Digital technology has become essential to competing in the aerospace and defense industry . Today, many companies are experimenting with digital capabilities. They are prioritizing digital investments and investing significantly in specific areas. But few are making the broad strategic moves necessary to gain a competitive advantage. The leading companies have recognized that they must take a comprehensive, integrated approach to digital adoption.

A recent BCG study sought to better understand what sets apart the digital frontrunners in A&D. It focused on a global survey of senior executives and managers that assessed the extent and impact of digitization and identified the main challenges. (See the sidebar, “About Our Survey.”) Simply put, we found that what a company invests in matters less than how it invests. This insight is supported by a number of findings:

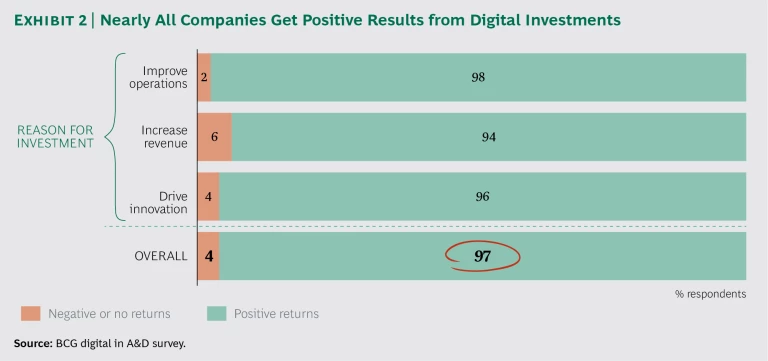

- Nearly all companies reported positive results from their digital investments, overall and with respect to each of three investment categories: improving operations, increasing revenue, and driving innovation.

- Companies that have broadly adopted digital—early in the development of a product and across functions—are achieving better results than those taking a selective approach.

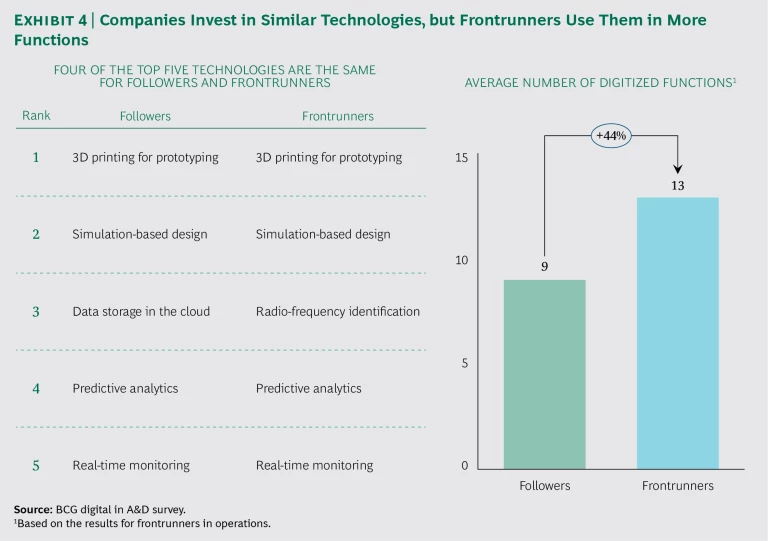

- Regardless of their results, companies generally invest in similar technologies, and these technologies may soon become table stakes for competing in the industry.

- At any stage in the digital journey, finding talent is a challenge and the need for culture change is acute; companies reporting the best results are establishing digital leadership positions and looking outside their organizations to fill new digital roles.

About Our Survey

In April 2017, BCG conducted a survey of 110 executives from A&D companies around the world. These companies spanned the value chain from lower-tier suppliers to prime contractors. The goals of the survey were to evaluate the extent of companies’ progress in implementing digital, identify the key factors contributing to success, and understand what companies considered to be the major challenges. The survey also covered the investments required to introduce digital, the technologies implemented, and the key enablers deployed, such as acquiring talent and setting up digital roles.

We found that respondents fell into either of two categories—frontrunners or followers—on the basis of their self-reported success in using digital to improve operations, increase revenues, and drive innovation. We also classified companies as high or low investors on the basis of their planned digital investments in 2017. High investors are those companies whose spending on digital ranked among the top 30% of their investment initiatives.

