The era of electric vehicles (EVs) is in sight, and batteries are poised to become a leading power source for mobility. To capture market share and economies of scale, battery cell producers are adding massive amounts of production capacity. But these efforts threaten to undermine the industry’s economics.

A market model developed by BCG forecasts that global capacity for battery cell production will exceed market demand by approximately 40% in 2021 and exert tremendous pressure on cell prices. To survive in this challenging market, producers will need to slash prices to fully use their capacity; even manufacturers of battery cells with innovative features will not be exempt. To preserve their margins while cutting prices, producers will need to reduce their manufacturing costs.

BCG’s research finds that improving operational performance is the most effective way for battery producers to become cost competitive in a market burdened by overcapacity. To achieve operational excellence, battery producers must adopt the concepts of the factory of future, in which Industry 4.0 technologies enhance plant structures and processes. (See The Factory of the Future, BCG Focus, December 2016.)

Battery producers must adopt factory-of-the-future concepts to achieve operational excellence.

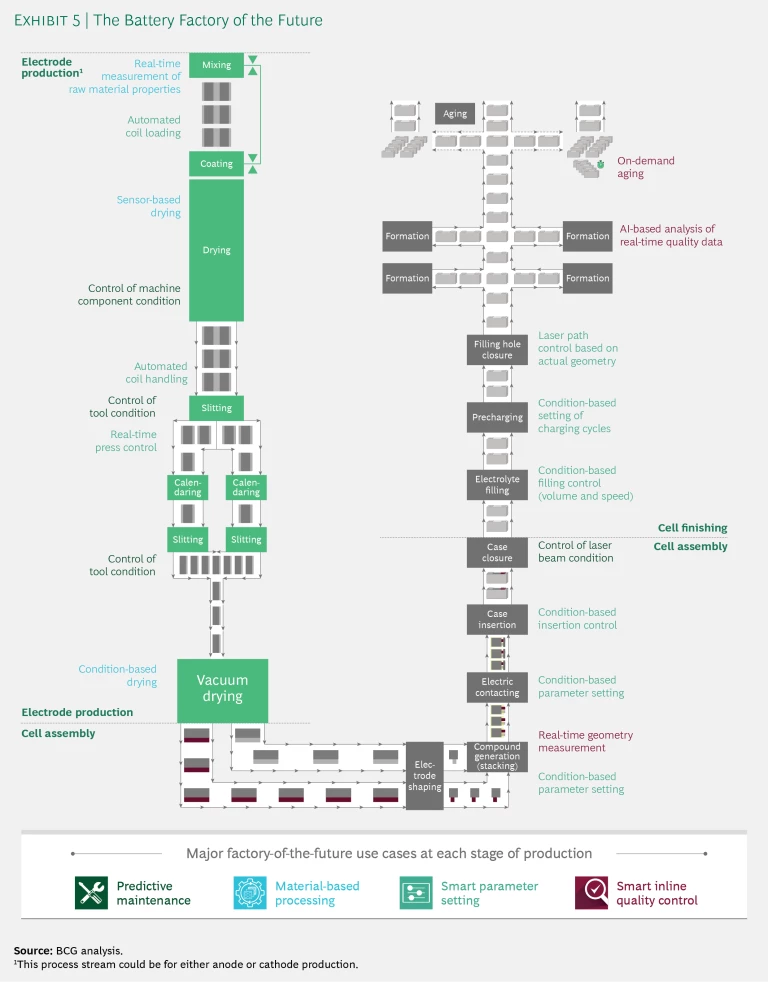

By transitioning to the factory of the future, producers can reduce total battery cell costs per kilowatt-hour (kWh) of capacity by up to 20%. The savings result from lower capex and utility costs and higher yield rates. The production-related costs (excluding materials) can be reduced by 20% to 35% in each of the major steps of battery cell production: electrode production, cell assembly, and cell finishing. Electrode production benefits from faster drying times that increase yield rates and reduce capex for equipment. In cell assembly, data-driven automated adjustment of parameter settings increases accuracy and reduces production times. Cell finishing is enhanced by shorter times for formation and aging, which significantly reduces capex requirements.

Battery cell producers and automakers must take actions to capture the benefits. Producers can retrofit existing plants with digital enhancements to structures and processes and design new plants as factories of the future. For automakers that manufacture EVs in the US and Western Europe, sourcing from a battery factory of the future is essential to becoming price-competitive with combustion-powered vehicles before 2030.

