This is an excerpt from The Comeback Kids: Lessons from Successful Turnarounds .

W hat do you do when you dominate a declining market? If you’re Finnish forest conglomerate UPM-Kymmene, you launch a transformation program to diversify your business and boost profits. About half of UPM’s revenue used to come from graphic paper. Yet demand has been steadily falling, especially for the magazine paper and newsprint that once made up the largest share of UPM’s sales.

Several forces have been behind the decline. Readers are increasingly consuming information digitally. And in the wake of the financial crisis, companies have scaled back their marketing budgets for print campaigns. Environmental concerns have been a factor as well, as consumers in many developed markets seek to limit their use of paper. From 2006 through 2012, demand in Europe and North America declined by an average of 5% each year. Worse, excess capacity across the entire paper industry pushed down prices. As a result, UPM’s paper businesses were facing pressure.

To improve performance, the company focused on both shifting to growth segments and increasing efficiency through numerous cost programs. From 2006 through 2009, the company closed about 14% of its paper production capacity. It bought a competing paper company and further consolidated those assets, leading to about $240 million in annual cost synergies. In 2013, it launched another round of cost reductions, closing several more paper facilities, reducing head count, and selling some forest property.

UPM focused on shifting to growth segments and increasing efficiency.

UPM then restructured its organization into six businesses: paper in Europe and North America, specialty paper (still a growth market), plywood, pressure-sensitive labels, biorefining (including pulp, timber, and biofuels), and energy. In addition, it shifted resources away from mature businesses and markets toward faster-growth businesses. Specifically, UPM invested about $730 million in a set of growth-oriented projects. These included a new specialty paper plant in China and a biofuels facility in Finland, the world’s first refinery capable of producing a wood-based renewable diesel fuel.

As a result of the portfolio transformation and restructuring, the portion of revenue from declining paper markets has declined from about 70% in 2006 to below 50% in 2016, and the company is continuing to reshape its portfolio. To ensure it can lead these markets, UPM has made a big push for innovation, increasing the number of annual patent applications by 280% since 2008. And management has pushed more decision-making authority down to the business units, allowing them to set and execute their own strategy. As a result, the units are more nimble and better able to capitalize on fast-moving opportunities.

Most impressive, UPM focused on developing its employees and organizing for sustained performance throughout the turnaround, through measures such as a new performance management system, a commitment to leadership by people in individual markets, and an improved safety culture. From 2008 through 2016, employee engagement increased by 20 percentage points, even as productivity soared (sales per employee are up 34% over the same period, and time lost because of accidents declined 83%).

UPM developed its employees and organization for sustained performance throughout the turnaround.

Sustainability measures are in place as well: all wood is sustainably sourced (forest owners now use digital apps to better manage UPM’s properties), wastewater is down significantly, and the company has been named on several prestigious lists and indices for sustainability.

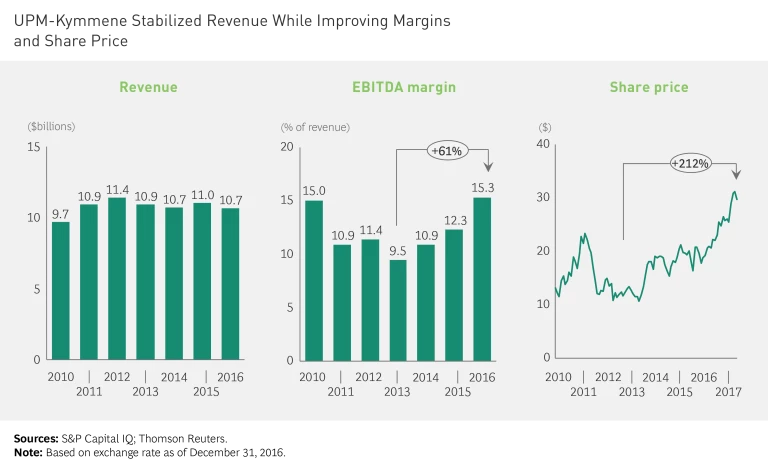

The transformation has dramatically improved UPM’s financial performance. Despite scaling back from its former core business, the company has maintained consistent revenue, even as its profit margins and share price have soared. (See the exhibit.)

UPM’s story shows what’s possible when management accurately recognizes structural challenges in its industry and launches a bold transformation to address them. By remaking its portfolio, the company has pivoted away from a declining industry and invested in high-growth adjacencies, rewarding shareholders along the way.