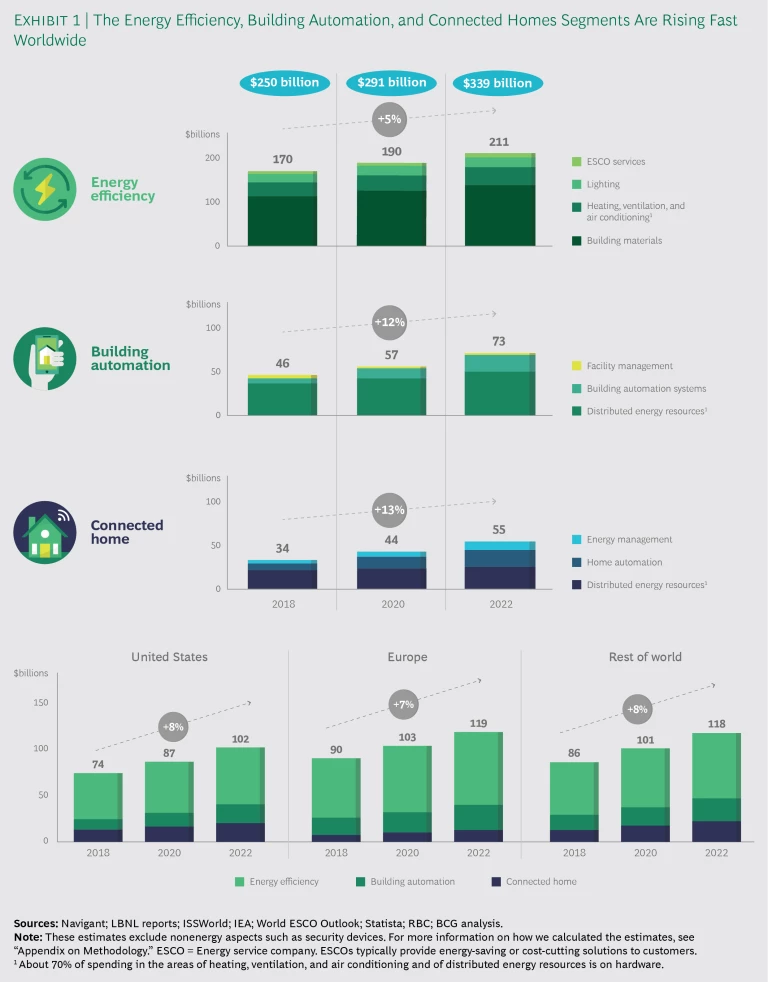

Change is sweeping through three related segments of the construction industry—energy efficiency, building automation, and connected homes—and their boundaries are blurring. Emerging from this upheaval is a single smart buildings market that is likely to cause a surge in value. Already the three segments generate global annual revenue of about $250 billion. (See Exhibit 1.) As they converge, that figure will continue to rise sharply, reaching about $339 billion by 2022, divided fairly evenly among the United States, Europe, and the rest of the world.

In many parts of all three regional groupings, the market is maturing. But as it consolidates, it grows increasingly complicated, and participants and analysts find it harder than ever to navigate. For companies already involved in this dynamic market, the prospects are invigorating, though far from failsafe. Aspiring companies, meanwhile, had better prepare thoroughly before jumping aboard, if they hope to secure a foothold. To capture the opportunities, established companies need to review their value propositions, and aspiring companies need to equip themselves with the right capabilities. Various new business models hold promise.

An Evolving Space

The smart buildings market is complicated because it is multidimensional. The principal dimensions are as follows:

- Domains, including lighting; heating, ventilation, and air conditioning (HVAC); and building materials

- Verticals, particularly residential, small commercial, and industrial

- Links in the value chain, such as products, system integration, and operations

Traditionally, five business models have dominated the relevant sectors:

- Original Equipment Manufacturer (OEM). Companies of this type tend to focus exclusively on making equipment, typically within a single domain, such as lighting or HVAC. Some OEMs, however, have opted to pursue greater vertical or horizontal integration.

- Systems Integration Specialist. Companies of this type offer systems integration services, mainly engineering and design but sometimes also financing, project management, and installation in one or more domains.

- Operations and Maintenance (O&M) Specialist. Companies of this type provide facility management services—services involving operations, repair, and maintenance in one or more domains.

- Vertically Integrated Company. Companies of this type operate across stretches of the value chain, whether in a single domain such as lighting or in multiple domains such as HVAC and building management equipment and services. They may contract as full operators or on a pay-as-you-use basis.

- Platform Specialist. Companies of this type operate in the building automation and connected homes segments. They provide platforms that enable hardware and software in buildings to interact.

Successful though these business models have been in the past, their future viability is dubious. They are poorly suited to the converging market and are vulnerable to the disruptive changes that are now underway—most notably, to changes involving technology, platforms, the competitive landscape, and customer preferences.