The Demand for Low-Cost Battery Capacity Is Soaring

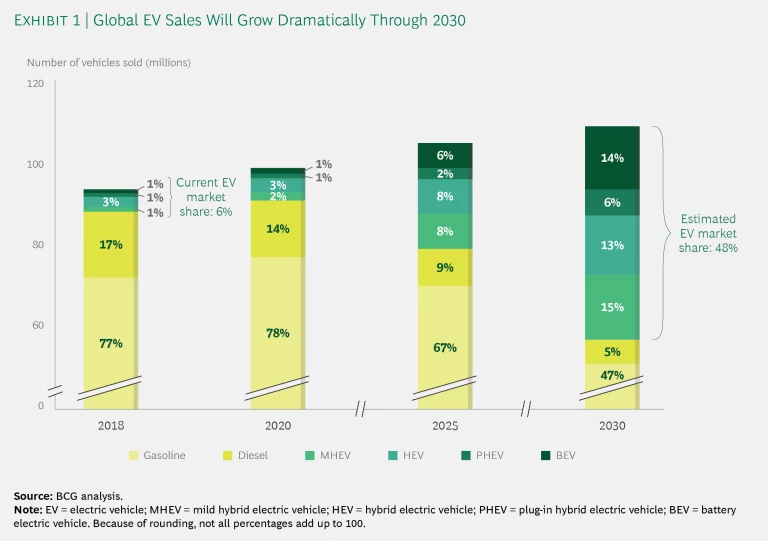

To determine the demand for battery capacity, we used BCG’s projections for EV adoption. (See Exhibit 1 and The Electric Car Tipping Point: The Future of Powertrains for Owned and Shared Mobility, BCG Focus, January 2018.)

Specifically, our model considered the following assumptions relating to the battery capacity requirements and adoption rates of four types of EVs:

- Mild hybrid electric vehicles (MHEVs) have an internal combustion engine (ICE) plus a low-power electric engine with battery capacity of approximately 5 kWh. We estimate that MHEVs will represent 15% of the global automotive market in 2030.

- Hybrid electric vehicles (HEVs) combine an ICE and a medium-power electric engine with battery capacity of approximately 10 kWh. The market share in 2030 is estimated to be 13%.

- Plug-in hybrid electric vehicles (PHEVs) have an ICE and a high-power electric engine with battery capacity of approximately 18 kWh. Market share in 2030 is expected to be only 6%.

- Battery electric vehicles (BEVs) have an electric motor powered by a large-capacity battery. Depending on the vehicle class, the battery capacity may be as much as 110 kWh. We estimate that BEVs will represent approximately 14% of the automotive market in 2030.

BEVs will be responsible for the largest share of battery capacity demand. To understand how that demand may break down, we looked closer at four classifications of BEVs and their battery requirements. We also projected the market share of each vehicle class.

- Urban. These small vehicles are typically used for short-range commuting within cities. The battery is charged overnight using standard voltage from outlets in garages or on the street. We forecast that urban applications will represent approximately 20% of the BEV market in 2030.

- Family. These midsize cars are used for midrange, intercity travel. Charging times range from 30 to 60 minutes at high-power charging stations. The estimated market share in 2030 is approximately 40%.

- Premium. Vehicles in this segment use the most powerful engines of all BEV types, allowing for ranges of approximately 500 miles. The time required to fully charge these batteries is approximately two hours. Enough capacity for 125 miles of driving is available after charging for 15 minutes. The market share in 2030 is expected to reach approximately 25%.

- Robo-Taxi. These self-driving taxis will be used for urban transportation. Advanced fleet management and very short charging times (10 to 15 minutes) at high-power stations will enable a driving range of up to 125 miles. Robo-taxis will be sold to fleet operators, not consumers. We estimate that these vehicles will represent approximately 15% of the BEV market in 2030.

On the basis of these assumptions, we found that the annual demand for battery capacity will increase from 70 gigawatt hours in 2017 to 800 to 900 gigawatt hours in 2030.

