The performance gap between digital champions and laggards is widening, and digital’s continued contribution to company performance means that gap will likely grow. But any company can improve. By taking steps to become more digitally mature , a company can boost cost efficiency, time to market, competitive advantage, and market share.

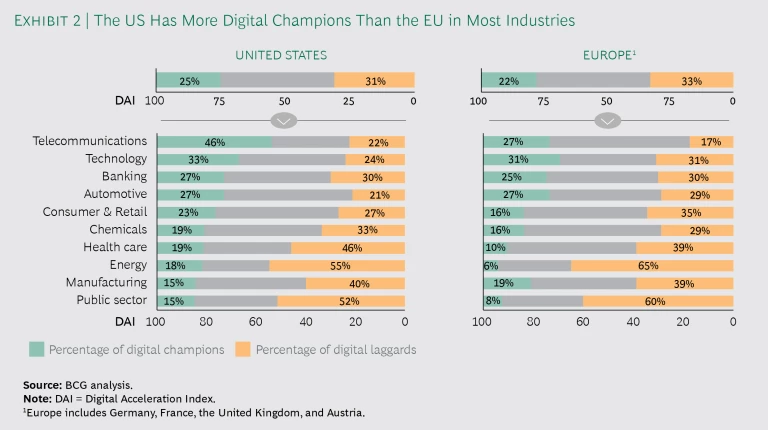

This holds true across a wide range of industries, according to a second annual study conducted by The Boston Consulting Group (BCG). The study, involving more than 1,900 companies in Europe and the US, relied on BCG’s Digital Acceleration Index (DAI) to derive comparisons. (See “Our Methodology.”) Specifically, the study found that, while 25% of the companies surveyed qualify as champions, almost one-third appear significantly behind in their digital capabilities. Among industries, the biggest share of digital champions comprises telco, technology, banking, and automotive.

Our Methodology

Our Methodology

For our 2018 study, we asked 1,900 companies in Europe and the United States to estimate their digital maturity on a scale of 1 to 4 in 37 categories. We then aggregated those raw scores and calculated resulting values to their responses on a scale from 0 to 100. We weighted them to determine each company’s overall performance on our Digital Acceleration Index (DAI). Companies with a DAI of 67 to 100 qualify as champions, while those with a DAI of 43 or less are categorized as laggards. Champions had an average maturity level of at least 3 out of 4 on all maturity dimensions, whereas laggards reported average maturity levels of less than 2 in 66% of the assessed dimensions and an average maturity of 3 in 33% of the assessed dimensions. Champions in this study had an average DAI of 80, while laggards scored 30 on average.

We collected data from companies with at least 2,500 employees in the US, Germany, the UK, and France across 10 industries: manufacturing, chemicals, technology, banking, telecommunications, consumer goods and retail, automotive, energy, health care, and the public sector. Mostly senior leaders participated: 30% were C-level, 34% were division leaders, and 26% were general managers (10% did not report their role).

Meanwhile, industries with a higher share of digital laggards—such as health care, energy, and manufacturing—are looking for ways to improve their standing. Our study correlates specific digital initiatives with specific positive outcomes—such as boosting market share—and shows how digital champions are starting to see a return on their digital investments. These findings could provide valuable guidance for companies that have fallen behind, suggesting how they might up their digital game in the most efficient way possible.

Digital Drives Performance

We found that increased levels of digital maturity significantly improved competitive advantage along multiple performance indicators, such as time to market, cost efficiency, product quality, and customer satisfaction. In fact, an increase in digital maturity of 25 DAI points improves the likelihood of reaching a superior performance for time to market, and cost efficiency doubles. This connection holds for an increase of 50 and 75 points, respectively, with the likelihood tripling and quadrupling. We observed less strong, yet significant, effects for product quality and customer satisfaction.

