Global asset management is undergoing a metamorphosis, and so are its practitioners, as advanced digital and analytics finally go mainstream. Fresh evidence of flux and reinvention fill every corner of The Boston Consulting Group’s 16th annual study of the industry’s current performance and huge potential.

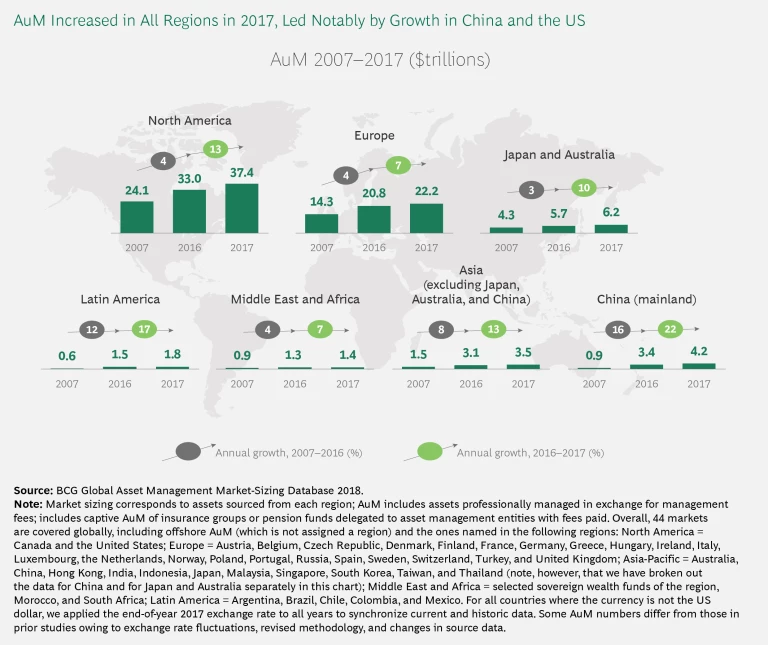

Asset managers enjoyed exceptional results in 2017. Fueled by bull markets, they broke global records for net inflows and for profitability. Assets under management (AuM) increased by 12%—the strongest rate in a decade—to a total $79.2 trillion, led notably by growth in the Chinese and US markets. (See the exhibit.)

The robust results were especially remarkable considering the previous year’s plodding performance. In 2016, both global revenues and global profits fell for the first time since the 2008 financial crisis. Still, most of the bounce-back growth of 2017 was market driven, not structural. Below the surface, pressure on margins will persist because of continued fee erosion and cost pressures—especially as equity markets turn less favorable.

Asset management’s biggest act of reinvention is still to come: embracing the full potential of the digital and analytics revolution. Despite its resources, the $79 trillion industry hasn’t rushed to join the first movers of that revolution. As a result, the digital assets of even the most advanced asset managers fall far short of the operational and customer platforms of the world’s leading digital-first businesses—from Amazon, Alibaba, and Apple to Baidu, Facebook, and Google.

Although nearly every firm has a digital agenda in 2018—a plan that usually involves hiring technologists and experimenting with new analytics and alternative data—few have mastered digital and analytics at scale. Doing so will require significant and sometimes complex organizational change, and we believe that most firms will eventually adopt agile ways of working—collaborative teaming and problem-solving processes that break traditional siloes and accelerate the process of identifying, testing, and implementing change.

We see 2018 as an inflection point in this transformation, with a lot more change ahead. Five years from now, asset managers will look very different from the way they look today, in part because of digital innovation and in part owing to structural shifts in the market.

The savviest firms will manage their business the way owners would. That means tightly managing costs and investing the savings—and the one-off riches of 2017—to reinvent their platforms for the next wave of growth, while protecting against future adverse conditions.

Globally, the record net flows of 2017 reflect increased penetration of asset management products supported by three trends: the bull market run encouraging retail investors to allocate more money to investment funds; the growth of wealth in emerging countries, especially China; and the continued flow into pension products to prepare for retirement.

The recent solid performance of asset managers extends beyond business fundamentals, such as AuM growth and profitability. Managers have also excelled at delivering exceptional investment returns, as indicated by total shareholder returns (TSR), the standard measure of gains received by a company’s owners.

Over the past five years, publicly owned asset managers recorded an average TSR of 12%, surpassing the strong performance of global stock markets. The top quartile of asset managers generated an annual average TSR of 20%, compared with an average of 9.1% for the three other quartiles, considered as a group.

Disaggregating and analyzing the TSR data revealed that the most successful firms grew at the same rate as others, but that they did so more profitably because they maintained price levels and expanded margins. In terms of product strategy, the biggest winners were either small niche players or very large asset managers with strong growth in passive products.

Another sign of metamorphosis: asset managers continue to follow the shift in investors’ product preferences from traditional active products to passives, solutions, and real assets. Passives, in fact, were easily the fastest-growth product category in 2017, posting a record 25% increase in AuM. Traditional active products continued to lose share to solutions and specialties.

Going forward, the expanding push by some firms into “smart beta”—passive products with an active component—could pose a bigger threat to active management than the broader passives trend. How to achieve optimal product diversification is a hotter topic than ever.

Geographic diversification matters, too, as the metamorphosis of regional markets in the global order accelerates. AuM increased robustly in almost all regions in 2017, but China’s growth and potential stood out: AuM there rose 22%, elevating it to the fourth-largest global market. We expect China’s AuM to triple by 2025, which would make it the second-largest market after the US.

The partial opening of the Chinese market, combined with its rapid growth, has created the conditions for a potential gold rush among foreign firms—even though they still have limited access to the market and their role remains at an early stage of development.

The benchmarking survey that informed this year’s report drew on 165 leading asset managers representing $48 trillion—or more than 65%—of global AuM and covered more than 3,000 data points per player. Our measurements assessed assets in 44 markets globally, including offshore.