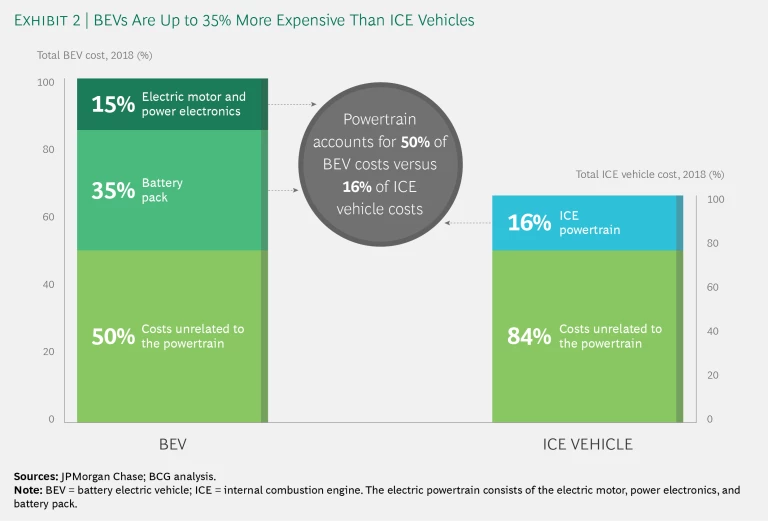

Auto manufacturers do not only need more battery capacity to meet EV demand, they also need cheaper batteries. Current industry benchmarks suggest that the electric powertrain (including the electric motor, power electronics, and battery pack) will account for at least 50% of a BEV’s cost. By comparison, the ICE powertrain typically accounts for approximately 16% of a traditional vehicle’s cost. (See Exhibit 2.) The battery pack (including the battery management system) is the major cost, accounting for about 35% of the overall vehicle cost. Companies that seek to reduce the cost of BEVs have a clear imperative: reduce the cost of battery packs.

A battery pack consists of multiple battery modules, each of which typically contains 6 to 12 battery cells. Cells are the most cost-intensive component, representing approximately 70% of the total cost of battery packs. Today, most large automakers outsource cell production to battery producers. However, automakers typically perform module and pack assembly in-house and plan to continue doing so. Because modules and packs are critical to determining an EV’s range and charging rate, automakers want to control how the battery pack space is used and cooled. Going forward, battery packs will become an even more essential aspect of vehicle design.

Planned Production Increases Will Create Price Pressure

In an effort to reduce cell production costs through economies of scale, leading battery producers have announced plans to add significantly more production capacity. Such announcements have occurred frequently in the past year. For example, Chinese battery maker Contemporary Amperex Technology announced plans to build its first European EV battery factory in Germany, and US automaker Tesla has said it is considering opening a cell production factory in Germany. The largest cell production factories are planned for Asia, with Chinese manufacturers making the steepest increases in capacity.

Through 2021, the planned increases would more than double the installed global production capacity. Even though global demand for EV batteries is expected to rise significantly, it will not catch up to the planned production capacity in the near term. We forecast that by 2021, approximately 40% of installed production capacity will be unused worldwide. In China, this figure will exceed 60%. Moreover, much of the newly installed capacity is intended to produce battery designs that will quickly become outdated.

By 2021, about 40% of installed production capacity will be unused worldwide.

In order to fully use their installed capacity, producers will need to slash battery prices. Indeed, we forecast that prices will decline by more than 50% during the next ten years. The solar panel industry provides a cautionary example: production overcapacity of 35% drove down solar-panel prices by more than 50% from 2006 through 2015.

The price decline will drive an equivalent reduction in the maximum manufacturing cost that allows for profitable battery production. By 2021, the cost per kWh will be $153, down from $195 per kWh in 2018. Previous forecasts had been much more favorable for producers. In 2010, the most optimistic cost forecast for profitable production as of 2021 was $270 per kWh. The 2018 figure is already 28% lower than the 2010 prediction.

On the basis of current estimates, the price of a battery pack for a midsize car will range from $7,600 to $10,700 in 2021. In this scenario, the price differential between BEVs and ICE vehicles in this category will decline to less than $5,000. BEVs would thus become cost competitive with ICE vehicles, especially considering tax incentives for the purchase of BEVs. Although the lower price differential will promote higher adoption of BEVs, overcapacity in battery production is forecast to persist.

Battery producers must find ways to alleviate the price pressure resulting from overcapacity. Players seeking to enter the industry with innovative products face the added challenge of having to cope with lower prices before they achieve economies of scale.

