The time has come for the container-shipping industry to join the digital revolution. Digital opens the door for carriers to strengthen their direct relationships with end customers, further reduce their costs (including for fuel, vessel operation, and customer service), and pursue new revenue streams beyond traditional shipping services .

Only a few leading carriers have applied digital technologies toward enhancing their commercial and operational activities. Box tracking, empty-container repositioning, document management, network design, and pricing are among the activities that these carriers have started to digitalize.

Although the rewards of a digital transformation can be significant, so are the challenges to making it happen. To succeed, carriers must adopt a structured approach to defining a digital vision and integrating new technologies, capabilities, and mindsets into their traditional way of working. It is not too late to get started. The industry is still in the early stages of digitalization, and most carriers have yet to achieve significant progress. Carriers that approach a digital transformation with the right ambition, resources, and scale can leap to the forefront of adoption. Within 18 months, they can achieve a step change in their digital capabilities that strengthens their competitive advantage. Quick wins are achievable within 12 months.

Rough Seas Demand Digital Adoption

In BCG’s November 2016 report Sailing in Strong Winds: The New Normal in Global Trade and Container Shipping , we discussed the industry’s then-current challenge: slow growth in global demand coupled with a persistent oversupply of vessel capacity. Although global container demand did improve in 2017, moderate long-term growth projections combined with a new round of vessel purchases indicate that overcapacity will remain in the range of 6% to 9% in 2020.

Even as the economic challenges of the new normal persist, carriers face an increasing threat from digital attackers. A variety of players—including both traditional logistics players and new entrants—are adopting digital technology to provide seamless, end-to-end services. If these companies’ business models succeed, carriers run the risk of losing direct contact with some of their most profitable customers—primarily small and midsize freight forwarders and beneficial cargo owners (known as BCOs). In this scenario, the carrier’s role could be reduced to providing commoditized ocean freight services.

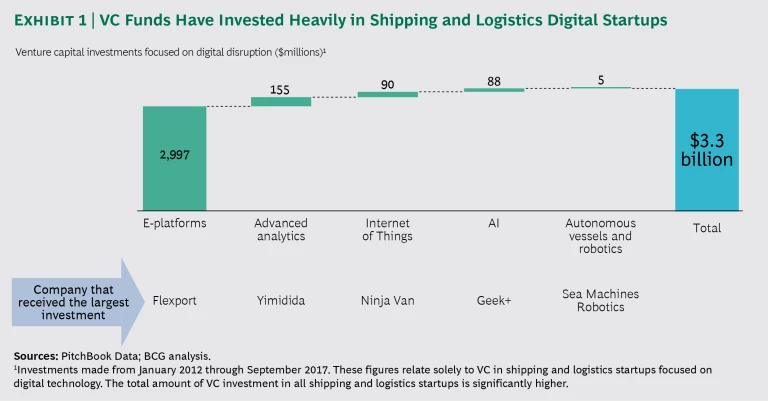

One of the strongest threats is from players that are adopting digital technology as the basis for an assetless business model that lets them compete with a much lower cost base. Recognizing the opportunity, e-commerce giant Amazon has obtained a license to operate as an assetless cargo forwarder between China and the US. Startups are also gaining traction. For example, Flexport is a technology-based freight forwarder that, as of October 2017, had attracted more than $200 million in venture capital investment. Flexport is not alone in attracting venture capital. In the past six years, more than $3.3 billion has been invested in digital startups in the shipping and logistics sector. (See Exhibit 1.)

