The digital era is revolutionizing the health care industry, but pharma's approach to product development and market access has remained relatively unchanged. Pharma companies have been experimenting with digital technologies and analytics-driven pilots, but instead of seeing meaningful impact on productivity and access, they’re seeing cost and complexity go up. As one pharma executive put it, “It’s like lasagna. We just keep adding ever more layers of cost and taking nothing out.”

The reality is that digital technologies won't transform a business if its operating model isn't designed to accommodate digital innovation. To thrive in the era of value-based health care and personalization, companies can't just make incremental changes within their existing operating model. They need an end-to-end redesign.

The disruption of the technology industry by the iPhone provides an illustrative analogy to what's possible in pharma today. First, Apple assembled proven technologies (like touchscreens and GPS) into an end-to-end redesign of the customer experience. While existing competitors were optimizing locally within the constraints of the legacy model (by introducing new product features, for instance), Apple was breaking through the constraints of that model entirely. Then Apple opened up the iPhone to an ecosystem of third-party app developers, creating platform economics. Each new app increased the value of the entire platform not only for Apple, but for its development partners and customers, fueling a virtuous cycle that attracted ever more developers and customers and accelerated strategic differentiation.

We see a similar opportunity for pharma companies to assemble proven digital and analytics innovations into an end-to-end redesign, from product development through to market access. And by opening up the data science platform at the heart of the redesign to customers (payers and large provider institutions) and external innovators, pharma can create its own platform economics. Such a redesign has the potential to double the economic value of a pharmaceutical company’s products.

A New Model for Pharma

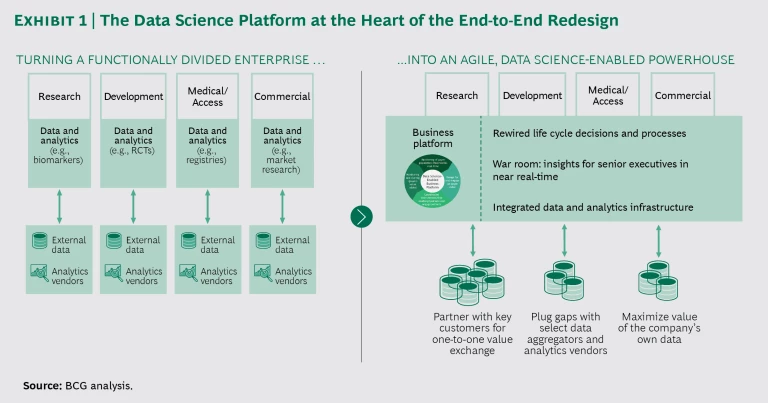

A shift is required from the current functionally divided approach to product development and market access to an agile, data science-enabled model that takes advantage of continuing digital innovation and regulatory flexibility. The end-to-end redesign includes identifying and prioritizing the evidence valued by payers early in the process, shifting the burden of evidence generation from randomized controlled trials to new approaches that apply predictive analytics and real-world evidence, automating patient matching (that is, the pairing of the right patient with the right trial or treatment), and engaging customers more proactively throughout the life cycle of a product. It requires breaking down functional silos and adopting agile ways of working. Taken together, these changes will quite dramatically reduce costs and accelerate the time to access and peak sales, while reducing risk and increasing value (net price and access).

At the heart of the redesign is a data science-enabled business platform that provides personalized evidence that matters to customers across the product life cycle. (See Exhibit 1.) Let’s say the product team finds that patients A and B are at the highest risk of disease progression and are unresponsive to existing treatments, representing an unmet need. With the platform in place, clinical-trials recruiters will know that these two types of patients are good candidates for the trial of their company’s new medication. Once evidence from the trial is available, customers will know about patients A and B, who represent the cohort that will benefit most from the medication. Physicians will know how to find patients A and B and match them to the medication. Finally, providers will be able to share what they learn in the real world with the pharma company's product team, further enriching the platform and fueling a virtuous cycle.

While pharmaceutical companies already have access to lots of data on populations and patients (through vendors, collaborative research with customers, registries, informed consent, and other mechanisms), this data is used narrowly within individual functions for specific purposes like trial design, patient recruitment, pricing, and marketing. Companies are falling short when it comes to building the fundamental capabilities needed to thrive in an era of value and personalization.

