that is most likely to resonate with that customer. Other initiatives are paying dividends as well, and more applications will become available in the coming decade. (See Exhibit 1.)

But survey responses suggest that, overall, telcos are uncertain about how to adopt AI and robotics—and how much to bet on them. AI and robotics did not rank among the top-three IT investment areas for any TeBIT participant; overall, expenditures on the technologies amounted to just 0.12% of total revenues. This kind of dabbling is not the approach that companies generally take toward game-changing technologies.

Indeed, the industries that have benefited the most from AI and robotics have not succeeded by taking half measures. Automakers, for example, have deployed robotic technologies throughout their value chain (the automotive industry alone accounts for nearly 40% of all industrial robots now in the field). But there is, perhaps, an even more compelling reason to think bigger on AI and robotics: not only does adoption pay off, but it does so in exactly the right ways.

According to our 2017 TeBIT study, the benefits that operators are seeing from their early, if limited, forays into AI and robotics are just the kinds of benefits they need. Predictive maintenance, next best offers, and chatbots that respond to user requests and questions all can improve the customer experience—while reducing costs. TeBIT participants with projects underway are achieving annual ROIs of 160% to 300%—and those numbers mainly reflect reductions in cost because other benefits can be more difficult to measure.

So why the tepid embrace of AI and robotics? The survey responses shed some light here, too. Among the reasons: a lack of strategy for adopting the technologies, difficult integration with legacy systems, and a preference to wait and see what other telcos do. But perhaps most significant, AI and robotics simply constitute new ground for telcos. Operators often lack the required skills and experience to work with the technologies—or to know how best to use them.

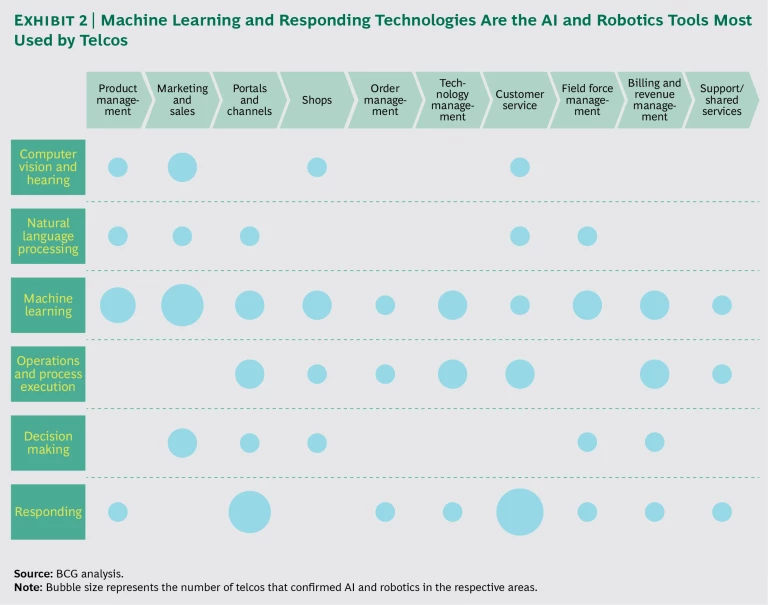

Still, patterns are emerging with regard to where telcos are applying AI and robotics. Marketing and sales, along with customer service, are focal points for investment: around 70% of TeBIT participants are funding initiatives in these areas. Product management, field force management, order management, and shops get less attention: about half of the participants are investing in AI and robotics in each category.

We also saw some trends in how telcos are using these technologies. Machine learning, for example, was the most heavily used technology in marketing and sales as well as in technology management. (See Exhibit 2.) This makes sense, since understanding patterns in customer behavior and system performance is essential for identifying next best offers and potential failures. Similarly, so called responding technologies—such as speech synthesis, chatbots, and robotic process automation—dominated in customer service. Such capabilities can speed responses to customer queries and requests while enabling more efficient staffing.

In the short term, participants plan to boost their spending on AI and robotics by more than 40%, on average, and the increases will vary by area. Portals and customer channels will see the greatest boost, with investment amounts roughly doubling. Yet even at these higher levels, each telco’s annual investment in AI and robotics will still amount to less than €7 million. That’s not trivial, but it won’t buy a transformation in the way telcos work and serve customers.

A Moving Bull’s-Eye for IT Investment

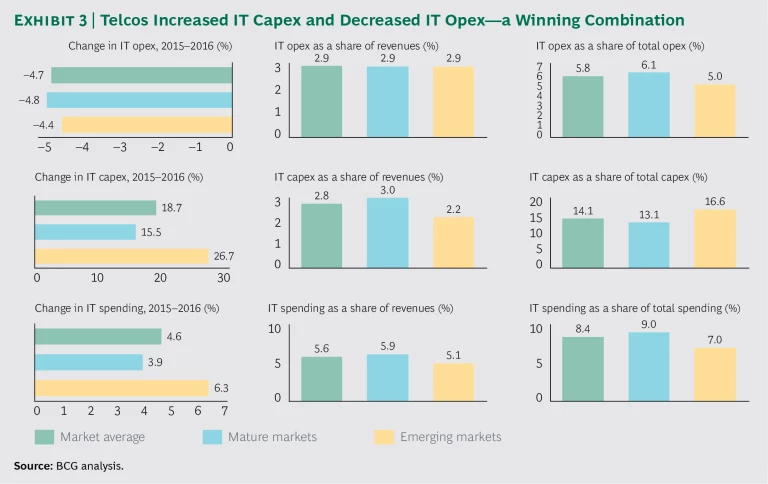

Despite essentially flat revenues in both mature and emerging markets, TeBIT participants increased their IT spending in 2016 by 4.6%, on average. Even more noteworthy was the sharp rise in IT investments. Overall, IT capital expenditures rose 18.7% for participating telcos (with a 15.5% increase in mature markets and an even more robust 26.7% rise in emerging markets).