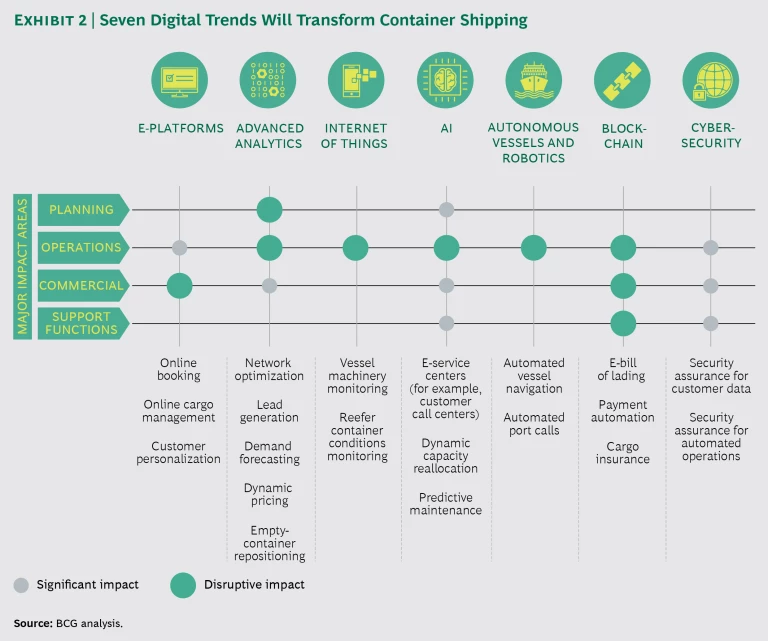

Fortunately, carriers have many opportunities to apply digital technology—not only to maintain their direct customer relationships with acceptable costs but also to improve their operations and grow their businesses. Seven digital trends have emerged as especially valuable in the shipping industry . (See Exhibit 2.) These trends are contributing to performance improvements across the full scope of carriers’ operations.

Overcoming the Obstacles to Getting Started

So far, most carriers have failed to take a systematic approach to digital adoption. Manual intervention is still required for operations such as trimming during voyage, restowage, and documentation management. Network optimization, empty-container repositioning, cargo routing, forecasting, and pricing are among the core processes that can be digitalized. However, most carriers still handle them in the traditional way, without systematically leveraging the power of advanced analytics and artificial intelligence (AI). For example, some carriers that have collected impressive volumes of data lack the skills or agile processes to generate insight and improvements.

What is holding them back? We have found that many believe that creating a state-of-the-art IT environment is a must before launching a digital transformation. But this belief is a misconception. Embarking on the digital journey does not require an immediate large-scale and expensive overhaul of IT systems. Carriers should begin by leveraging their existing infrastructure, gradually enhancing systems as required.

Furthermore, imperfect data, a well-known challenge, should not be considered reason enough to postpone digitalization. Instead, advanced analytics solutions can be used to cleanse existing data, which can then be fed into the company’s first digital tools. Simultaneously, the company can pursue initiatives to improve data quality.

We have also seen carriers fall into the trap of moving too slowly to implement a digital transformation. After establishing a long-term vision, a company must move quickly to launch digital sprints and achieve initial successes that showcase the organization’s opportunities and help fund the digital journey. It is essential to fast-track the development of digital capabilities and agile ways of working in order to enable a full-scale transformation.

The Agenda for a Digital Transformation

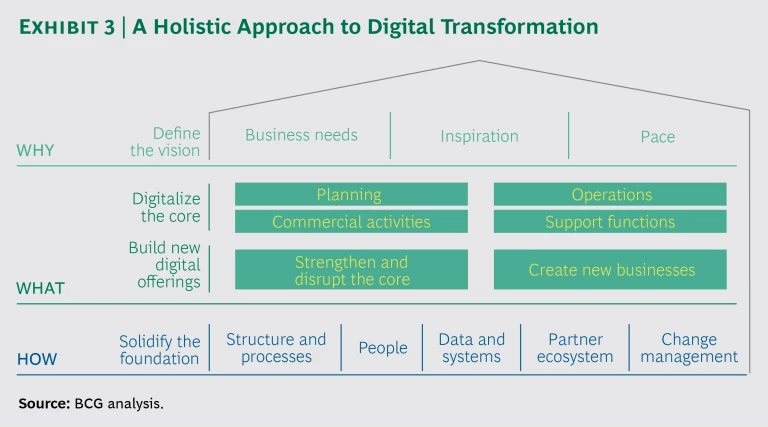

To promote success, a carrier’s digital transformation agenda must be comprehensive, ranging from the strategic vision to the fundamental enablers. (See Exhibit 3.)