To get the most from data within the existing regulatory framework, pharma companies must build more direct strategic relationships with major customers and collaboratively run analytics behind those customers’ firewalls (based on a new data governance paradigm in which the “analytics travels to the data”). This win-win approach drives the platform economics. Customers value access to analytics that solve their big problems, such as finding patients at the highest risk of disease progression or identifying patients who are receiving suboptimal care. Meanwhile, pharma companies gain access to customer data (directly via strategic partnerships or indirectly via intermediaries), tapping into ever-richer insights about patients in the real world and creating smarter analytics to unlock even greater value for customers. Companies with a powerful data science platform will be viewed as the partner of choice by innovative startups that lack late-stage development and commercialization capabilities.

We haven’t seen an opportunity of this magnitude in the pharmaceutical industry for a very long time. In the 1990s, Pfizer created a closed-loop field force platform that totally overhauled its commercial performance. By leveraging external data on point-of-sale prescriptions along with formulary data and local customer information, the company redesigned its approach to territory management, call planning, and sales incentives in a way that was “personalized” at the local level. The platform, along with other developments in Pfizer’s business, resulted in a fivefold increase in revenue from 1995 to 2005. A similar window of opportunity now exists for innovation in product development and market access.

Companies with a powerful data science platform will be viewed as the partner of choice by innovative startups that lack late-stage development and commercialization capabilities.

Why Now?

A confluence of factors is forcing the reinvention of pharma’s product development and market access models. Payers are pushing back against the economics of blockbusters and mass markets, demanding to see evidence of real-world value by population segment. Under the existing model, this adds cost and delays and narrows pharma's market access, pushing the economics to the breaking point. At the same time, new technological possibilities—such as data and analytics, digital, and next-generation sequencing—are providing an opening to break through the constraints of that model. Regulators are actively encouraging this reinvention, opening up new regulatory frameworks for agile product development. Four trends are contributing to this opportunity:

- An Explosion of Data, Analytics, and Digital Capabilities. The gold standard for evidence has traditionally been clinical trials—the first generation of data-driven evidence. The second generation has come from the digitization of health care over the past two decades—electronic claims, electronic medical records (EMRs), lab automation. Wearables, ingestibles, and other Internet of Things devices will drive the third generation. Advances in analytical technologies, particularly artificial intelligence, are now allowing companies to translate massive and growing amounts of data into actionable insights about disease populations and treatments at scale. New digital tools now harness the power of embedded software to automate business processes and simplify ways of working.

- Regulatory Innovation Everywhere. In the US, the passage of the 21st Century Cures Act opened the door for the use of real-world evidence (RWE) to satisfy requirements for label expansion, while the Prescription Drug User Fee Act has enhanced the Food and Drug Administration’s ability to consider RWE when evaluating a drug’s safety and efficacy. And a new European Medicines Agency program, PRIME, has laid the foundation for RWE to be increasingly substituted for randomized controlled trials (RCTs) in Europe. We believe this trend will persist as regulators continue to encourage digital innovation.

- Customers Demanding Patient-Level Value. Information asymmetry has flipped in the past few years; customers have 80% of the data on the performance of a pharma company’s products. Customers are digging into this data to segment patient populations, identifying those at the highest risk of disease progression and modifying the deployment of care management resources and programs accordingly. For payers, this is the next step beyond managing unit costs and utilization. They are demanding a similar commitment from pharma, asking to see "de-averaged" evidence at the subgroup level that can be tracked in their claims or EMR data—particularly in the disease areas targeted by high-priced specialty drugs. In this way, customers can track key outcomes (such as a reduction in the total cost of care versus the projected baseline) in the patient subpopulations of greatest interest to them. The imperative for pharma is to seize the opportunity to engage more strategically with customers on their biggest problems—or else be left on the sidelines.

- An Industry Model Increasingly Under Strain. The industry’s cost structure has become unsustainable. It takes over $2.5 billion to bring a new product to market. Rebates continue to increase, rising on average from 28% to 41% over the five-year period between 2012 and 2017. Compounding all of this, the window between launch and loss of exclusivity has shortened from 180 months to 145 months. The demand from customers for additional evidence, combined with the attendant costs and delays to best access (the point at which the maximum number of patients who need the medication have affordable and convenient access to it), are only worsening the economics of the existing model.

