The wind industry is starting to come to terms with the fact that it is no longer the “new” in “renewable.” It must now shift its emphasis from maximizing output to optimizing the value of equipment over the lifetimes of those assets.

Although wind has had plenty of wins thus far, industry players—equipment manufacturers, turbine owners, wind farm operators, service providers, and others—must now look to the long term and consider very different business models as the industry matures. Once a marginal contributor to the energy market, the wind industry is becoming a mainstream supplier of power in more and more regions worldwide. At the same time, the entire energy sector is being roiled by the growth of digital technologies and looming political factors.

To be fair, the wind industry has not needed to grow up until now. Companies rarely incurred severe consequences for their mistakes or miscalculations. Until recently, they were able to stick with safe choices rather than taking big risks for the chance of a bigger payoff. For example, operators could opt for older turbine types—a choice smiled upon by lenders—rather than selecting brand-new, unproven models.

Until recently, wind industry players were able to stick with safe choices rather than taking big risks for the chance of bigger payoffs.

Industry players have enjoyed this prolonged youth. They have had long development phases during which data could be collected, assessed, and reviewed; their building permits came with access to comfortable feed-in tariffs; turbine supply contracts have had performance guarantees from the original equipment manufacturers. Wind companies have also benefited from long-running service contracts with guaranteed availability levels—the promise that every megawatt-hour that could be produced would be paid for even if, for example, the grid connection hadn’t been built on time or the grid was overloaded.

Today, wind companies are increasingly facing conditions that will compel them to adapt more quickly and boldly than they have ever had to.

The Forces of Change

The industry is being buffeted from all sides. Auction models are proliferating, successfully depressing energy prices and at the same time shifting risks to operators. Most regulators have adopted auctions in one form or another; in Europe, in particular, it is quite likely that auctions will become mandatory. (See “Outrunning the Regulators.”)

Outrunning the Regulators

Outrunning the Regulators

Wind energy players aren’t as far ahead of the regulators as they might think. Although it is true that regulatory bodies have typically not moved fast, some are proving that past is not precedent.

For years, EU energy regulators have been steadily refining policy milestones with the overall goal of “making energy more secure, affordable, and sustainable” for the bloc’s citizens. Now there is a concerted push to accelerate targets for 2020, 2030, and 2050. For instance, for 2030, European regulators want to boost renewables’ share of energy generated in the region from 27% to 30%. A proposed revision to the Energy Efficiency Directive would make those levels binding within the EU.

Here are just a few of the effects these changes may produce: coal-fired plants will no longer receive compensation for keeping capacity on standby (obviously, the asset owner will be still be paid for the energy produced); there will be no economic bias against (or for) energy storage; and the elimination of fixed minimum and maximum prices will require new schemes for paying generators of renewable energy.

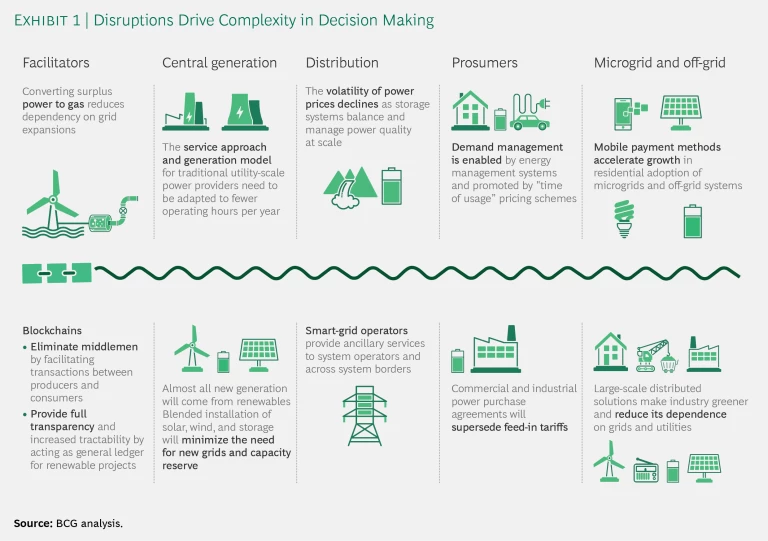

At the same time, new entrants are capturing value with disruptive business models. (See Exhibit 1.) One day soon, industrial goods companies may be supplying generation and storage technology, and consumer goods suppliers may sell plug-and-play solutions for residential and off-grid energy needs. IT and data companies could step in to manage the interfaces between industry players, balancing demand and supply in a secure environment. The insurance industry could provide hedges. And blockchain cryptocurrencies may upend traditional business processes by streamlining payment flows between electricity producers, distributors, and consumers. Few of those changes were imagined, let alone felt, just a few years ago.