Technology. The most powerful disruptive influence is likely to come from technological changes, including the following:

- Refinements in data storage, sensors, and machine-to-machine connectivity, spurring innovation and improving efficiency and data security

- Commoditization of standard hardware components such as boilers, light bulbs, and cameras—components that until recently yielded handsome margins for their manufacturers

- Improved communication through higher-bandwidth, lower-energy consumption (permitting longer battery life), and lower-cost connectivity

- Further advances in big data and analytics

Platforms. Newly available open-source standards are gaining popularity and prompting platform consolidation. In all likelihood, few current leaders will achieve the scale necessary to survive, so the overall number of platforms will probably fall.

Competitive Landscape. Sources of competitive advantage are changing. In the past, equipment services companies might have differentiated themselves by offering financing to clients; but today, financing is fairly common or even standard. At the same time, equipment is becoming increasingly commoditized and plug-and-play, making installation much simpler. And capabilities such as data management, analytics, and artificial intelligence are becoming more crucial. As a result of these changes, proprietary technology ecosystems, which used to last for decades, are rapidly losing ground to open, fast-changing ecosystems.

Customer Preferences. Customers are better educated about their buying options and more demanding than they used to be. They expect products to offer more functions, greater operational simplicity, and a better user experience—all at a moderate price.

Implications for Incumbents

As these four trends proceed, the three market segments involved—energy efficiency, building automation, and connected homes—are losing their individual identities and starting to merge into a unitary smart buildings market. Product offerings and service offerings will continue to integrate, and companies that once occupied separate spaces may become direct competitors, with substantial revenues at stake.

Two traditional business models—OEMs and O&M specialists—are especially likely to feel the effects. Currently, these companies differ in their core business, but increasingly they will compete at many pivotal points as they seek to supplement their products and services through M&A or by developing their internal capabilities.

Vertically integrated companies are likely to begin offering straightforward financing and delivery solutions, which could be very disruptive in the energy services segment. Complicating matters further, companies from unfamiliar sectors such as telecommunications, IT, and utilities may infiltrate the market. Online intermediaries may try their luck, too.

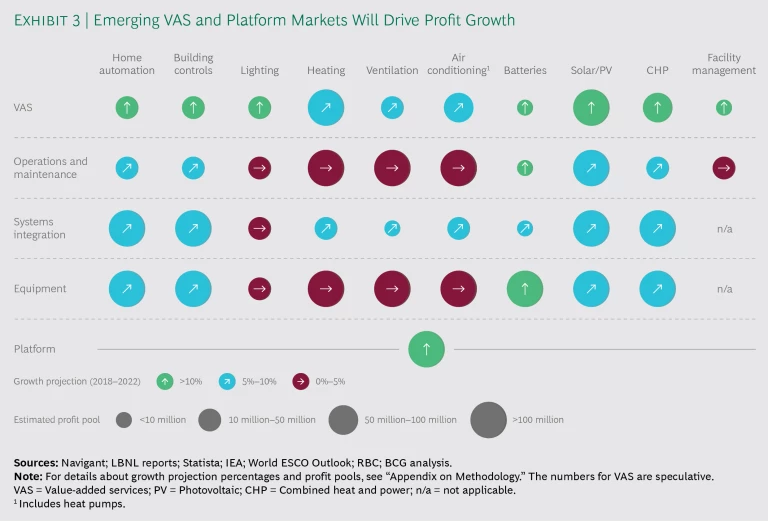

Another danger—or opportunity—for incumbents is that the market may change its idea of what is valuable and important. In one plausible scenario, value-added services such as energy analytics become a highly attractive feature and a source of differentiation; new platforms enable smart buildings systems, especially for homes and smaller buildings; and new technologies, coupled with growing customer demand, create new domains and accelerate growth in existing ones.

If these developments do indeed occur, businesses will need to rethink their value propositions and business models.

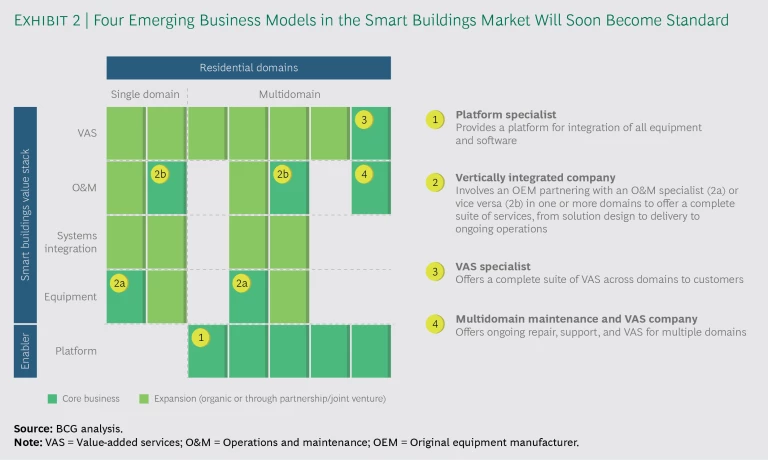

In our view, the smart buildings market (in both its residential and its commercial-industrial aspects) will eventually be dominated by four new business models that are very different from the five prevailing models. (See Exhibit 2.) One common feature of the new models is their ability to leverage the vast data that smart buildings constantly generate.