The Solution: Reduce Cell Production Costs

Because cells represent about 70% of total battery pack costs, cell production is the most important step of battery production to target in order to reduce the price of battery packs. Production-related costs (excluding materials) represent 30% to 40% of cell costs. (The costs of module and pack integration and materials are outside the scope of our discussion here.)

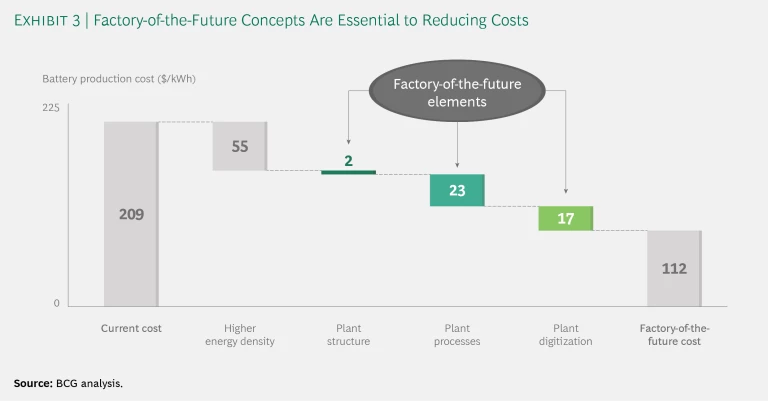

The cost of cell production is measured as the ratio of manufacturing cost to energy content (measured in kWh). There are two main ways to reduce cell production costs: using advances in production accuracy and cell chemistry to increase energy content at the same volume and weight (that is, energy density) and applying factory-of-the-future concepts (which improve plant structure and processes and digitize the plant) to reduce manufacturing costs. These approaches can similarly be applied to module and pack assembly, enabling cost reductions at the overall battery level. (See Exhibit 3.)

The industry is strongly focused on the first approach. For the current lithium-ion technology, energy densities of 400 to 450 watt-hours per liter (WH/l) can be realized on a cell level. By 2023, we forecast that energy densities could increase to 650 to 700 WH/l. The higher densities will result from improved production accuracy (an additional 150 WH/l) and innovations in chemistry (an additional 100 to 150 WH/l). But the higher densities cannot be achieved economically using traditional manufacturing method (known as winding), because it is not capable of producing low-tolerance designs.

Companies will need to invest in a new method (known as stacking) in order to make higher-density cells. Considering the high level of capex required, innovations to increase energy density will not, by themselves, be enough to save the industry’s economics. Battery cell producers have not focused strongly enough on using digital enhancements in production to reduce manufacturing costs. Because labor costs are a relatively small element of total cell-production costs, these factory-of-the-future concepts are the most effective way to reduce production-related costs.