Define the Vision

Establishing a clear vision for the carrier’s digital identity is essential for generating commitment to an orchestrated, organization-wide approach. A vision should address business needs, be informed by inspiring examples, and reflect a realistic time frame for success. Maersk Line, CMA CGM, and Hapag-Lloyd are among the first carriers to have clarified—and started to pursue—their digital vision.

Business Needs. To define a vision, the company should start by identifying ways that digital technologies could help address its business needs along the value chain, from the initial shipping request through final delivery and repositioning of the empty container. It is essential to determine current pain points in operations and identify activities in which value that is currently being lost could be recovered through the use of digital solutions. Moreover, it is critical to assess the potential impact of new competitors that disrupt the market with technology-enabled solutions and then to determine how to respond.

Inspiration. Carriers should scan the business environment for digital inspiration. Trends along the entire transport value chain should be closely monitored. For example, how are freight forwarders using digital technologies to serve the same pool of customers? Those technologies that attract the attention of venture capital investors are markers of emerging trends. Carriers should also consider how companies in other industries that are further along in the digitalization journey have successfully applied digital technology.

Pace. The vision should be grounded in the reality of how fast the organization can transform. To establish a timeline that is both bold and realistic, a carrier needs to assess its organization’s readiness to adopt digital. BCG has developed the Digital Acceleration Index , a comprehensive digital health check, that draws upon our experience with many companies and industries.

Digitalize the Core

Adopting digital to support core business processes provides the greatest opportunity for a carrier to create value. It is also the greatest challenge of a digital transformation. Planning, operations, commercial activities, and support functions should all be addressed.

Planning. Carriers need advanced analytics tools to optimize planning for their networks. BCG has determined that carriers must consider more than 10,000 variables—including, for example, stowage and priorities for allocating capacity among customers—in order to optimize their networks. To analyze these variables, a carrier requires a steady flow of commercial and operational data to inform an algorithm. It also needs data science teams, either within the organization or through external collaborations, to provide the analytical manpower for developing and maintaining the required tools.

Operations. Digital technologies can enhance the full range of carriers’ operations:

- Voyage Operations. Today, many carriers use onshore fleet centers to improve visibility into voyage execution (including vessel position and speed and bunker consumption). However, they rarely derive the full range of benefits from this wealth of information. In addition to providing visibility, fleet centers can optimize decision making by bringing responsibility for key decisions onshore. The center’s staff can apply advanced analytics that consider all available data on voyage execution as well as external factors (such as expected weather conditions and port congestion) to determine the optimal voyage routing, speed, and trimming.

- Fleet Maintenance. Onshore analysis of vessel machinery performance data can dramatically improve fleet maintenance. For example, AI systems can identify performance patterns that signify an upcoming machinery failure and then warn crews about the need for maintenance or replacement. With this capability, a carrier can both reduce maintenance and procurement costs by nearly eliminating emergency replacements and minimize the time a vessel is “off hire” owing to unscheduled maintenance and technical failures.

- Port Operations. Today, up to 30% of a vessel’s voyage time can be spent in port. Digital technology can significantly reduce this time. Connectivity solutions can enable the seamless flow of information and documents among all stakeholders, including shippers, carriers, terminals, forwarders, and port authorities. For instance, ports can optimize the docking sequence and equipment availability, and forwarders can improve pickup scheduling. Crews can access such information while a vessel is en route, enabling them to improve coordination and schedule adherence, minimize wasted time, and reduce fuel consumption. Blockchain, an emerging technology, can help promote these benefits. (See the sidebar.)

How the Shipping Industry Can Benefit from Blockchain Technology

How the Shipping Industry Can Benefit from Blockchain Technology

A blockchain is a shared database that provides a secure and trusted ledger for transactions or assets. (See “ Thinking Outside the Blocks,” BCG article, December 2016.) Each party that shares the database can enter its transactions into it and read other parties’ entries with no need for gatekeeper support. Selected outside parties (such as regulators) can also be given permission to view the ledger. The technology eliminates the need for intermediaries, improving transaction efficiency. For example, many banks are already using blockchain technology to register letters of credit, allowing importers, exporters, and their lenders to share common data and to release funds without delay or error.