Throughout the industry, value is shifting from those manufacturing and installing the assets to those managing them—and to those managing the expanding volumes of operating and performance data. This shift applies as much to a single asset as it does to entire fleets of turbines and is as relevant for wind farm operators as it is for equipment manufacturers, asset owners, and independent service providers. The ways in which industry players respond will determine their operations and maintenance roles over the long term.

The big changes ahead will require wind energy executives to ask new questions of themselves and their colleagues. (See “Crucial Questions as Wind Energy Grows Up.”) Their answers will help them assess new risks and opportunities and make it easier to envision very different business models for their industry. Specifically, they must confront the rising importance of scale as setup costs continue to climb. They will also need to consider new organizational models and new competencies, such as bundling demand into new power purchase agreements (PPAs), complementing wind farms with storage systems, assessing the optimal lifetime of wind assets, and managing new interfaces among departments and companies.

Crucial Questions as Wind Energy Grows Up

Crucial Questions as Wind Energy Grows Up

- Are we set up to optimize the service of these increasingly digital assets?

- Can we optimize the value we create from energy production better than anyone else?

- Do we have the skills to translate production optimization into revenue optimization both during the term of the support scheme and after?

- Are we the right long-term owners for this type of wind farm, or should we specialize in operating on behalf of an infrastructure investor?

- What is the best party for each aspect of the business, given the scope and range of activities that need to be coordinated and executed?

- Do we have to do so much in-house?

- Do we do things in-house because we’re concerned about proper management of the required interfaces?

- If yes, how much better are we at managing these interfaces than an outsourcer might be?

- How can we benefit from the technical advances made to next-generation turbines after we specified and ordered our turbines?

- Can we shift between running the turbines in power boost mode and lifetime extension mode?

- What are the economics of both modes and under which circumstances should we apply each mode?

BCG has identified four major themes that will inform the decisions that industry executives must make soon.

Maximizing Value Rather Than Output Over an Asset's Lifetime

Gone—or going, at least—are the days of fixed revenue streams per megawatt-hour, when the primary metric was how much power you could produce and how quickly. Under the traditional model, the lifespan for operating assets was more a function of the support scheme than the asset’s design lifetime. Investors and shareholders lived in financial cocoons with little or no exposure to market risks.

Today the emphasis is shifting quickly from megawatt-hour numbers to revenue figures and asset lifetime value optimization as support schemes come to an end and more auction wins go to those players prepared from day one to live with very limited subsidies—or even none at all. And new technologies such as data analytics and the Internet of Things are enabling a host of advanced tools and techniques with which to optimize. This is happening as renewables make greater inroads into global energy markets—a trend that highlights the industry’s spiky supply-and-demand characteristics, deflating prices at the energy exchanges on windy and sunny days and sending prices soaring on windless, overcast days.

The concept of asset lifetime value optimization is much the same for a wind farm operator as it is for an industrial company building a new production plant; the company must tune production volume to market demand, without any certainty regarding how long the plant will be competitive. In the case of renewables, though, there are two crucial differences. First, the majority of the costs for generation are upfront capital expenditures, unlike the operating expenses more typical in other industries. Second, the market mechanics are likely to change because the energy-only market (in which payment is determined by the kilowatt-hours generated) was designed for conventional generation, a form that is clearly on the decline.