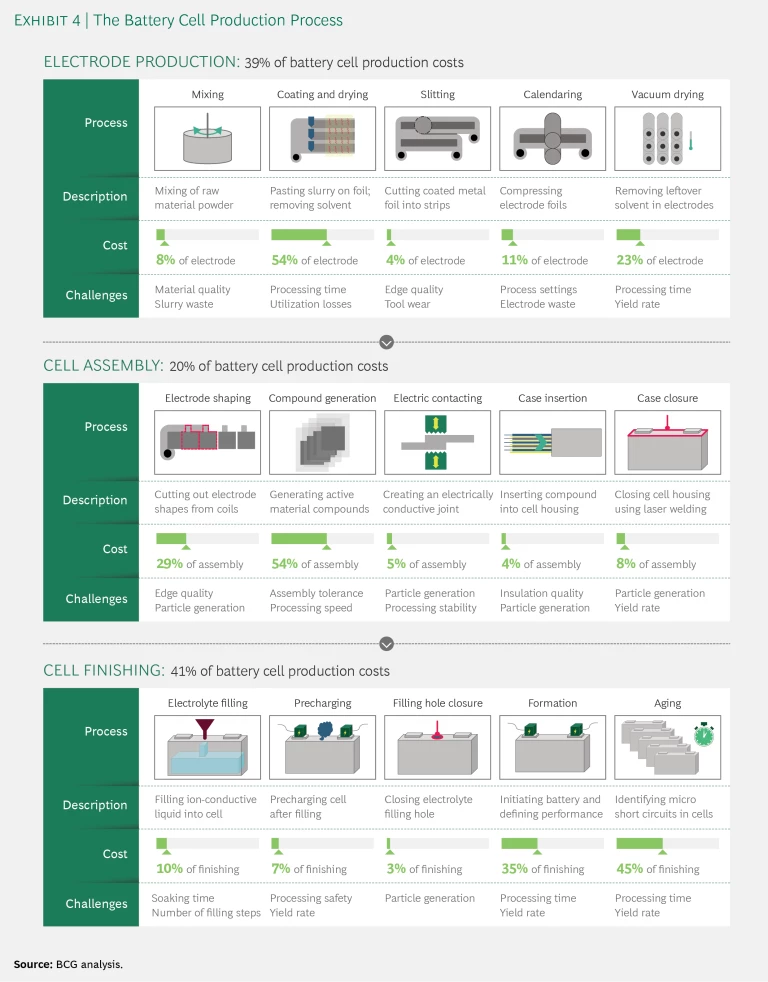

To identify how the factory of the future can reduce the cost of manufacturing battery cells, it is essential to understand the three major steps, each comprising multiple processes. (See Exhibit 4.) Below, we highlight each step’s cost share, major challenges, and most cost-intensive processes. Our analysis is based on the assumption that prismatic cells will be the dominant design used in EV battery packs. (See “Three Types of Cell Design.”)

Three Types of Cell Design

Three Types of Cell Design

Three major types of cell design have evolved for EV applications, and each design has pros and cons.

Pouch Cells

Active material is packaged in flexible housing made from a material composite that includes aluminum foil. Some major battery cell producers, including LG Chem, currently use this design.

- Pros: Low production costs and high energy density at the cell level.

- Cons: Integration costs are high and energy density is lost at the module and pack levels; these disadvantages result from the complexity of integration processes and the challenge of cooling cells.

Cylindrical Cells

Consumer products commonly use cylindrical cells (such as the AA format). Applications for vehicles are less common, although Panasonic produces cylindrical cells for Tesla.

- Pros: A simple, low-cost production process; the highest energy density at the cell level.

- Cons: High safety hazards in the event of a vehicle accident, complicated module integration, and low energy density at the pack level.

Prismatic Cells

Several industry groups have proposed standardized designs for prismatic cells for use in BEVs and PHEVs. Although there are some variations in the designs, the cells have the same pros and cons:

- Pros: Low safety hazards, low integration costs at the module and pack levels, and high energy density at the pack level.

- Cons: Cell production costs are slightly higher than the other two types; energy density at the cell level is lower than that of cylindrical cells.

Prismatic cells are most commonly used in EV battery packs today, and we expect their dominance to continue. Although cylindrical cells are more advantageous in some respects, energy density on the module and pack levels is highest for prismatic cells. Moreover, prismatic cells tend to be safer than cylindrical cells.

Electrode Production. This step accounts for 39% of the production-related costs of battery cells. There are separate, but similar, processes for anode and cathode production. The major challenges are processing time and yield rate. Coating and drying is the most cost-intensive process. An active material slurry is coated onto thin foil, and the solvent is removed in the subsequent drying process. Drying, which can take two to six minutes, accounts for most of the processing costs, owing to large capex investments and a high level of energy consumption. Machine downtime resulting from unplanned stoppages can drive costs significantly higher.

Cell Assembly. The assembly step is responsible for 20% of the production-related costs of battery cells. Overcoming the challenges of particle generation and processing stability are essential to prevent internal short circuits that render the cell permanently unusable. The lion’s share of costs relates to generating active material compounds. As noted, producers must use stacking technology in compound generation in order to achieve high energy densities. However, the complexity of stacking and the need to process compounds slowly to achieve accuracy makes it the largest cost factor of cell assembly.

Cell Finishing. The finishing process accounts for 41% of the production-related costs of battery cells. Formation and aging are the most cost-intensive processes, reflecting the challenges of processing time and yield rate.

In the formation process, cell properties are established through multiple charging and discharging cycles. The processing time at cost-intensive stations can range from two to ten hours. In the aging process, finished battery cells are stored for several weeks in order to identify micro short circuits. At any given time, a producer may need to store several hundred thousand cells in warehouses that require expensive environmental controls and safety precautions. Maximizing the yield rate is the major challenge for this processing stage.