Participants in the shipping industry have started to investigate ways to use blockchain technology to enhance operations. For example, the Port of Antwerp is testing a blockchain solution for upgrading the security and efficiency of container handling. However, the most important emerging blockchain application is the creation of an indisputable electronic bill of lading (eB/L) to improve the tracing and tracking of containers.

Here’s how it works: Each container is assigned a unique identifier, and that identifier is used when entering the container’s cargo, location, and status data in an eB/L. While the cargo is in transit, the eB/L is visible to customs authorities, terminals, and the cargo recipient. This visibility prepares the parties for timely cargo unloading, clearance, and pickup. Improper documentation is identified and corrected while the cargo is en route, thus minimizing port delays. Expanding eB/L capabilities to track each cargo milestone—for example, loading, unloading, and customs clearance—would allow for tracking cargo in real time and proving provenance. The use of an eB/L could be further extended to streamline cargo insurance, fraud detection, and automation of payments.

To capture such benefits, stakeholders should seek to create an industry-wide blockchain framework. A critical mass of players needs to reach agreement on a set of blockchain standards and develop a common platform on the basis of those standards. The industry can optimize container operations globally and gain significant market-wide benefits by expanding the number of participants in this collaborative effort. The Blockchain in Trucking Alliance, in which major transport and technology players are collectively developing blockchain standards for the freight industry, provides a credible model.

- Cargo Operations. Although carriers already use IT solutions to optimize onboard cargo positioning, there is a wide variety of additional opportunities. Advanced analytics solutions can further optimize restowage time and cost. Back-end communication between the IT systems of carriers and ports can reduce instances of human error (such as those that arise as a result of language barriers) and minimize stowage mistakes. And AI and sensor technology can improve equipment scheduling, thus minimizing equipment idle time. Overall, such solutions could reduce active port time by as much as 30%.

- Capacity Management. Using historical booking data, current booking data, and cargo demand indicators, carriers can apply advanced analytics to dynamically reallocate a vessel’s capacity across ports. Analyzing this data, a carrier can identify booking patterns and accurately predict demand at each port of a voyage. The predictions improve as the voyage date approaches, reaching an accuracy of plus or minus 10% one week prior to departure. This level of accuracy allows a carrier to increase the total volumes handled by more than 5% and to select the most profitable cargo across all ports in cases of excessive demand. Machine learning can continually test the accuracy of predictions against actual bookings, and the forecasting algorithm can improve itself after each voyage.

- Intermodal Operations. Most carriers that have tried to expand their inland offerings have encountered significant challenges relating to, for example, intermodal pricing and box evacuation. Today, carriers can use an advanced analytics solution to overcome these challenges and reduce operational complexity. Using historical demand data and price lists for inland transport, the solution can calculate the total cost arising not only from the box movement itself but also from, among other variables, potential evacuation requirements and equipment delays. The output is advice on the optimal door-to-door rates. The same analytics solution provides advice on the best mode of inland transport, considering each customer’s specific requirements. Additionally, sea and inland carriers can use common online platforms to streamline operations and improve the predictability of tracking and delivery.

Commercial Activities. Carriers should also consider the following opportunities for improving the effectiveness and efficiency of commercial activities:

- Customer Online Experience. An online booking platform that lets a customer receive instant quotes will soon be considered table stakes for competing in the industry. However, providing instant quotes for container shipping is complicated, especially for journeys entailing intermodal transport. It requires a robust underlying IT infrastructure with, at a minimum, frequently updated price sheets that account for different permutations of services and allow for intermodal quotations. After an order has been placed, the customer expects real-time reports on the location and condition of the cargo—especially, refrigerated cargo. Leading carriers are already working to improve the online experience. For example, my.maerskline.com is a portal that provides Maersk’s customers with one-stop access to online quotes, remote container management, and container tracking. Similarly, Traxens, a cargo logistics startup, offers a technology solution that provides visibility into container location and the condition of shipped cargo. Such services both improve the customer experience and enhance a carrier’s ability to increase revenues.

