Internet connectivity has transformed societies around the world, yet millions of people in rural areas of the US lack access to high-speed broadband. The technologies that work in urban areas are often not economically viable in less populated regions, and because of the high costs required to connect and serve people in these areas, telecom companies are investing slowly.

To estimate the investment it would take to provide broadband access to all residents in rural America, BCG recently conducted a directional analysis. We found that these Americans could receive high-speed internet service for about $10 billion—not by means of a single technology, but rather through a mix of different technologies.

This approach could deliver sizable benefits to rural residents. Other studies have found that internet access leads to stronger economic growth and improved access to health care and education, among other advantages. At a time of growing economic disparity in the US, putting the entire country on a more even footing when it comes to internet access is one way to help close the gap.

The State of Broadband Access in the US

The US Federal Communications Commission (FCC) criteria for broadband are download speeds of 25 Mbps and upload speeds of 3 Mbps. The vast majority of the US population has access to internet service that meets or exceeds these standards. But about 20 million people, or roughly 30% of those living in rural areas, do not have access to land-based internet communications, applications, and services at 25 Mbps.

The lack of high-speed access carries real economic consequences. The World Bank estimates that a 10% increase in broadband penetration can lead to a 1.21% jump in GDP growth in developed economies and a 1.38% jump in developing economies. The FCC argues that the economic payoff from investing to improve broadband access is greater than from other types of infrastructure investments.

A 10% increase in broadband penetration can lead to an estimated 1.21% jump in GDP growth in developed economies and a 1.38% jump in developing economies.

There are definite barriers to high-speed internet penetration in rural markets, but recent technological developments, as well as the increased use of broadband itself, can surmount several of them. (See “ Internet for All ,” BCG article, May 2016.)

- Affordability. Low-income earners in rural areas may struggle to pay the monthly charges for high-speed service and equipment, or they may not believe the service is sufficiently valuable to justify those charges. New technologies can bring down costs.

- Skills and Awareness. Researchers have found that a lack of digital skills and limited awareness of the benefits of the internet prevent users from going online. With more prevalent broadband access comes better digital skills and greater awareness of the internet’s benefits.

- Local Adoption and Use. In some regions, there are not enough local apps and services to make the internet appealing to users. Relevant content in areas such as e-government, agriculture, and forestry can make the internet more appealing to users in rural markets.

These issues are important, but there is a fourth and equally critical barrier: infrastructure. Thus far, most US telecom companies have not seen a workable business case for building the infrastructure needed to serve rural areas. But our analysis indicates that it is possible to deliver high-speed broadband service to these consumers at a reasonable overall investment. (For more details on our model, see the sidebar “Cost Assumptions.”)

Cost Assumptions

Cost Assumptions

Assessing the cost of specific technologies required that we make certain assumptions. Changes to any of these would change the results of our analysis. Our assumptions were as follows:

- 700 MHz LTE and High-Frequency 4G LTE. We estimated deployment costs (base station towers and equipment, along with termination devices) based on industry-typical data and experience. We based spectrum costs on previous US wireless spectrum auctions. We assumed typical specifications for standalone base stations (at 700 MHz and 2,500 MHz, respectively), with outdoor antennas for sufficient gain.

- TV White Spaces. We used the performance specifications of TV white-space equipment expected to be available in 2018. The configuration included aggregation of at least three 6 MHz channels to ensure that the equipment can achieve the required download and upload speeds. The first TV white-space equipment using three to four 6 MHz channels is being tested under experimental licenses from the FCC and should be certified for commercial use later this year.

- Satellite and Fiber to the Home. We based these cost estimates on an August 2014 study conducted by BCG on the cost of deploying broadband to residents in rural Australia. We adjusted those costs for US county populations, coverage, and density, correcting for inflation, currency conversion, and differences in labor costs. We compared the fiber-to-the-home costs with the costs of fiber rollouts in other parts of the US and in Europe to validate their continued applicability.

A Mix of Technologies for Broadband Access

There is no single solution that is universally applicable across all rural areas. The key is to leverage the most cost-effective technology in each region. There are at least four such technologies to consider: 700 MHz LTE, high-frequency 4G LTE, TV white spaces, and satellite. Our analysis included a fifth option, fiber to the home, but we determined that it would be cost effective in only a negligible subset of rural counties with high population densities. We also considered digital subscriber lines, or DSL, technology, but did not ultimately include it in our analysis because its download speeds are just under the FCC threshold of 25 Mbps. However, DSL may still be worth considering for some telecom companies. (See the sidebar “DSL as an Incremental Solution.”)

