This article is an excerpt from 2018 BCG Global Challengers: Digital Leapfrogs .

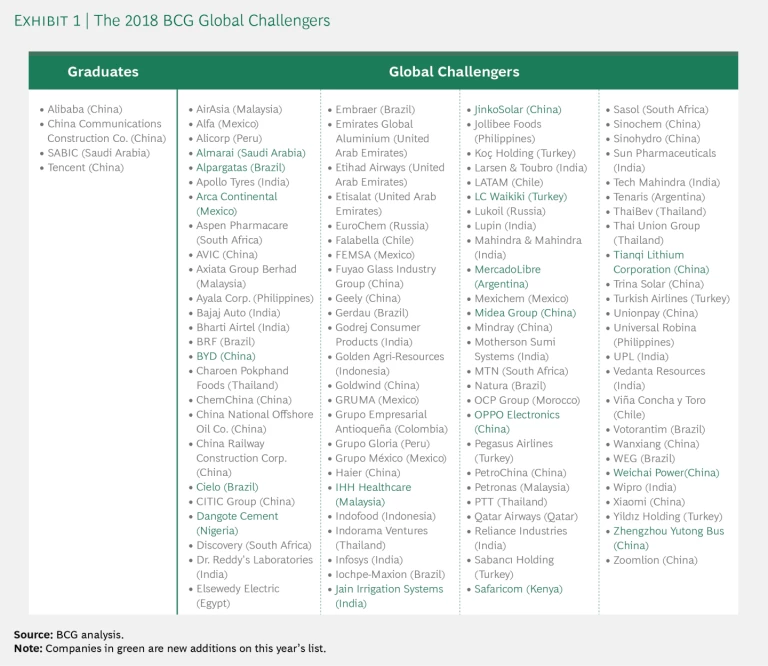

At first glance, the 2018 Global Challengers 100 list bears a lot of resemblance to previous years’ lists. (See Exhibit 1.) Four companies graduated to become global leaders, and 17 companies joined the list. It’s a diverse group, with all major regions and many economic sectors well represented.

Read more on Global Challengers 2018: Digital Leapfrogs

Read more on Global Challengers 2018: Digital Leapfrogs

- Emerging Markets: A Driving Digital Force

- Digital Leadership in Emerging Markets

- Digital Innovation on the World Stage

- Digital Global Challengers Are Leapfrogging Competitors - Infographic

Digital’s Increasing Impact

Look a little closer, though, and it’s clear that the times are indeed changing. The global challengers are selected on the basis of consistent quantitative and qualitative criteria. (See “ Our Methodology .” ) This year, once the list was compiled, we assessed each company on its digital capabilities and its use of digital and technology as part of its business model, both today and five years ago. We identified three categories: digital natives (that is, those that were born a digital company), digital adopters (those that have adopted digital technologies as an integral part of their business models), and traditional companies (those that may pursue some digital initiatives, but these are not critical to their business models). Almost 60% of the companies on the 2018 list are either digital natives or significant digital adopters, while only 17% made significant use of digital technologies in 2012. Digital adoption can be seen in the following sectors, among others:

- Industrial Goods and Manufacturing. Industry 4.0 technologies counter the rebalancing of global supply chains and rising wages in emerging-market manufacturing centers.

- Consumer. E-commerce and omnichannel sales and distribution compensate for the lack of modern trade channels in many cities.

- Technology, Media, and Telecommunications. Infrastructure, hardware, and software for a mobile-first environment leapfrog the PC as the primary way to go online.

- Energy. Renewable energy sources and efficient grids address pollution problems in emerging-market megacities.

- Health Care. Digital health care delivery helps deal with limited hospital capacity and growing epidemics such as diabetes.

- Financial Services. Fintech products and services are offered in markets where people have neither credit cards nor credit histories.

Moreover, two of the four global challenger graduates—Alibaba and Tencent—are digital powerhouses whose position and influence in their home market of China, as well as elsewhere, rival those of Western digital leaders such as Amazon and Facebook. (See the related article, “ Digital Leadership in Emerging Markets .”)

