International climate talks in Paris set an ambitious goal: to sharply reduce global warming by 2100. This will require increasing current investments in clean energy and other sustainability efforts by $1 trillion per year until 2050. The more recent discussions at COP23 in Bonn further addressed the challenges of reaching this goal—and the lack of meaningful progress. What will it take to persuade companies to develop more of these projects, and capital markets to invest in them? To find out, the World Business Council for Sustainable Development (WBCSD) joined forces with The Boston Consulting Group (BCG) to explore what types of green projects are succeeding, what financing options are available, and what the investment community thinks about sustainable investing.

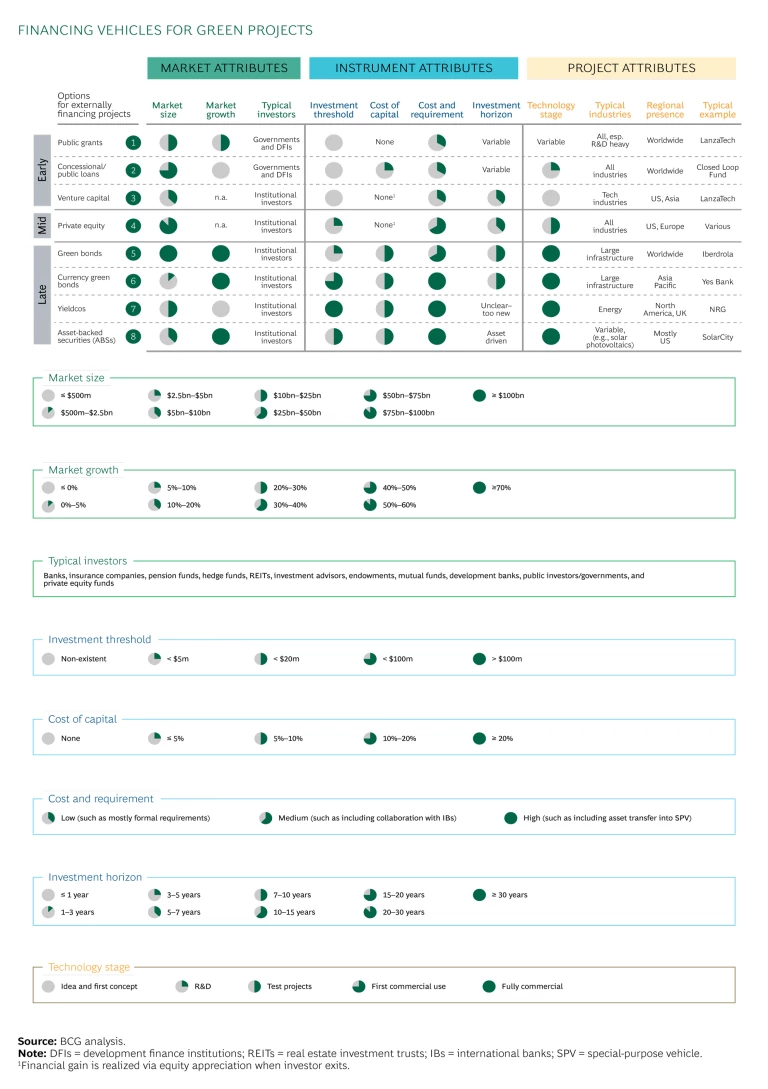

Our resulting report revealed, first and foremost, that green investments must be financially attractive. And in fact, they do deliver above-average returns, as shown in the 13 case studies outlined in the report. Various sources of funding are available for green projects, depending on their stage of maturity. The report explores eight different options ranging from grants and government loans to venture capital and green bonds. The overview of each option includes typical market, instrument, and project attributes. (See the exhibit.) For instance, we found that the green finance market for venture capital is $5 billion to $10 billion, largely funded by institutional investors and primarily focused on early-stage projects in technology industries.

We looked at green investments across four critical sectors—alternative fuels, clean transport, reusable resources, and renewable energy—to gain a better understanding of the range of vehicles used and how they map against different stages of project maturity. Some financing options, such as internal funding, government grants, bank loans, and private equity, are fairly well known. Companies may be less familiar with other options, such as:

- Tax Equity. This type of private equity project financing is primarily used in the US. It allows investors to profit from tax benefits available to the owners of renewable energy projects. To take advantage of the tax benefits, the investor owns a majority of the project for a certain period; then, when the investor has realized these benefits, ownership reverts to the developer.

- Yieldcos. Listed on the stock exchange, these vehicles bundle operating assets from different projects, giving investors high returns and providing a steady source of new capital to project developers. For instance, yieldcos that bundle assets from wind farms generate stable income from the electricity generated and can pay substantial dividends to investors.

- Asset Rotation Models. This special-purpose vehicle (SPV) is created to hold a specific and defined set of assets, such as a wind farm. The typical investors—a pension fund or sovereign fund, for instance—are oriented toward long-term returns, looking for cash yield, and relying on the seller’s ability to operate and maintain the asset.

- Credit Enhancements. A credit enhancement assures the lender that the borrower will repay the loan, often by offering collateral or a third-party guarantee. This type of insurance policy makes a green investment more attractive to large investors. One typical example in renewable energy financing is the power purchase agreement (PPA), in which a state-owned electric utility agrees to buy an independent producer’s electricity.

- Green Bonds. Green bonds are similar to conventional bonds, but their proceeds are reserved for funding green projects. They may be issued by public or private institutions. Green bonds in local currency, such as masala bonds in India, constitute a subcategory that, because they are denominated in a foreign currency and listed on a stock exchange abroad, tend to attract foreign investors. For the issuer, the bond moves the currency risk to the investor, whose returns depend on the current value of the currency.

In addition to developing company case studies across the four green sectors, we took an in-depth look at how specific members of the investment community in different regions and industries are shifting their portfolios to focus more on greener investments—and how they’ve found ways to make those investments economically attractive. All indicated that they would be willing to expand their green investments if the risk-return profiles continue to be good.

The report includes detailed recommendations for companies and investors that are hoping to go green. To increase the odds of success, companies should weigh the risks and potential returns of any sustainability project and create a strong business case before proceeding. In other words, they should evaluate green projects as they would any other strategic business initiative. For their part, investors should stay on top of new technologies, industries, and locations with strong potential. Projects and technologies with the biggest environmental and financial impact will attract the most attention and demand—and deliver the biggest returns. To stay aligned going forward, companies and investors alike should:

- Think creatively and strategically. Companies may need to rethink their green projects to make them more attractive to investors. And investors must develop creative financing options that meet the needs of the green market.

- Capitalize on low interest rates. Today’s low rates mean that green projects offer a relatively high return to investors and make it cheaper for companies beyond the startup stage to borrow.

- Work for better regulatory support and incentives. Countries with supportive regulatory and tax environments attract more green projects and investors and tend to offer more financing options.

- Don’t ignore emerging markets. Emerging economies offer interesting projects, superior returns, and innovative financing—and they are crucial to achieving ambitious CO2 targets.

- Keep two-way communication open. To ensure alignment among investors and companies, make sure that project risks, impact, and technologies are clear.