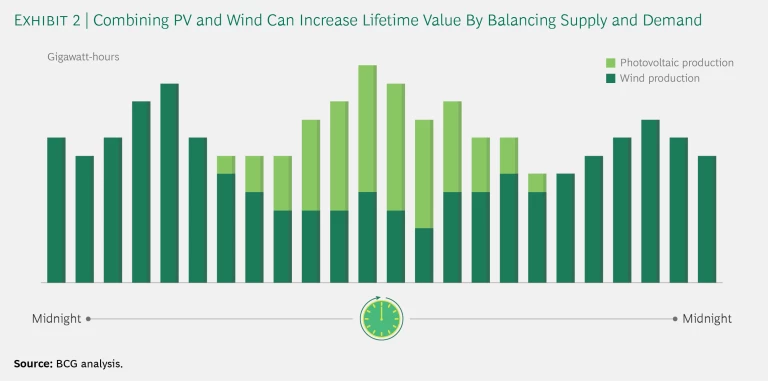

As variable renewables become more of a factor in energy markets, balancing supply and demand becomes increasingly important. A starting point for wind companies is to rethink the old definition of assets. Today, owners can combine wind and photovoltaic (PV) energy on the same site, with PV generating during sunny afternoons and wind taking over in the evening. (See Exhibit 2.) Such asset combinations may not have been economical two or three years ago but are probably worth revisiting soon. Solar costs are forecast to fall 59% by 2025, whereas wind costs are expected to decline at only about half that rate.

The keys to optimizing any industrial process are finding the best way to manage the bottleneck and delivering a product that meets the needs of the customer. In the renewables world, that most often means optimizing expensive grid capacity and striving to have the generation profile match the demand profile as closely as possible.

One large wind OEM and its partners have optimization very much in mind with a blended wind and solar project they are developing in the southern hemisphere. Four gigawatts of wind turbines will be paired with 2 gigawatts of PV, and a subsea DC cable will deliver the power to population centers in a nearby nation. The hybrid project is due to be fully operational by 2029.

The maximum lifetime value concept includes a rethinking of an asset’s longevity. Most wind turbine components easily exceed their design lifetime. Turbines last about 25 years before needing an upgrade, according to recent research from Imperial College in London. That’s about the same as the lifespan of the turbines in natural-gas power plants.

There are additional questions for industry executives: for example, whether owners have data on mean time between failures for all relevant components based on site characteristics and whether they’re using that data in their long-term service plans. The questions should reflect what can be done with newer technology—for example, using data and analytics to reconfigure turbines so they can better handle violent gusts of wind or to rethink familiar assumptions about the relationship between wind speed and power generated.

The viability of assets beyond the span of a support scheme raises big questions about the roles of all stakeholders—owners, operators, financiers, service providers, and others. Owners, for example, will have to reconsider how long they want to hold on to their assets. This raises other questions: Am I extracting full value using real-world data, which is necessary to make binding competitive bids? (These bids differ from so-called casino bids, where auction winners secure options and only later choose whether or not to act on them.) Which other assets should be part of my portfolio, and how will they change my interactions with my customers?

A shift in focus to lifetime management of assets will bring with it more operational tasks, many of which are well-suited to sharing among partners.

Intra-Industry Collaboration: A More Certain Route to Higher Value

In the new world of lifetime optimization, wind operators and OEMs have to stop fighting and start collaborating. A shift in focus to lifetime management of assets will bring with it more operational tasks, many of which are well-suited to sharing among partners. All kinds of collaborative models are in play in the chemicals sector, for instance, where the value of partnerships is widely recognized. In a digital age, that value is magnified, yet few wind companies have considered new cooperation models, let alone implemented them. This is because these companies tend to look at the contractual side first—the obligations, liabilities, liquidated damages, and so on—rather than beginning with the business case, or because they are scared off by the complexity of the interfaces.

