This is an excerpt from The Comeback Kids: Lessons from Successful Turnarounds .

L ike most medical technology companies, Boston Scientific has faced a tougher market over the past decade. Yet the company—which offers a range of cardiovascular devices, along with advanced products in urology, endoscopy, and areas such as interventional cardiology (the use of catheters to treat heart conditions)—has also grappled with internal issues. In 2006, Boston Scientific acquired Guidant for $27 billion. The company needed to absorb that cost; it also wanted to improve and better integrate quality production systems and establish a new culture.

In 2011, the company implemented a focused strategy to turn itself around. It revamped its portfolio through a series of acquisitions, shifting the emphasis to stronger growth and category leadership. For example, an acquisition in the urology segment reinforced the company’s position as a leader in that category. And a sales initiative helped target large health systems in developed markets more effectively.

Boston Scientific revamped its portfolio to emphasize stronger growth and category leadership.

Boston Scientific also expanded into emerging markets—specifically, China and Brazil—and reoriented its R&D to a more global perspective. Through these measures, the share of sales from emerging markets has doubled since 2013.

Throughout the transformation, management took steps to reduce manufacturing costs, setting up several manufacturing centers of excellence to streamline and improve processes. Some measures relied on established tools and methodologies (like lean), while others capitalized on emerging technologies. Similarly, the company launched measures to improve R&D productivity, and those measures have paid off—R&D as a percentage of revenue declined by 10%, yet the company is continuing to roll out innovative products.

To organize for sustained performance, Boston Scientific made a concerted effort to develop a more innovative, creative culture. Senior leaders thinned out the bureaucracy at higher levels of the company to speed decision making. Boston Scientific also launched a program aimed at getting teams to develop unconventional solutions, empowering people to share ideas regardless of job titles. The most promising projects get funded, and the teams that came up with them get recognized. In a rapidly changing industry like health care, that kind of bottom-up innovation can lead to large gains.

Senior leaders thinned out bureaucracy at higher levels to speed decision making.

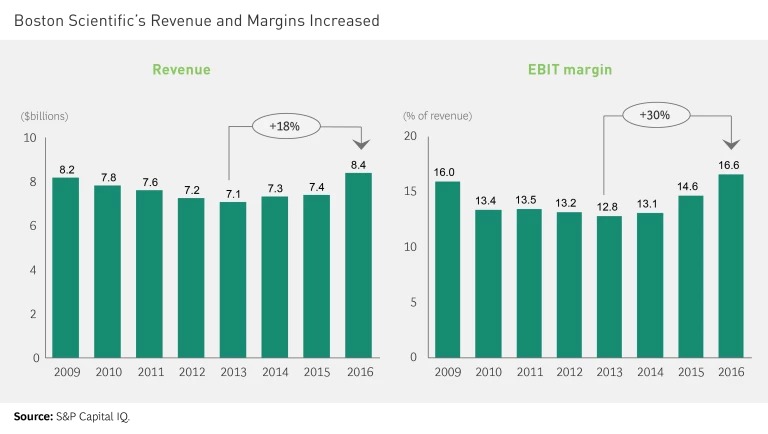

Overall, profits are now strong and growing in all of Boston Scientific’s business units. Revenue is up nearly 20% since 2013, and EBIT margins are up 30%. (See the exhibit.) Shareholders have benefited: the company’s market cap has nearly quintupled in that period. “Our strategy of category leadership in key markets and diversification into high-growth adjacencies is working, and enabling continued investment in innovative medical technologies,” said chairman and CEO Michael Mahoney.

By realigning itself around innovative products, improving manufacturing processes, and taking steps to revamp its culture, Boston Scientific has seen a rebound in profits and has established a strong position for the future.