Battery Cell Costs Can Fall by as Much as 20% in the Factory of the Future

The application of next-generation digital technologies enables battery factories to transition from the earliest stage of Industry 4.0 maturity (transparency in operational performance) to the most advanced factory-of-the-future design (fully automated factories). Total battery cell costs per kWh of capacity can be reduced by up to 20%, above and beyond savings that result from improvements to production accuracy and chemistry. Production-related costs (excluding materials) can be reduced by 25% in electrode production, 20% in cell assembly, and 35% in cell finishing. Additionally, energy density on the cell level improves by 10% to 15%. (Applying factory-of-the future concepts to module and pack integration offers further savings potential, which is not considered here.)

Four factory-of-the-future use cases are especially valuable for reducing costs:

- Predictive Maintenance. Predictive maintenance can reduce cell production costs by 7% to 10%. This use case promotes benefits in each step of cell production, because planned and unplanned machine stops significantly affect costs in a variety of processes. These stoppages typically reduce overall equipment effectiveness by 5% to 10%. The impact is highest in the coating and drying process, followed by formation, compound generation, and aging. Smart monitoring of machine conditions and predictive correction of parameter settings can prevent unplanned stoppages and extend the operating time of machine components. Smart planning and scheduling of maintenance optimizes maintenance processes, thereby reducing planned downtimes and repair times. The resulting increase in machine uptime allows producers to purchase smaller-capacity machines, enabling capex reductions. The required technologies are sensors for monitoring machine conditions, a local data analytics platform in the factory, and local data storage.

- Material-Based Processing. By increasing the efficiency of electrode production, material-based processing (for example, measuring the actual composition of the cathode material slurry to control the coating and drying process) can reduce cell production costs by up to 8%. Sensors measure material quality and provide real-time feedback so machines can adjust the process, reducing drying time, for example, or altering calendaring pressure. In addition to sensors, technology requirements include local data storage, an analytics tool set, and an interface between the data analytics system and the machine control system.

- Smart Parameter Setting. Smart parameter setting in cell assembly and cell finishing allows producers to reduce cell production costs by up to 10%. Producers can use data about electrode coating accuracy to adjust process settings for electrode shaping and compound generation. The improvements allow producers to reduce compound tolerance ranges from ±1.0 millimeter to ±0.1 millimeter. The greater accuracy enables higher energy density, leading to lower production costs per kWh. Producers can also reduce formation time by adjusting formation parameters based on actual electrode properties and current cell parameters. Cost savings result from reducing capex, maximizing cell capacity, and reducing variations among cells. To capture the benefits, a producer needs a central database to store process parameters and product-quality measurements taken at relevant workstations. Additional requirements include a big data analytics tool set, connected in real time to sensors that measure assembly parameter settings.

- Smart Inline Quality Control. Using big-data analytics to improve quality control during cell finishing can reduce cell production costs by up to 15%. Technical requirements include capabilities to measure quality throughout the value chain, a big-data lake (a repository of data in its native form), and an analytics tool set that enables real-time analysis. A manufacturing execution system (MES) provides critical data inputs to analytics tools. All plants would be required to have an MES, so that producers can analyze manufacturing parameters and related quality measurements. These analyses are necessary to meet global industrial standards for product quality and transportation security. BCG studies have found that most battery producers regard an MES purely as a cost factor, without payback potential. However, by implementing an MES in combination with advanced analytics tools, producers can achieve significant cost savings.

Each step of cell production can benefit from one or more of these use cases. (See Exhibit 5.)

- Electrode Production. During electrode production, variations in the composition of raw materials lead to high levels of scrap. For example, variations in the material slurry and coating die can lead to centerline deviations in electrode geometry, which necessitate scrapping the electrode. Today’s factories address the problem by increasing the tolerance ranges for electrodes, but this reduces the energy density of cells.

In the factory of the future, material-based processing uses inline process controls to allow machines to proactively respond to centerline deviations. Mixing and coating machines are equipped with material sensors that determine the composition of the active material slurry and adjust it using real-time feedback from the subsequent stations: the drying, slitting, and calendaring machines. In addition, smart parameter settings for calendaring and vacuum drying allow for self-adjustment on the basis of porosity and humidity measurements taken before and after calendaring. Because processes self-adjust, producers can tighten the tolerance range for electrodes and thereby increase energy density. Overall, smart process controls within coating and drying stations can reduce drying times by up to 40%. In addition, advanced robots support electrode production by performing loading, setup, and unloading tasks that are done manually today.