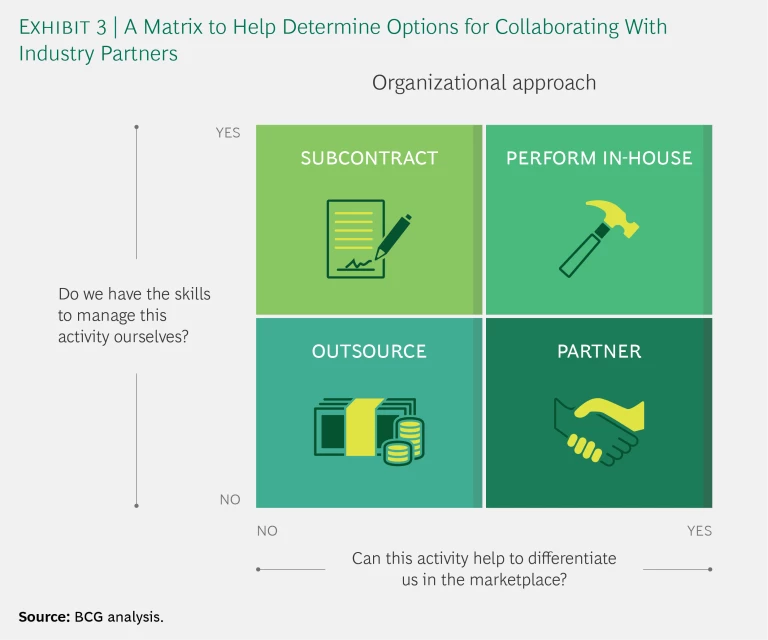

The complexities are real, of course. In any collaboration, the partners must acknowledge and agree upon their respective roles. Wind asset owners also need to think through the necessary balance between the business activities that they will continue to do best in-house and those that would be better handled by outsourcing firms, subcontractors, or other industry partners. For instance, if digital analytics techniques are outside an asset owner’s expertise, what kinds of partners—and partnership arrangements—will the company need in order to add those capabilities? For servicing activities, there has to be agreement about who will manage parts supply, whose job it is to monitor all the data coming from the turbine gearbox, who trains the service techs, and more. There are no permanent answers to such questions: they have to be revisited regularly by the executive team.

Too many asset owners and operators still believe they should perform all service tasks themselves. The pendulum is swinging away from this idea as the costs for building in-house service competencies soar and as scale becomes crucial. In the past, 1 to 2 gigawatts of installed capacity was considered large enough for an operator to build service skills in-house. But if that capacity includes, say, ten types of turbines spread across four countries, the equation will look very different. Today, 5 gigawatts or more typically is needed to build an at-scale service organization. And as the costs of OEM service offerings fall, the case for building a full-fledged in-house service team is tougher to make. This is not to suggest that all service tasks should be relinquished to the OEM, no matter how low they go in price. It’s crucial to remember that OEMs’ full-service contracts focus on megawatt output; operators need to focus on the value of each megawatt and the value contributed by operations.

BCG has created a simple matrix to help industry players find the right partner for various tasks. (See Exhibit 3.) For some tasks, wind asset operating companies are well-suited to handle the work themselves; for many others, partnerships would be much more effective. The wind industry should embrace new forms of collaboration, including appropriate allocation of all service and operation activities and new bundling of those activities, guided by the matrix.

Using Merchant Risk to Escape the Commoditization Trap

In most of the energy industry, financing mechanisms are structured around the fluctuation in prices. The wind sector, long accustomed to the support of regulated pricing agreements, has resisted taking on the merchant risk inherent in such market-based financing. That has to change.

A recent report focused on Europe helps paint a picture of the new risk landscape. By 2030, only 6% of European wind capacity will be fully protected against market risks through support schemes, down from 75% today. According to this report, 67% of the capacity by 2030 will be partially exposed to power markets, with 27% fully exposed. Insurance companies and reinsurance companies have neither the appetite nor the capacity to cover merchant risk. So as support schemes start to fade, more and more owners of generation assets are figuring out new ways to manage risk. These include gaining a better understanding of future electricity demand and pricing patterns, optimizing the timing of service and repairs and running turbines at lower load factors, and investing in digitalization.

One company’s experience in combining massive storage batteries with wind production offers an example of potential portfolio approaches to assets—and shows how wind players can mitigate their risks. Not long ago, a storage company installed a 100-megawatt battery at a wind farm. Just two weeks after work was completed, a coal-fired station tripped. The battery-equipped wind farm not only kept the local grid going, but it also earned its owner about $700,000 in two days. Reports say that the wind farm was able to sell electricity at a very high per-megawatt-hour rate for a month, while paying almost nothing to generate electricity.

