Strong growth and healthy margins have long been hallmarks of the medical technology industry. But the commercial model that has served as the accelerator for that success now acts more like a brake. Consolidation on the buyer side and intense downward pressure on prices make it increasingly costly for medtech companies to sustain a large sales force and not to take action on overly accommodating pricing policies. At the same time, the resulting margin squeeze limits companies’ abilities to take advantage of opportunities in the emerging areas of outcome-based health care and digital health.

How can medtech companies extricate themselves from the margin squeeze and put their foot back on the gas pedal? Addressing two important aspects of pricing will free up the resources to fund and monetize innovation, sharpen the focus on existing market segments, and seize opportunities to tap into new ones. Medtech companies need to fix their pricing basics by introducing greater structure and discipline to their pricing policies. They also need to secure their futures by implementing innovative pricing models aligned more closely with value created within and along the care continuum.

On both of these challenging paths, 80% of the success depends on implementation and execution, which in turn requires a next-generation pricing platform comprising strategy, people, process, governance, and tools. Medtech companies that have fixed the basics—supported by richer, more reliable data and adequate tools—have improved their EBIT by 2 to 5 percentage points. Those that have implemented value-based pricing approaches have accelerated their transition to the emerging worlds of outcome-based health care and digital health. Ideally, a medtech company will design and implement its next-generation pricing platform to serve both objectives.

Medtech companies that have fixed their pricing basics have improved their EBIT by 2 to 5 percentage points.

Medtech’s Margin Squeeze

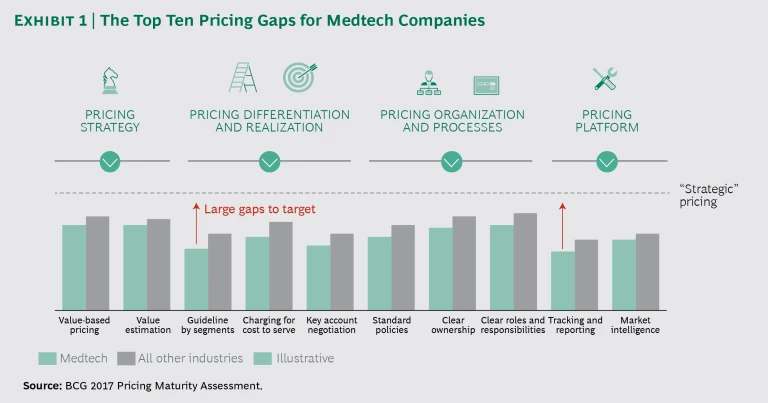

There is no single, dramatic reason for the tightening of margins in the medtech industry. Rather, the pressure points reflect two slow, continuing trends. The first is consolidation and price pressure on the buyer side (hospitals and group purchasing organizations), which expose the risks in medtech suppliers’ overly accommodating pricing policies and models. The second trend is medtech companies’ sluggishness in altering their pricing models and addressing the well-documented issues in their costly commercial models . The results of our 2017 Pricing Maturity Assessment Survey, conducted with the Professional Pricing Society, underscore the extent to which medtech companies trail other industries in key pricing capabilities. (See Exhibit 1.) Particularly noticeable are the large gaps in segment-specific guidelines and in tracking and reporting.

One driver of these trends is increased transparency, which is fueling price pressures. Customers and reimbursement authorities are now looking at prices across country borders. In the US, group purchasing organizations (GPOs) are consolidating, growing their power. The negotiating power of hospital systems is also growing, and they increasingly contract below GPO prices. Finally, reimbursement pressures are increasing throughout the US and the EU, disrupting established players and creating step-change decreases in prices.