Three Avenues to Advanced Digital Development

Global challengers develop their digital capabilities in three main ways: They are active investors in internal innovation programs and research and development. They pursue partnerships and join digital ecosystems or establish their own. And they acquire digital capabilities through M&A and private investments in startup companies and technologies. All are proving to be highly productive avenues to digital development.

Internal Innovation and R&D. Strong investment in in-house digital innovation and R&D has led global challengers, and emerging-market companies generally, to catch up with, if not leapfrog, developed nations on technology leadership. Huawei, a global challenger graduate, filed for 4,000 to 6,000 unique patents every year from 2012 through 2016—at least twofold more than many leading Western tech players. Focusing on R&D, Huawei moved from follower to leader in five years in communication equipment, doubling both revenue and market share. Tata Consultancy Services (TCS), using its in-house incubation center, has developed Ignio, a cloud-based cognitive automation model that is built on an artificial intelligence (AI) platform and tackles multiple IT challenges for both TCS and its clients.

Koç Holding, Turkey’s largest conglomerate, is applying digital capabilities across its subsidiaries, several of which are quickly becoming leaders in Industry 4.0 technologies. One subsidiary, appliance manufacturer Arçelik, has established a shared creative platform to encourage design-focused thinking and is accelerating its activities in the development of communication protocols, cloud security, data analytics, robotics, and AI capabilities related to digitization and the Internet of Things. Arçelik’s Atölye 4.0 digital factory utilizes advanced automation tools, AI, digital twins, image processing, mobile technologies, and collaborative robots.

Partnerships and Ecosystems. Many emerging-market players are leading joint efforts with other companies and building digital ecosystems. Tencent, a global challenger graduate and the world’s fifth-largest company by market capitalization, has achieved its outstanding scale and engagement in social media by leveraging a broad-based digital ecosystem that delivers a comprehensive range of value-added services to its users. (See the related article “ Digital Leadership in Emerging Markets .”) Ant Financial, an Alibaba affiliate, created a global smart-payment ecosystem by partnering with merchants, banks, and other fintechs. Xiaomi has built a large smart-home ecosystem focused on appliances, health care, and entertainment. MercadoLibre, the leading online marketplace in Latin America, with 175 million users, set up an ecosystem that includes payment solutions, credit scoring, and advertising.

M&A and Private Investments. Leading emerging-market players are pursuing strategic investments to either expand their business or build new capabilities faster. Many of these deals have a technology component—that is, they involve two tech companies or a nontech company acquiring technology or a tech capability. Globally, the share of nontech-sector acquirers of tech companies has grown by 9 percentage points since 2012 to encompass about 70% of all tech transactions. (See “ The Resurgent High-Tech M&A Marketplace ,” BCG article, September 2017.)

Global challengers have made some 2,400 acquisitions or investments since 2013. In about 16% of these transactions, the target was a digital native. But many of the rest of the deals involved the acquisition of digital or advanced capabilities. For example:

- Jain Irrigation of India acquired Observant of Australia, which develops farm information management platforms and applications.

- Midea Group of China acquired German robot manufacturer KUKA.

- Zoomlion of China acquired m-tec, a Germany-based company focused on accelerated and economical building processes.

- AirAsia of Malaysia acquired Tune Money, a company that serves value-seeking customers with a wide range of digital banking solutions.

- Tianqi Lithium Corporation acquired a 51% equity interest in Windfield, the parent company of Talison Lithium, the world’s largest lithium mineral producer.

BCG research has shown that the number of digital joint ventures has increased by almost 60% in the past four years, and many of these involve companies in emerging markets.

Global challengers continue to produce outstanding value from traditional and digital assets. They have multinational physical footprints from which to serve global and local client needs. They have built influential brands that attract and retain a growing customer base. Talented workforces deliver high-quality products and services, and proven operating models have built track records of consistent success. Innovation, based on extensive know-how, stays high on global challengers’ agendas.