How Digital Creates Value in A&D

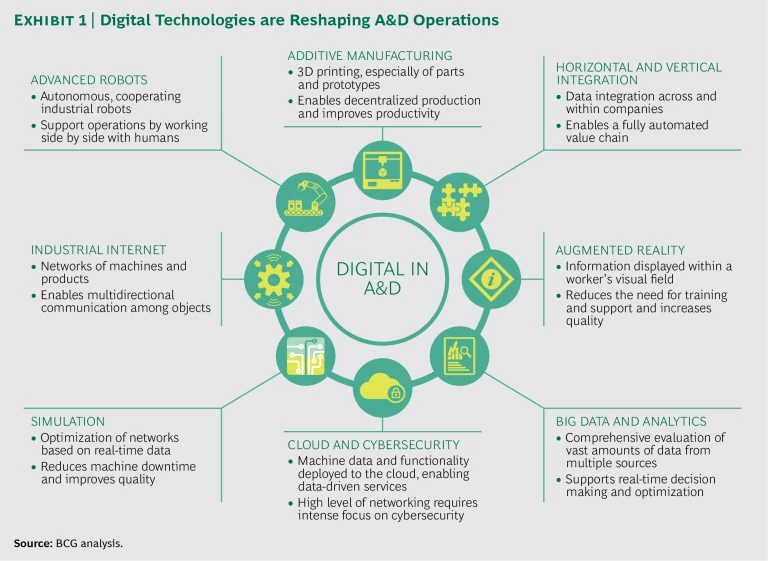

As in other industries, eight technology drivers are reshaping A&D. (See Exhibit 1.) However, to become a digital enterprise, a company must do more than implement specific new technologies. It also must have the vision, tools, ways of working, organization, and partnerships needed to enable effective implementation. To be successful, the company must ensure that its digital investments address customer needs and key business objectives.

As noted above, A&D companies are using digital technologies to improve operations, increase revenue, and drive innovation.

Improving Operations. A&D companies are applying digital throughout all aspects of operations:

- Program Management. Companies are utilizing the cloud and applying big data and analytics to organize and plan program management activities.

- Design and Development. 3D prototyping and simulation-based design have been introduced to support upstream research and technology, development, and prototyping.

- Production. A&D companies are deploying new digital technologies in manufacturing to speed up production and reduce costs. For example, they are using augmented reality to perform quality inspections, autonomous guided vehicles to move parts within factories, and additive manufacturing to produce spare parts and thereby avoid stockouts.

- Supply Chain. Companies are using “control towers”—rooms in which teams monitor the status of orders and the location of parts—to facilitate decisions that reduce delivery lead times. They are using data analytics to forecast needs and identify new opportunities to reduce costs. Some companies have also implemented collaboration portals to monitor suppliers’ performance.

- Service. Companies are providing their field engineers with detailed information and technical documentation on mobile devices. They are also starting to use augmented reality to guide operators in making repairs, thereby significantly reducing the turnaround time of their products.

One leading A&D company has, over the past eight years, invested in digital solutions that have promoted operational savings and increased agility and production speed. In total, it has implemented more than 400 digital projects, with the impact extending across functions: a 300% increase in quality control productivity, improved life cycle inventory and extended product lifetimes for end users, and lower production and supply chain costs.

These projects focused on solving specific operational challenges on the plant floor. A team of experts assisted the plant managers in implementing digital solutions that address issues raised by workers. For example, plant managers installed radio-frequency identification (RFID) tags on major aircraft components in order to better manage part flows and reduce inventory costs. The company has also installed autonomous robots to perform drill tasks that have a high error rate. All of these projects had a two-year return on investment.

The digital tools created through these initial projects feed into a “digital menu” that is accessible across all plants. The digital menu lists the available tools, the results achieved by deploying them, and contact information for subject matter experts who can help with deployment. The menu has helped promote wide-spread adoption and greater scale for a set of tools with demonstrated operational value.

Increasing Revenues. Companies use new digital capabilities to increase sales by acquiring new customers, establishing deeper customer relationships, and increasing customer satisfaction. Examples include applying predictive analysis to boost the uptime of equipment sold to customers and using artificial intelligence to optimize sales of spare parts and manage inventory. An especially promising application is the use of “digital twins” (digital representations of physical objects) combined with augmented or virtual reality to involve customers earlier in the design process, thereby minimizing the need for expensive late-stage design changes. For example, many leading A&D companies have recently built immersive centers in which customers can experience new product capabilities virtually and provide input into the designs. One leading A&D company reported that it captured a return on its investment in immersive centers within one year.