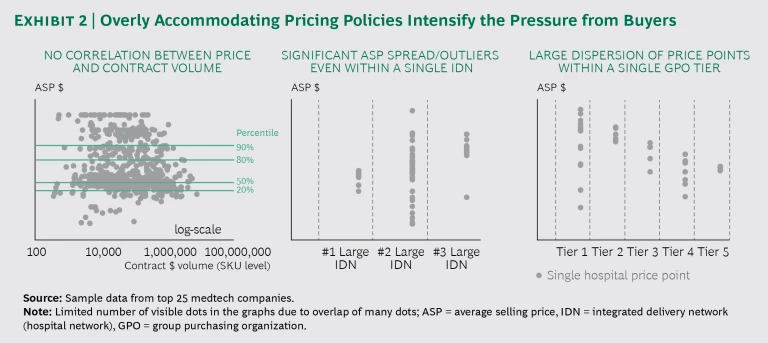

But medtech companies cannot simply attribute these trends to “market conditions” beyond their control. The companies’ own actions have both contributed to these trends and amplified their effects. The unmistakable proof and consequences of their history of overly accommodating pricing policies—driven by a decision-making process dominated by the sales force—are visible in Exhibit 2.

Notice the very limited correlation between average selling price (ASP) and volume (measured by contract size, in dollars) in the figure on the left. Some individual hospitals receive better prices than the largest integrated delivery networks (IDNs), often because of a sales team’s desire to close a sale at all costs. Within large IDNs, the ASP for the same product can vary widely across member hospitals, as the middle image in Exhibit 2 shows. This reflects the decisions made by suppliers’ local sales representatives and reveals a lack of strong pricing governance.

Finally, the image on the right shows two effects: large dispersions of price points within a single GPO tier and an overlap across tiers, which means a lower tier sometimes gets a better price than a higher one. The more a medtech company perpetuates these practices, the more price transparency risk it exposes itself to as buyers demand the lowest price.

More often than not, the patterns shown in Exhibit 2 reflect breakdowns in implementation and execution more than issues with strategy per se. Medtech companies have traditionally struggled with the tension between pricing teams and a sales-force-centric commercial model, which emphasizes the immediate sale over long-term value. They also find themselves at a “data disadvantage” relative to their customers, which have invested heavily in procurement tools and training. Medtech companies generally have only limited visibility into pricing performance and in some cases even lack the tools to generate vital tracking and reporting analyses. Customers know more than medtech companies.

Addressing either of these pressure points is challenging enough. To make matters worse, the margin squeeze is tightening at the same time that the pricing basis in medtech has started to shift away from devices and toward outcomes and other value-based measures. The era when a medtech company could get away with incremental innovations and a basic cost-plus model (rather than a full-pricing model) is coming to a close. Medtech companies that don’t combat the margin squeeze will struggle to participate in this new outcome-based game, let alone win it.

Margins are getting tighter at the same time that the pricing basis in medtech has started to shift from devices toward outcomes and other value-based measures.

The Two Benefits of a Next-Generation Pricing Platform

A next-generation pricing platform is a significant but necessary shift away from the industry’s classic “milkman” model. Developing and implementing the platform fixes the company’s pricing basics and secures its future by enabling new, value-based pricing models. The platform integrates strategy, people, process, governance, and tools around a disciplined focus on value and outcomes. (See Exhibit 3.) It starts with the strategic commitment to align price with the value that a product generates. Nowadays, this strategy extends far beyond the hardware itself. Companies can establish objective criteria to differentiate prices by customer segment and can develop the discipline to enforce them. This approach naturally leads to better price realization and improved profits.

None of these positive effects are sustainable, however, without an organization that encourages ownership and accountability. What people in the organization need to own is their role in the new processes to make informed pricing decisions in a structured and disciplined way. The “informed” part of those decisions comes from the ability to gather richer, more reliable data, and then to analyze and interpret it. This gets rid of the data disadvantage and fuels medtech companies’ ability to define and defend the innovative pricing models that will enable them to take advantage of new data-driven opportunities.

Fixing the Pricing Basics Across the Organization

The first step to fixing pricing basics is to recognize the existence of the margin squeeze and diagnose the drivers behind its tightening. In other words, each company needs the visibility and insights from analyses such as those in Exhibit 2.