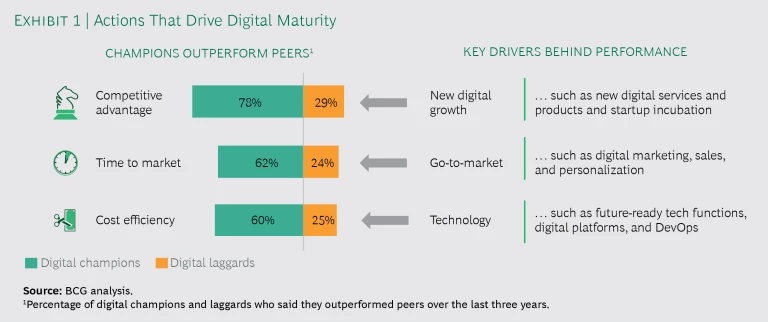

For gaining competitive advantage overall, we found that new digital growth is the main driver. Champions who offer new digital services and products and incubate startups seem to have stronger competitiveness than laggards in those dimensions. (See Exhibit 1.)

As for individual performance indicators, we identified the most relevant digital initiatives as follows:

- To improve time to market, building go-to-market capabilities such as digital marketing or personalization is essential. Startup incubation also has a major effect in addition to contributing to competitive advantage.

- To enhance cost efficiency, digitizing the technology enablers is imperative—for example, making the tech function ready for the future, building digital platforms, and setting up DevOps for digital delivery.

- To upgrade product quality, people and organizational dimensions such as digital leadership are important, as well as a strong digital culture and governance to foster digital initiatives and digital talent. In other words, investing in digital talent naturally yields higher-quality digital products.

- To perform better in customer satisfaction, it’s critical to

focus on digital customer journeys

and personalization of offerings as well as prototyping digital products and supporting lighthouse projects.

All of these effects on competitive advantage manifest over time. In a DAI deep-dive study, we assessed 81 leading telcos from more than 40 countries to compare the market share evolution of champions and laggards. From 2012 to 2017, champions increased market share by 7% and laggards saw their market share drop 11%.

Applying Digital Boosters

Given that digital pays off, the question becomes how to digitize fast. In last year’s study, we identified three boosters that champions have adopted: investment (>5% of operational expenditures [OPEX] on digital), recruitment of digital experts (>10% of full-time-equivalent [FTE] employees having digital roles), and embedding digital in their organization (in a hybrid or built-in model). In our previous study, champions that applied all three boosters had a DAI score that was 16 points higher, on average, than the laggards’. This gap has actually widened to 21 points in the recent study. Even applying just one booster improves DAI scores: 8 (recruiting digital experts), 9 (spending more than 5% of OPEX on digital), or 14 (embedding digital in the organization) points on average.

In this year’s study, we found the effects of these boosters varied by industry. For example, a high share of digital FTEs has a strong impact on manufacturing (12 DAI points) and health care (15 DAI points). Given that these industries severely lack digital skills, it’s logical that hiring any new digital talent accelerates the companies’ digital journeys. Meanwhile, spending more than 5% of OPEX on digital significantly improves DAI scores in banking, tech, and health care. Embedding digital in the organization and empowering business units to drive digital initiatives is the strongest booster across all industries.

Industries Struggle with Digital Maturity

In line with last year’s results, the US outperformed Europe with more champions (25% versus 22%) and fewer laggards (31% versus 33%). (See Exhibit 2.) Much of this edge in US performance is due to stronger US technology and telco sectors, which support other industries’ digitization efforts through partnerships and close collaboration. Among US telcos, 46% score as digital champions, compared with only 27% of European telcos. The difference, based on self-assessments, is less dramatic in the tech industry, where 33% of US and 31% of EU companies report a high digital maturity; that’s surprising, given the large number of leading tech companies based in the US.

It’s logical that tech, telco, and banking companies lead in digital since their main products and services are already mostly digitized. For all other industries, the digitization journey is more challenging, given their nondigital product portfolio. An exception is automotive, an industry traditionally more focused on products rather than service, with a strong share of champions in both the US and Europe (27% in both regions).