- Cell Assembly. The tolerance level that can be achieved during assembly determines a cell’s energy density. Because current assembly machines typically rely on statistical machine control, they do not adjust to actual variations in part geometries. This limits machine accuracy, and, consequently, reduces energy density. In the factory of the future, smart parameter settings that enable inline measurement of part geometries can increase assembly machine accuracy, thereby improving cell capacity. The first applications have demonstrated that cell capacity can be increased by approximately 15%, compared with conventional assembly processes that require fixed parameter settings.

Today’s assembly machines can produce a specific cell type, chemistry, and design, with limited variations. Whenever a producer introduces a new product, it must make significant investments in new assembly machines, and may even need to build an entirely new factory. In the factory of the future, modular assembly machines directed by smart parameter-setting systems and supported by advanced robots can produce a wider range of cell geometries. This will allow manufacturers to make a greater variety of products on a single production line—a game-changing capability for battery production. The expanded product portfolio could include cells used for nonautomotive applications, such as storage.

In the factory of the future, manufacturers can make a greater variety of products on a single production line.

- Cell Finishing. As each cell is assembled in the factory of the future, the production system generates a digital twin—a multidimensional digital representation of the cell, including data such as component specifications and in-process quality measurements. The digital twin is used in the cell-finishing step for smart inline quality control, allowing the producer to greatly reduce the number of physical checking stations. For each cell, electrolyte filling and precharging parameters are automatically adjusted on the basis of the features represented in the digital twin. For example, the filling machine can adjust its flow and pressure using the material property measurements recorded during electrode production. The improvements result in shorter filling times.

In today’s factory, engineers rely on experience, rather than physical correlations, to set formation parameters. The same experience-based parameters are used for every cell produced. However, because acceptable variations make each cell different, fixed parameters prevent producers from maximizing cell performance. In the factory of the future, producers analyze data represented in digital twins to set cell-specific parameters for the formation process, thereby adapting to variations and maximizing performance. Additionally, by applying quality measurements taken during previous steps (electrode production and cell assembly) and processes (filling), producers can reduce formation time by up to 20%.

Aging time can be reduced by up to 80% through smart inline quality control that uses product measurement data collected throughout the entire value chain. This advanced analytics capability allows producers to determine the risk of micro short circuits for each cell without the need for physical measurements. Only cells for which quality remains in doubt after the data analysis will need to go through the aging process—an approach called on-demand aging. Because most cells will skip the aging process, a producer needs significantly less warehouse space and related equipment.

Producers can continue to capture benefits from digital enhancements after a battery pack is in service. For example, they can analyze data on battery usage and cell performance generated by EVs on the road. The insights can be applied to improve battery design and manufacturing processes.

Battery Producers Must Retrofit Plants or Build New Ones

The steps to implement the factory of the future depend on whether a factory is operating or in the planning stage.

Existing Factories. Given the challenges of integrating Industry 4.0 into an existing factory, battery producers should limit the retrofitting investment for a particular machine to, at most, 10% of its original cost. A higher investment would likely require the producer to shut down production for a significant amount of time, which would be less cost-effective than building a new production line. To select and implement the right technologies, producers should take the following actions:

- Assess the current state of the plant, including the maturity of digital applications, and identify the pain points in the value chain that are responsible for the highest costs.

- Choose new digital solutions that can address the identified pain points.

- Prioritize the identified solutions on the basis of their value: quantify the potential costs savings and other benefits that each solution could generate by addressing the pain points.

- Launch pilots of the prioritized use cases and develop a detailed implementation roadmap.

Planned Factories. For plants in the planning phase, producers have more freedom to realize the full concept of a factory of the future. The following steps can be used to identify and capture the value:

- Develop a value stream map, which is a bottom-up summary of processes and costs.

- Ensure that the factory plans specify the required information flows among processes, as well as the sensors, machine controls, and tools necessary to apply advanced analytics.

- Detail the process and material flows in the factory design, in order to provide the basis for setting machine specifications and selecting suppliers.

- Create a detailed implementation roadmap that covers activities through the start of production at the factory. It is critical to provide information about the required process measurements and data flows to teams designing processes and products.