The fate of one leading diagnostic equipment company changed when it began to fix its pricing basics by emphasizing differentiation and realization, two aspects that had received little attention or support during the company’s rapid growth. The underlying premise is that a company improves its price realization when it implements guidelines that turn a seemingly random distribution of prices and volumes into a controlled pattern of differentiation driven by objective criteria and enforced by tighter discipline.

When the company took a closer look at its sales performance, it realized that it had loosely defined guidelines for the sales force on when and how to grant discounts. The company took two steps that increased its net revenue by 1.5% and its profit by 5%. First, it developed robust, data-driven guidelines that established clear discount criteria based on customer attributes, product categories, portfolio effects, total life cycle value, and channel. Second, the company invested in organization, processes, and tools to support the new guidelines. The company implemented a suite of custom sales tools to support the sales teams’ discounting decisions and launched new pricing dashboards to give leadership better, ongoing visibility into and control over the discounting process. It also worked closely with the sales team to improve price realization.

Fixing the pricing basics is long overdue in the medtech industry. Companies that start developing and implementing their next-generation pricing platform become more successful at offsetting the pressure from buyer consolidation, payers, and the entry of viable low-cost competition. They also sharpen the skills that allow them to make better, faster, data-driven pricing decisions and eliminate the data disadvantage. Third, but no less important, are the direct financial gains from better pricing, which allow companies to develop the innovations they need in order to play a health care game driven by solutions and outcomes.

Securing the Future with Value-Based Pricing Models

As health care becomes increasingly solution- and outcome-driven, one principle holds true: you cannot participate in the market for value-based health care if you can’t align your pricing with the value created within and along the care continuum. The key challenge lies in the fact that the definition of value in medtech is expanding and evolving, and, with it, the nature of innovations and how to take them to market successfully. A medtech company’s innovation choices, pricing strategies, and approaches must expand and evolve with this changing definition.

You cannot participate in the market for value-based health care if you can’t align your pricing with the value created within and along the care continuum.

Reimbursement in the US, done primarily on a fee-for-service basis today, is only one of many areas where this definition is evolving. Pricing in that environment means understanding the true drivers of value for customers, given fixed-fee payments, and then optimizing pricing in that context. Incremental nurse labor, for example, does not itself drive increased reimbursement. But any innovation that yields labor savings—such as the introduction of negative-pressure wound therapy devices instead of traditional wound care dressings—creates a pool of value that medtech innovators and hospitals can share. When wound closure companies succeeded in demonstrating the benefits of such devices in reducing labor and accelerating wound closure, they achieved a premium price positioning. Companies that assess the value they create using the most reliable data and the most rigorous analytics are best positioned to devise a successful pricing strategy.

Nonetheless, even companies that have historically excelled at value assessment will need novel approaches to align their pricing with the value of the future. Hardware remains the primary pricing basis in many areas of medtech, even though hardware is losing its differentiation and product life cycles are becoming longer. Furthermore, innovation in the industry will increasingly derive from software and data, areas where the traditional cost-plus pricing model is not applicable, where scale is crucial to deliver the full promise of the R&D investment, and where value delivery is not closely tied to the number of devices sold or the number of procedures performed.

Robotic surgery illustrates this changing environment, rendering old ways of thinking obsolete. While robotic surgery sometimes achieves clinical benefits that might justify a per-procedure pricing model, it also generates significant additional benefits for the hospital by improving its ability to retain and attract surgeons and by increasing patient traffic. A medtech company must incorporate this significant additional value into its pricing decisions.

To compete and win in this environment, medtech companies must offer differentiated solutions that create measurable value for patients, providers, and payers, and price these accordingly. “Solutions” and “outcomes” apply to the needs of multiple stakeholders, including physicians, institutions, and patients. In the following section, we highlight three ways in which medtech companies are understanding real value drivers and using novel pricing models to monetize their most recent innovations.

Share the risk. When medtech suppliers share risk with customers and other stakeholders, they gain the ability to capture a price premium for innovations that deliver improved outcomes and cost savings.