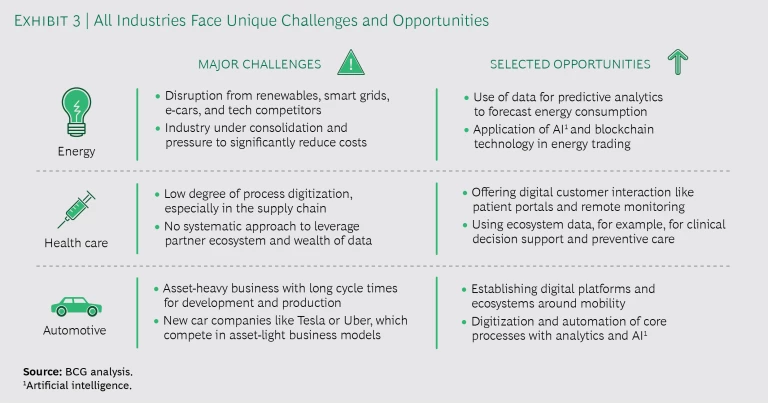

Compared with last year’s report, we expanded the scope of our study and took a closer look at several additional industries, including health care and energy, where we found a comparably high share of laggards. These industries face significant challenges to bringing their digital strategies to life, particularly when it comes to driving innovative technologies into core processes or pursuing new business opportunities. (See Exhibit 3.)

Energy Has the Most Laggards

As a whole, the energy sector reported the highest share of laggards among all surveyed industries: 61%. The picture by subindustry provides more differentiation: 71% of oil and gas (O&G) companies assessed themselves as laggards, while the share in utilities (57%) was much lower. It’s somewhat surprising that O&G reported such a high percentage of laggards, given that companies have invested significantly in making the exploration process more efficient. One explanation could be the high degree of autonomy in operating units. Enterprise-wide, end-to-end digitization is challenging to achieve because each operating asset has its own requirements and initiatives.

Interestingly, O&G companies are now reviving digital initiatives that had been on hold since the oil price crash, when the industry turned its attention to consolidation and cost reduction. For O&G players, the biggest challenge is tapping into their large pools of data. Both the data platforms and infrastructure and the data and analytics governance dimensions in our survey show very low maturity (both with average DAI scores of 20). On the other hand, O&G players reported the greatest aspiration for these dimensions by 2020 (DAI 35 and 39, respectively).

As noted, there are fewer laggards among utilities, which are closer to end-customers and have stronger go-to-market capabilities driven by their stronger B2C footprint. But like O&G, utilities tend to think more on a project-by-project basis (for example, building a new power plant), which can make end-to-end digitization initiatives seem less urgent or necessary. That said, market forces such as the disruptive power of renewables, the decentralization of energy creation (the smart grid), tech competition (such as Google Nest), and the increase in demand from electric cars are pushing utilities toward digitization.

This has led to important initiatives, such as recruiting experts from other industries and building innovation labs to explore new opportunities (such as electric car batteries and peer-to-peer marketplaces for power). Furthermore, some utilities started leveraging their vast customer data to develop new products and services, and many are quite advanced in analytic modeling (for example, weather information for predicting the utilization of windmills). Some have even started to pilot artificial intelligence and blockchain technology in the trading space—reflected in the high score for the artificial intelligence dimension (DAI 39). By comparison, O&G companies are only beginning to use AI and other emerging technologies and so scored much lower (DAI 13).

All of these technologies require a digital and IT function that will act as a partner with the business to identify the right use cases for these technologies and enable the digital future.

Health Care’s Wide-Ranging Maturity

The health care sector has a big share of laggards (43%), but like energy, the picture is more nuanced when looking into the various subsectors: medical technology (medtech), providers, and biopharma/pharmaceuticals (bio/pharma). All three subsectors score highest in having a business strategy driven by digital (medtech DAI 64, providers 52, bio/pharma 46). Even though all have a solid digital strategy, when it comes to digitizing the core, we found that medtech (DAI 61) is far ahead of providers (DAI 40) and even more so bio/pharma (DAI 25). Success in this area is what seems to truly differentiate laggards and champions.

Medtech is the most advanced subsector, with only 10% laggards, which makes sense since technology and software for diagnostic purposes are at the core of its business. Being close to the customer and regularly receiving feedback on product innovation helped them achieve a respectable DAI score of 63 in reinventing customer journeys. Meanwhile, they are also experimenting with connected devices (for example, for remote monitoring) for new growth, which is reflected in the high score for new digital services/products (DAI 50) compared with 29 for bio/pharma.

