What do you do when your M&A-driven growth plan brings your company to the brink of bankruptcy? If you’re Royal Unibrew, you heed the lessons, regroup, and try again—only this time, you do it right.

Read more about the Nordic Comeback Kids

Read more about the Nordic Comeback Kids

- Overview

- Danske Bank: Rediscovering the Customer

- Husqvarna: Honing a Competitive Edge

- BillerudKorsnäs and Metsä Board: Two Paper Companies, Two Routes to Reinvention

- UPM-Kymmene: Evolving Beyond Declining Product Categories

- Nokia: Reprogramming for Growth

- Royal Unibrew: Crafting a Turnaround from a Winning M&A Move

Formed in 1989 through the merger of Jyske Bryggerier and Faxe Bryggeri, Royal Unibrew (then, Danish Brewery Group) is one of the largest beer makers in the Nordics and Baltics, with brands such as Royal Beer, Ceres, and Lapin Kulta. The company, which sells throughout Europe, Africa, Central America, and the Caribbean, also produces soft drinks and malt beverages.

In the early 2000s, buoyed by strong earnings, Royal Unibrew embarked on an ambitious, acquisition-based growth strategy. It took the name Royal Unibrew in 2005 to establish a more global identity, and set a revenue target of 50% growth for the next three years. The company staked a big bet on two Polish breweries that it acquired in 2005 and 2007. It also banked on earning steady returns from four Caribbean breweries in which it had bought a controlling interest in 2007.

The Poland acquisitions proved to be ill fated. With just a 3% market share in Poland, Royal Unibrew had started out at a disadvantage. The breweries turned out to be in poor condition, and the distances between plants made achieving the hoped-for synergies difficult. When the global financial crisis hit, it became clear that the Poland ventures were disastrous. The company responded by swallowing DKK 385 million ($73 million at the 2008 exchange rate) in impairment losses, an amount roughly 1.5 times its EBITDA.

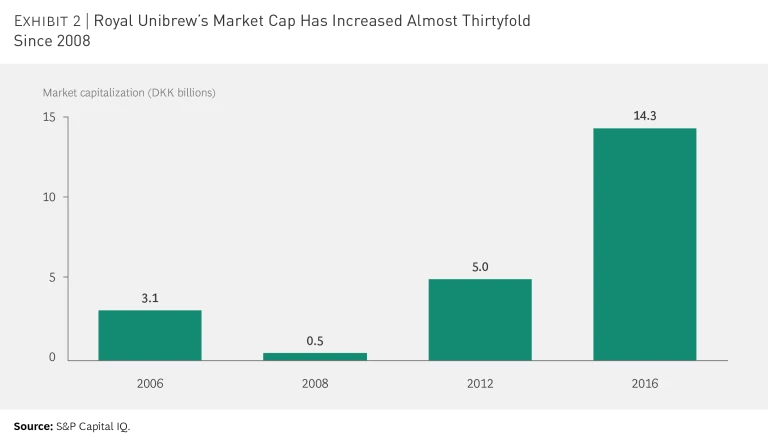

As the recession set in, demand throughout Royal Unibrew’s core markets waned, and the company could no longer maintain its debt levels. As 2008 wore on, external financing sources dried up. The company had no choice but to refinance its debt. From 2006 to 2008, Royal Unibrew’s market cap declined from DKK 3.1 billion to DKK 0.5 billion.

Rallying for Action

Royal Unibrew’s senior executives signaled a turnaround with the appointment of Henrik Brandt as the company’s new CEO in 2008. Brandt and his team ushered in a four-year program of restructuring and operational improvements. To slash debt, they carried out a DKK 400 million share issuance and sold the Poland and Caribbean assets.

Leaders relentlessly sought operational efficiencies: consolidating manufacturing plants, introducing production efficiencies (such as reducing water and energy consumption), and investing in new packing line equipment and new packaging. They modernized distribution, too; in Denmark, for example, they established a call center, implemented dynamic route planning, and integrated the entire outbound supply chain. They also streamlined the company’s administration and staff.

On the commercial side, Royal Unibrew concentrated on marketing and selling its core brands and developing innovative marketing campaigns. At the same time, the company ventured into new energy drink and juice segments. By the end of 2012, Royal Unibrew had increased its market capitalization to DKK 5.0 billion, from a low of DKK 0.5 billion in 2008.

Igniting Growth

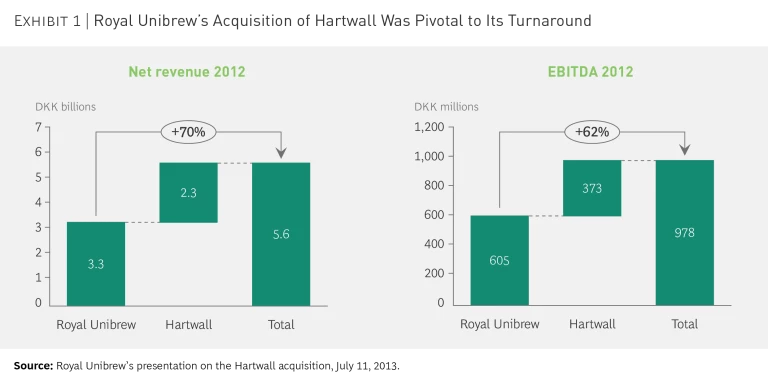

By 2013, Royal Unibrew had stabilized and was ready to accelerate growth—this time, with the acquisition of Hartwall, the number-two beer producer in Finland. The Hartwall acquisition was nothing like the doomed Polish ones. Although Hartwall had seen minor market share decline in recent years, it was a strong company in its own right, founded in the early 19th century and independently owned until 2002. Its Original Long Drink, introduced in 1952 at the Helsinki Olympics, remains Finland’s most popular bottled mixed drink. Formerly owned by Heineken Group, Hartwall was also Finland’s top seller of mineral water, cider, and ready-to-drink beverages (including “alcopops”) and the country’s number-two seller of soft drinks and energy drinks. The Hartwall acquisition gave Royal Unibrew an immediate lift, increasing the company’s revenues in one year by 70% and its EBITDA by more than 60%. (See Exhibit 1.)

Hartwall’s varied portfolio added much-needed diversity to Royal Unibrew’s product lineup (beer represented only 36% of Hartwell’s sales). Hartwall also had licensing agreements with PepsiCo, fortifying Royal Unibrew’s relationship with PepsiCo and Heineken.

Despite its still-solid condition, Hartwall had room for improvement, and Royal Unibrew’s leaders moved quickly to bolster and integrate the new acquisition. The company implemented an efficiency program that, among other things, cut waste and excess inventory and increased utilization rates. Leaders reorganized administrative functions to reduce complexity and integrated the enterprise IT system. On the commercial side, they introduced changes to the product mix to align it more closely with market trends.

Royal Unibrew’s performance results clearly suggest the staying power of its turnaround strategy. By 2016, its market cap hit DKK 14.3 billion, almost triple the figure for 2012 and almost 30 times that for 2008. (See Exhibit 2.)

With its new operational efficiencies, financial strength, and strategic flexibility, Royal Unibrew is brewing up big plans: expanding its market presence, seeking greater share for key brands, strengthening partnerships (including the PepsiCo relationship), and pursuing new investments.