DSL as an Incremental Solution

DSL as an Incremental Solution

An option for some telecom companies—particularly established players—is to improve DSL service, which uses existing phone connections and offers internet download speeds of just below 25 Mbps. DSL service could be reconfigured for customers who live near the network equipment to increase speeds by a couple of megabits per second, above the 25 Mbps threshold for broadband as defined by the FCC. This solution would be relatively inexpensive, and it would have a material impact on the number of Americans with broadband access. But the change in service level, while technically meeting the broadband criteria, would not fundamentally change the experience of users. Thus, DSL represents an incremental solution, rather than a transformative one.

700 MHz LTE

700 MHz fixed wireless, a spectrum band that is typically used by mobile network operators, would need to be used jointly for mobile and for residential internet service in rural areas. Our model includes the spectrum costs for 700 MHz LTE, because network operators wishing to use this spectrum band can do so only if they purchase a license and then buy access to the spectrum. However, for network operators that have already purchased the license and access to the spectrum needed to roll out broadband service, those expenses are a sunk cost. Moreover, because 700 MHz LTE can support both mobile and residential service, mobile network operators can generate additional revenue from their infrastructure investments. For these reasons, 700 MHz LTE likely offers a more attractive business case for these companies.

High-Frequency 4G LTE

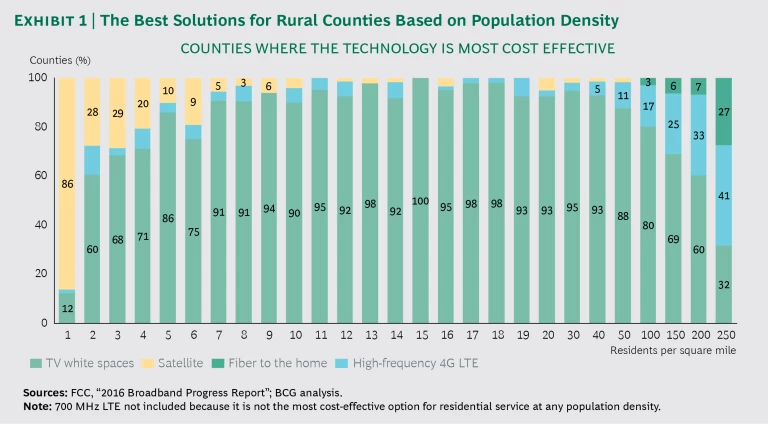

At population densities greater than 200 people per square mile, the most cost-effective option is high-frequency (including 2.5 GHz) LTE technology. This is typically used for mobile internet service on phones, tablets, and similar devices—often in cities, where base stations can be placed in close proximity and signal range is not an issue. With the addition of directional antennas, the reach of high-frequency 4G LTE extends up to about 8 miles in line-of-sight conditions. Our analysis indicates that this technology can cost effectively connect about 15% of the rural US population currently without broadband access.

Tv White Spaces

A promising solution for rural America is TV white spaces. This technology uses parts of the VHF and UHF spectrum that have been set aside for broadcast television but are currently either unassigned or unused. These spectrum bands are below 700 MHz, typically in between the channels that broadcasters use to send their signals to customers over the air. Throughout much of rural America, the available spectrum bands exceed nine channels, or 54 MHz. Moreover, operators do not need to purchase an expensive license to access this spectrum—though it is not explicitly allocated to them, either.

TV white-space technology is attractive because the signals can carry communications across greater distances than other technologies (up to 10 miles from a central base station, in ideal conditions) and can penetrate walls, hills, foliage, and other obstacles, which signals using higher-frequency spectrum bands cannot do. (In principle, the 700 MHz band has similar characteristics.)

TV white-space technology is attractive because the signals can carry communications across greater distances than other technologies.

The development of TV white spaces, like other technologies, has been rapid and could accelerate with increasing adoption. Currently, base stations are capable of delivering 33 Mbps. This is expected to grow to 48 Mbps in the coming months and eventually to even faster rates. However, the amount of available spectrum could limit these upgrades, particularly compared with the 4G and 5G mobile upgrades now underway. In order to create the right investment climate, TV white-space operators and equipment manufacturers argue that a minimum of three usable channels are needed in every market.

FCC rules for the use of TV white spaces require the use of a database, which is now available from several approved operators, to prevent the use of these frequencies from interfering with existing television signals and other licensed uses of the bands. Given that the available spectrum is finite, this technology has two shortcomings: upload and download speeds are more limited than with multiband LTE or fixed-line alternatives, and each base station can currently serve only about 100 homes.

Our analysis indicates that TV white-space technology is the most cost-effective way to connect roughly 80% of the rural US population currently lacking high-speed access.

Satellite

At population densities of less than two people per square mile, the most cost-effective solution is satellite technology. Satellite broadband is costly on a per-household basis and suffers from limitations on data usage and high latency (meaning upload and download delays for users). Yet it can provide coverage across even the largest areas, including those inhabited by a small percentage of the rural population. According to our analysis, satellite technology is the most cost-effective solution for about 2% of the rural population currently without broadband access.