The imperative for pharma is to seize the opportunity to engage more strategically with customers on their biggest problems—or else be left on the sidelines.

Five Key Elements of the End-to-End Redesign

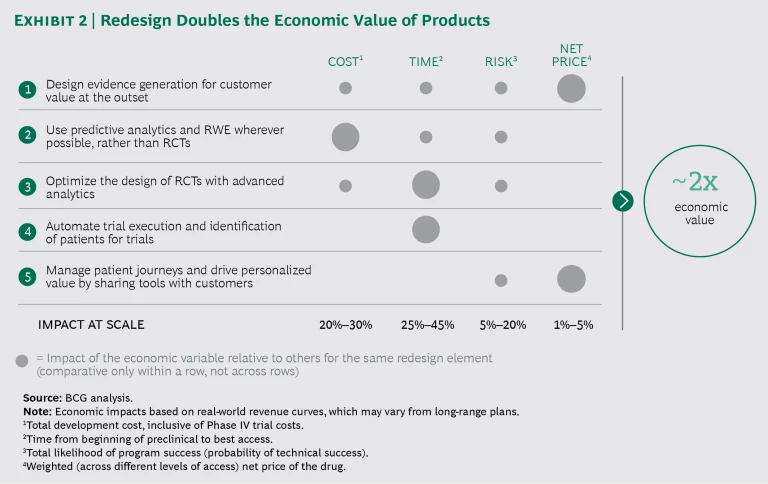

Five specific changes in the operating model—all predicated on working across functional boundaries, including the voice of the customer in life cycle decisions, and adopting agile approaches broadly—define the end-to-end redesign.

Design evidence generation for customer value at the outset. Under the new model, pharma companies would collaborate with customers upfront, prioritizing evidence generation around value to the customer. This would allow them to model the customer economics well in advance of launch and thereby prepare customers for the impact of any cost savings. They could also discuss financing and value-based contracting options earlier in the process. Finally, it should be possible to eliminate much of the back-and-forth with payers on getting access, reducing waste in the development process and yielding more win-win pricing arrangements.

Use predictive analytics and RWE wherever possible, rather than RCTs. The majority of a company's post-marketing commitments and evidence generation can be fulfilled using RWE. Some of the evidence valued by payers can be generated using predictive analytics. As the regulatory window widens, some of the evidence generated in Phase II and Phase III RCTs can be replaced with alternative approaches. Recent examples indicate that doing so reduces cost and time significantly. One pharma company used rapid-cycle analytics on top of a network of payer databases to satisfy its post-marketing commitments, accomplishing this at 95% lower cost and reducing the time required for evidence generation from 60 months to 6 months. Another company expanded its oncology label through RWE, taking advantage of the regulatory opening made available by the 21st Century Cures Act.

Optimize the design of RCTs with advanced analytics. Using real-world data science and predictive tools, pharma companies should design clinical endpoints to demonstrate the largest drug effect in high-payer-value patient subpopulations. Optimizing RCT design can dramatically reduce the risk inherent in trials by increasing their likelihood of success, yielding more valuable evidence. Existing experiments include the many partnerships in which third parties use EMR data to optimize trial inclusion and exclusion criteria.

Automate trial execution and identification of patients for trials. Pharma companies should analyze customer data to identify patients who meet specific inclusion criteria for trial enrollment and then automate enrollment and data management. By automating trial execution and accelerating patient recruitment, companies can significantly shorten clinical trials and increase the consistency and integrity of their trial data. One analytics company is already using new biomarker-based analytics to automate the matching of patients to clinical trials and treatments.

By automating trial execution and accelerating patient recruitment, companies can significantly shorten clinical trials and increase the consistency and integrity of their data.