Driving Innovation. Companies are using digital to develop new service offerings for their current businesses and to create new business models. Examples include:

- Advanced “Power by the Hour” Solutions. These use real-time connectivity enabled by onboard sensors to remotely diagnose and predict maintenance needs. Rather than buy equipment, end users pay for equipment according to the hours used. The equipment supplier retains ownership and provides maintenance services.

- Offerings Based on Parts Availability. These use sensor data to monitor products throughout multitiered supply chains and flag risks to quality and production schedules, among other issues. Companies apply predictive analytics to identify potential supply issues before they happen.

- Surveillance and Observation Services. Instead of buying and operating a drone or satellite system, the customer buys access to data from diverse sources. This model enables the customer to acquire data without making upfront investments or incurring operating expenses unrelated to the data received.

Broad Digital Adoption Is Low Risk and Drives Success

Nearly all the respondents to our survey reported positive results from their digital investments, overall and in each of the three investment categories. (See Exhibit 2.) They appear to regard digital investment as a low-risk move, with nearly half (45%) willing to invest without a short-term business case.

How much a company invests in digital generally does not determine whether it is a digital frontrunner or a digital follower. (As noted in the sidebar, we classified companies on the basis of their self-reported success in using digital to improve operations, increase revenues, and drive innovation.) Among frontrunners, 49% of companies were high investors and 43% were low investors. Notably, investment level does make a difference in improving operations—41% of frontrunners in this category were high investors, while 25% were low investors. This implies that, except in operations, how a company invests has a bigger impact than investment level on its ability to pull ahead of others.

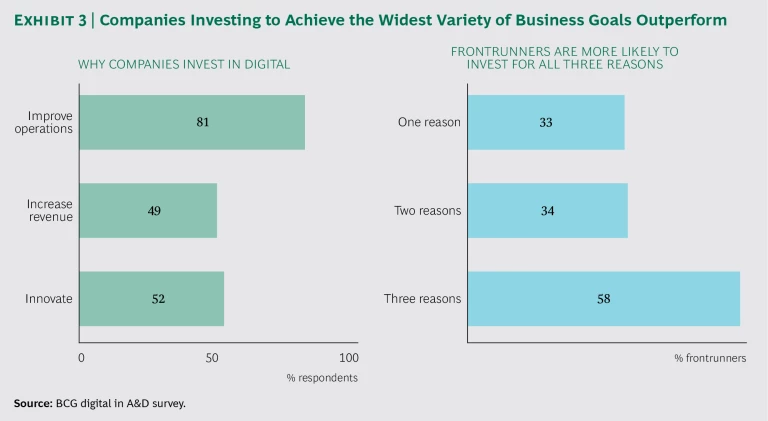

Improving operations is the focus of companies’ investments. Among our respondents, 81% invested in digital to improve operations, compared with 49% to increase revenue and 52% to innovate. (See Exhibit 3.) However, companies that invest to achieve the widest variety of business goals outperform. Among companies that invested in all three categories, 58% are frontrunners. Only about one-third of companies that invested in two categories or one category are frontrunners.

Frontrunners also apply digital across a greater breadth of functions (for example, program management, engineering, supply chain, and production) and across activities within those functions. Many companies use digital tools for design activities (such as prototyping and testing). However, a company is four times more likely to be a frontrunner in operations if it applies digital across the life cycle of the product, from initial program management to aftermarket and sustainment activities.

Companies are generally investing in similar technologies. (See Exhibit 4.) 3D printing for prototyping, simulation-based design, predictive analytics, and real-time monitoring are the most commonly implemented technologies, which suggests that these capabilities may soon be table stakes for competing in A&D. But frontrunners apply these technologies more broadly across their functions. They implement a digital technology in an average of 13 functions, compared with only 9 functions for followers.

Enablers and Challenges

The formal enablers of a digital organization—including structures, leadership positions, talent strategies, digital roles, and capabilities for agile development—are far more prevalent in the organizations of frontrunners. For example, frontrunners are more likely to have established formal structures, such as a digital organization at the corporate center or in business units or shared services. The biggest differentiator between frontrunners and followers is having a chief digital officer (CDO), although few companies have created this leadership position. Frontrunners are also more likely to have established digital roles, especially for data scientists and leaders responsible for the user interface and user experience.