Yet while IT capex rose, IT operating expenses declined. (See Exhibit 3.) Telcos in mature markets saw, on average, a 4.8% drop. Participants in emerging markets saw a 4.4% decline. The decrease could well be the result, at least in part, of earlier cost-cutting projects (such as those reported in previous TeBIT surveys).

Boosting IT capex while decreasing IT opex is just the right approach for telcos. They need to pursue opportunities to generate revenue—particularly in emerging areas, such as digital and big data—while continuing to improve efficiency. AI and robotics can be particularly well suited to help telcos hit these twin goals. Consider, for example, chatbots, which can lower costs by reducing staffing needs—yet, at the same time, improve the customer experience by providing quick responses 24-7. By helping to boost efficiency and generate revenue, whether directly or indirectly, AI and robotics initiatives can lower IT opex while freeing up or creating more funding for IT capex.

Overall, IT investment was much more focused in 2016 than in previous years: TeBIT participants spent, on average, some 40% of their IT capex budgets on their top-three investment areas (last year, when spending was more spread out, the figure was just under 18%). The areas of focus—digital transformation, converged fixed-and-mobile offerings, and content-related services—are all drivers of growth for telcos. But the investment breakdown also reveals just how much less telcos spent on AI and robotics. While a top-three investment area typically accounted for 5% to 20% of a telco’s IT capital expenditure, AI and robotics accounted for, at most, 2.5% of the average annual IT spending of TeBIT participants.

Moving AI and robotics higher on the priority list could reduce costs while improving speed, overall quality, customer satisfaction, and—whether directly or indirectly—the bottom line. To put it another way: telcos can get everything they need.

COTS Software and Outsourcing

As in past years, TeBIT participants expressed high satisfaction with commercial-off-the-shelf (COTS) software, which plays a key role in a multitude of process areas, including marketing and sales, billing, and revenue management. Nonetheless, there seems to be room for improvement, especially with regard to how COTS software can support AI and robotics.

Survey responses indicate that one of the key challenges in adopting AI and robotics is a lack of plug-and-play integration with the existing business support systems and operations support systems that power so many telco functions. By incorporating AI and robotics into existing suites (for example, through add-on modules), vendors could differentiate their own products as well as help telcos leverage these new tools.

We also saw that, like last year, telcos are staying on top of managing complexity in their IT operating models. Survey participants scored an average of 46 (out of 100) on TeBIT’s complexity index, a slight rise from last year’s score of 42 and a more significant uptick from the average of 36 in 2015. It’s not surprising that complexity is increasing as telcos venture into new areas, such as big data and analytics. Yet the declines in IT opex that we saw for 2016 suggest that operators are doing a good job of managing any added complexity.

One trend did reverse, however. Over the past few years, we’ve seen telcos devote an increasingly smaller percentage of their IT budgets to outsourcing. In 2016, the trajectory changed: TeBIT participants allocated 18.7% of their IT budgets to outsourcing, up from 12% for 2015. Yet they still seem to be deploying it in a carefully considered way, using outsourcing more in areas where in-house expertise is lacking rather than in areas of strength. Indeed, outsourcing could help telcos ramp up their efforts in AI and robotics—reducing the time and effort needed to launch new initiatives.

Efficiency Boost or Paradigm Shift?

Early returns don’t always predict the future. But there is reason to believe that the initial benefits generated by AI and robotics may portend bigger things for telcos. The projects now underway seem to be hitting all the right notes: cutting costs, improving the customer experience, and growing revenues (even if indirectly). The question is: Will AI and robotics result in an ordinary efficiency boost or a paradigm shift?

Other industries have experienced transformation, but, unlike telcos, they have also invested heavily in the technologies. And while TeBIT participants do plan to spend more in the area, the increases don’t look as though they will be dramatic, at least in the short term.

TeBIT participants are trying a variety of initiatives and planning more—such as machine learning for cybersecurity and more uses for predictive analytics. Sharply increasing investment in AI and robotics would be a bold move. But by doing so, telcos would be able to more fully explore the technologies and use cases, and zero in on those that matter most.

Fortunately, there are ways to smoothen and accelerate the process. One idea is to look at other industries for insights. The businesses may be different, but many of the tactics that leaders in AI and robotics are taking—such as using machine learning to better understand customer behavior—may be relevant for telcos, as well.

Telcos should also consider how best to track the performance of projects involving AI and robotics. This isn’t always straightforward because the benefits may be indirect or impacted by multiple factors. But developing a link between an initiative and results is crucial for understanding where and how these technologies can best be employed.

Collaboration—both internally, between the business side and IT, and externally, with vendors and even other telcos—can be an effective way to tackle the challenges that may be holding back the adoption and the payoff of AI and robotics. By sharing ideas and experiences, telcos might be better able to identify optimal practices and strategies. They can find out—as an industry—whether AI and robotics will be good for them, too.