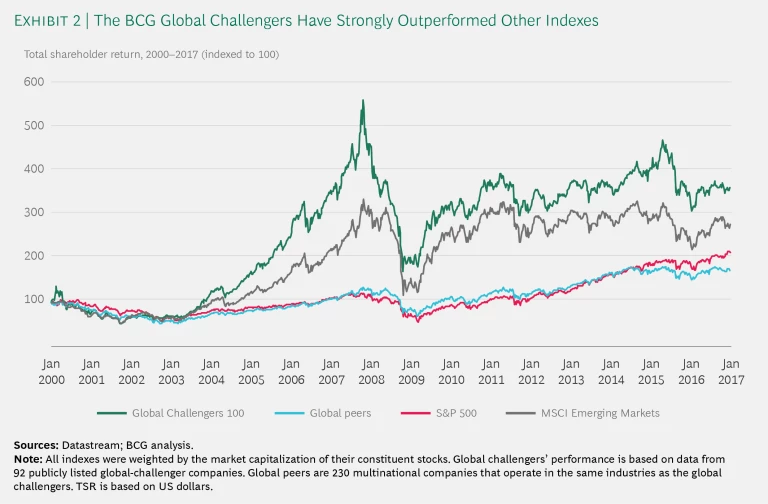

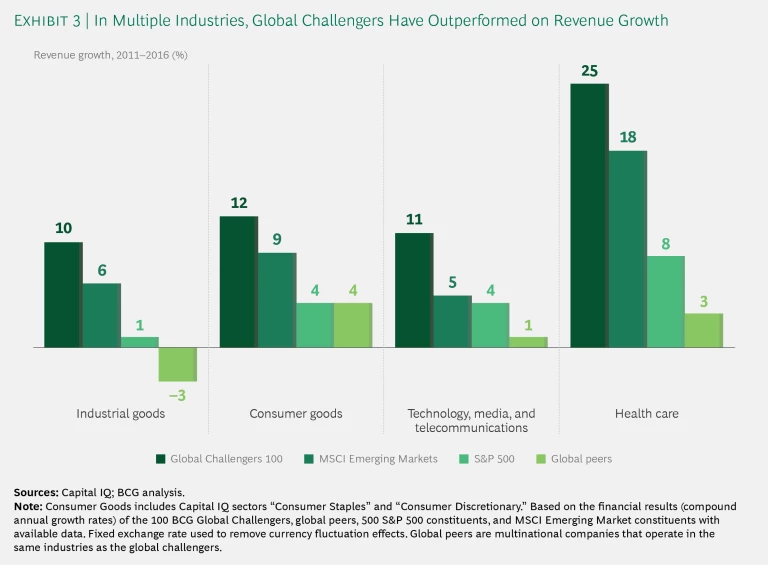

In terms of long-term (2000–2016) total shareholder return, the BCG Global Challengers 100 have substantially outperformed their global peers, the S&P 500, and the MSCI Emerging Markets Index. (See Exhibit 2.) More recently (2011–2016), the challengers’ TSR performance (as well as that of the MSCI Emerging Markets Index) has been affected by broader economic conditions in emerging markets, but even during this period, their revenue growth has outpaced that of peers in other indexes across multiple sectors, and operating margins have remained strong, at an average of 10%. (See Exhibit 3.) A big drag on the global challengers (as well as on other indexes) has been the performance of large energy companies, which has suffered in the face of falling oil prices.

…with a Digital Kicker

Going forward, we believe the global challengers are well positioned to use their digital assets and advantages to capitalize on a number of the defining characteristics of emerging markets. For example, these markets contain the world’s last remaining pools of high demographic and economic growth, which the global challengers can access with efficiency and value-based productivity. Consumer-focused companies can connect more easily with a fast-growing base of digitally savvy consumers open to using new technologies. Policymakers and regulators in many developing nations are seeking to foster digital innovation with favorable regulatory environments, which facilitate the development of digitally enabled workforces, collaboration in digital ecosystems, and growth. For example, the Central Bank of Brazil (Bacen) has created an innovation pool with banks such as Banco do Brasil and Caixa and technology leaders such as Microsoft to support the development of fintechs in Brazil’s financial system. And India is touting its leadership in fintech development.

All of this has put the global challengers in a strong position to continue to outperform in their home markets and to challenge developed-market companies for leadership internationally.