Medical providers (such as hospitals and medical centers) are much further behind on the digital journey, with 54% being categorized as laggards. But the subsector with the most laggards was bio/pharma (70%). This is due to a very complicated supply chain that some companies still manually manage on Excel spreadsheets. Bio/pharma’s customer journey score (DAI 28) shows room for improvement, especially compared with providers (DAI 44).

But the outlook for health care is positive, especially if it can better utilize two inherent advantages: a broad ecosystem and tons of data. Today, many health care companies have myriad partnerships yet no strategic approach to leverage these networks for new growth. To turn this potential into a reality, they will need digital capabilities and real-time data access, which is currently still an area with lower digital maturity.

For example, bio/pharma scored DAI 13 on data and analytics governance and DAI 7 on digital and artificial intelligence. They will also need to ramp up data analytics capabilities to apply AI and other emerging technologies like blockchain. (See “ A Prescription for Blockchain in Health Care ,” BCG article, April 2018.) To provide one example, a multinational biopharmaceutical company launched a digital initiative to integrate data sources, gain greater visibility into the supply chain, and generate insights beyond what is possible from traditional enterprise resource planning (ERP) data. This project allowed the company to map the supply chain end-to-end, expose sources of volatility, and get real-time updates on material flow and disruptions. By applying machine learning and smart analytics to this deeper well of data, and leveraging those to guide their process optimization and operational excellence initiatives, the company lowered costs by 3% to 5% and became more efficient, reducing working capital by 5% to 7%.

Automotive’s Digital Know-How

The automotive industry has the highest share of champions, 27%, after telco, tech, and banking. Digital champions scored particularly high in digital roadmap (DAI 87) and manufacturing/Industry 4.0 (DAI 85). Automotive is very experienced—and way ahead of other industries—when it comes to digitizing R&D and production. With the emergence of connected and autonomous cars, digital has become essential to the product roadmap.

Today, fast-moving newcomers pose a threat to the industry. These new entrants have very fast internal cycle times, or, like Uber, they compete using asset-light digital business models. Some of the champions in automotive started responding early to these threats. This is reflected in their high scores for developing digital capabilities (DAI 75), digitizing their core processes (DAI 77), and launching digital businesses (DAI 75). Car lenders, dealers, and OEMs should move quickly and partner with startups or build their own digital platforms or ecosystems to create revenues form adjacent or new businesses. For instance, Daimler and Volkswagen funded AutoGravity, a site where potential car buyers apply for loans and compare rates directly on their smartphones.

The 25% of laggards in automotive face challenges foremost in process digitization and robotics, next-generation sales, and DevOps (each dimension with average DAI score of 25). These laggards risk losing long-term competitiveness with their peers, as well as digitally savvy new entrants.

Steps Moving Forward

Every company has its own starting point. While we found that most companies are incorporating digital in their strategic road maps, what truly sets apart the champions is how they bring that strategy to life on an operational level. Here are some findings that hold true for all companies:

Create the next-generation tech function. Companies should pursue digital maturity to create a technology function of the future. Besides improving efficiencies and costs, a future-ready IT and tech function is critical to enabling emerging technologies such as AI and blockchain.

Drive customer-centric digitization of the core. Companies need to create value fast with digital initiatives that always keep the customer top of mind—for example, by designing digital customer journeys. This leads to customer satisfaction, of course, but it also enhances product quality. In addition, through personalization and digital marketing, companies can accelerate their time to market.

Focus on new digital business opportunities. Companies that digitize the core while simultaneously identifying new growth areas gain competitive advantage. Opportunities are manifold and may involve startup collaboration, ecosystem expansion, and leveraging assets such as customer data.

Becoming digital pays off in superior performance. Across all industries, we see great opportunities to improve financial performance and gain competitiveness from digital investments. Companies must move away from seeing IT as a cost center but rather as a source of economic and competitive advantage. Only then will they have the confidence and commitment to move their digital transformations forward.