Roles must change as A&D companies adopt digital technologies, but finding the right people will be a challenge. Today, frontrunners are somewhat more likely than followers to look outside their organization, sourcing talent from other A&D companies and universities, rather than retraining current employees.

Frontrunners and followers cited similar challenges in adopting digital, with both ranking culture as the top challenge. For frontrunners, the next most frequently cited challenges were finding the right digital solution, demonstrating the benefits of digital, and identifying the right technology provider or partner. For followers, demonstrating the benefits of digital stood out as the second most important challenge.

How to Become a Digital Frontrunner

Before launching a new digital strategy, A&D companies should assess their current level of adoption in order to uncover key gaps in capabilities and the most important challenges. BCG has developed a comprehensive digital health check, the Digital Acceleration Index , that draws upon our experiences with many companies and industries. The index provides insight into the maturity of processes and capabilities across 27 topics relative to best-in-class levels and helps identify specific interventions. In addition, we have developed targeted health checks that assess the maturity of digital service offerings, digital sales and marketing, Industry 4.0 adoption, and enablers.

Once a company has determined its starting point, it can design a program to augment its strengths and address its weaknesses. Whether an A&D company is a frontrunner trying to extend its lead or a follower seeking to catch up, a program for digital adoption should be guided by the following set of imperatives:

- Set a clear top-down vision and address culture change from the top. Ensure that leaders set the tone for the digital enterprise and are prepared to invest in new talent, tools, and operating models. To enable the digital workforce to extract value rapidly, provide the necessary digital tools and operating models as well as the supporting culture.

- Appoint digital leaders and set up a control tower for digital projects. Given the transformative nature of digital, appointing dedicated leaders, such as a CDO reporting to business unit heads or the CEO, helps to promote broad engagement and success. A digital control tower, with oversight across functions and business units, helps ensure that tools and know-how are applied at scale and shared throughout the organization. In addition, a digital accelerator approach (also know as “build-operate-transfer”) can be used to train a large number of employees on how to apply new technologies, as well as how to implement a digital culture broadly and rapidly.

- Think at a systems level. Run pilots that span functions in order to achieve scale and expand impact. Set up mutually reinforcing digital initiatives, such as pilots in the supply chain, manufacturing, and design, all focused on using digital twins and accelerating the speed of production.

- Train and recruit talent from new sources. Expand the company’s pool of digital talent by hiring new employees with digital skills and retraining current employees. Replenish the talent pipeline continuously and look for new sources of talent, bearing in mind that the average tenure is one year at leading digital companies.

- Establish targets—and track results—for operational cost savings, revenue growth, and innovation. As noted, nearly all types of investments have positive results. Setting specific business objectives achievable through digital will help drive adoption and support CDO-led initiatives.

- Set up agile, flexible teams and focus on minimum viable products. Deploy these teams across the organization to lead initiatives and accelerate innovation. The objective is to develop a minimum viable product quickly and then to improve it through iteration.

- Think like a venture capital investor and be willing to invest ahead of the business case. Move quickly to capture opportunities, because mature technologies have rapidly become table stakes for competing. Invest before establishing the two-year business case, as many successful A&D companies are starting to do, in order to ensure long-term success.

- Decide whether to “make or buy” technology. Companies must carefully evaluate which technologies to develop in-house and which to acquire through M&A or partnerships. In many cases, companies can obtain the building blocks of a digital enterprise, including the supporting data architecture, from technology providers or other companies. Companies across the A&D value chain are competing for data ownership and designing their own approaches to monetizing data. However, no player has so far found a “killer app.” In this competitive environment with few success stories, a company must maintain the agility to capture opportunities when they emerge.

The fact that a company’s level of investment in digital technology does not correlate with success is both a warning sign and a beacon of hope. The winners in the race to extract value from digital will be those companies that define a vision to guide their investment decisions and establish the right supporting structures, roles, and culture. However, because the digital race has no finish line, even today’s frontrunners may be tomorrow’s followers. As more companies adopt similar approaches and digital tools become cheaper, the first-mover advantage erodes. To stay ahead as competitors catch up, companies must ensure that their digital strategies continuously evolve.