Combining generation assets with storage units will become the norm. Adding storage can be done when the generation asset is newly commissioned or later, as a retrofit. We expect to see many retrofits in the near future as hybrid solutions emerge. The three main drivers for that are: more and more generation assets will be without fixed subsidy schemes (exposed to market risk); at the same time, the increasing penetration of renewables leads to more and more hours where the market price for electricity is at zero or below; and the costs for installing battery storage are falling dramatically. In Europe, the breakeven for adding storage as a retrofit to a wind farm is when 5% to 10% of the energy generated is exposed to negative market prices. This threshold will go down as battery prices tumble, which is why it is already good practice to reserve some space in a wind farm for retrofitting or expanding storage.

With battery prices falling, it’s already good practice to reserve space at wind farms for retrofitting or expanding storage.

Approached strategically, merchant risk can be good for the entire renewables sector. The effective management of that risk means ensuring that the megawatt-hours produced are needed. BCG expects a rapid convergence of supply and demand, brought on by regulatory adjustments and the proliferation of smart meters and other smart technologies that make monitoring that balance much more practical. These include electric vehicles, new storage technology, and sector coupling, which is the integration of energy-consuming sectors such as buildings (for heating and cooling) with the power-producing sector. When supply and demand are balanced there is no need to curtail generation, and power prices will not drop below the cost of production; the difference between the average price for power and the average price for renewable power will diminish and policymakers will be comfortable with renewables’ steadily growing role in the overall energy mix.

This transition will be evident in the bundling of consumer demand and in the development of more and more corporate and industrial (C&I) PPAs. The US has been a forerunner in such agreements, with several Fortune 500 companies signing corporate PPAs. In Europe, C&I PPAs have begun to emerge in the Nordic nations and the Netherlands, and hybrid PPAs are being structured in Portugal and Spain. It remains to be seen whether wind asset owners will build this capability for themselves or if new intermediary businesses emerge.

Of course, not every industry player has the capacity or the skills to manage merchant risks. However, BCG believes that leading companies will take lessons from other industries. The oil and gas majors long ago mastered the management of such risks. It would not be surprising to see the emergence of true majors in the wind and solar sectors in the near future—companies perhaps ten times the size of current renewables players and comfortable in the merchant world.

A Marked Push Toward Bigger Bets

The mantra of “costs down, performance up” is necessary for lifetime optimization, but it’s no longer sufficient. Because merchant risk exposure is a far bigger factor today, long-term success in wind energy now calls for imagination across asset types and national borders—at scale.

A large European wind farm operator provides a good example. The company recently bought the rights to a huge solar development in Australia. (With sunshine year-round, the expected load factor is 23%.) The company has further widened its geographic portfolio with the purchase of a 2 gigawatt wind pipeline in the US. Those moves illustrate two ways that wind operators can manage risk: by spreading it across different technologies with different generation profiles and by taking on calculated risk with investments in selected markets, since it is hard to predict how—and how quickly—markets are moving away from support schemes.

But there’s another aspect to risk: not taking the right kinds of risks in the first place. BCG observes that many energy players, such as oil and gas companies, are looking for attractive entry strategies and opportunities to test the waters in the renewables market. They are most interested in wind power, because the sector requires more engineering competence. Executives at those companies typically say they want to start with small projects where they can safely make mistakes before rolling out their bigger investments. Some expect to get industry returns right from the start.

However, the industry is moving into an era of bigger bets. Newcomers that follow a toe-in-the-water approach with something as small as a 100 megawatt wind farm will almost certainly conclude that renewables are not viable for them and that the returns don’t match their needs. Developing and operating different asset types at scale in several markets require multibillion-dollar companies and high levels of commitment. Delaying that commitment will only make it more challenging to enter the market later.

It’s clear that the wind industry will look very different in ten years—perhaps in as little as five years. That will be the case whether or not industry executives take action, because many of the forces of change are coming from outside of the industry as it is defined today.

If leaders expect to control their own destinies, they must make big new decisions very soon—about the lifetime optimization of wind assets and about which roles they will occupy and which they will outsource, subcontract, or take on with a partner. They must exercise imagination, take bigger risks, float new ideas, and learn about unfamiliar areas—the economics of PV, for example.

The four themes described above provide the means to start asking the questions that will inform those decisions. There’s no time to waste; the changes affecting the industry are coming thick and fast. So today is a good day to begin asking one of the most important questions of all: What do you need to do right now, this week, that will help ensure your success in tomorrow’s renewables sector?