Manage patient journeys and drive personalized value by sharing tools with customers. The value of a pharma company’s analytic toolkit can (and should) accrue directly to its partnering customers. The toolkit can be used to help payers identify high-value patients and enable physicians to get the right patients on the right therapy at the right time, resulting in more personalized formularies. Pharma companies should collaboratively demonstrate value to customers and share in the risk by means of value-based contracts where appropriate. This post-launch collaboration with customers can significantly improve patient outcomes and customers’ total costs. For example, in order to accelerate uptake and demonstrate a new medication’s real-world value compared with that of a product that was soon to go off-patent, one pharma company provided a payer with the RWE-based analytics needed to target the new drug to the right patient subpopulation.

The Payoff

Proof points already exist for each of the five elements of the redesign. Implementing them together at scale will double the economic value of a pharmaceutical company’s products. (See Exhibit 2.) This is owing to a combination of four factors: lower cost of evidence generation, lower risk, faster time to best access (increasing the launch-to-loss-of-exclusivity window), and better net price (inclusive of rebates, copay assistance, and access). The redesign ultimately puts companies on a new S curve, allowing them to more readily translate ongoing digital and analytics experimentation into bottom-line impact (as opposed to just adding new costs, as is often the case with such investments today).

By being faster, cheaper, and better at product development and market access, companies also gain a huge advantage in external sourcing and business development, becoming the partner of choice for external innovators. As better owners of products, they can take the lead in M&A and unlock much greater synergies from those transactions.

How to Make It Happen

The biggest perceived barriers to embracing this new model are regulatory and compliance issues: ensuring that collaboration with customers doesn’t run afoul of fraud and abuse statutes and fair-market-value considerations, accessing data without triggering privacy violations, and avoiding off-label-marketing compliance issues. While these are very valid concerns, our experience suggests that significant value can be unlocked within the existing regulatory framework. Regulators are encouraging digital innovation and many concerns are addressable .

The real hurdle to capturing value stems from a reluctance to make changes to core business processes, cultural resistance to using new data in decision making, and a disinclination to stop doing things the old way. But any digital reinvention implemented within the constraints of the existing operating model will fall flat, delivering at best 20% of the total value. The key is not to make changes within existing siloed functions but to implement operating model changes across all key functions.

We suggest three steps to capture the full value of the end-to-end operating model redesign.

Set a bold top-down agenda. The organization’s leaders should communicate the vision, in the form of stories, to clarify how the company will create value for stakeholders and gain an edge on competitors. They should set goals that cannot be achieved under the existing model and deputize a team to lead the charge. They’ll also need to create incentives to get the new model up and running while still supporting continued performance under the existing model as the transition proceeds.

Elevate data science culture and capabilities into a business platform. It’s time for pharma to shift away from its traditional regulatory-driven caution to the proactive use of integrated insights (around patient, practice, and disease) in all decision making throughout the product life cycle. Companies must pivot away from siloed data and analytics and embrace a cross-functional business platform. This requires several changes to the existing model:

- Partner directly with leading customers to build a collaborative approach to evidence generation and data science throughout the product life cycle.

- Prioritize collaboration with data aggregators and analytics vendors that provides distinctive value above and beyond existing partnerships and enables a view of patients and populations that cuts across functions.

- Pursue two-sided value creation so that the platform improves decision making by both the company and its strategic partners.

- Establish a war room to promote the culture of data science: (1) develop an easy-to-use dashboard that provides continuously updated evidence and insight on critical development and access questions to support executive decision making; and (2) establish cross-functional value teams that collaborate with decision makers to ensure end-to-end optimization of decisions.

Create a mechanism for redesigning the business processes of development through to access. An effective approach is to create a distinct entity that can “build, operate, and transfer” the new ways of working. This BOT entity embeds data science into business-critical decisions and processes at scale, while addressing cultural and other perceived hurdles, such as regulatory issues. It has a semipermanent (three- to five-year) program management role, driven by leadership’s agenda. It’s also the vehicle for injecting new skill sets like design thinking and agile project management. The BOT team, acting as a control tower, directs the sequence of redesign projects in an agile manner in order to continuously deliver on its bottom-line mandate.

A once-in-a-generation opportunity has opened up to digitally redesign a core part of pharma companies. Capturing the opportunity requires vision and leadership; it’s not about the technology. Those that seize the opportunity first will see accelerated competitive differentiation and create broad value for customers and patients. The impact of decisions made in the next few years will shape the pharma industry for decades.