The four new models are as follows:

- Platform Specialist. Companies of this type will provide platforms that integrate equipment and software. As the platforms’ importance increases, so will the companies’ role.

- Vertically Integrated Company. Companies of this type—mainly OEMs and O&M companies that expand their offerings—will collaborate or form partnerships to provide a complete suite of services, from designing solutions to providing operational support.

- Value-Added Services (VAS) Specialist. Companies of this type will supply such services as consulting, programming, and analytics. Upgraded platforms will enable some companies to offer services in multiple domains.

- Multidomain Maintenance and VAS Company. Companies of this type will offer a combination of maintenance and VAS in multiple domains.

Any convergence of the energy efficiency, building automation, and connected homes market segments is certain to significantly affect one particular subsection of energy efficiency: building materials. Energy-efficient building materials—including windows, roof tiles, insulation, and facades—already make up about 70% of the energy efficiency segment. Although the full extent of the impact remains unclear, it will certainly be powerful. (See “A Smart New Building Materials Market.”)

A Smart New Building Materials Market

A Smart New Building Materials Market

Compared with the three main market segments discussed in this report—energy efficiency, building automation, and connected homes—the building materials subsegment (within energy efficiency) has had a fairly tranquil history, with a far less disruptive environment and less pressure to change its business models. The main reasons for this relative stability are that most building materials are not smart and that the industry tends to be fragmented into regional markets—so much so that innovative products struggle to reach the critical mass they need for commercial success.

The situation is changing, however, as building materials start to acquire smart characteristics. In early 2018, Tesla solar roofs made their commercial debut. These roofs incorporate Tesla’s solar tiles and link customers’ houses to the electricity grid.1 Several other breakthrough innovations have recently emerged or are under development: self-monitoring concrete and asphalt; smart mats to monitor footfalls and hence consumer behavior; ceramic floor tiles capable of charging smartphones; and photovoltaic or electrochromic windows.2 In addition, thanks to building information modeling (BIM), the process of purchasing building materials is becoming more streamlined, enabling customers to benefit from greater transparency on timelines and price. (See BIM Revolution Comes to Building Materials, BCG report, February 2017.)

These developments raise issues for companies in the building materials subsegment: the prospect of aggressive new competitors, the need for closer relationships with building equipment companies, and the need to seek new ways of dealing with customers in a changing customer journey. Building materials companies are finding their surroundings increasingly unfamiliar, and they should examine the business model changes that other types of company are adopting.

Here are some of the implications for building materials companies:

- Building materials manufacturers should provide product data in an online format, to allow project managers and architects to specify and order materials through the BIM system. They should also make arrangements for building operators to place their orders through the same channel.

- More and more building materials suppliers are extending their sales efforts online, rather than limiting themselves to traditional retail/wholesale outlets and contractors.

- Startups and some established companies now offer additional services such as planning, erection, and maintenance, since traditional contractors cannot quickly adapt to using smart materials.

- Some building materials manufacturers may take the initiative to expand and become vertically integrated companies. They may seek to merge with distribution and construction firms, and even with service providers.

All building materials companies, including those that have already made strategic moves in response to market changes, should continue studying how best to position themselves in the brave new environment.

Notes

Companies that opt for any of these four new business models will have to develop the appropriate capabilities and gear up to respond nimbly to changes in customer preferences. Consider the example of companies that currently operate mainly as OEMs or O&M specialists: they should start offering devices and services that can integrate seamlessly with one or more platforms; alternatively, they can take the calculated risk of betting that a specific platform will be a winner. They should also be ready to oblige any customers that demand new tools for advanced analytics to optimize decision making.

Or consider the example of companies that currently operate mainly as platform specialists: such companies should quickly begin building a critical mass of users in order to acquire the advantages of operating at scale, and they should identify the best way to monetize their offerings. This might involve offering subscriptions, selling software, or cross-selling equipment.

In all cases, companies should continually review their strategy, so they can tap into the most promising profit pools at any time. (See Exhibit 3.)

The Path Ahead

To understand how the smart buildings market works and how to capitalize on opportunities, companies should consider adopting a four-step process:

- Prioritize and assess the areas of the market that you want to participate in. In assessing each area, take account of revenue, margins, growth prospects, and potential return on investment.

- Analyze your capabilities and strengths in the specific market segments of interest. This analysis should include identifying the products and services to offer within each targeted domain; calculating the budget for each domain as a percentage of the total budget; and estimating the current share of each domain’s total revenue.

- Assess the strength of your offering relative to that of your competitors. Calculate their profitability and market share, and identify critical success factors—for example, brand strength, innovation, and access to talent. This assessment will help you to decide where to place your bets.

- Accurately assess your ability to adopt any of the four emerging business models. For example, rate your readiness to integrate vertically; to expand into other domains; to build a winning platform; to offer value-added services; and to grow organically through partnerships, joint ventures, and M&A.

By adopting this process, companies will be able to review and adjust their business model with greater precision.

Going forward, some companies will quickly formulate the right strategies and then implement them efficiently. Those companies will likely end up as the winners in the new smart buildings market. But companies that resist change or change too slowly may soon find themselves sidelined, unable to share in the profit pools that the industry’s consolidation opens up.