- Sales Force Effectiveness. Digital solutions can help increase the productivity of a carrier’s large sales force. Lead generation is a case in point. Today’s carriers largely regard lead generation as an art conducted at the local level. However, data-driven lead generation and qualification is now possible, and carriers can use the trove of customer data they already possess to more precisely segment and target their customer base. With such precision, the sales force can define individualized offerings, thereby enhancing customer loyalty.

- Dynamic Pricing. Advanced analytics offers an unprecedented capability for dynamically adjusting prices. A carrier’s pricing engine should use historical data to calculate a price-demand curve (the relationship between offered rates and booked volume) for each port pairing and to adjust rates by using a multitude of statistical variables, such as seasonal periods of high demand and the carrier’s utilization forecast for each voyage. As a trip date approaches, the engine should be continually fine-tuning rates. Early adopters have improved overall profitability by 3% to 5%.

Support Functions. Shared-service centers and procurement are chief among the support functions that can benefit from digital adoption:

- Shared-Service Centers. It has become common practice for carriers to assign manual tasks, such as the processing of accounts payable and receivable, to shared-service centers in low-cost locations around the world. In addition to personnel costs, manual processing entails the possibility of human error that can cause delays. To a great extent, digital advancements can automate these tasks, minimizing errors and ensuring compliance with company policies. Digital solutions can streamline many other shared services, such as claims management.

- Procurement. Procurement warrants special attention, as its digitalization can result in considerable direct savings. With a central database and advanced business intelligence software, a carrier can build and maintain a spending-analysis tool that significantly improves the organization’s ability to identify savings opportunities. In addition, an e-auction platform for soliciting price quotes can generate cost savings in the range of 10% in certain procurement categories—mainly materials, such as lubricants, for which specifications can be well codified. Carriers around the world are already embracing digital procurement solutions, with major players in container and bulk shipping leading the way.

Build New Digital Offerings

Carriers can increase their value to customers and strengthen their relationships by offering new digitally enabled solutions in addition to ocean freight services, the core offering. In an analogous situation, Uber has added a food delivery service to its core offering of car rides, thereby addressing additional customer needs.

Strengthen and disrupt the core. The opportunities to consider first are those that help the carrier expand its offerings to its existing customer base, building on in-depth knowledge of customer needs and long-term relationships. For example, forwarders and several carriers already offer trade financing. Companies can use digital platforms to extend this to a broader set of customers. Moreover, carriers can strive to join the ranks of digital champions by disrupting their core offering. For example, Damco, Maersk’s third-party logistics arm, has incubated Twill Logistics , a digital freight forwarder that facilitates shippers’ bookings, documentation management, and tracking shipments worldwide.

Create new businesses. Carriers should think far afield. For example, they could use their role in the ecosystem to incubate new businesses, such as industry platforms and marketplaces. Digital platforms and marketplaces can eliminate the industry’s major legacy inefficiencies by improving the enforceability of contracts with shippers and, thus, increase the predictability of utilization or by offering digital supply chain management. For example, xChange is an online marketplace that allows for the direct interchange of containers among carriers and container-leasing companies, reducing both costs and emissions related to the repositioning of empty containers. Similarly, in the trucking industry, MAN has launched Loadfox, a startup that offers “ridesharing for freight” through an online marketplace that allows truckers to sell vacant space on their trucks to a community of shippers.

Solidify the Foundation

To realize digital’s promise, each carrier must make a strong commitment to build digital capabilities throughout its organization:

Structure and Processes. An end-to-end digital transformation requires a clear ownership structure that includes nimble, cross-functional innovation teams, with participants focusing exclusively on their innovation project. It is essential to adopt agile ways of working and foster an entrepreneurial culture that rewards experimentation and accepts the fast failure of unsuccessful ideas. Incentives and KPIs must be designed to support the entrepreneurial culture.