New technologies such as medium- and low-earth-orbit satellites are coming online that promise lower latency, higher data limits, and lower costs, and these will help hundreds of thousands of people in the rural US get online cost effectively. We did not include those technologies in our analysis because there is not yet enough information to effectively model their costs.

TV white-space technology is the most cost-effective way to connect roughly 80% of the rural US population currently lacking high-speed access.

The Business Case for Telecom Operators

Our model assumes that the technologies described above would be used on a county-by-county basis, with the cheapest technology deployed across individual counties. (See Exhibit 1.) This is a simplification, of course. In the real world, the geographic breakdown would be more refined, with some counties using different solutions in different areas, leading to even lower costs.

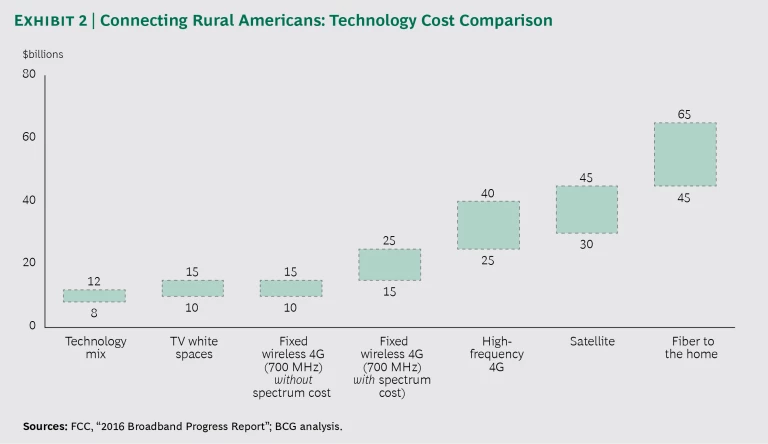

With a mix of technologies deployed across counties, providing broadband access to unserved rural Americans would require a capital expenditure of $8 billion to $12 billion—less than for any individual technology. (See Exhibit 2.) Moreover, at approximately $50 per month in potential user revenue, the investment would likely pay for itself in roughly five to six years.

The number of operators in a given market has a significant effect. The business case for delivering broadband access in rural areas is more attractive when a single player with sufficient market penetration controls the market. For TV white-space technology, which we found to be the most cost effective in the majority of rural US counties, the model assumes about $1,200 in capex per home and 60% market penetration (this is similar to rural areas in other developed markets that currently have high-speed broadband, such as Australia). If a second operator entered the market and sought to build its own network, or if fewer customers in connected regions signed up, the business case would become less attractive. This is true for other technologies as well. At the same time, equipment cost reductions would improve the business case.

The bottom line: from a pure cost-of-deployment perspective, TV white-space technology is the most attractive option in many rural US counties, particularly for new entrants that wish to serve regions where no major telecom player is offering broadband. However, for most established telecom companies—especially mobile network operators—other technologies may be more attractive, particularly 700 MHz LTE and ADSL upgrades. Both technologies can capitalize on existing infrastructure, and 700 MHz LTE offers potentially greater revenue from both mobile and residential service (in part because many mobile network operators already have the licenses and spectrum needed to roll out broadband service).

The multitechnology approach could be further optimized by using WiFi to provide broadband service to small concentrations of homes; this could shave off up to $500 million in capital expenditures.

Needed: A Cross-Industry Dialogue

These challenges are unlikely to be resolved by a single segment of the industry. Given that our model shows lower capex for a mix of technologies, we believe a cross-industry dialogue is needed that brings together telecom companies, broadcasters, and technology firms, along with regulators and policymakers. The objective would be to create the conditions for the infrastructure investments needed to provide service to rural residents while still creating value for companies. Potential questions to address include the following:

- How can technologies such as TV white spaces and 4G LTE be made operationally viable in rural markets?

- What is a pragmatic and equitable approach to determining who can use the TV white-space spectrum without interference issues?

- Which players could be convinced to invest? How can they be reassured that their investment case will not be negatively affected either by regulatory changes or by other entrants in the same area?

- Some geographic areas will support only one supplier. Which approach can trigger investment and avoid potential future abuse of monopoly pricing power?

- What role can government funding, tax incentives, and private-sector funding play in stimulating deployment in places where even a single provider does not see a viable business case?

- Which public-private partnership structures would support TV white-space deployment? What is the right role for counties and states in these partnerships?

- How can broadband providers best connect rural service offerings to the internet backbone?

In an increasingly digital world, a large group of residents in rural areas of the US are at risk of being left behind because they lack broadband access. With the deployment of a mix of technologies, rural areas can receive high-speed broadband access for a total investment of about $10 billion. This will not be easy, but it is a social and economic imperative.