Automakers Should Seize a Landed-Cost Advantage

Automakers that currently manufacture ICE vehicles can find it difficult to transition to electric mobility. Sourcing batteries from a factory of the future can not only facilitate the transition but also help incumbent automakers effectively compete against startups that solely focus on designing and manufacturing EVs.

Today, most auto manufacturers of EVs purchase standardized battery cells from producers with factories that are designed to achieve economies of scale. However, using standardized cells constrains automakers’ designs for electrified powertrains. To continue to be competitive, auto manufacturers need batteries that are customized to the specifications of each vehicle platform. Only then can automakers achieve better vehicle performance through increased battery life and operating range, for example.

Advances in battery technology are enabling customized cell designs, and the battery factory of the future makes it economical to produce customized cells. Indeed, we expect that after 2030, the level of customization in electrified powertrains could exceed that of ICE powertrains today.

To benefit from these advances in the near term, automakers should move beyond traditional supplier relationships by forming strategic partnerships with battery producers that are taking the lead in applying cutting-edge technology. Such partnerships should give automakers deep insights into the major challenges of battery production and allow them to participate in developing innovative technological solutions. Close collaboration between automakers and battery producers will also enable the parties to quickly adjust production processes to new cell dimensions and chemistries and integrate new battery designs into vehicles.

Over the long term, it could be economical for automakers to build their own factories to produce customized battery cells for future generations of EVs. As an industry benchmark, production capacity of 10 gigawatt hours per year is considered the lower limit for achieving the scale effects required for cost-competitive production. This corresponds to approximately 150,000 EVs per year. According to recent announcements, many established automakers are targeting sales of more than 1 million EVs per year by 2030. At that sales level, the in-house production of battery cells would become feasible for these manufacturers. And given that they have decades of experience in optimizing mass production systems, many of them could optimize battery production lines at scale as well.

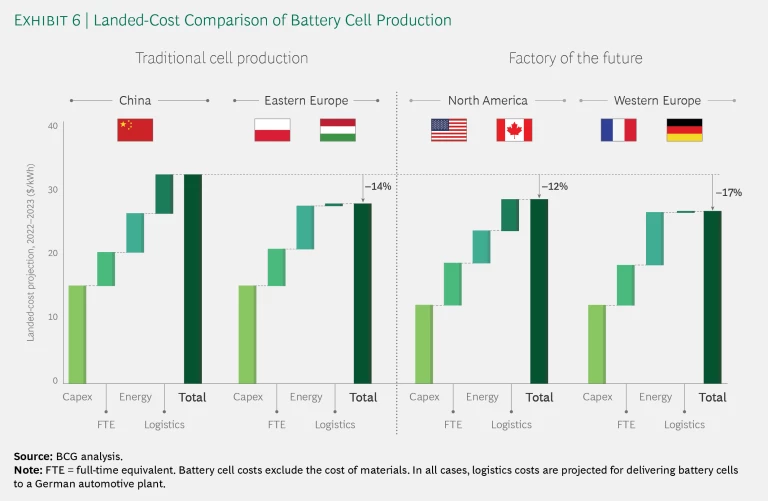

Indeed, for automakers in the US and Western Europe, sourcing batteries from a factory of the future (whether a supplier’s or their own) will be essential to reduce landed costs to the levels required to reach price-competitiveness with ICE vehicles well before 2030. The cost improvements will also allow these automakers to compete on landed costs with their counterparts in China and Eastern Europe. (See Exhibit 6.)

Existing and under-construction battery factories in China and Eastern Europe do not use factory-of-the-future concepts. This creates an opening for the US and Western European automakers to seize a landed-cost advantage. Realizing a 20% cost savings by sourcing batteries from a factory of the future would reduce capex, full-time equivalent expenses, and energy consumption. With the savings enabled by factory-of-the-future concepts, the landed cost of EV manufacturing in the US and Western Europe would drop below the landed cost in China by 12% and 17%, respectively. In addition, the landed cost of EV manufacturing in Western Europe would be 3% less than that in Eastern Europe.

By implementing the factory of the future, battery producers will counteract the lower prices that result from overcapacity and help the entire mobility industry realize the potential of EVs. Producers cannot count on superior cell chemistry to save their economics. To achieve profitability, they need to reduce manufacturing costs. The factory of the future comprises the technologies and systems required to accomplish this objective, driving cost reductions of up to 20%. The first producers to reap the rewards will emerge as the industry’s cost leaders. The race to the future of battery production starts today.