Consider Medtronic’s Tyrx antibacterial sleeve for cardiac implantable electronic devices (CIEDs), which prevents post-op infection. Medtronic’s shared-risk pricing model reimburses customers for follow-up procedures if the infection rate exceeds the expected reduction. Cost estimates for CIED infection treatment range from $30,000 to more than $50,000, and the Centers for Medicare and Medicaid Services (CMS) does not reimburse for this complication. Thus, Tyrx sleeves are creating significant value that Medtronic can share with customers through its pricing model.

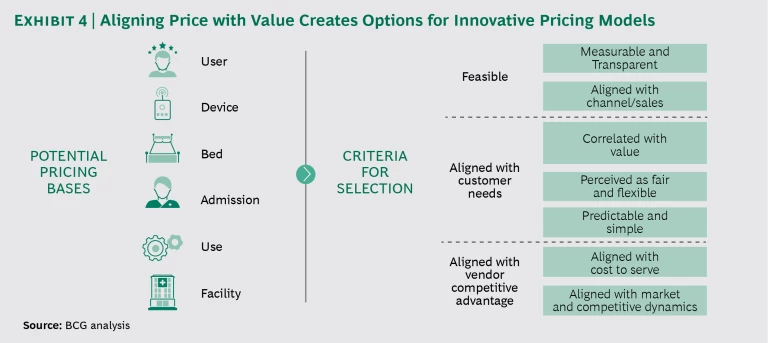

Stop pricing by device. The secret to becoming truly value-based is to understand how an offering delivers value and align the pricing model accordingly. Pricing per device is only one of many options and is often not the one that reflects how users, institutions, or patients derive benefits from the product or service. (See Exhibit 4.) Companies should look at alternative pricing models when the number of devices sold or used is not fully aligned with the benefits delivered.

The key criteria to evaluate potential pricing bases are feasibility, alignment with customer needs, and the potential to offer competitive advantage. Once a medtech company decides on a new basis, it needs to develop and implement a plan to shift to a new pricing model over time, helping stakeholders manage the change.

Charge separately for the true sources of innovation. The rapidly growing area of digital health cries out for innovative pricing models rather than simply putting a price tag on metal and plastic devices. Big data, artificial intelligence, mobile applications, 3D printing, drug device combinations, robotics, advanced sensors, and other technologies are creating unprecedented opportunities. The challenge is to capture their value. The truth is that medtech companies have not been good at monetizing innovation, especially when it comes to digital.

The rapidly growing area of digital health cries out for innovative pricing models rather than simply putting a price tag on metal and plastic devices.

A company that bundles an innovation with hardware whose pricing is set or anchored risks giving away the value of that innovation. It also unnecessarily limits access to the hardware and thus to the innovation. One way to capture a fair share of the benefits from innovations is to unbundle the price of hardware, software, and services. This makes the value of each component transparent and enables the company to charge prices in line with this value, using appropriate models. Companies can also monetize the insights and analytics derived from the data that software generates. Once a medtech company starts looking at all this, it becomes clear that blending data-driven innovations into a per-device pricing model is not the optimal approach.

The commercial and financial results from the organization-wide implementation of a disciplined next-generation pricing platform are significant. Faced with slow growth in the midst of reimbursement uncertainty and increased competition, a capital equipment manufacturer made improvements across all the areas we describe above. Using enhanced tools for customer segmentation, the company identified which tiers of customers it could target more effectively. This gave the company the rationale, confidence, and discipline to raise prices on high-volume, high-private-payer reimbursement accounts.

To unlock an additional addressable market, the supplier introduced a new pay-per-use pricing model, which aligned pricing more tightly with the value customers derived. This model expanded the market by more than 10% by giving lower-volume accounts more affordable access to the equipment. The combination of pricing changes helped spur a 10% increase in margins.

The time has come for medtech companies to take their foot off the brake. They need to make the long overdue shift away from increasingly outdated and inadequate pricing approaches. Implementing a next-generation pricing platform will enable them to hit the gas pedal again, stay in the race, and accelerate into the emerging worlds of outcome-based health care and digital health.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit

Featured Insights

.