People. To fully adopt digital across the organization, carriers need to acquire new skills. Some digital skills can be developed in the existing organization by building current capabilities within commercial, operations, and support functions, including IT. However, for certain roles—such as data scientist, data modeler, and Web and user interface designer—carriers will need to recruit talent from the very competitive digital market. In many cases. this means going head to head with startups whose entrepreneurial cultures and opportunities for fast growth attract digital specialists. Carriers must find pragmatic ways to overcome the challenge. One approach is to create a build-operate-transfer program like those developed by companies in other industries, such as automotive. Well-established companies have attracted digital talent by launching a separate company that focuses on building and operating digital solutions. Once new solutions become operational, they are transferred to the parent company. (See “ Data-Driven Transformation: Accelerate at Scale Now ,” BCG article, May 2017.)

Data and Systems. Having outdated IT systems should not be an excuse for delaying digitalization. Indeed, to start the journey promptly, it is critical to make use of the available infrastructure. Simultaneously, a carrier should modernize its systems by implementing a comprehensive and robust digital architecture and a data infrastructure that is scalable and modularized, allowing digital and IT functions to integrate new technologies as they become available. For instance, to identify and pursue digital initiatives, teams need access to integrated data—operational, commercial, technical, and financial—ideally, in a central data warehouse. The architecture should also be able to accommodate the adoption of blockchain and other solutions aimed at integration with external partners. In addition, advanced cybersecurity systems must be in place to ensure the confidentiality of the centralized data and the integrity of systems. Carriers should anticipate the need for employee retraining and avoid the pitfall of anchoring the architecture in legacy systems.

Partner Ecosystem. In addition to developing digital solutions inhouse, carriers need to join the digital ecosystem. The flow of venture capital money into the market has helped many startups mature to a stage at which they can provide fully operational offerings. Carriers should scan the market for opportunities to acquire or form joint ventures with startups that are attractive investment targets.

Change Management. Introducing digital technologies into traditional ways of working is a complex undertaking that requires a bold, yet realistic, approach to change management. A carrier’s management should both consider how fast the organization can adapt and determine how to ensure that its adoption of digital is sustained.

Five Imperatives for Success

Rather than injecting digital technology into their organization sporadically, carriers must systematically orchestrate their implementation of each element of the digital transformation. An end-to-end approach should be guided by five imperatives.

Develop a digital vision. Whether a carrier chooses to be a digital frontrunner or a fast follower, it must establish a tangible vision for its transformation. The vision should include a clear ambition with respect to the targeted value and implementation timeline. And having evaluated the long list of potential opportunities, the carrier should present a vision that sets out the priority areas selected.

Commit to rapid adoption. To avoid incremental and fragmented efforts, a carrier must commit to bold and rapid digital adoption. By using digital sprints to develop minimum viable solutions quickly, a carrier can showcase the opportunities for value creation to internal and external stakeholders.

Lay the foundation. Carriers must recognize that a digital organization requires an operating model enhanced with new digital capabilities, as well as KPIs and incentives for rewarding experimentation. Moreover, carriers need to embrace agile ways of working that foster rapid decision making and deal well with the fast failure of unsuccessful experiments. Carriers must focus on building the required capabilities both organically and by acquiring digital talent.

Incubate outside the main organization. Across industries, best-practice companies have used the build-operate-transfer approach to create incubation teams that are distinct and separate from the main organization not only to develop innovative offerings but also to devise innovative ways for tackling their core operations. To spearhead the digital transformation, carriers should follow suit, establishing a digital innovation team outside the core company. This team’s efforts should not be tied to corporate processes or review cycles that could hamper the pace of digitalization.

Test and then scale fast. For all types of digital initiatives, it is essential to test the ideas in pilots before moving to a full-scale rollout with maximum speed.

To emerge as a winner in the digital era, a carrier must be willing to invest significant time and resources. Most carriers lack an overall vision and compelling plan for digital adoption. They also face major organizational hurdles and are slowed down by the scarcity of workers with digital capabilities and skills. Fortunately, a carrier can overcome such obstacles rapidly by taking a structured and disciplined approach to digital adoption. Although there is still time to get started, we expect the window of opportunity to close soon. Now is the moment for carriers to embark on the voyage to digital leadership.